[ad_1]

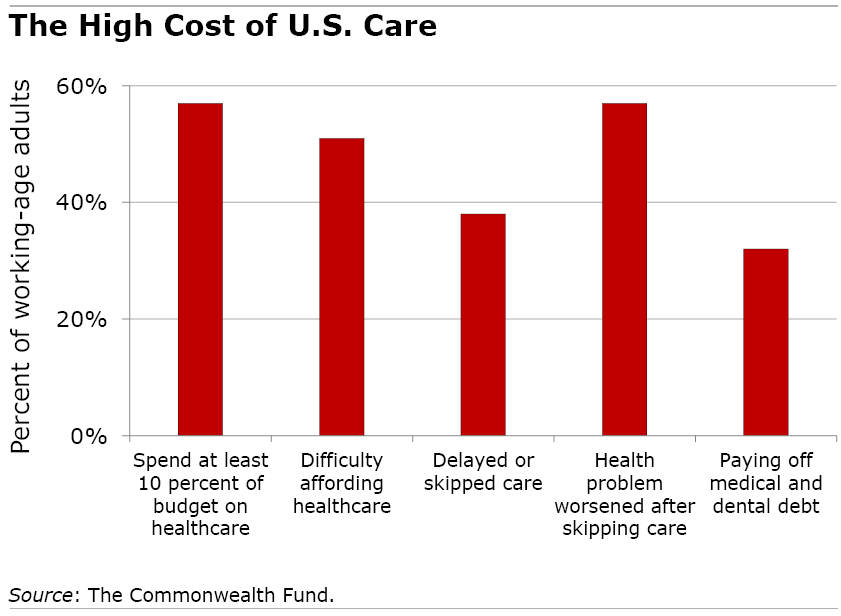

Almost 40 p.c of Individuals have delayed or skipped needed medical care previously yr as a result of they couldn’t afford it.

How can we stack as much as different developed nations? Useless final. Even the lowest-wage staff in locations like Australia, New Zealand, and the UK are higher in a position to afford their care than the typical U.S. employee.

The fee obstacles to U.S. healthcare, specified by a brand new report by The Commonwealth Fund, are hardly earth-shattering information. Massive deductibles, a pointy rise in 2023 premiums, the excessive price of prescriptions, spotty insurance coverage choices, and suppliers’ poor billing practices – the multitude of issues proceed.

Many Individuals, no matter how a lot they earn or the standard of their insurance coverage, “have insufficient protection that’s led to delayed or foregone care, vital medical debt and worsening well being,” the healthcare analysis group stated.

And there’s extra dangerous information: premiums for household plans underneath employer insurance coverage went up sharply this yr – 7 p.c, in line with KFF – after being secure in 2022. This yr, workers with household plans are getting a mean of $6,575 deducted from their paychecks to contribute to their premiums. However that quantity masks a considerably bigger burden – $12,000 in premiums – for workers at small companies that may’t afford the top-drawer protection Fortune 500 firms present.

Congress did give one group a break final yr. The monetary help package deal handed throughout COVID had elevated the subsidies for staff shopping for particular person plans underneath the Reasonably priced Care Act (ACA). The Inflation Discount Act of 2022 prolonged these beneficiant subsidies by way of 2025. Nonetheless, these well being plans typically have excessive deductibles that present a second barrier to inexpensive care.

The underside line, specified by Commonwealth’s survey, is that there are well being and monetary prices to costly medical care. Greater than half of working-age Individuals stated a medical downside received worse after they determined to skip care. A 3rd have been paying off medical or dental debt when the survey was carried out early this yr. Greater than half of staff commit greater than 10 p.c of their month-to-month family budgets to premiums, deductibles, coinsurance and different funds for care.

Commonwealth offered a laundry checklist of steps that Congress, state lawmakers and regulators might take to offer reduction, from enacting harder rules on medical debt to additional decreasing the ACA’s out-of-pocket prices and ending state waivers that override Medicaid’s requirement that care is roofed throughout the three months previous to making use of if the individual is permitted for protection.

KFF’s chief government, Drew Altman, doesn’t have a lot hope for reduction, although he does level out that the nation has expanded protection considerably lately by way of Medicaid and the elevated ACA premium subsidies.

However relating to price, Altman stated, “the nation has no technique.”

Squared Away author Kim Blanton invitations you to observe us on Twitter @SquaredAwayBC. To remain present on our weblog, please be a part of our free e mail checklist. You’ll obtain only one e mail every week – with hyperlinks to the 2 new posts for that week – while you join right here. This weblog is supported by the Heart for Retirement Analysis at Boston School.

[ad_2]