[ad_1]

Kim Moody: Canada must take a tough have a look at reducing private tax charges and guarantee folks maintain a minimum of half of all positive aspects

Critiques and proposals are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made by way of hyperlinks on this web page.

Article content material

Earlier than 2015, Alberta had, by far, the bottom federal-provincial mixed high marginal tax price in Canada at 39 per cent. This comparative benefit contributed vastly to massive quantities of funding and folks going into Alberta.

That 12 months, nevertheless, the federal Liberal Occasion fashioned the brand new authorities, and in Alberta, the NDP surprisingly got here to energy provincially. The brand new federal authorities promptly introduced it was elevating the charges on so-called high-income earners by “asking them to pay just a bit bit extra” (an offensive talking level that was overused for the following four-plus years, particularly when one understands how a lot high-income earners already pay when in comparison with the entire of Canada). The brand new “ask” would start in 2016 by introducing a brand new excessive federal bracket that elevated the top-end price by 4 per cent.

Commercial 2

Article content material

Article content material

The Alberta authorities additionally launched new greater charges for 2015 and 2016. When the mud settled, Alberta’s highest marginal private tax price elevated to a high finish of 48 per cent, a big enhance from its earlier low and considerably narrowing the hole between a few of the provinces that already had excessive private charges, resembling Ontario, Quebec and a few of the Maritime provinces.

After the 4 per cent federal enhance, Ontario, Quebec and the Maritime provinces had private charges of greater than 50 per cent. Ontario settled right into a mixed federal–provincial tax price of 53.53 per cent and it stays that in the present day. Quebec and the Maritime provinces are related. British Columbia just lately joined that membership.

Bluntly, Canada’s marginal private revenue tax charges are far too excessive. Once I point out this to a few of my left-leaning mates, they might rebut: “Kim, you notice that Canada’s highest marginal charges traditionally have been within the 80-plus-per-cent vary … proper? From that comparability, our present highest charges are a cut price.”

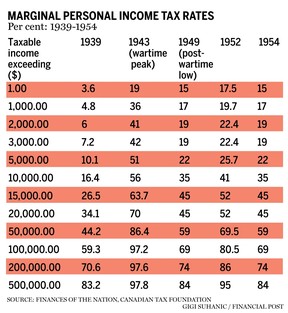

Technically, they aren’t fallacious. Take a look on the information within the accompanying desk from a 1954 publication, Funds of the Nation, by the Canadian Tax Basis. You’ll shortly see that the best marginal charges topped 80 per cent, with the excessive being 97.8 per cent in 1943.

Article content material

Commercial 3

Article content material

However let’s put a few of that into context. First, Canada’s private revenue tax system was comparatively younger from the Nineteen Thirties to the Fifties. The quantity of precise taxpaying people in comparison with the inhabitants as a complete was very low in comparison with in the present day. As well as, capital positive aspects weren’t taxable again then (capital positive aspects didn’t change into taxable in Canada till 1972). So, after all, there was no scarcity of gamesmanship taken by the small variety of high-income taxpayers to transform their revenue into non-taxable capital positive aspects.

In 1962, the federal authorities — led by John Diefenbaker — had the braveness to convene The Royal Fee on Taxation to evaluate your complete taxation system and make suggestions about what Canada ought to do. In 1966, the Royal Fee launched its voluminous report and proposals. Concerning private tax charges, the report acknowledged this in Chapter 11:

“We’re persuaded that top marginal charges of tax have an adversarial impact on the choice to work quite than get pleasure from leisure, on the choice to save lots of quite than devour, and on the choice to carry property that present financial returns quite than property that present advantages in variety. We predict there can be nice benefit in adopting a high marginal price no larger than 50 per cent. With such a most marginal price, taxpayers can be assured that a minimum of half of all positive aspects can be theirs after taxes. We predict there’s a psychological barrier to larger effort, saving and worthwhile funding when the state can take multiple half of the potential achieve.”

Commercial 4

Article content material

In 1974, American economist Arthur Laffer mentioned the same subject when he mused in regards to the relationship between taxation charges and the ensuing ranges of presidency tax income. The “Laffer curve” assumes that no tax income is raised on the excessive tax charges of zero per cent and 100 per cent, that means that someplace between these extremes is a price that maximizes authorities tax income. Discovering that most price is a difficult train for governments.

In my expertise, private behaviours considerably change when private tax charges strategy 50 per cent (much like what the Royal Fee mentioned in its report above). Individuals will seek for methods to decrease their tax payments, particularly when the notion is that there’s not a lot worth being offered when in comparison with the associated fee (or, as many politicians say, “funding”).

There’s a motive why vital quantities of high-income earners/rich individuals have just lately been leaving Canada. And it’s the identical motive why this nation has a troublesome time attracting top-end expertise in drugs, biotech, expertise, skilled sports activities and different industries/professions. Every time I elevate this alarm bell, I routinely get a rebuttal that I’m exaggerating. I’m not.

Commercial 5

Article content material

Associated Tales

-

New tax guidelines may imply donating extra to charity this 12 months

-

Rejection of CRA expense denial candy music to taxpayer’s ears

-

Tax system not constructed to maintain up with inflation

Canada must take a tough have a look at this situation to decrease private tax charges and guarantee folks that “a minimum of half of all positive aspects can be theirs.” And it would go a great distance to enhance its lagging productiveness … an vital subject for one more day.

Kim Moody, FCPA, FCA, TEP, is the founding father of Moodys Tax/Moodys Personal Shopper, a former chair of the Canadian Tax Basis, former chair of the Society of Property Practitioners (Canada) and has held many different management positions within the Canadian tax neighborhood. He may be reached at kgcm@kimgcmoody.com and his LinkedIn profile is www.linkedin.com/in/kimmoody.

Article content material

[ad_2]

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. Now we have enabled electronic mail notifications—you’ll now obtain an electronic mail for those who obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Group Tips for extra info and particulars on learn how to regulate your electronic mail settings.