[ad_1]

No, “almost half” of $94.5 billion in retail stock losses in 2021 was not “attributable to organized retail crime.”

That line is simply one other in a protracted sequence of falsehoods put forth by the skilled bullshitters on the Nationwide Retail Federation.

Right here’s Reuters:

“The principle lobbying group for U.S. retailers retracted its declare that “organized retail crime” accounted for almost half of all stock losses in 2021 after discovering that incorrect knowledge was used for its evaluation.”

I’ve been calling out their nonsense for almost twenty years and was able to retire my Black Friday debunking of their annual Thanksgiving silliness. I tracked the annual retail gross sales forecast as a twofold train: Keep away from forecasts, as they’re principally incorrect, and have a tendency to lose buyers’ cash. And second, be cautious of what self-interested commerce teams say about their trade; they’re lobbyists and cheerleaders, not seekers of fact.1

However since a spokesperson for the NRF admitted they needed to take away content material from its report on organized retail crime (report from April 2023, produced with employed gun K2 Integrity), I’ve begun to rethink that.

After six months of relentless propaganda on crime, the NRF needed to edit the declare that “almost half” of stock losses have been organized crime.

It’s not.

You’ll be able to rely on C-Suite executives at publicly traded firms to leap on each pattern to excuse poor firm efficiency. Early this 12 months, Walgreens finance chief James Kehoe admitted as a lot: “Perhaps we cried an excessive amount of final 12 months” about merchandise losses. Up to now, firms have referenced COVID-19, crypto, inflation, conflict, and even AI reveals in quarterly calls as a part of their “contextualizing” income and revenue patterns.

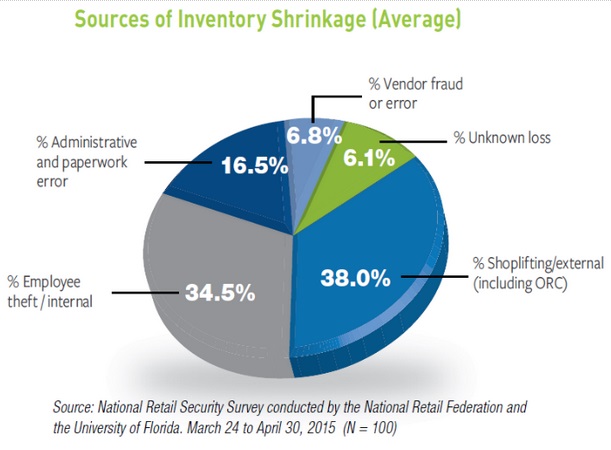

There are numerous sources of “Shrinkage” of stock, and whereas there may be some debate as to the most important sources, they appear one thing like this:

Worker theft: It’s the primary supply of shrinkage. (My expertise: it’s typically uinderreported by firms). Issues “fall off” the truck, Staff steal merchandise, or resell it and hold the money. This prices retailers anyplace between $15-20 billion yearly within the US.

Shoplifting: $10-15 billion per 12 months. Whether or not its merely strolling out with items, doing smash & grabs or in any other case dishonest self-checkouts, it’s the second largest supply of retail theft, and a pernicious problem to all retailers.

Return fraud: Returning stolen merchandise is a variation of shoplifting; be aware it generally (incessantly?) entails cooperative staff.

Credit score Card Fraud: Has been an enormous supply of losses; a few of it’s borne by banks, and greater than a bit of of it impacts shoppers, who typically are unaware of it.

Vendor Fraud: Mild shipments and different types of stock shrink earlier than items even arrive at retailers or their warehouses account for $2-4 billion in losses

Administrative errors: Generally these are reputable errors in ordering,. Logistics, and stock monitoring.

Operational loss, or unintentional loss: Any firm that buys, ships, warehouses and shows tens of millions of products a 12 months goes to often break, injury or misplace them. Its regular, and a part of any retail enterprise.

Accounting Fraud: Not each retailer is Loopy Eddies, cooking the books, however quite a lot of shops have been identified to get inventive with their stock administration.

The declare that organized retail crime accounted for “almost half” of stock losses was false, however it’s additionally an indictment of contemporary media. All too typically, the reality issues a lot lower than meme manufacturing and clickbait.

Who has time to really fact-check information when one thing this juicy comes alongside? That it was clearly false and based mostly on previous lobbyists’ experiences by no means appeared to lift any pink flags.2

The LA Occasions referred to as out how foolish a number of the claims have been in late 2021:

“It’s straightforward to get consideration for sensational claims, nonetheless, notably once they come from official sources. Rachel Michelin, president of the California Retailers Assn., informed the San Jose Mercury Information that in San Francisco and Oakland alone, companies lose $3.6 billion to organized retail crime annually.

That will imply retail gangs steal almost 25% of complete gross sales in San Francisco and Oakland mixed, which amounted to round $15.5 billion in 2019, based on the state company that tracks gross sales tax.

Can that be proper? In a phrase: no.”

And based on NRF knowledge itself, from its annual Retail Safety Survey, shrink attributed to exterior theft, together with organized retail crime, has largely remained the identical since 2015. On-line dasher just lately reported that “The common retail shrinkage fee has hovered round 1.4% for over a decade.”

Buyers ought to look askance at knowledge and claims from trade spokespeople and commerce teams. All of them have agendas, none of which embrace the well-being of your portfolios.

Sources:

US retail lobbyists retract key declare on ‘organized’ retail crime

By Katherine Masters

Reuters, December 5, 2023

‘Perhaps we cried an excessive amount of’ over shoplifting, Walgreens government says

By Nathaniel Meyersohn

CNN January 7, 2023

Retailers say thefts are at disaster degree. The numbers say in any other case

By Sam Dean

LA Occasions, December 15, 2021

Companies hold complaining about shoplifting, however wage theft is an even bigger crime

Michael Hiltzik

LA Occasions, August 30, 2023

UPDATE 12:40 pm

A good friend sends me this as effectively:

Organized journalistic crime

JUDD LEGUM AND TESNIM ZEKERIA

Well-liked.data, Dec 11, 2023

Beforehand:

Black Friday Survey #Fails

__________

1: See additionally, The Nationwide Affiliation of Realtors.

2. Extra Reuters:

In response to NRF spokesperson Danielle Inman, the declare that organized crime accounted for almost half of all stock losses was based mostly on two-year-old testimony from Ben Dugan, former president of the advocacy group Coalition of Legislation Enforcement and Retail. In 2021, he informed a U.S. Senate committee that organized retail crime accounted for $45 billion in annual losses for retailers, based on estimates by the coalition.

The inclusion of the declare in NRF’s report was “taken instantly from Ben’s testimony” and “was an inference made by the K2 analyst linking the outcomes of the NRF survey from 2021 and Ben Dugan’s assertion made that very same 12 months,” Inman stated.

[ad_2]