[ad_1]

Older folks have an excellent potential to adapt and cope.

A lot of the work we do means that persons are not saving sufficient for retirement. Extra particularly, since 2006 we’ve revealed our Nationwide Retirement Danger Index (NRRI), which makes use of the Federal Reserve’s triennial Survey of Shopper Funds to match households’ projected substitute charges – retirement revenue as a proportion of pre-retirement revenue – with targets that may keep their way of life. These households with a projected substitute fee that’s greater than 10 p.c beneath the goal are characterised as falling quick. After nearly twenty years of kicking the tire, the NRRI continues to point out that nearly half of as we speak’s working households won’t have sufficient in retirement.

Some critics don’t like our mannequin or assumptions; others say the outcomes have to be improper as a result of folks report being completely content material in retirement. Lately, as background for a much bigger challenge, we appeared on the happiness measures reported within the main longitudinal survey of older households (the Well being and Retirement Research). This survey asks three recurring questions on satisfaction:

- Please take into consideration your life-as-a-whole. How happy are you with it? Are you fully happy, very happy, considerably happy, not very happy, or by no means happy?

- All in all, would you say that your retirement has turned out to be very satisfying, reasonably satisfying, or by no means satisfying?

- Enthusiastic about your retirement years in comparison with the years simply earlier than you retired, would you say the retirement years have been higher, about the identical, or not nearly as good?

We centered on query #2, the place the responses have been coded as follows: 3 = “retirement could be very satisfying; 2 = “reasonably satisfying,” and 1 = “by no means satisfying.” The outcomes counsel that not solely are the degrees of satisfaction excessive, however they’re enhancing as folks age (see Determine 1).

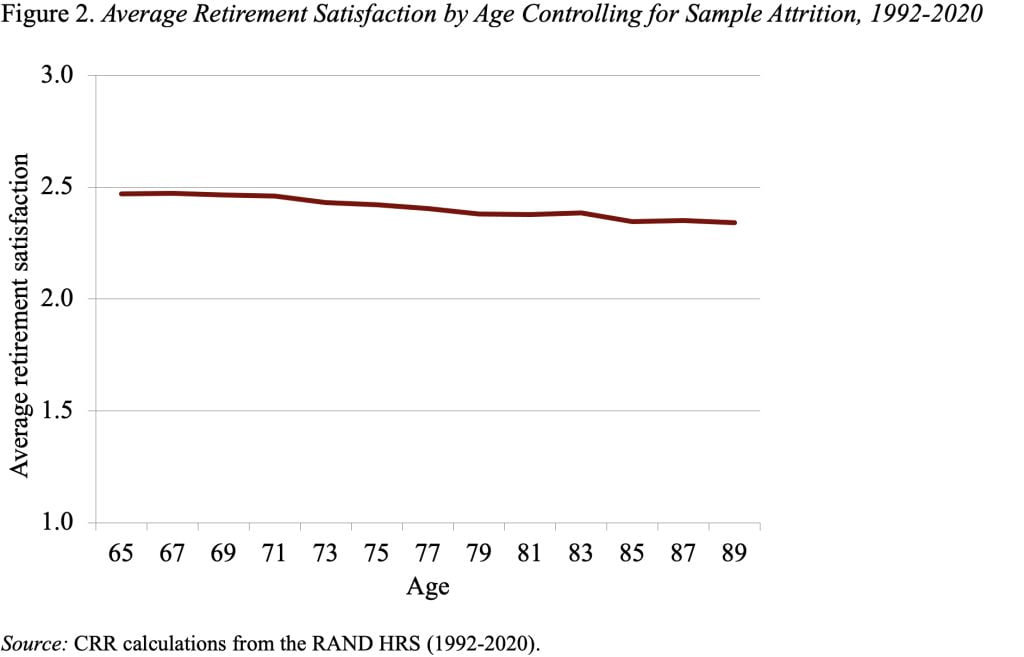

That image just isn’t fairly honest as a result of those that discover retirement “by no means satisfying” are usually poor and sickly and die sooner than the others. After they go away the pattern as they die, it raises the extent of satisfaction for the remaining group. So possibly controlling for this attrition would change the image. Certainly, it does slightly (see Determine 2). The road slopes down with age, however the stage of satisfaction stays effectively above a 2 – someplace between “reasonably satisfying and really satisfying.” That doesn’t look like a state of affairs the place retirees are in dire straits.

So, what’s occurring right here? It seems that older persons are typically happier than their youthful counterparts, and a complete physique of psychological literature is dedicated to making an attempt to clarify older folks’s positivity. It seems that older folks have a higher potential to insulate their ideas and emotional reactions from detrimental conditions and have an excellent potential to adapt and cope.

Candidly, I discover that myself as an older individual. The oriental rug within the entryway of our home has worn skinny typically, and has truly developed a pretty big gap. Twenty years in the past, we might have shopped for a brand new rug, now we merely put coloured paper beneath the outlet!

The underside line is that it’s most likely not potential to evaluate the adequacy of financial savings by asking older folks about their stage of satisfaction or happiness. They’re all actually completely happy. But surveys repeatedly present that when persons are requested what they need to have finished in another way, they typically reply: “I ought to have saved extra” or “I ought to have began saving earlier.”

We’re off to seek out different metrics to determine what’s occurring.

[ad_2]