[ad_1]

The transient’s key findings are:

- Households ages 62-75 have substantial earnings.

- The Nationwide Retirement Danger Index, which assumes all households declare Social Safety – and retire – at 65, doesn’t rely earnings after 65.

- So, about half of all earnings for these 62-75 are excluded from the Index and will distort the outcomes.

- Introducing extra sensible claiming ages for low-, middle-, and high-income households solves two issues:

- Will increase the earnings within the Index to two-thirds, with the remaining going primarily to excessive earners the place it has little affect.

- Produces a extra smart sample of proportion “in danger” by earnings group.

- One factor that doesn’t change is the general proportion of immediately’s working households in danger: that’s nonetheless about 50 p.c.

Introduction

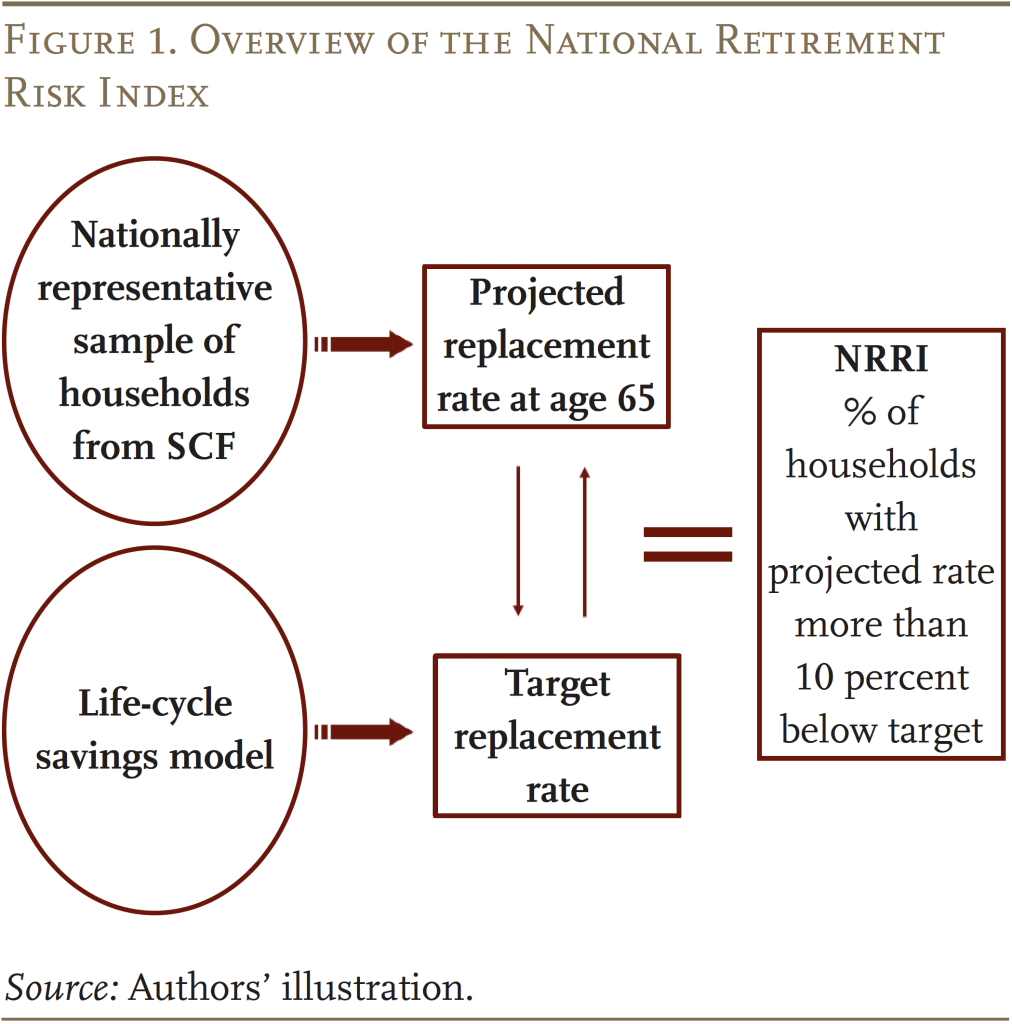

The Nationwide Retirement Danger Index (NRRI) measures the share of working-age households that might be unable to keep up their pre-retirement lifestyle as soon as they retire. The Index relies on knowledge from the Federal Reserve’s Survey of Shopper Funds and compares family projected alternative charges – retirement earnings as a proportion of pre-retirement earnings – with goal charges. These households whose projected alternative charge falls greater than 10 p.c beneath the goal are characterised as being “in danger.”

The NRRI, which has been estimated repeatedly since 2006 and most not too long ago completely revamped, persistently exhibits that – even when households work to age 65 and annuitize all their monetary property, together with the receipts from reverse mortgages on their properties – nearly half of households are liable to being unable to keep up their lifestyle.

Regardless of the consistency of the NRRI, we’re at all times searching for methods to enhance the measure. In a evaluate of the revamped NRRI, our favourite colleague and critic – Andrew Biggs of the American Enterprise Institute – argued {that a} critical flaw with the Index is that it omits a significant supply of earnings in retirement – particularly, earnings. Certainly, the Index doesn’t embody the earnings of older folks as soon as they retire, however roughly half of mixture earnings of these ages 62-75 happen earlier than the assumed retirement age of 65 and subsequently are already included within the mannequin as a part of wealth accumulation. Nonetheless, given the significance of the connection between Social Safety claiming ages and the inclusion of earnings, this transient explores the extent to which assuming extra sensible claiming ages reduces the “excluded-earnings” drawback.

The dialogue proceeds as follows. The primary part describes the nuts and bolts of the NRRI, as presently constructed. The second part explores the significance of earnings and the connection between earnings and Social Safety claiming age amongst older households for low-, middle-, and high-income teams. The third part exhibits that an NRRI that varies claiming ages by earnings group incorporates about two-thirds of earnings within the mannequin and produces very related total outcomes to the unique NRRI. The ultimate part concludes that whereas the prevailing NRRI produces a superb illustration of danger for the entire inhabitants, an index that varies Social Safety claiming ages contains the majority of earnings by older staff and gives a greater image of outcomes by earnings group. So these parameters might be used to assemble the NRRI going ahead.

Nuts and Bolts of the NRRI

The NRRI is constructed with knowledge from the Federal Reserve’s Survey of Shopper Funds (SCF), a triennial nationally consultant family survey. Calculating the NRRI entails three steps: 1) projecting a alternative charge – retirement earnings as a share of pre-retirement earnings – for every SCF family ages 30-59; 2) establishing a goal alternative charge that will enable every family to keep up its pre-retirement lifestyle in retirement; and three) evaluating the projected and goal charges to seek out the share of households “in danger.”

The alternative charge calculation begins with a projection of retirement earnings, presently at age 65. This measure is outlined broadly to incorporate earnings from Social Safety, outlined profit (DB) plans; monetary property each in outlined contribution (DC) plans and saved instantly; and housing, which incorporates imputed hire in addition to house fairness. As famous within the introduction, the NRRI doesn’t embody earnings from work, as a result of the main target is retired households and labor pressure participation declines noticeably after 65.

The values for DC property, non-DC monetary property, and housing fairness are derived from reported wealth within the SCF. They’re every projected individually to age 65 based mostly on their respective wealth-to-income ratios by age, which have been remarkably steady over time. The NRRI then assumes that households convert all their property, together with monetary property, 401(ok)/IRA balances, and proceeds from a reverse mortgage, right into a stream of earnings by buying an inflation-indexed annuity.

Sources of retirement earnings that aren’t derived from reported wealth within the SCF are estimated instantly. Particularly, Social Safety advantages are calculated based mostly on estimated earnings histories for every member of the family, listed to nationwide common wage progress. DB pension earnings relies on the quantity reported by survey respondents.

The remaining step is to calculate common lifetime earnings previous to retirement. Pre-retirement earnings for owners contains earnings and imputed hire from housing. Common lifetime earnings (with earnings, once more, listed to common wage progress) then serves because the denominator for every family’s alternative charge. This measure excludes earnings from property.

To find out the share of the inhabitants that might be in danger requires evaluating projected alternative charges with a benchmark charge. A generally used benchmark is the alternative charge wanted for households to keep up their pre-retirement lifestyle in retirement. Folks usually want lower than their full pre-retirement earnings since they often pay much less in taxes, now not want to avoid wasting for retirement, and sometimes have paid off their mortgage. Thus, a larger share of their earnings is on the market for spending. The Index estimates the goal alternative charges for various kinds of households utilizing a consumption-smoothing mannequin, which assumes that households need the identical degree of consumption in retirement as that they had earlier than they retired.

The ultimate step is to match every family’s projected alternative charge with the goal from the consumption-smoothing mannequin. These whose projected alternative charges fall greater than 10 p.c beneath the goal are deemed to be liable to having inadequate earnings to keep up their pre-retirement lifestyle. The Index is solely the share of all working-age households that fall greater than 10 p.c wanting their targets.

Earnings and Retirement for Households Ages 62-75

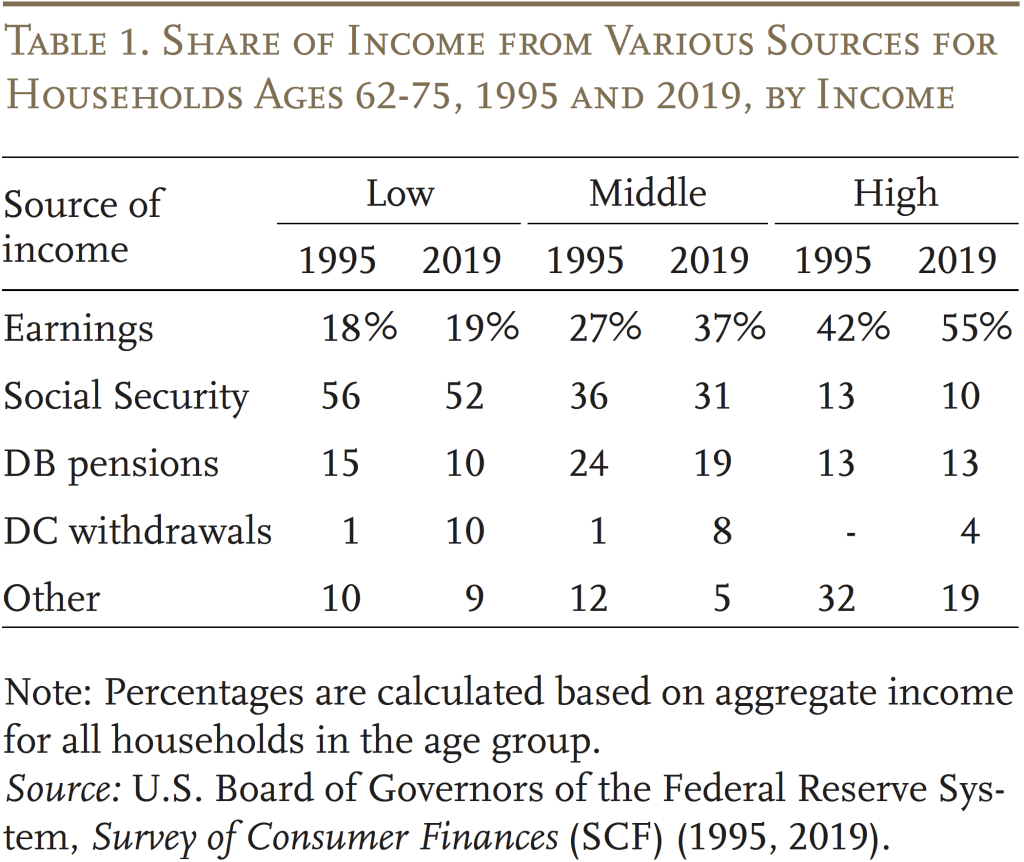

The primary query at hand is the significance of earnings amongst households with a head ages 62-75 – a bunch eligible for Social Safety, lots of whom may very well be presumed retired. As proven in Desk 1, earnings symbolize an amazingly excessive share of whole earnings for these older households – 19 p.c for low-income households, 37 p.c for the middle-income group, and 55 p.c for high-income households. Furthermore, a comparability with 1995 reveals that earnings have been a major factor of the earnings of older households for a while, and have develop into extra necessary not too long ago. The share elevated by 10 proportion factors for middle-income households and by 13 proportion factors for high-income households. It seems that phrase has gotten out that working longer is the important thing to a safe retirement, and people with essentially the most training and assets have modified their conduct.

The present Index assumes that every one households cease working and declare Social Safety advantages on the identical age – particularly, 65. SCF knowledge on the claiming age for the family head, nevertheless, recommend that extra affordable claiming ages for the three teams could be 62, 66, and 67. Various claiming ages by earnings group incorporates about two-thirds of the overall earnings of staff 62-75.

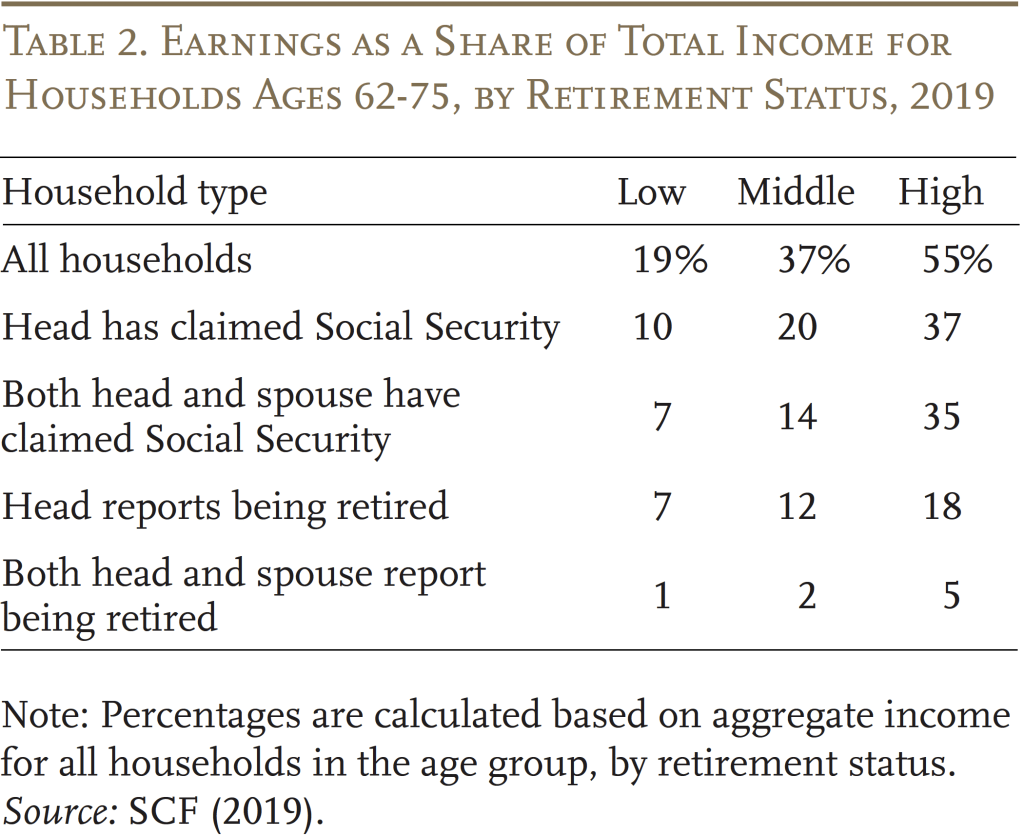

One third of earnings stays outdoors of the NRRI calculations as a result of the standard hyperlink between claiming and retirement has damaged down – notably for high-income households. Receipt of Social Safety advantages was once a surefire option to classify a family as retired, however high-income households – even when each spouses have claimed – nonetheless obtain greater than a 3rd of their earnings from earnings (see Desk 2). Earnings proceed till each the top and the partner self-report being retired.

Utilizing differential claiming ages has a significant impact on households’ retirement readiness throughout earnings teams. The affect works via three channels:

- Social Safety advantages. Claiming at 62 as an alternative of 65 for the low-income group entails a big actuarial discount in advantages; claiming at 66 for middle-income households and at 67 for high-income households – as an alternative of 65 – considerably will increase advantages.

- Wealth accumulation. Claiming at 66 or 67 quite than 65 gives households with extra time to build up DC property, different monetary property, and housing wealth. In distinction, retiring at 62 quite than 65 leaves much less time to build up wealth.

- Annuity elements. As famous, the NRRI assumes that households convert all their property and proceeds from a reverse mortgage right into a stream of earnings by buying an inflation-indexed annuity. The funds from that annuity improve with the age at which the annuity begins.

Utilizing differential claiming ages additionally modifications the goal alternative charges in the identical path as projected alternative charges, however the modifications within the targets are a lot smaller. Consequently, modifications within the projected charges dominate.

Re-estimating the NRRI

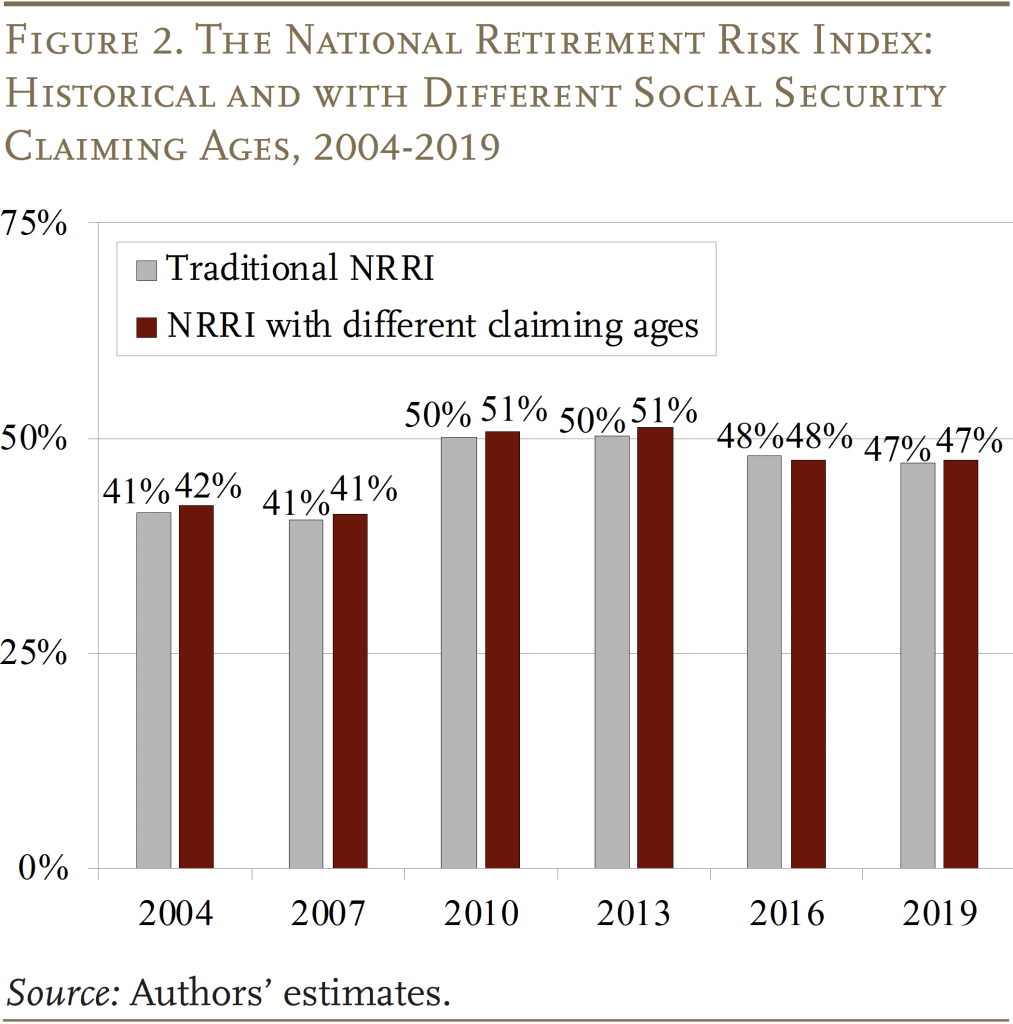

The duty is then to re-estimate the NRRI utilizing Social Safety claiming ages that modify by earnings group. Mechanically, the method entails operating the mannequin thrice – as soon as assuming the claiming age is 62 for all earnings teams, as soon as assuming 66 for all, and as soon as assuming 67 for all. The proportion of low-income households in danger is derived from the age-62 run; for middle-income households from the age-66 run, and for high-income households from the age-67 run. These outcomes are then mixed to provide the revised total Index, which is proven in Determine 2 with the standard NRRI. The important thing discovering is that the sample is an identical and the numbers are extraordinarily shut – roughly half of households aren’t ready for retirement beneath every measure.

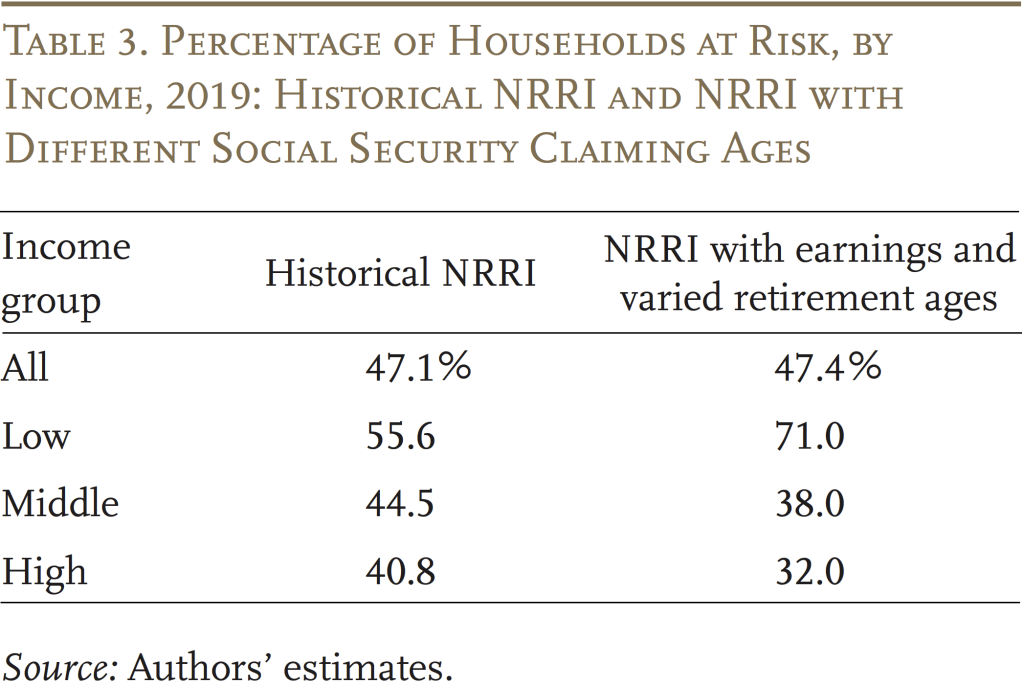

What argues for utilizing the NRRI model with assorted claiming ages is that it contains extra earnings within the calculation, permits for a extra acceptable Social Safety actuarial adjustment, and produces a extra smart sample by earnings group. As proven in Desk 3, various claiming ages reduces the share in danger for high-income households and will increase it for these within the low-income tercile. The upper proportion of low-income households in danger confirms findings from different research.

The remaining query is whether or not persevering with to exclude one-third of earnings for staff ages 62-75 is prone to distort the NRRI. One would suppose not. SCF knowledge present that roughly 80 p.c of the excluded earnings accrue to high-income households, so the exclusion seemingly has no impact on the share of households in danger within the low- and middle-income terciles. Therefore, the query narrows as to if some high-income households are mistakenly categorised as in danger – that’s, lower than 32 p.c could be in danger if all earnings had been included. Answering that query, requires distributing the excluded earnings amongst high-income households nonetheless working at age 68 and annuitizing these quantities over their remaining lifetimes. This train solely reduces the share of high-income households in danger from 32 p.c to 30 p.c., which means that the remaining excluded earnings aren’t distorting the NRRI.

Conclusion

The NRRI is an try to mix all elements of the retirement panorama right into a single quantity to gauge the adequacy of our system for households at totally different factors within the earnings distribution and at totally different moments in time. It requires an unlimited quantity of knowledge, many assumptions, and quite a few selections – all of that are open for debate. The factor that provides us coronary heart is the steadiness of the outcomes regardless of intensive stress testing. Various the Social Safety claiming ages is a living proof. The NRRI headline quantity nonetheless hovers round 50 p.c. However the truth that the outcomes produce a greater sample by earnings group argues for utilizing the brand new method as we replace the NRRI to include knowledge from the 2022 Survey of Shopper Funds.

References

Biggs, Andrew. 2023. “Will Retirees’ Incomes Be Sufficient? It Is dependent upon What You Depend as Earnings.” (June 19). New York, NY: Forbes.

Tan, Fu, Fiona Greig, Andrew S. Clarke, Kevin Khang, Kate McKinnon, and Victoria Zhang. 2023. “The Vanguard Retirement Outlook: A Nationwide Perspective on Retirement Readiness.” Retirement Outlook Report. Valley Forge, PA: Vanguard.

[ad_2]