[ad_1]

Some type of risk-sharing plan could be good, however protection is the true difficulty.

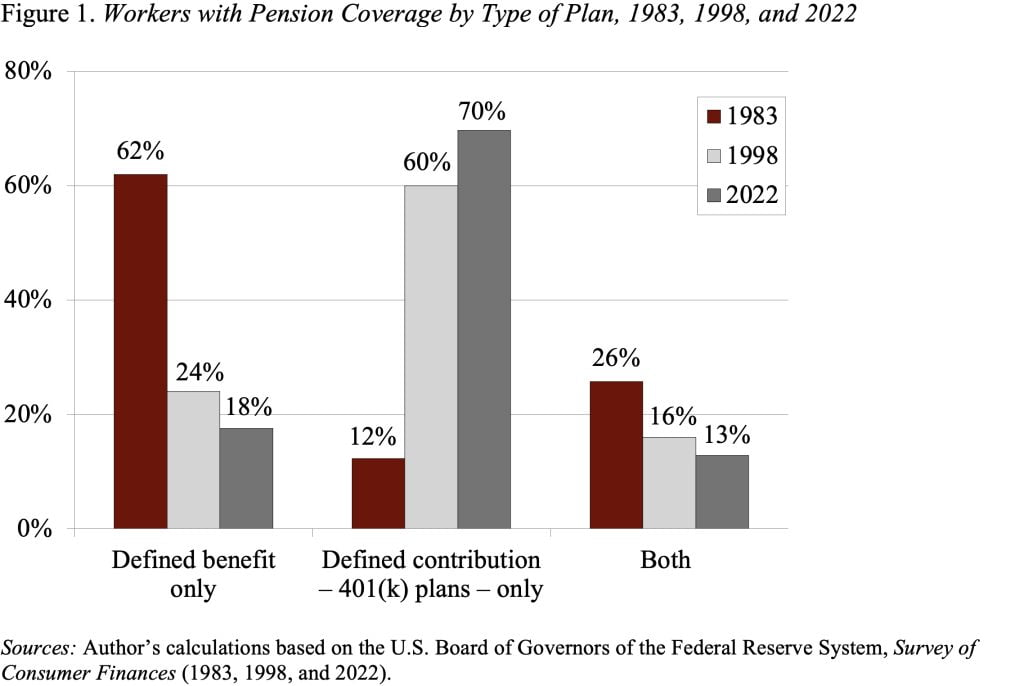

How did this occur? Now that the shift from outlined profit plans to 401(ok)s is nearly full (see Determine 1), everyone appears to be speaking about outlined profit (DB) plans. They have been on the want listing of the United Auto Staff. The Wall Road Journal had an editorial arguing that the time is ideal for the comeback of outlined profit plans. And it seems like IBM simply re-opened its money steadiness plan. What’s occurring and does it make any sense?

The WSJ article argues that outlined profit plans might now be probably the most cost-effective manner for employers to offer retirement earnings. The excessive rate of interest related to the present inflation has made future obligations low-cost, thereby significantly enhancing the funded standing of personal sector DB plans. And better returns additionally make it cheaper to fund a $100,000 annual retirement annuity.

A number of ideas. First, employers don’t present advantages out of the goodness of their hearts; they resolve on the full compensation they wish to pay staff and in the event that they improve retirement advantages, they reduce on wages. That’s, workers pay for his or her retirement advantages via decrease wages nevertheless they’re structured.

Second, underneath the normal DB pension employers bear each funding and mortality threat. They didn’t like that. On the flip facet, workers don’t have any safety from inflation. Since inflation took off in 2021 retirees have seen the worth of their non-public sector DB advantages decline by 15 %. Retirees don’t like that. In the long run, it will be good to have a system by which workers and employers shared dangers.

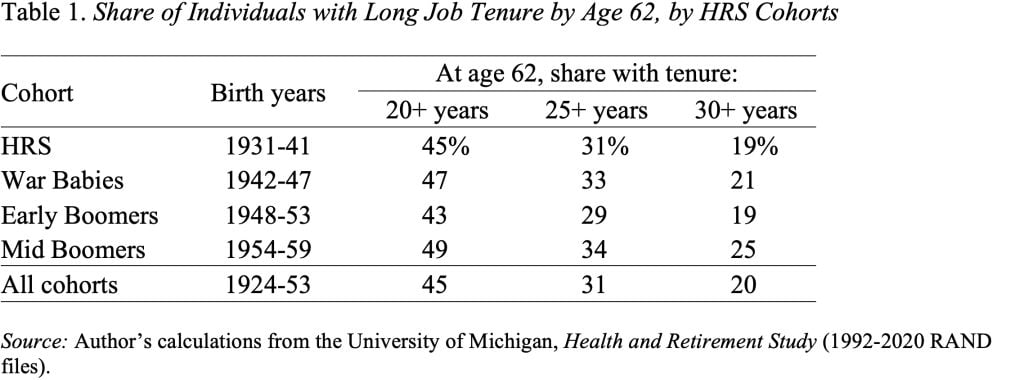

Third, DB plans work for many who stick with the identical employer for years, however job hoppers truly do higher – all else equal – with 401(ok)s. I believed that extra job-hopping was occurring right this moment than prior to now, however that doesn’t seem like true. Not less than it hasn’t proven up in lifetime employment patterns but, the place about 30 % of these age 62 have spent 25+ years with one employer (see Desk 1).

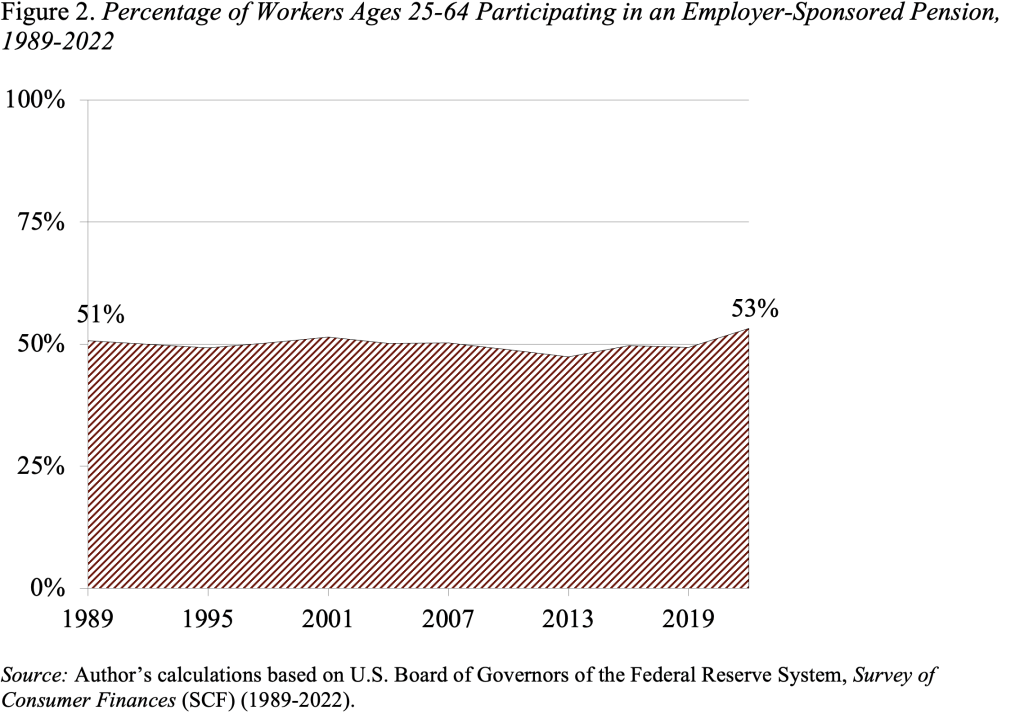

However all this chit chat doesn’t get on the fundamental level. The large drawback with right this moment’s non-public sector retirement system just isn’t that we have now 401(ok)s somewhat than DBs, however somewhat at any second in time solely half of the non-public sector staff are taking part in a retirement plan. This quantity has not budged over time; it wasn’t any greater within the DB world than in right this moment’s 401(ok) world. And the very fact is that people who find themselves repeatedly coated by a retirement plan – the highest third of earners – do very nicely. Those that are nearly by no means coated – the underside third of earners – do poorly and need to rely completely on Social Safety. The center third of earners, who transfer out and in of protection, find yourself with insufficient retirement earnings. This sample holds no matter sort of retirement plan.

In brief, protection – not sort of plan – is the necessary factor to fret about. Going off on a tout about DBs is solely a diversion.

[ad_2]