[ad_1]

The temporary’s key findings are:

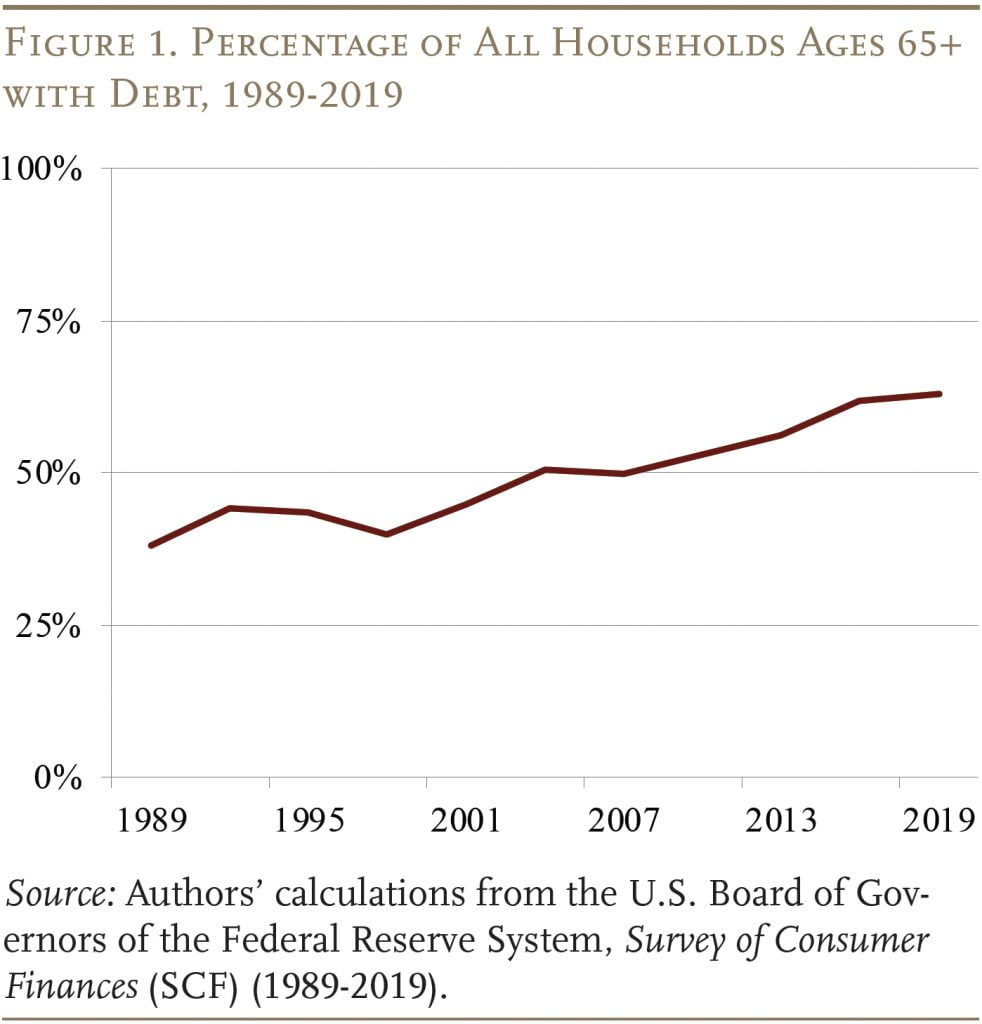

- The share of older Individuals with debt has been rising for the reason that Nineties, however holding debt in retirement just isn’t essentially dangerous.

- The query is, what number of older debtors are at excessive threat of economic misery as a result of kind and measurement of their debt?

- The evaluation finds that almost all of older debtors are at excessive threat, however not all high-risk debtors are alike.

- The high-risk fall into 4 teams: 1) financially constrained; 2) bank card debtors; 3) an excessive amount of home; and 4) rich spenders.

- Therefore, no one-size-fits-all answer exists, so focused coverage interventions can be handiest.

Introduction

The share of older Individuals with debt has been on the rise during the last a number of many years. Having debt, nevertheless, doesn’t all the time sign monetary fragility as a result of debt can be utilized for varied functions. For instance, households that take out a low-interest mortgage to purchase a house, which usually appreciates in worth, are probably making a savvy selection. In distinction, households that carry unpaid bank card balances may see their debt snowball, resulting in monetary misery. Figuring out these distinctions in family debt conditions is essential to understanding the implications of the rise in debt holding amongst seniors.

This temporary, based mostly on a brand new paper, addresses three key questions: 1) As extra older households carry debt in retirement, what share are at “high-risk” and “low-risk” of economic hardship? 2) Is the expansion in debt holding pushed by the high- or low-risk households? and three) What are the several types of high-risk households? The solutions will assist policymakers decide which varieties of debtors are most susceptible and develop tailor-made options for helping them.

The dialogue proceeds as follows. The primary part offers background on traits in debt holding amongst older Individuals. The second part types households into high-risk and low-risk based mostly on their debt and asset profiles, and it exhibits that high-risk debtors are driving the expansion in debt. The third part identifies 4 teams of high-risk debtors with very totally different traits. Given the various conditions of high-risk debtors, the fourth part suggests some potential methods to deal with every group’s particular wants. The ultimate part concludes that the debt burdens of high-risk debtors are trigger for concern, however a one-size-fits-all answer doesn’t exist, so focused interventions can be handiest.

Background

Because the Nineties, the share of Individuals ages 65+ with debt has been growing, elevating considerations amongst policymakers and researchers (see Determine 1). A lot of this development, although, is pushed by rising mortgage debt. Given the low rate of interest setting in current many years, carrying mortgage debt into retirement may very well be financially savvy. Certainly, prior research have prompt that older households are refinancing their mortgage with out extracting any extra fairness. However carrying housing debt into retirement will not be a superb transfer for everybody as mortgage funds can turn out to be a considerable portion of retirement bills.

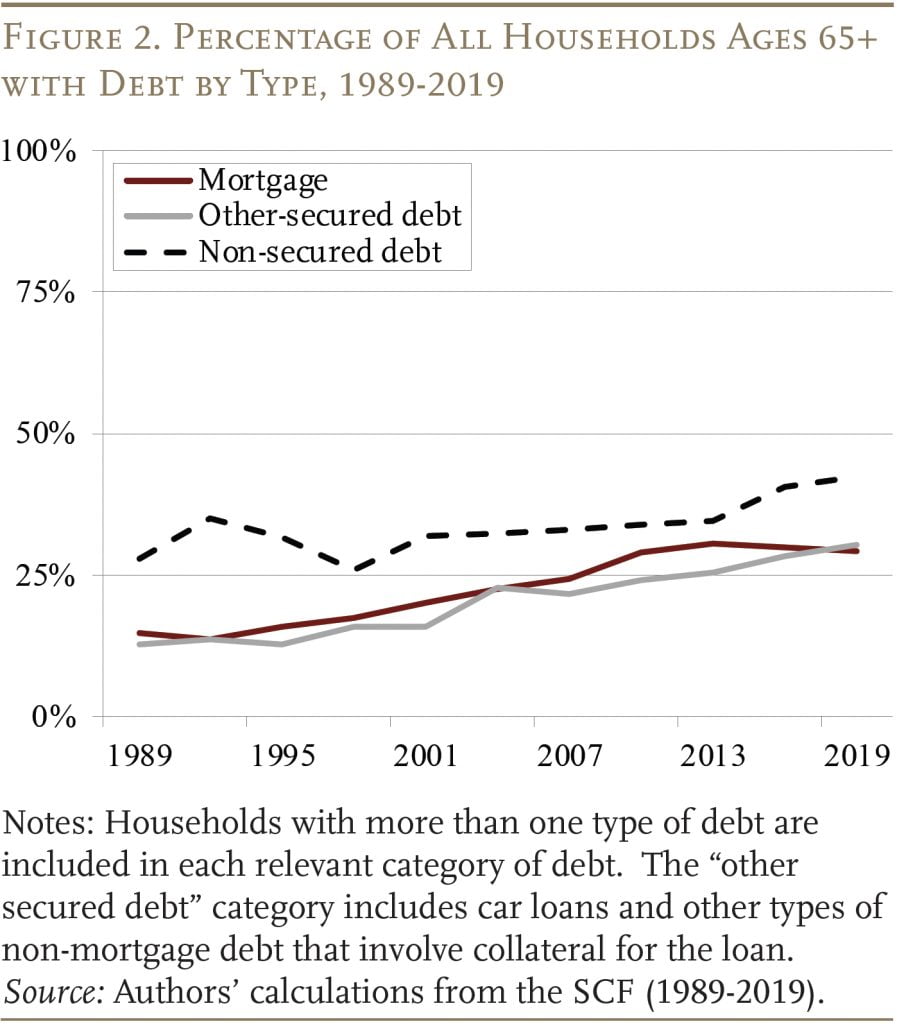

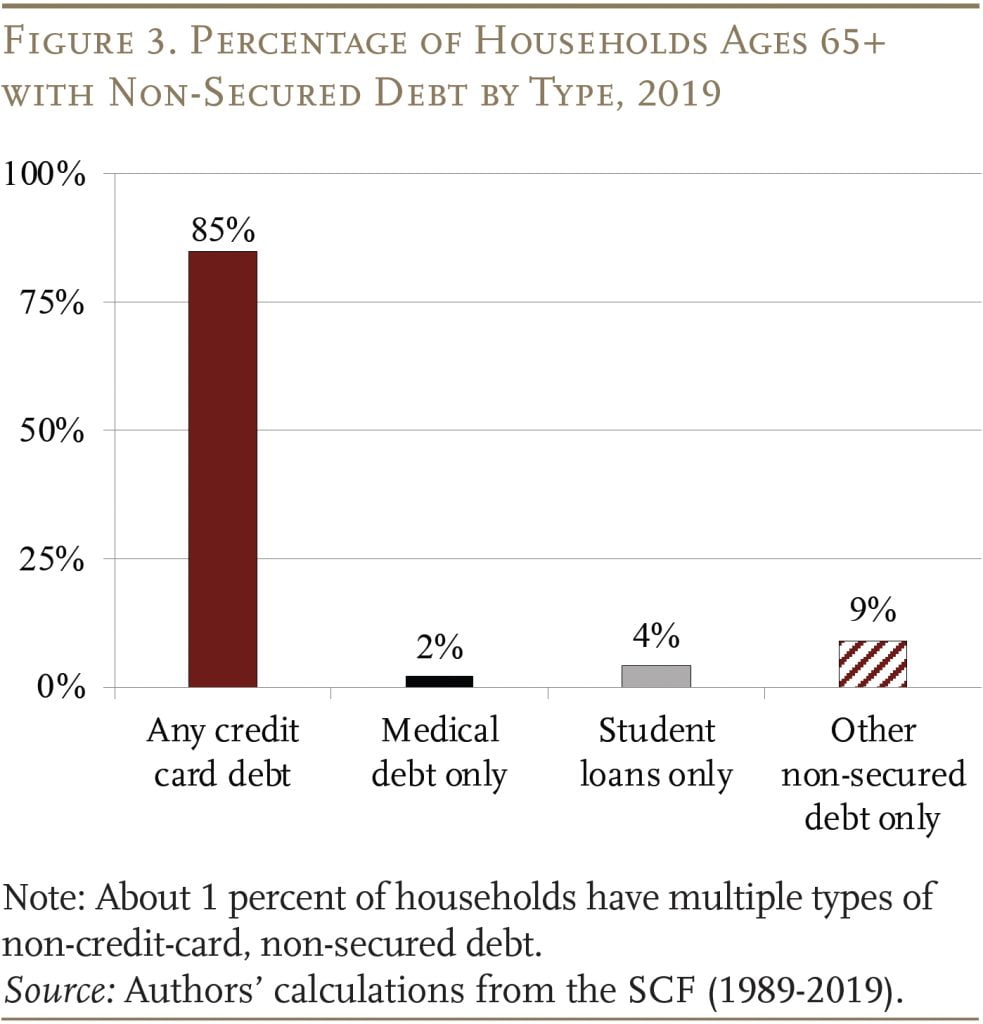

Whereas a lot of the expansion in borrowing amongst older households is because of rising mortgage debt, different non-secured types of debt – equivalent to bank card, scholar mortgage, and medical – have additionally elevated (see Determine 2). This sort of debt can put older households vulnerable to monetary misery. Bank card debt – the dominant type of non-secured debt held by households (see Determine 3) – has high-interest charges, which may result in the fast accumulation of huge balances and will end in critical monetary penalties, equivalent to chapter. The smaller types of non-secured debt can even increase considerations, significantly for in any other case financially susceptible teams.

Briefly, it’s not clear how a lot of the expansion in older households with debt is a priority. The objective of this research is to differentiate between debtors who’re at excessive threat of jeopardizing their retirement and the financially savvy debtors that made essentially the most of low rates of interest.

Defining Low- and Excessive-Threat Debtors

The evaluation attracts from two nationally consultant surveys – the Survey of Client Funds (SCF) and the Well being and Retirement Examine (HRS). The SCF, administered triennially since 1983, captures wealthy info on family steadiness sheets, together with the assorted varieties of debt. To complement the SCF, the evaluation makes use of the HRS, a biennial survey of households ages 51+ with detailed knowledge on family property and money owed, to supply extra info by race.

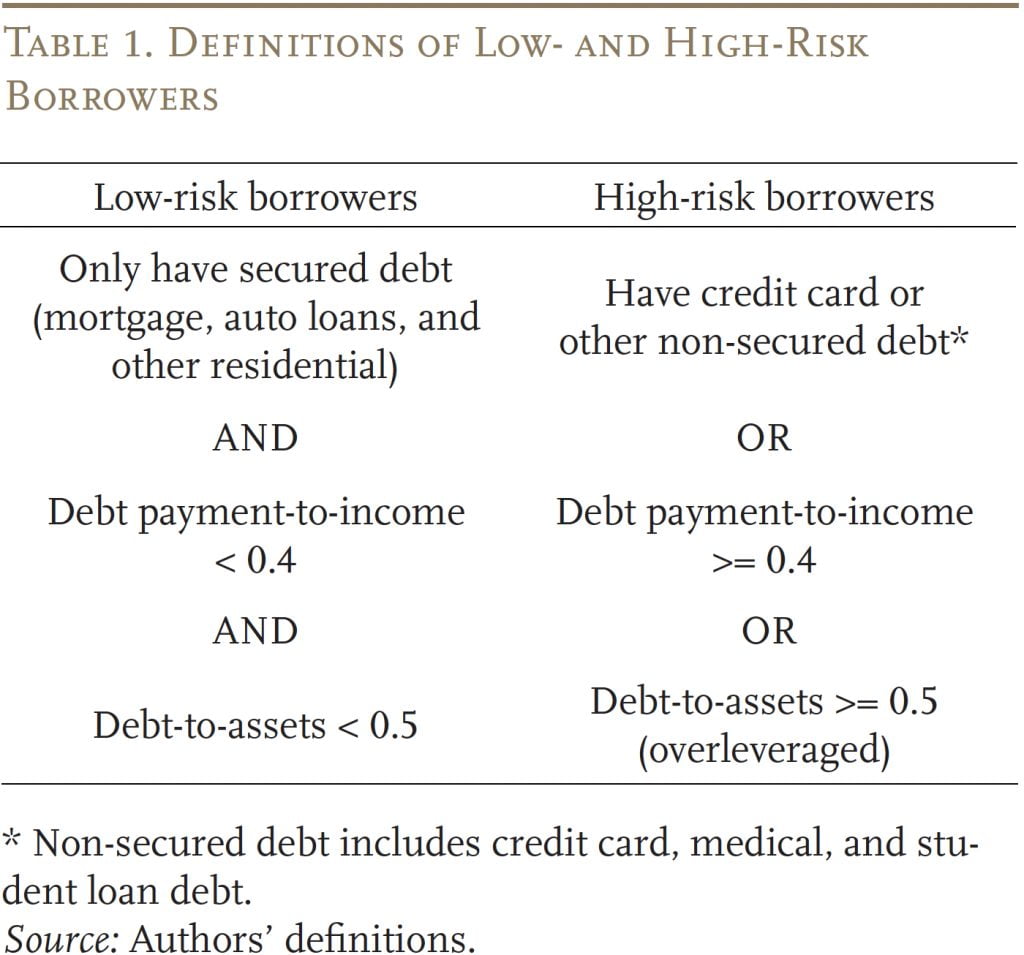

Step one is to group older households with debt into these at “low-risk” and “high-risk” of economic misery in retirement on account of the debt (see Desk 1). The elements used to group households (kind of debt, debt payment-to-income ratio, and debt-to-assets ratio) are generally utilized by lenders or different research. It is very important embody households with any revolving bank card debt within the “high-risk” group, since many of those debtors may expertise dangerous outcomes, despite the fact that they might not be captured by the opposite debt measures (in Desk 1).

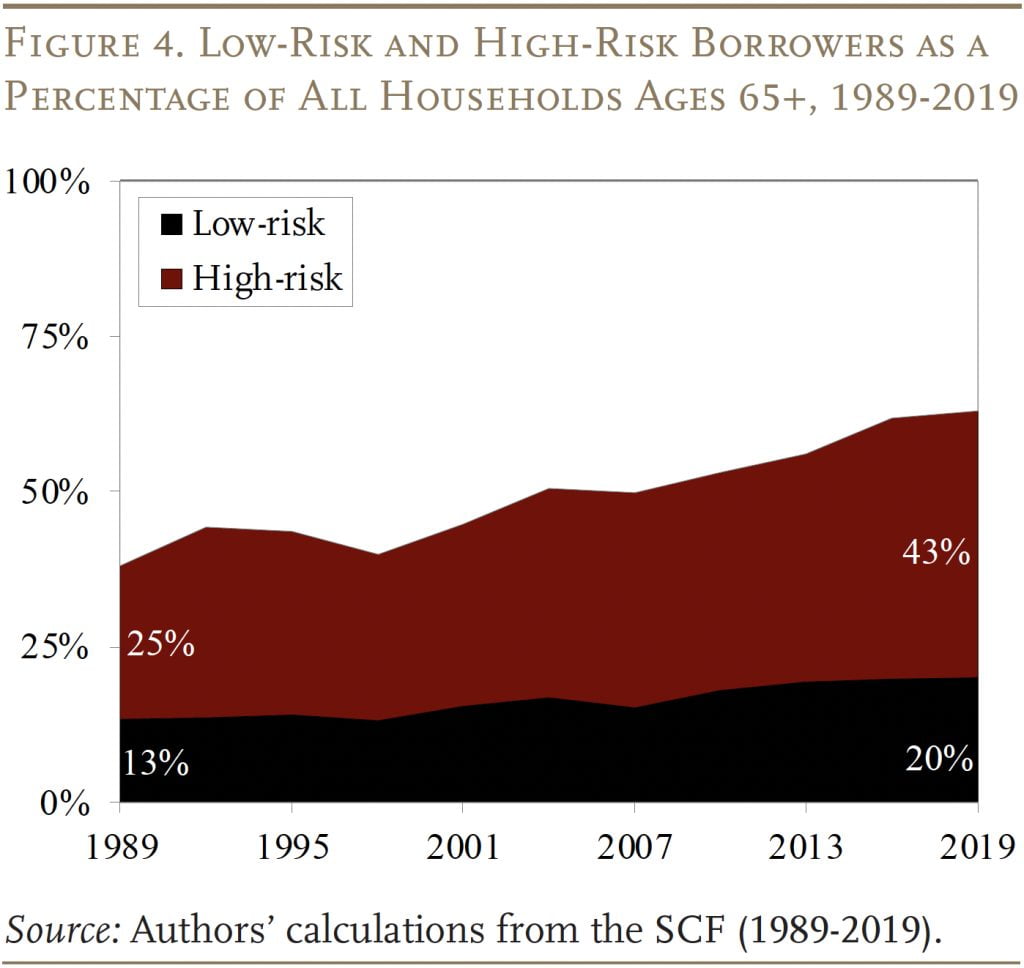

Breaking down households by threat stage reveals that, whereas each teams have grown over time, general development is pushed by the high-risk households (see Determine 4). Whereas these high-risk debtors are clearly the primary concern, it’s first price confirming whether or not or not the expansion in low-risk debtors is troubling as properly. Luckily, our evaluation finds that a big share of the expansion for this group – about one-half – is because of financially savvy debtors who took benefit of low rates of interest to acquire or refinance a mortgage mortgage. In distinction, nearly not one of the development for high-risk households is defined by such benign elements. So, the subsequent step is to take a better take a look at the traits of those debtors.

Who Are the Excessive-Threat Debtors?

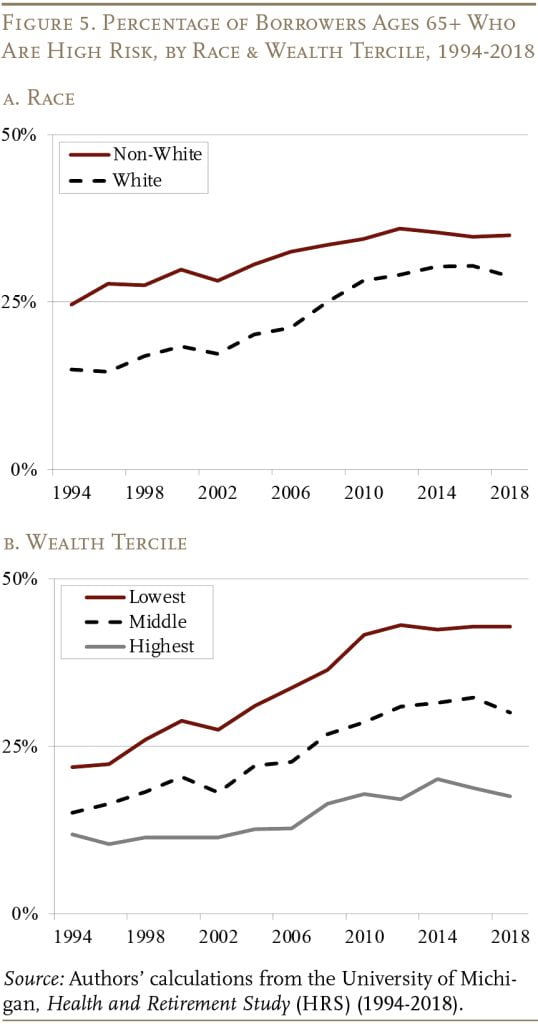

Step one is to easily take a look at high-risk debtors’ race/ethnicity and wealth: two traits that are typically related to the probability of being financially susceptible. The patterns listed here are as anticipated – non-White households usually tend to fall into the high-risk borrower group, although the hole with White households has been narrowing over time (see Determine 5a). Equally, households with much less wealth are additionally extra prone to be high-risk debtors; right here, although, the hole with high-wealth households has been widening (see Determine 5b).

The following step is to conduct a extra detailed evaluation to determine whether or not particular subgroups of high-risk debtors exist who might have totally different causes and wishes for accumulating debt. This method makes use of a Latent Class mannequin, which teams households based mostly on wealth, medical and monetary shocks, homeownership, debt traits, and issue in dealing with important bills.

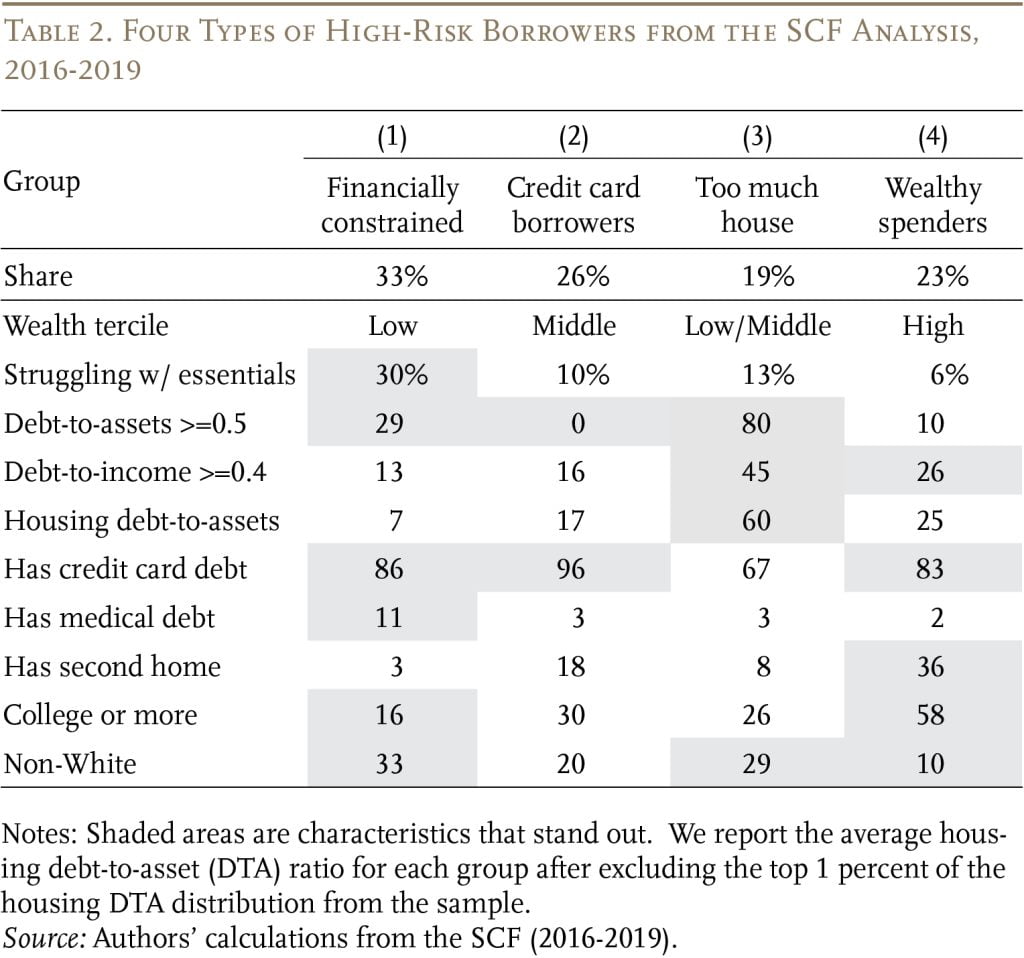

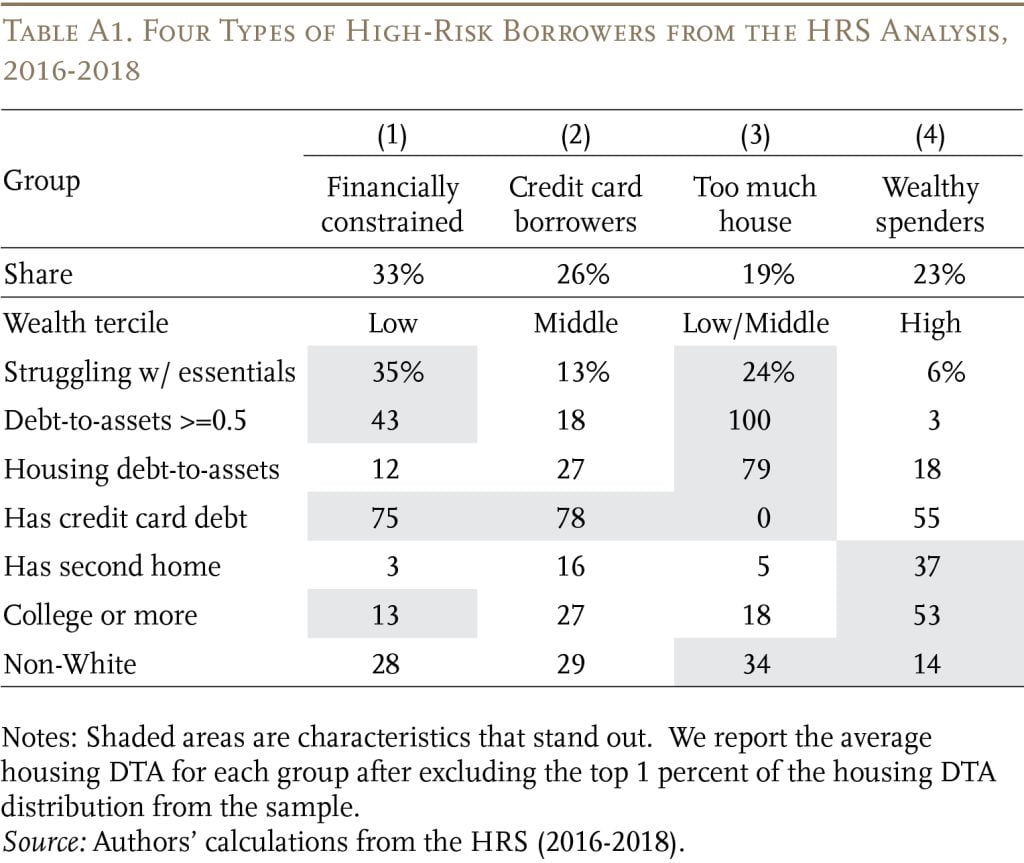

4 clear subgroups emerge from the evaluation (see Desk 2). The biggest group is “financially constrained” households, which have low ranges of wealth, are sometimes overleveraged, and usually tend to battle with the necessities. The overwhelming majority of this group has bank card debt and one out of ten has medical debt. They’re additionally disproportionately non-White and least prone to have a university diploma. This group could also be borrowing simply to get by.

The second subgroup is the “bank card debtors,” which incorporates middle-wealth households with no apparent must borrow. In comparison with the financially constrained group, these households are in a lot better form, as few battle to fulfill fundamental wants and none of them carry extreme debt in comparison with their property.

The third subgroup can’t afford their home. They’re low/middle-wealth households whose home has turn out to be a big legal responsibility and constraint on their revenue in retirement. Particularly, their housing debt equals 60 % of their residence worth (many have skilled massive drops of their housing worth since buy) and they should dedicate over 40 % of their revenue to debt funds. This group can also be disproportionately non-White.

Lastly, about one-fifth of the high-risk debtors are “rich spenders.” Regardless of being within the high third of the wealth distribution, a few quarter of their revenue goes to debt funds, about 80 % have bank card debt, and over a 3rd have second properties.

How Can We Assist Excessive-Threat Debtors?

What will be completed to scale back the monetary vulnerability of high-risk debtors? Clearly, given their numerous traits, no one-size-fits-all answer exists. Thus, the very best method can be for monetary counselors, client advocates, and/or policymakers to develop tailor-made options for the particular wants of the 4 teams and to focus on help to these most susceptible to monetary hardship. Whereas an in depth technique is past the scope of this research, a number of ideas might assist.

The primary and largest group of high-risk debtors is characterised by their “monetary constraints.” For these households, debt counseling and consolidation might assist, however many battle to fulfill fundamental wants, so that they want extra sources. One method is strengthening means-tested packages, like Supplemental Safety Earnings (SSI). Since SSI at the moment has extraordinarily low earnings and asset thresholds, many low-income seniors should not eligible, and the SSI profit quantity is lower than the poverty stage. Bettering a program like SSI may present a lifeline to scale back their burden. One other method is to reinforce Social Safety’s Particular Minimal Profit, which is supposed to supply an sufficient stage of advantages for lifetime low-earners. Nevertheless, the worth of this profit has eroded, and the quantity receiving the minimal profit declined from round 200,000 within the Nineties to about 25,000 in 2022.

The second group – “bank card debtors” – look very totally different from the “financially constrained” households and don’t have any apparent must accumulate debt, significantly expensive bank card debt. Households on this group might not perceive the implications of revolving bank card debt, how the excessive rates of interest have an effect on unpaid balances, and what the minimal cost means. Some on this group, who would not have an emergency fund, could also be utilizing their bank card to assist clean expense shocks. These households may benefit from conventional monetary counseling packages to curtail using high-interest-rate debt and to encourage precautionary saving for surprising bills. Laws requiring bank card issuers to supply higher info to customers may additionally assist. For instance, when customers navigate to a bank card cost display, the primary choice listed may very well be the quantity to repay the total steadiness. An alternative choice is for a warning to look if customers decide to pay an quantity that’s lower than the steadiness they owe.

The third group has “an excessive amount of home” and would greatest be served by packages that assist these overstretched householders cut back their housing burden. Choices may embody refinancing their mortgage to scale back their month-to-month funds or downsizing; albeit this step may very well be difficult if their housing fairness has declined, for some beneath their buy worth. Policymakers and monetary counselors may additionally encourage near-retirees to prioritize paying off their mortgage earlier than retirement to keep away from having mortgage funds overwhelm bills in retirement.

Lastly, the fourth group of “rich spenders” must get a deal with on their discretionary spending to assist rein of their borrowing. Many on this group have a second residence, so promoting it’s one solution to handle their debt burden. Whereas these households could also be a decrease precedence for policymakers as they’re the least susceptible, common monetary counseling may additionally assist them change their habits in order that they don’t eat past their means.

Conclusion

A quickly rising share of U.S. households carry debt in retirement, elevating considerations about their monetary safety; and the overwhelming majority of this development is pushed by debtors who’re at “excessive threat” of economic hassle. However the traits of those high-risk debtors differ quite a bit. Some teams appear to have the sources to handle their debt, so monetary counseling on the dangers of extreme bank card or mortgage debt or improved disclosure necessities for lenders might assist them get a deal with on their borrowing. Different teams have only a few sources to work with and battle with important bills. For these debtors, monetary training can present solely restricted assist, and so they want extra sources, maybe by broader entry to means-tested packages like SSI. The important thing takeaway is the popularity that no one-size-fits-all answer exists, so understanding the various traits of high-risk debtors is important to creating efficient insurance policies to assist older households scuffling with debt.

References

Brown, Jason, Karen Dynan, and Theodore Figinski. 2019. “The Threat of Monetary Hardship in Retirement: A Cohort Evaluation.” WP2019-10. Philadelphia, PA: Pension Analysis Council.

Butrica, Barbara A. and Nadia S. Karamcheva. 2013. “Does Family Debt Affect the Labor Provide and Profit Claiming Selections of Older Individuals?” Working Paper 2013-22. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty

Butrica, Barbara A. and Nadia S. Karamcheva. 2018. “In Debt and Approaching Retirement: Declare Social Safety or Work Longer?” AEA Papers and Proceedings 108: 401-06.

Chen, Anqi, Siyan Liu, and Alicia H. Munnell. 2023. “What Are the Implications of Rising Debt for Older Individuals?” Working Paper 2023-11. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Collins, J. Michael, Erik Hembre, and Carly City. 2020. “Exploring the Rise of Mortgage Borrowing Amongst Older Individuals.” Regional Science and City Economics 83(103524).

Domowitz, Ian and Robert L. Sartain. 1999. “Determinants of the Client Chapter Determination.” The Journal of Finance 54(1): 403-420.

Federal Reserve Financial institution of New York. 2022. “Quarterly Report on Family Debt and Credit score: 2021: This fall.” New York, NY.

Gross, David B. and Nicholas S. Souleles. 2002. “An Empirical Evaluation of Private Chapter and Delinquency.” The Assessment of Monetary Research 15(1): 319-347.

Haughwout, Andrew, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw. 2023. “Credit score Card Markets Head Again to Regular After Pandemic Pause.” Liberty Road Economics Weblog Publish. New York, NY: Federal Reserve Financial institution of New York.

Keys, Benjamin J. and Jialan Wang. 2019. “Minimal Funds and Debt Paydown in Client Credit score Playing cards.” Journal of Monetary Economics 131(3): 528-548.

Kluender, Raymond, Neale Mahoney, Francis Wong, and Wesley Yin. 2021. “Medical Debt within the US, 2009-2020.” Journal of the American Medical Affiliation 326(3): 250-256.

Lusardi, Annamaria and Peter Tufano. 2015. “Debt Literacy, Monetary Experiences, and Overindebtedness.” Journal of Pension Economics & Finance 14(4): 332-368.

Lusardi, Annamaria, Olivia S. Mitchell, and Noemi Oggero. 2018. “The Altering Face of Debt and Monetary Fragility at Older Ages.” AEA Papers and Proceedings 108: 407-11.

Lusardi, Annamaria, Olivia S. Mitchell, and Noemi Oggero. 2020. “Debt and Monetary Vulnerability on the Verge of Retirement.” Journal of Cash, Credit score and Banking 52(5): 1005-1034.

Moulton, Stephanie, Donald Haurin, and Caezilia Loibl. 2019. “Debt Stress and Mortgage Borrowing in Older Age: Implications for Financial Safety in Retirement.” Financial Inquiry 54(1): 201-214.

Mudrazija, Stipica and Barbara A. Butrica, 2021. “How Does Debt Form Well being Outcomes for Older Individuals?” Working Paper 2021-17. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Spader, Jonathan. 2021. “Can Altering Demographics or Refinancing Behaviors Clarify the Rising Ranges of Housing Debt Amongst Older Individuals?” Housing Coverage Debate 31(2): 290-305.

College of Michigan. Well being and Retirement Examine, 1994-2018. Ann Arbor, MI.

U.S. Board of Governors of the Federal Reserve System. Survey of Client Funds, 1989-2019. Washington, DC.

U.S. Authorities Accountability Workplace. 2014. “Older Individuals’ Incapacity to Repay Pupil Loans Might Have an effect on Monetary Safety of a Small Share of Retirees.” Washington, DC.

Wettstein, Gal and Siyan Liu. 2023. “How Do Unpaid Pupil Loans Influence Social Safety Advantages?” Challenge in Temporary 23-1. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Appendix

[ad_2]