[ad_1]

The transient’s key findings are:

- Regardless of Social Safety’s on-line instruments, many retiring employees nonetheless contact an company consultant for assist.

- Each on-line and in-person candidates report excessive satisfaction with the method of claiming advantages.

- Curiously, decrease satisfaction typically stems from those that would favor to make use of on-line instruments, however finally don’t.

- This outcome means that continued enchancment in, and promotion of, on-line companies might additional increase total satisfaction.

Introduction

Retiring child boomers are rising the demand for Social Safety Administration (SSA) companies at a time when price range constraints and retiring employees are limiting the company’s capability to ship them. On-line companies provide a approach for SSA to fulfill elevated demand with fewer sources. Nonetheless, whilst SSA has shifted extra customized info and companies on-line to its my Social Safety platform, analysis exhibits that many individuals nonetheless don’t use this software to view their Social Safety Assertion or apply for advantages. As such, this transient explores latest retirees’ satisfaction with the claiming course of amidst the shift to on-line instruments and the continued need by some for in-person or telephone companies.

The dialogue proceeds as follows. The primary part describes the CRR’s 2021 survey on people’ claiming course of, which is the supply of information for this evaluation. The second part paperwork survey respondents’ reported claiming satisfaction and finds that it’s usually excessive, with some small variations by race/ethnicity and claiming course of (i.e., on-line vs. offline). The third part explores the extent to which a claimant’s diploma of satisfaction with the method is related to their causes for contacting SSA. The fourth part describes survey respondents’ open-ended recommendations for enhancing the claiming course of. The ultimate part concludes that, total, latest retirees report being very glad with their expertise and that continued enhancements in on-line companies might probably additional increase satisfaction for individuals who choose to make use of on-line instruments.

Information and Prior Analysis

In Might 2021, the CRR surveyed about 1,600 older people relating to their latest expertise claiming Social Safety retirement advantages. The survey included questions on the general claiming means of respondents (together with their interactions with SSA main as much as – and shortly after – claiming) and their satisfaction with the method. In consequence, the survey gives a complete image of the claiming expertise of respondents: the claiming path taken, the obstacles encountered, the self-reported causes for his or her chosen path, total satisfaction with the method, and respondents’ recommendations for enchancment.

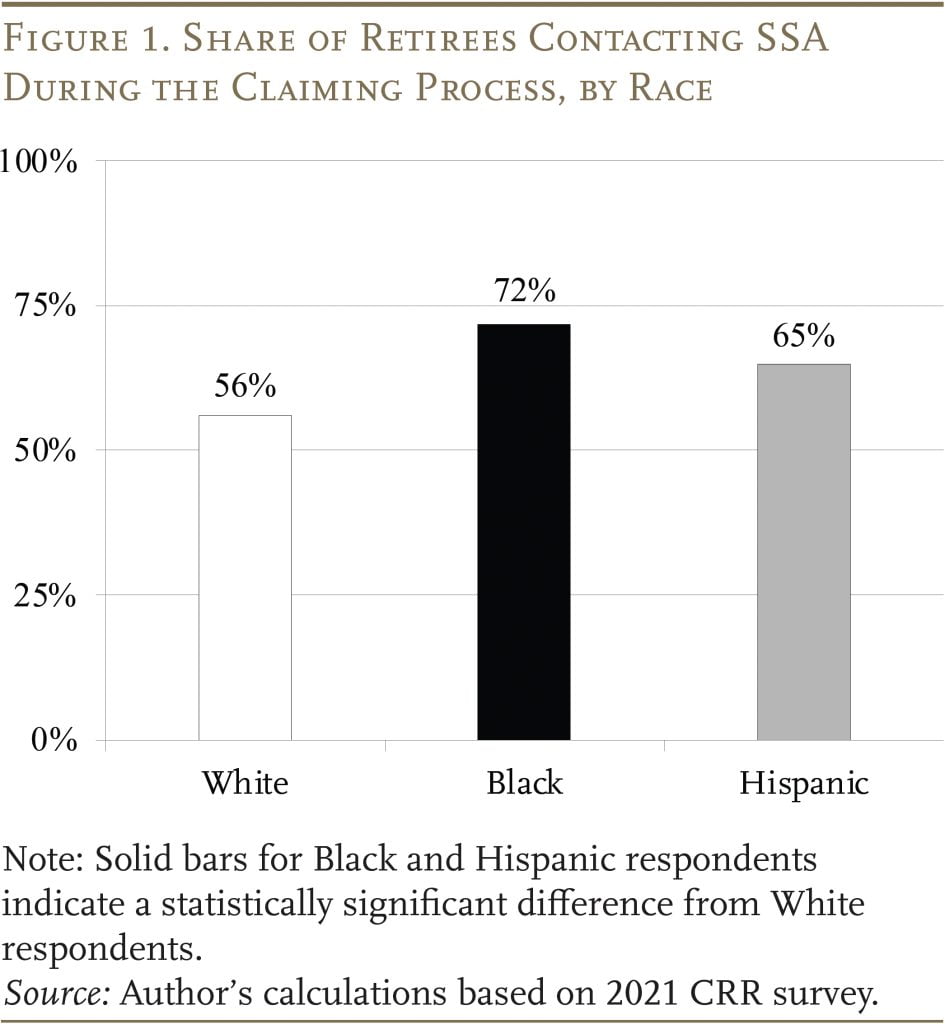

The CRR’s preliminary evaluation of the survey responses discovered that nearly 60 p.c of latest retirees contacted SSA in some unspecified time in the future in the course of the claiming course of and that those that contacted SSA have been extra more likely to be non-White (see Determine 1). The stable bars for the Black and Hispanic classes point out a statistically important distinction from Whites. Given the racial variations in claiming utterly on-line, this transient makes use of the survey to look at the final claiming satisfaction of latest retirees, in addition to variations in satisfaction by each claiming course of (i.e., utterly on-line or not) and race.

Claiming Satisfaction

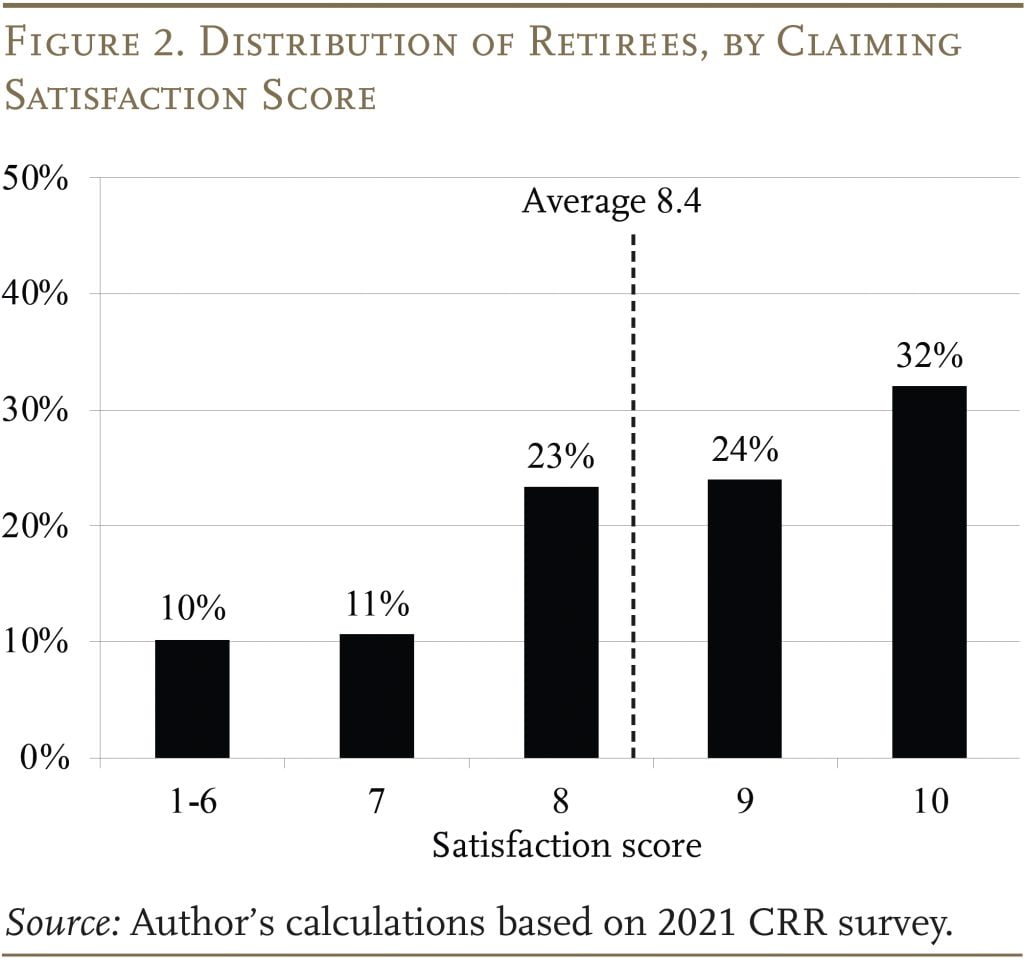

Within the survey, latest retirees have been requested to fee their total satisfaction with their claiming course of on a scale of 1 to 10, with 10 being the best degree of satisfaction. The common satisfaction rating was 8.4, with about 80 p.c of respondents reporting a rating of 8 or extra (see Determine 2). This discovering displays claiming of retirement advantages solely – it doesn’t seize incapacity profit purposes, a course of that faces well-known challenges similar to case backlogs. The excessive satisfaction scores for retirement companies in our survey additionally align with outcomes from SSA’s General Buyer Service Satisfaction Survey, which has persistently proven roughly 80 p.c of survey respondents score SSA companies as “wonderful,” “superb,” or “good.” Those that contacted SSA throughout their claiming course of report barely decrease satisfaction than those that claimed utterly on-line – 8.3 vs. 8.7 – a distinction that was statistically important.

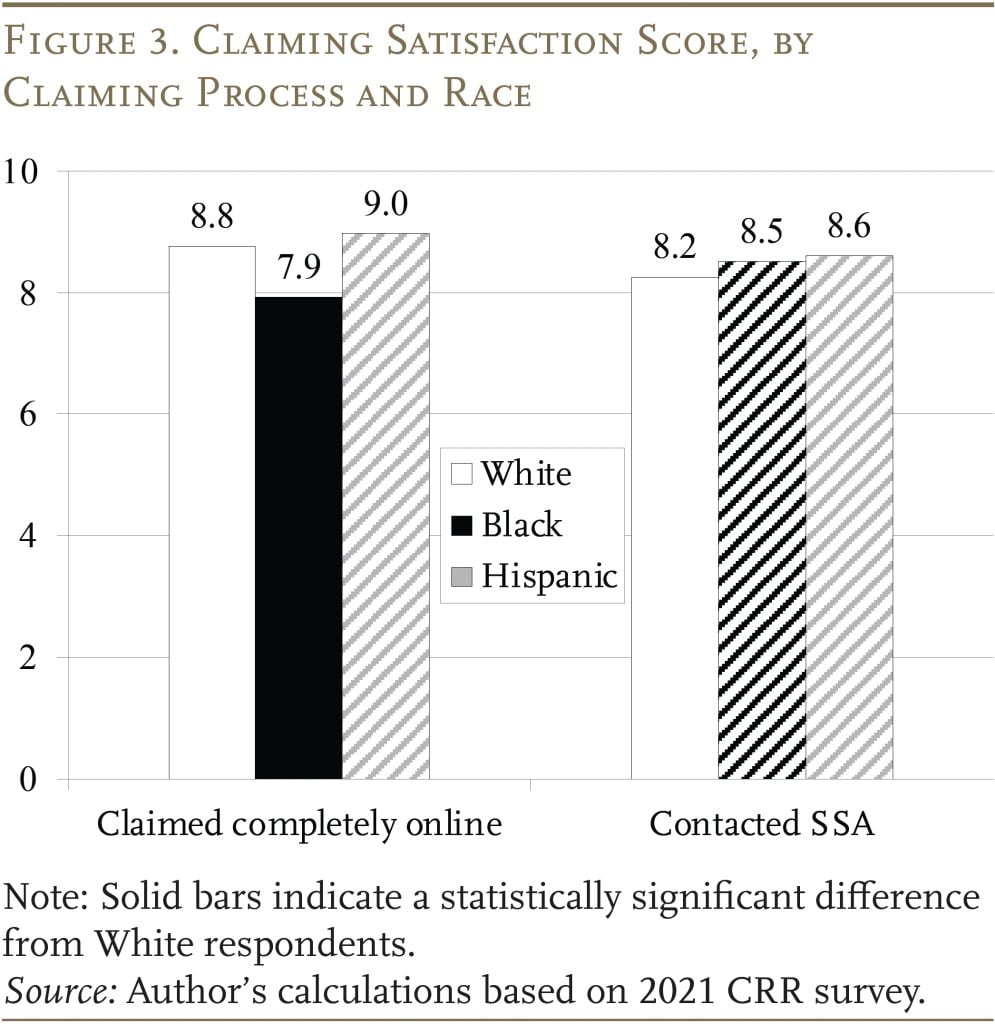

A better take a look at satisfaction by claiming course of and race reveals some attention-grabbing variations (see Determine 3). First, each Whites and Hispanics who claimed utterly on-line report increased satisfaction scores than those that contacted SSA when claiming. In distinction, Blacks who claimed utterly on-line report decrease satisfaction scores than their counterparts who contacted SSA. Second, although usually not statistically important, Hispanics report increased satisfaction scores than both Black or White respondents, whether or not they claimed utterly on-line or not.

Does Satisfaction Fluctuate by Motive for Contacting SSA?

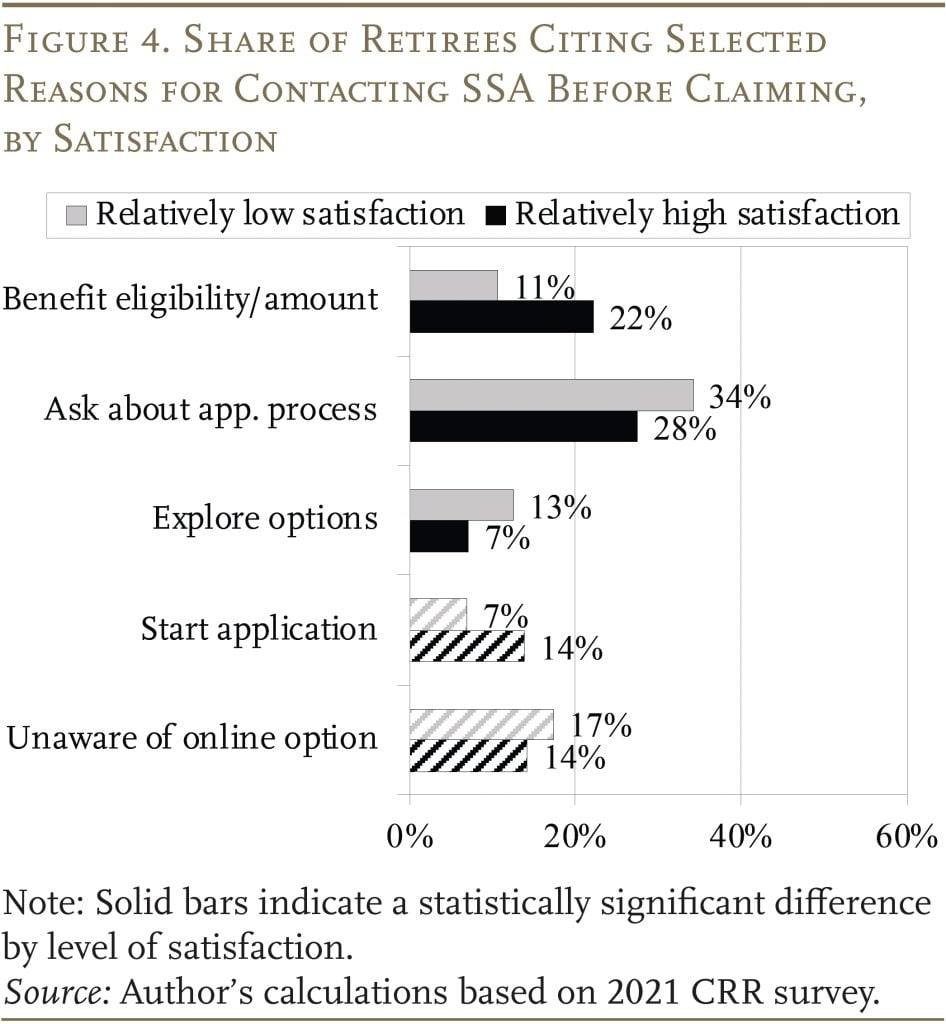

As famous above, a considerable variety of retirees contact SSA in some unspecified time in the future throughout their claiming course of, typically to get extra info earlier than making use of for advantages. It’s attainable that the explanation they contact SSA earlier than claiming might be related to their diploma of satisfaction with the expertise. Determine 4 compares some frequent causes given by people with a satisfaction rating of 8 or above (black bars) to these with a rating beneath 8 (grey bars). Those that report increased satisfaction scores usually tend to have contacted SSA to ask whether or not they have been eligible for retirement advantages or what quantity they might obtain, and people who report decrease scores usually tend to have contacted SSA to ask in regards to the steps within the software course of or to discover their choices (e.g., how claiming at completely different ages would have an effect on their advantages).

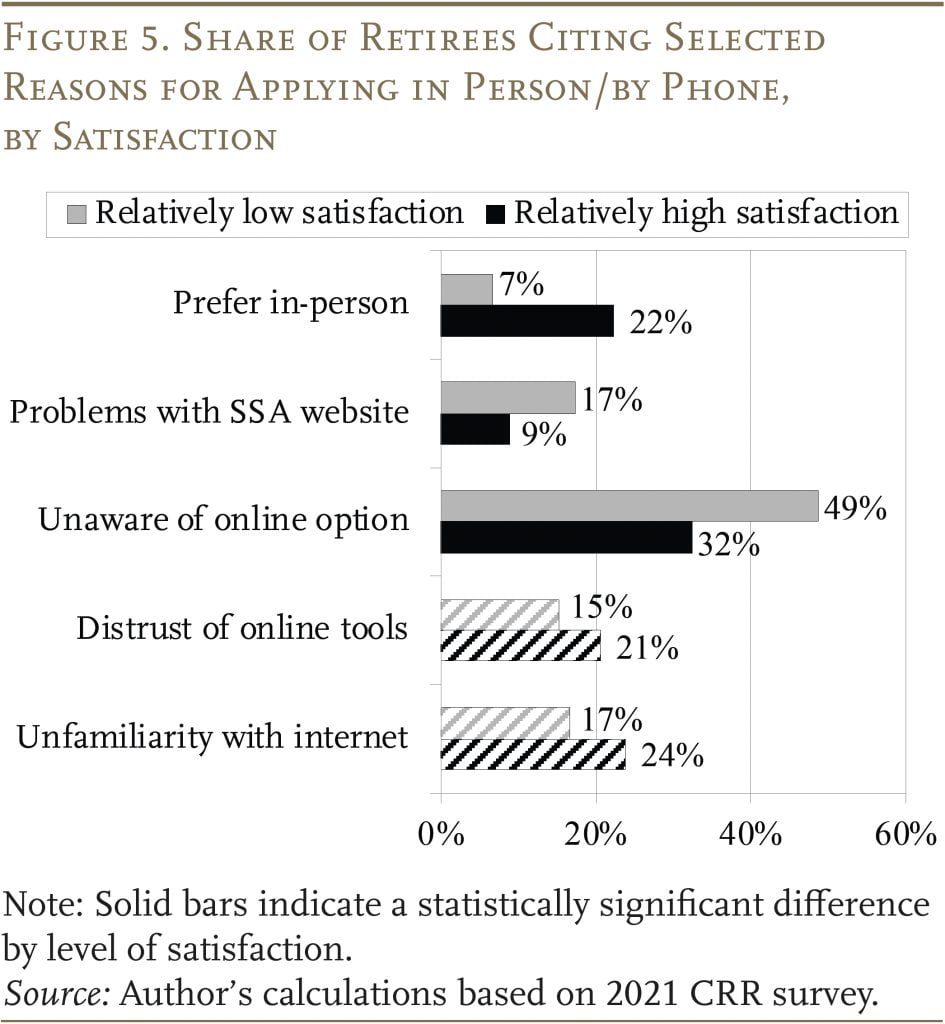

Shifting from pre-application to the precise software, the outcomes present that – for individuals who claimed their advantages in individual or by telephone – the respondents reporting increased satisfaction scores usually tend to choose making use of in individual (see Determine 5). In distinction, these with decrease satisfaction scores have been extra more likely to have contacted SSA as a consequence of issues with the SSA web site or as a result of they have been unaware of the web choice. This discovering means that decrease satisfaction typically stems from those that may choose to make use of on-line instruments, however finally don’t. Conversely, it additionally means that continued efforts to speak the provision of on-line instruments and enhance the web claiming portal might lower the variety of retirees who’re much less glad with their claiming expertise.

How Would Retirees Enhance the Claiming Expertise?

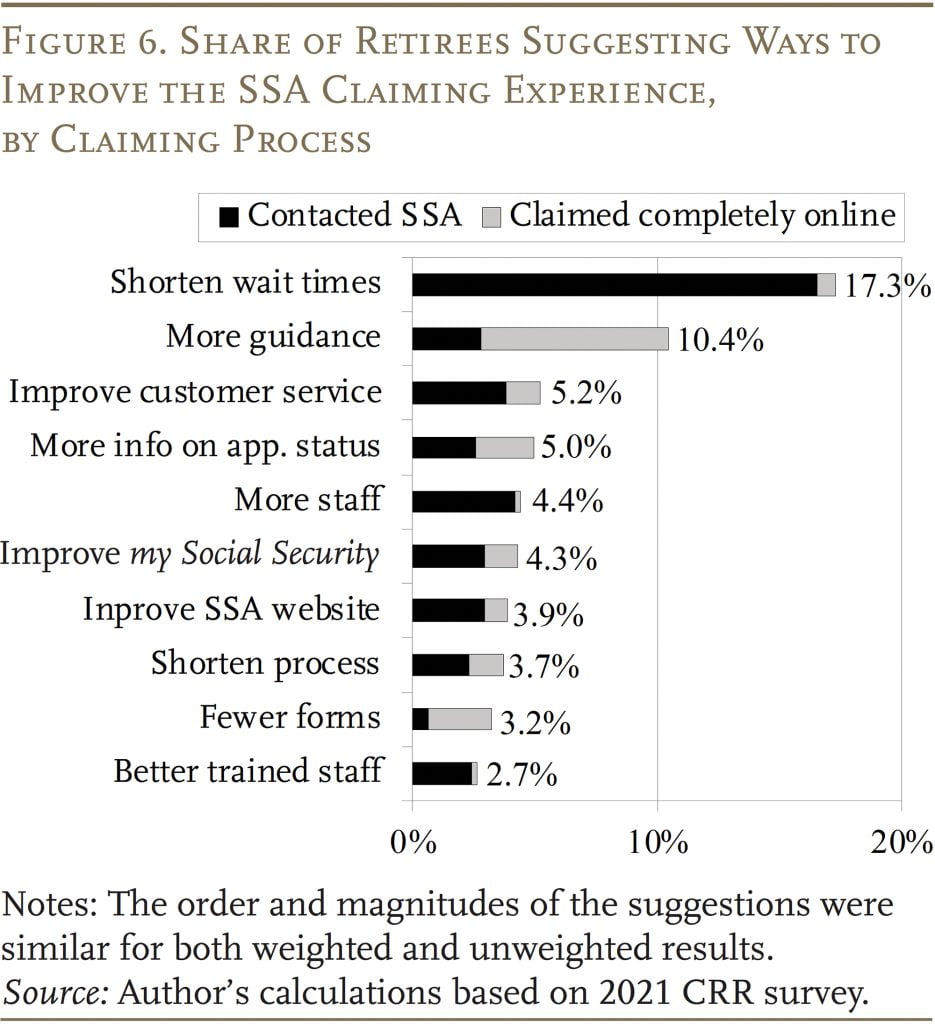

The CRR additionally requested retirees to recommend find out how to enhance the claiming expertise. Not surprisingly, given the general excessive satisfaction scores, simply over 20 p.c of retirees – about 435 respondents – provided recommendations for a way SSA may enhance its companies. (One other 15 p.c merely offered constructive suggestions on their expertise.) Whereas no statistical variations existed by race within the chance of providing recommendations, those that contacted SSA in the course of the claiming course of have been extra more likely to provide a suggestion.

When dissecting the recommendations offered by latest retirees, most included an concept that might be simply categorized. Unsurprisingly, the recommendations diverse considerably by whether or not a retiree claimed utterly on-line or not. For instance, one of the crucial frequent recommendations – given largely by those that contacted SSA – was to shorten wait instances, adopted by offering extra steering to retirees on the method – given largely by those that claimed utterly on-line (see Determine 6). Solely a small proportion immediately cited SSA’s on-line info and companies.

Conclusion

Offering on-line companies gives a approach for SSA to fulfill elevated demand with fewer sources. Nonetheless, whilst SSA has shifted extra customized info and companies to the my Social Safety on-line platform, analysis exhibits that many nonetheless don’t use it to view their Assertion or apply for advantages.

This transient explored latest retirees’ satisfaction with their claiming course of amidst the shift in the direction of on-line instruments and the continued need by some for offline companies. General, the outcomes recommend that SSA is offering stable customer support to retirees whether or not they select to make use of on-line instruments or contact SSA – with each teams reporting a mean satisfaction rating of greater than 8 out of 10. As well as, the findings recommend that continued enhancements in, and promotion of, on-line companies might probably additional increase satisfaction of those that would favor to make use of on-line instruments.

References

Aubry, Jean-Pierre and Kevin Wandrei. 2021. “The way to Enhance Utilization of SSA’s On-line Instruments.” Working Paper 2021-15. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Carman, Katherine, Samer Atshan, and Jhacova Williams. 2023. “Disparities in Social Safety Data and the Function of Social Capital.” Working Paper 2023-458. Ann Arbor, MI: College of Michigan Retirement and Incapacity Analysis Middle.

Knapp, David and Francisco Perez-Arce. 2022. “Racial and Ethnic Disparities in Data about Social Safety Packages.” Working Paper 2022-449. Ann Arbor, MI: College of Michigan Retirement and Incapacity Analysis Middle.

Peterson, Janice, Barbara A. Smith, and Qi Guan. 2019. “Hispanics’ Data of Social Safety: New Proof.” Social Safety Bulletin 79(4): 11-23.

Rabinovich, Lila, Janice Peterson, and Barbara A. Smith. 2017. “Hispanics’ Understanding of Social Safety and the Implications for Retirement Safety: A Qualitative Examine.” Social Safety Bulletin 77(3): 1-14.

Yoong, Joanne, Lila Rabinovich, and Noticed Htay Wah. 2015. “What Do Folks Know About Social Safety?” Working Paper 2015-022. Los Angeles, CA: College of Southern California, Middle for Financial and Social Analysis and Schaeffer Middle.

[ad_2]