[ad_1]

Working ladies have clearly made progress for the reason that Nineteen Seventies, led by the boomers who streamed into the labor drive. They’re higher educated at this time, and their pay has been rising relative to males’s.

However ladies proceed to cope with decrease pay and interruptions of their work histories and untimely retirements to care for kids or getting older dad and mom, making it harder to save lots of. The monetary problem of getting sufficient cash to retire is compounded by the truth that they normally stay longer than their husbands.

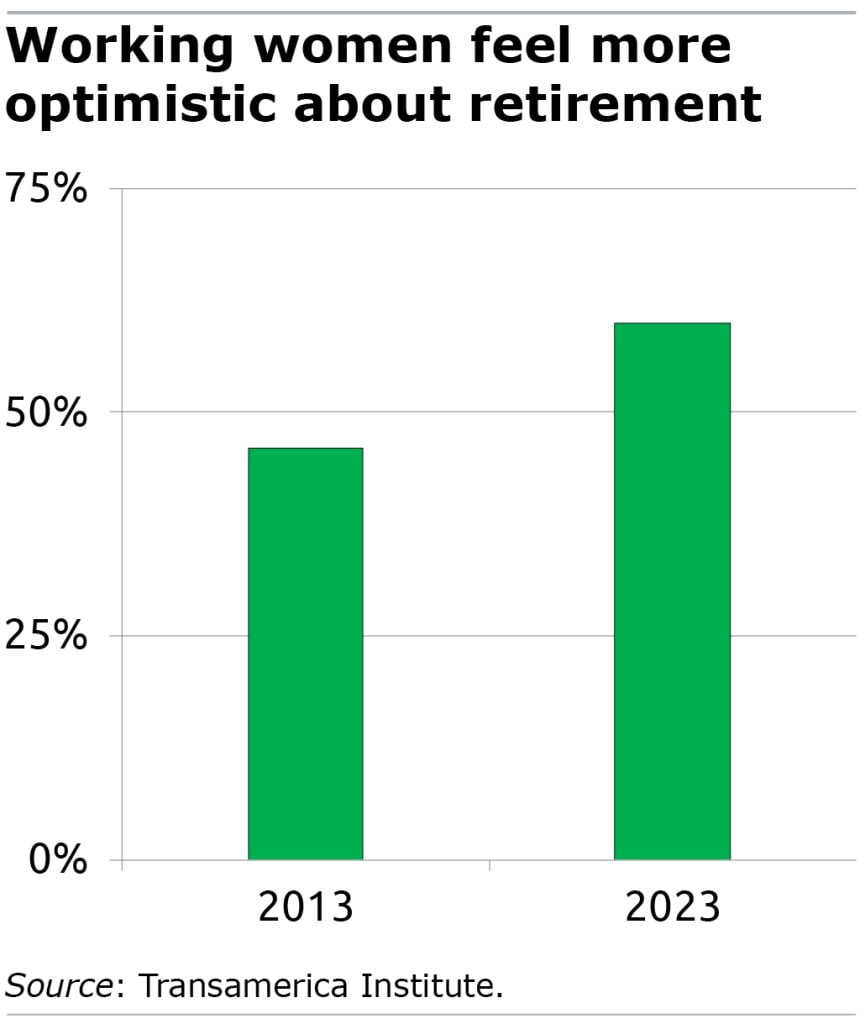

Within the Transamerica Institute’s 2023 survey report on retirement, ladies acknowledge that issues are wanting up. Nevertheless it’s robust for them to really feel glad with the place they’re.

At present, 60 p.c of working ladies mentioned they anticipate to retire comfortably. That’s up neatly from 46 p.c a decade in the past, which is in line with the positive aspects they’ve made within the labor drive, however nonetheless lower than the 73 p.c of males who really feel assured at this time.

Working ladies’s 401(okay) balances are additionally nonetheless considerably decrease than males’s. In Vanguard’s annual report by itself purchasers – keep in mind, this can be a lucky group of staff who’ve a financial savings plan at work – the standard feminine employee has saved about $25,000, in contrast with $35,000 for males.

Nonetheless, ladies appear to have gotten the message about how vital it’s to arrange for outdated age and try to do one thing about it.

Within the Transamerica Institute survey, they establish retirement as their second-highest monetary precedence – up from third place a decade in the past, when ladies have been extra involved about paying off debt and “getting by” after the Nice Recession. Males’s prime precedence at this time is retirement.

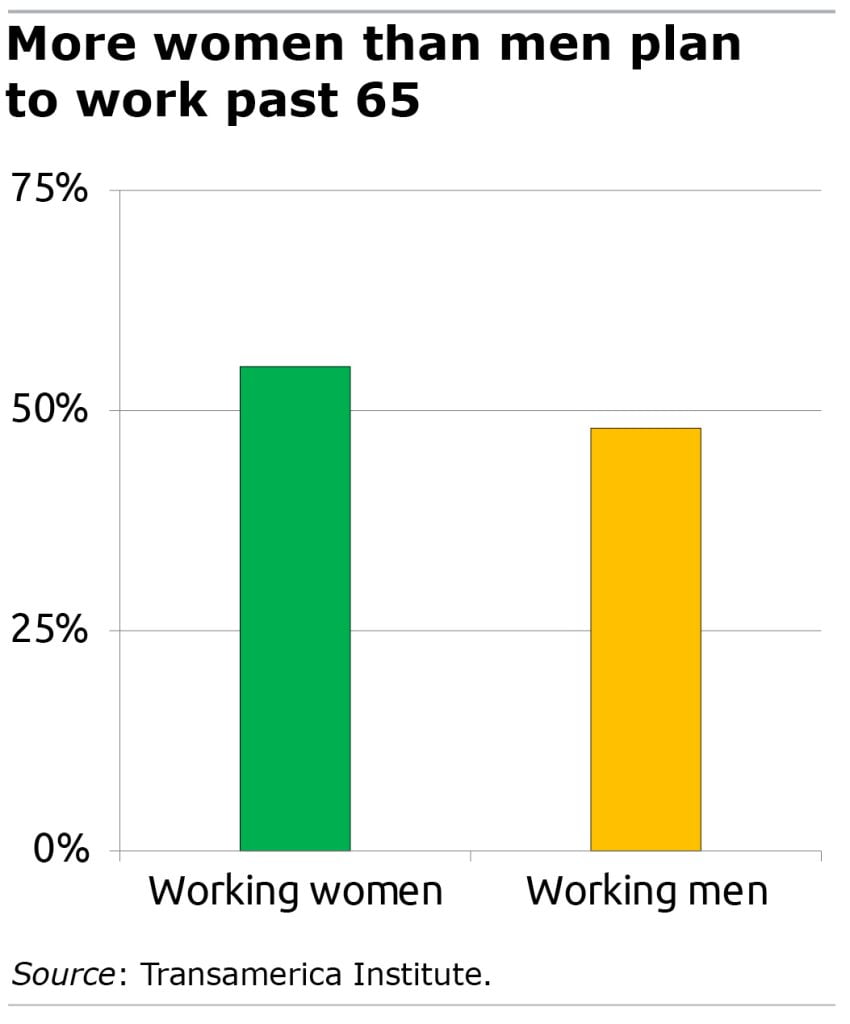

For individuals who haven’t saved sufficient, working previous age 65 is a great technique to considerably enhance their outlook by growing the scale of the month-to-month Social Safety checks. This 12 months, 55 p.c of girls say they’ll work previous 65, which is a pair factors larger than a decade in the past. Males are moving into the wrong way, with solely 48 p.c who’re planning to work longer.

The opposite advantages of working longer embody growing the period of time an older employee can contribute to her 401(okay) and decreasing the variety of retirement years she’ll have to attract on that financial savings.

Regardless of ladies’s finest efforts, Catherine Collinson, president of the Transamerica Institute, concludes that they want extra assist – from the federal government by coverage, from employers by pay and profit design, and from society by a recognition of the toll of unpaid caregiving.

“Everybody should play a job in bettering ladies’s retirement safety so that every one ladies can retire with dignity,” she mentioned.

Squared Away author Kim Blanton invitations you to observe us @SquaredAwayBC on X, previously referred to as Twitter. To remain present on our weblog, be a part of our free e mail checklist. You’ll obtain only one e mail every week – with hyperlinks to the 2 new posts for that week – once you join right here. This weblog is supported by the Middle for Retirement Analysis at Boston School.

[ad_2]