[ad_1]

Roughly three out of 4 low-income households may not find the money for to keep up even their modest lifestyle after they retire.

This sobering discovering is available in a refinement by the Middle for Retirement Analysis of its periodic take a look at employees’ retirement prospects.

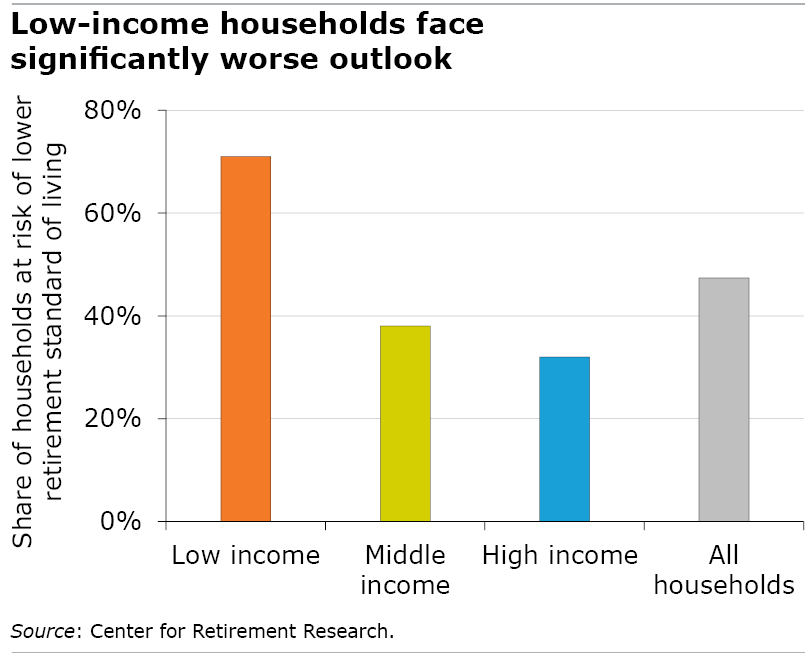

The middle’s researchers use the info within the Federal Reserve’s periodic Survey of Client Funds to estimate how employees are doing. And time after time, they arrive at an analogous conclusion: within the 2019 survey, roughly half of all working households have been prone to falling at the least 10 % wanting the revenue they’ll want to keep up their present dwelling commonplace in retirement.

However a second evaluation of the 2019 information cut up the households into three totally different revenue teams. To raised mirror real-world choices about when individuals often retire, the researchers used a distinct age for when every group indicators up for Social Safety – as a substitute of the belief within the prior estimate that everybody indicators up at 65.

Research have proven that low-income employees retire pretty early. So, reasonably than 65, the evaluation assumed they might begin their Social Safety at 62, highlighting that 71 % are in a precarious monetary state of affairs.

The age for the middle-income older households elevated from 65 to 66, which put simply 38 % prone to a future drop of their dwelling commonplace. Predictably, even fewer within the high-income group are in danger – 32 % – utilizing 67, reasonably than 65, since they have a tendency to delay their Social Safety.

Beginning their retirement advantages so early worsens low-income employees’ monetary prospects for 2 causes. It cuts the scale of their month-to-month Social Safety checks, and it shortens their careers, barely decreasing the cash they might’ve had in the event that they’d labored longer. Rising the claiming age for high-income employees considerably will increase their Social Safety revenue and the already appreciable monetary sources they take into retirement.

The estimates for every revenue group don’t imply that the unique, mixture estimate is unsuitable. In reality, the brand new evaluation utilizing totally different claiming ages will get an analogous general outcome as the unique 2019 calculation: 47 % of all working households are prone to a decrease lifestyle.

The benefit of assessing every revenue group’s threat individually is a extra correct image and one which exposes the diploma to which low-income employees are susceptible.

Squared Away author Kim Blanton invitations you to comply with us @SquaredAwayBC on X, previously often known as Twitter. To remain present on our weblog, be part of our free electronic mail checklist. You’ll obtain only one electronic mail every week – with hyperlinks to the 2 new posts for that week – whenever you enroll right here. This weblog is supported by the Middle for Retirement Analysis at Boston Faculty.

[ad_2]