[ad_1]

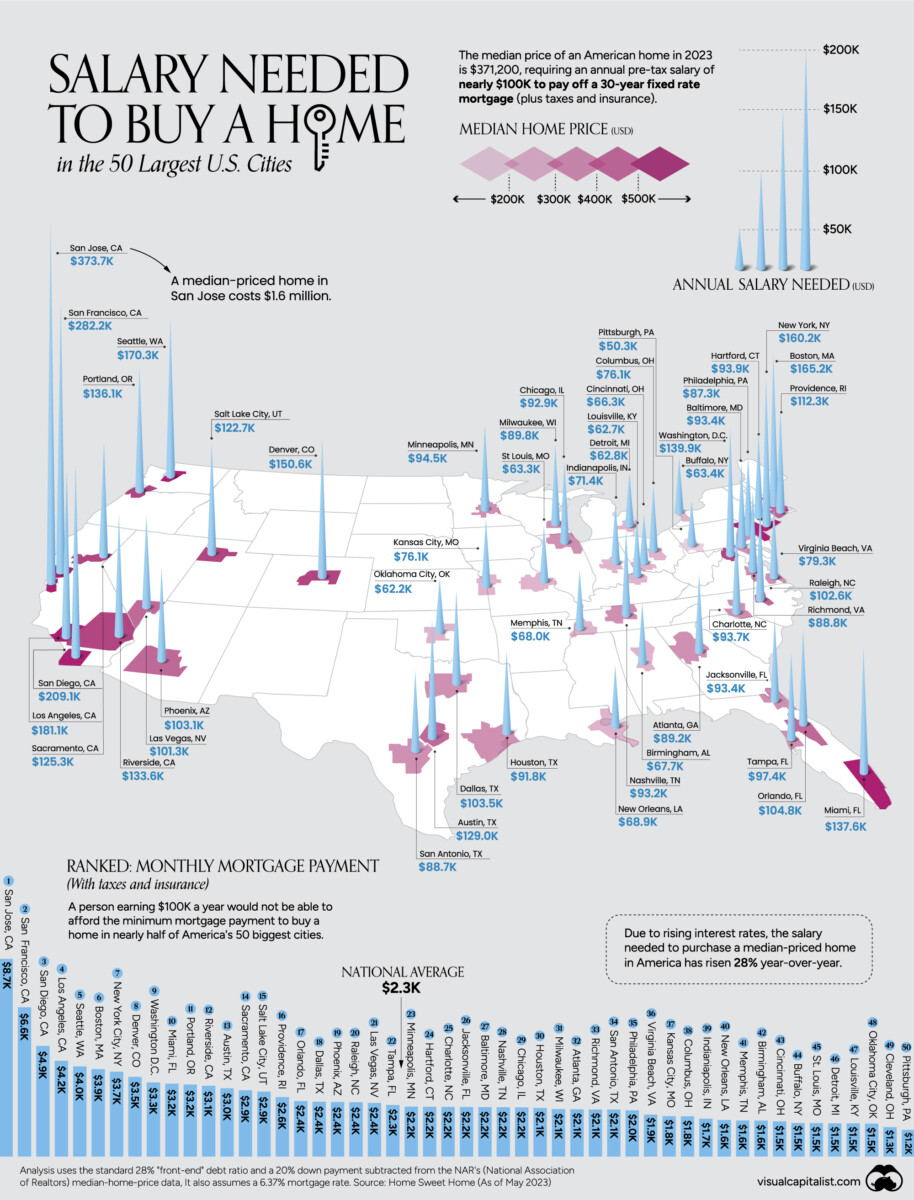

Whereas I’m wrapped up engaged on just a few initiatives as we speak, I needed to share this map/chart/desk exhibiting US actual property costs relative to revenue.

Quite a lot of elements drive residence costs — accessible provide, mortgage charges, inflation, wage/revenue progress, demand, and so forth. Its not so simple as many make it out to be.

It has additionally turn out to be apparent that the massive scarcity of single-family houses housing costs has saved costs elevated (though there are some indicators that some aspirational pricing is softening.

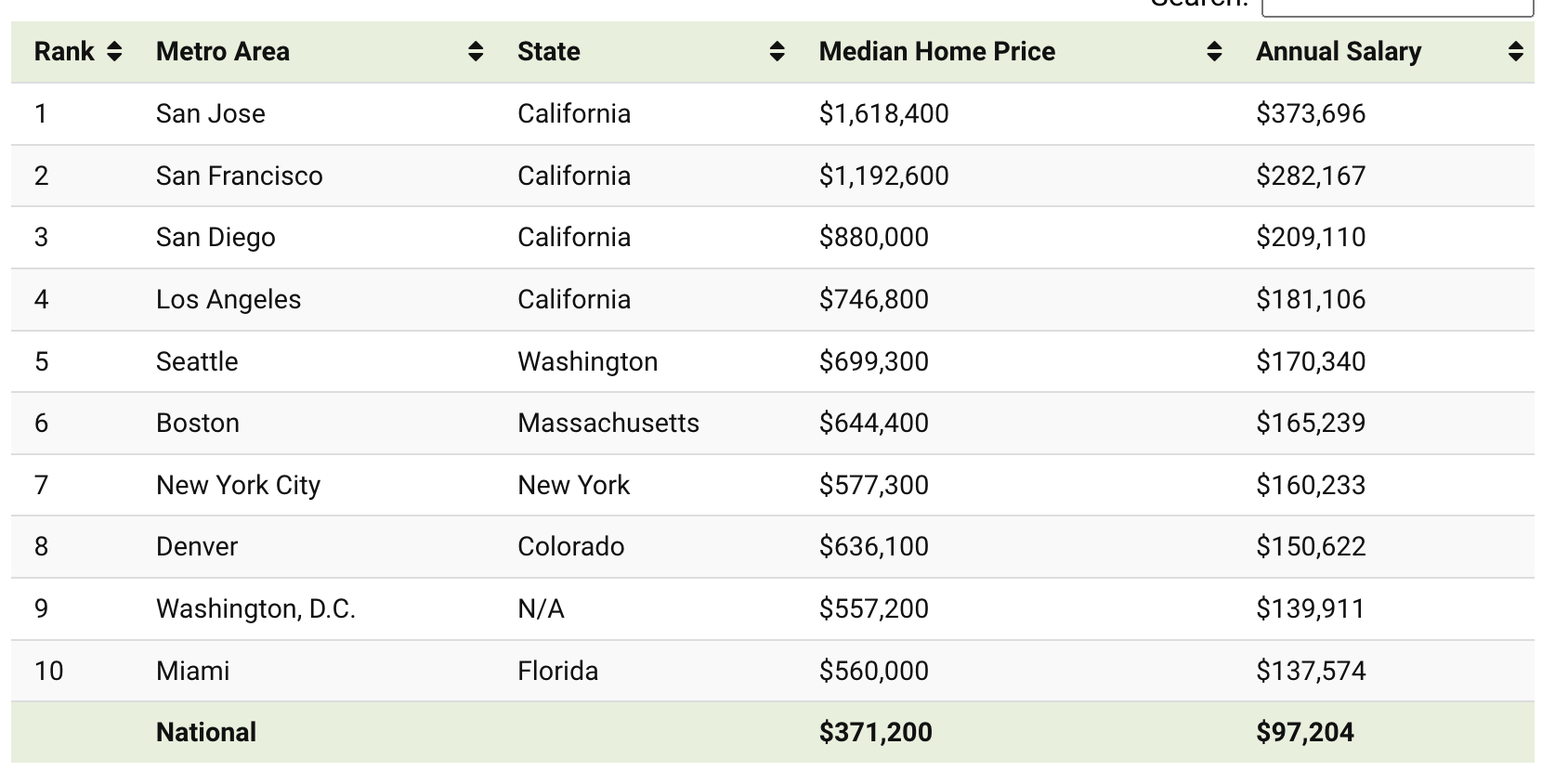

Regardless, the increase in the course of the lockdown has put residence costs out of attain for many Individuals in probably the most populous and sometimes probably the most affluent areas. Though it’s primarily the Coasts the place residence costs are highest relative to salaries, there are pockets like Denver (#8) and Salt Lake Metropolis (#15) within the high 50.

The annual wage to purchase a house in America’s 50 most populous cities.

Beforehand:

How All people Miscalculated Housing Demand (July 29, 2021)

Can We Untie Actual Property and Employment? (March 21, 2022)

U.S. House Value Progress 1983-2023 (July 6, 2023)

Mapping Modifications in US House Costs (July 12, 2023)

Nationwide Affiliation of Realtors Is Imploding (October 13, 2023)

Click on for the total submit on Visible Capitalist

[ad_2]