[ad_1]

Price-of-living adjustment makes positive the spine of our retirement system retains tempo with rising costs.

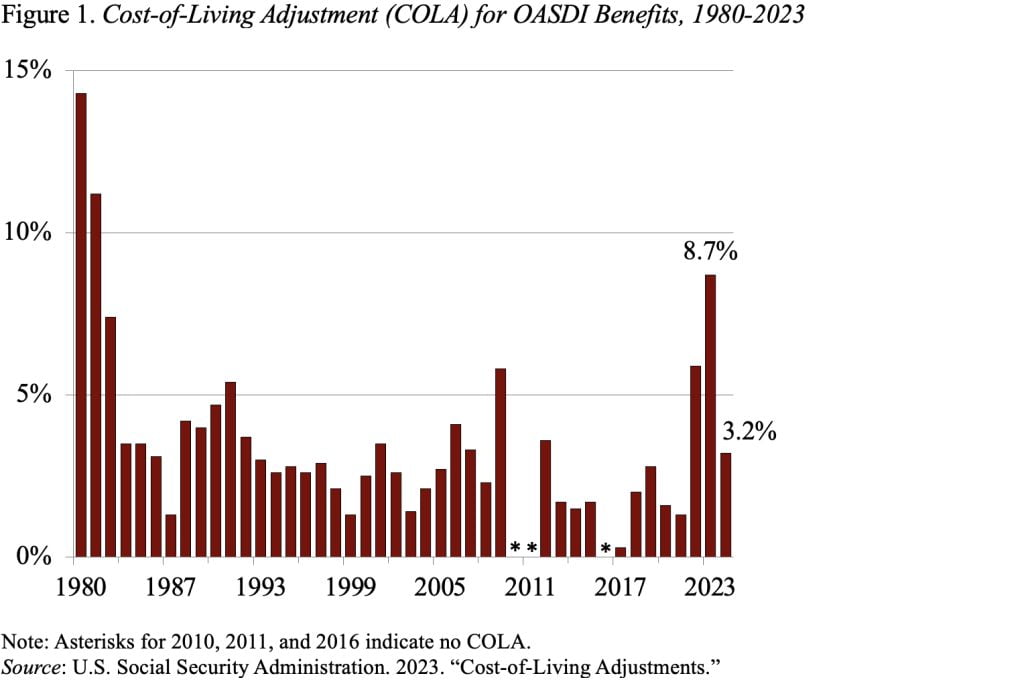

With the discharge of the September CPI-W inflation quantity, the Social Safety Administration introduced that the COLA for 2024 will probably be 3.2 p.c (see Determine 1). The adjustment relies on the rise within the CPI-W for the third quarter of 2023 over the third quarter of 2022. Some bemoan that this yr’s COLA is smaller than these previously few years, however the adjustment is designed to compensate for rising costs, in order inflation drops, the magnitude of the required adjustment additionally falls.

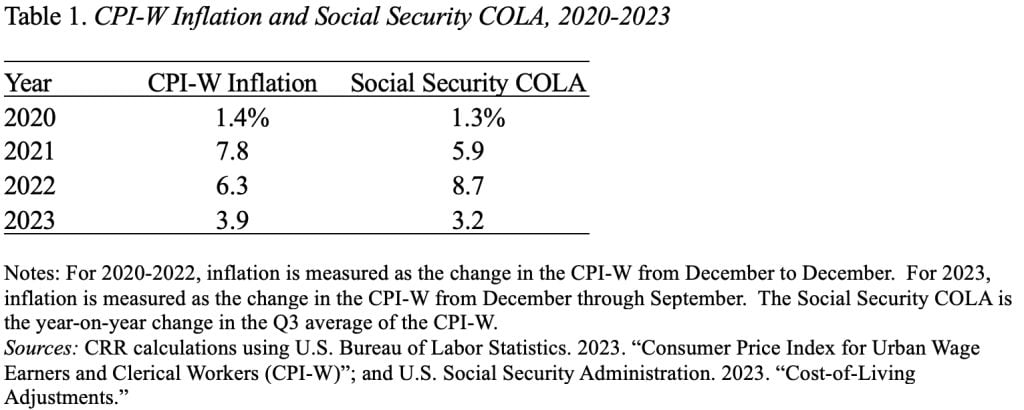

Social Safety’s COLA does the job it’s meant to do. The previous couple of years make that time in spades. The primary column of Desk 1 reveals the December-to-December improve within the CPI-W every year from 2020 via 2022, with an estimate for 2023. The second column reveals the COLAs introduced in 2020 via 2023, which take impact within the following yr. In essence, Social Safety’s purpose is to compensate for the rise in costs of 1.4 p.c in 2020 by elevating advantages by 1.3 p.c in 2021. When inflation is pretty regular, inflation and the COLA are very shut.

When inflation takes off, nonetheless, the backward-looking nature of the calculation implies that – within the brief time period – the COLA offers lower than a full adjustment. That’s, in 2021 costs rose 7.8 p.c from January to December, however the COLA introduced for 2022 was solely 5.9 p.c (primarily based on the third quarter of 2021 over the third quarter of 2020). This discrepancy triggered nice consternation on the time. However look what occurred in 2022 – inflation slowed to six.3 p.c, however the COLA was a lot bigger at 8.7 p.c. So, COLAs are typically too small when inflation begins and too giant as inflation comes down. The necessary level is that, over the entire cycle, Social Safety beneficiaries are absolutely compensated for inflation.

On a a lot smaller scale, this yr’s COLA appears to be like considerably low in comparison with our estimate of the rise in costs for 2023. However my finest guess is that inflation subsequent yr could dip beneath 3 p.c and that the Social Safety COLA introduced subsequent fall will probably be increased than precise inflation.

Social Safety’s COLA is without doubt one of the most beneficial points of this system’s design. It has at all times supplied invaluable safety. Even an inflation charge as little as 2 p.c cuts the buying energy of a $1,000 profit to $600 over a 25-year retirement. The COLA prevents that erosion. However the lack of drama implies that the COLA goes unappreciated. The one good factor that could be stated in regards to the present inflation spike – which is dangerous for all points of our lives – is that it has highlighted the worth of getting retirement advantages that sustain with costs.

[ad_2]