[ad_1]

Buyers and significantly homebuyers are questioning when will the Fed lastly begin reducing charges? After 11 charge hikes to this point since 2022, traders and homebuyers are beginning to really feel the pressure of upper borrowing prices.

The longer the Fed Funds charge stays excessive, the extra detrimental influence it can have on the economic system. Ideally, the Fed needs to keep away from one other U.S. financial recession. Nevertheless, if the Fed retains charges excessive and doesn’t reduce by the top of 2024, there’ll doubtless be a lot more durable instances forward.

For homebuyers, pent-up demand will proceed to develop. In some unspecified time in the future, life should go on, as persons are compelled to purchase properties as a result of start of a kid, a change in jobs, dad and mom shifting in and extra.

Nevertheless, the typical charge for a 30-year fixed-rate mortgage is over 7%, up from roughly 3% at first of 2022. This has deterred potential homebuyers from shopping for and made current householders reluctant to promote their properties and purchase one other. Because of this, stock stays low and residential costs stay excessive.

Though housing exercise has fallen sharply, a lot of the remainder of the economic system appears to be chugging alongside. Households’ extra financial savings and actual wage progress have briefly blunted the influence of upper rates of interest. Nevertheless, anticipate the economic system to fade over the following 12 months.

Excessive-Curiosity Charges Profit The Rich Most

Mockingly, high-interest charges have helped wealthy traders get richer on the expense of the center class and the poor. This is smart as a result of a lot of the Fed Governors are wealthy and other people tend to deal with their very own wants first.

The wealthy are much less doubtless in want of a mortgage to purchase a house. Due to this fact, the wealthy can get higher offers with no financing contingencies.

The wealthy even have extra extra financial savings, which profit extra from greater Treasury bond yields, cash market fund yields, and CD charges.

Lastly, the wealthy have seen their inventory portfolios rebound essentially the most in 2023. With their internet worths again to close all-time highs, traders are feeling much more safe on this high-interest charge surroundings.

Managing Inflation Again Down From Its 2022 Excessive

Inflation peaked in mid-2022 and has trended downward since. Due to this fact, the Fed’s charge hikes are working to decelerate the economic system.

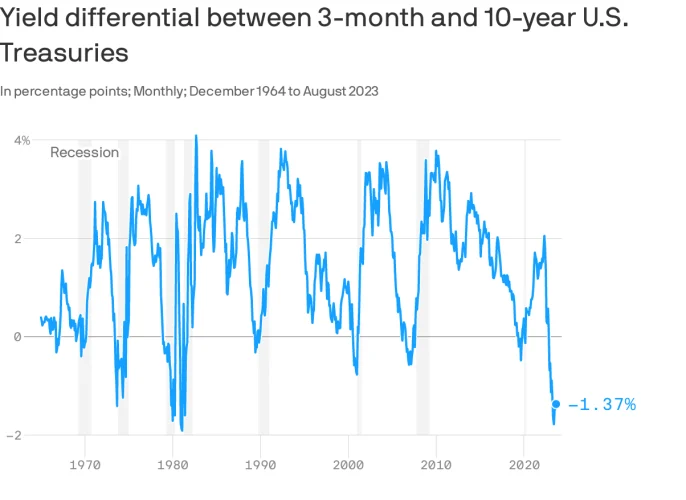

The principle query now could be when will the Fed start to chop charges? As soon as the Fed begins reducing charges, bond costs ought to enhance and mortgage charges ought to begin to head again down as a result of anticipation of additional charge hikes.

As well as, the yield curve will doubtless steepen because the brief finish of the curve lastly declines. The Fed Funds charge is the shortest of the brief finish.

Reducing charges will assist stop a hard-landing financial state of affairs that drives the unemployment charge up and pummels danger property. Reducing rates of interest will assist the center class essentially the most as a result of high-interest charges harm the center class essentially the most.

Let’s evaluate some predictions from numerous economists, cash managers, an bankers relating to when the primary Fed charge reduce will probably be. I am going to then share my prediction and why. Please fill out the survey on the finish and share your reasonings why as effectively.

Fed Charge Lower By Finish Of 2023 In accordance To JPAM Chief Funding Supervisor

Bob Michele, J.P. Morgan Asset Administration’s chief funding supervisor, mentioned the Fed might pivot and reduce charges by the top of 2023.

“They will inform us that they’ll preserve charges greater for longer till inflation is at their goal,” he mentioned. “However the magnitude of the slowdown we’re seeing throughout the board tells us that we’ll most likely nonetheless be hitting recession round year-end, so that they’ll be reducing charges by then.”

At present, the consensus is for no charge cuts in 2023.

Fed Charge Lower In February 2024 In accordance To Morningstar Economist

On August 31, 2023, Preston Caldwell, a Morningstar senior US economist, wrote in a publish he expects the Fed to begin reducing rates of interest in February 2024, the primary Fed assembly of 2024.

Caldwell argues,

The Fed will pivot to financial easing as inflation falls again to its 2% goal and the necessity to shore up financial progress turns into a prime concern.

1) Curiosity-rate forecast. We mission a year-end 2023 federal-funds charge of 5.25%, falling to about 2.00% by the top of 2025. That may assist drive the 10-year Treasury yield right down to 2.50% in 2025 from a mean of three.75% in 2023. We anticipate the 30-year mortgage charge to fall to 4.50% in 2025 from a mean of 6.75% in 2023.

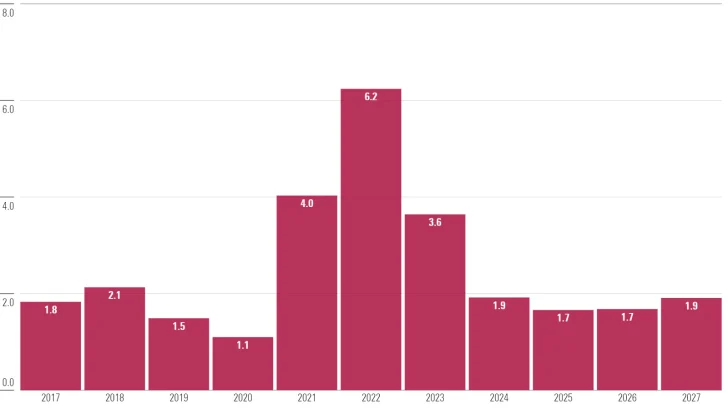

2) Inflation forecast. We mission worth pressures to swing from inflationary to deflationary in 2023 and the next years, owing significantly to the unwinding of worth spikes brought on by provide constraints in durables, power, and different areas. It will make the Fed’s job of curbing inflation a lot simpler. The truth is, we predict the Fed will overshoot its objective, with inflation averaging 1.8% over 2024-27.

We anticipate that GDP progress will begin accelerating within the second half of 2024 because the Fed pivots to easing, with full-year progress numbers peaking in 2025 and 2026. The decision of provide constraints ought to facilitate an acceleration in progress with out inflation changing into a priority once more.

Supply: Morningstar

The Fed Will not Lower Charges Earlier than April 2023 In accordance To A Hedge Fund Supervisor

David Einhorn, the founder and president of the hedge fund Greenlight Capital, wrote that he did not anticipate the Fed to chop rates of interest till March 2024.

“We proceed to imagine that the market is over-anticipating charge cuts and now we have prolonged that view via March of 2024,” he mentioned.

David Einhorn is known for shorting Tesla and shedding a bunch of cash throughout its 1,000% run-up. Regardless, David continues to be a really rich man given hedge funds make tons of cash.

Reducing in February or March 2024 is about the identical. I would buck them collectively.

Fed Charge Lower In Could 2024 In accordance To KPMG Economist

Following the discharge of August’s inflation report, KPMG US’s chief economist, Diane Swonk, wrote in her piece, Inflation Reheats, the Federal Reserve may not be finished elevating rates of interest. She writes,

The Fed must see quarters, not months, of essentially cooler inflation to chop charges. We’re not even shut. Our forecast for the primary charge reduce in Could 2024 holds.

“The trail down on inflation is affected by potholes. We hit one in August, which is one among many causes that the Fed will pause however depart the choice to boost charges once more in November on the desk at its assembly subsequent week.

The message from the Fed will probably be clear. It intends to carry charges excessive for longer and won’t hesitate to boost once more if inflation will get caught at year-end. The Fed must see quarters, not months, of essentially cooler inflation to chop charges. We’re not even shut. Our forecast for the primary charge reduce in Could 2024 holds.

In response to CME Group’s FedWatch instrument, the possibilities of a charge reduce in March 2024 is nineteen%, however jumps to 82.3% in Could 2023.

Fed Charge Lower Between April and June, 2024 In accordance To A Reuters Ballot

In a Reuters ballot of 97 economists, the consensus prediction is that the Fed would not reduce rates of interest till a minimum of April 2024. Listed here are extra particulars from the Reuters article.

Almost 20% of the economists, 17 of 97, predicted a minimum of yet one more charge rise earlier than the top of the 12 months, together with three who anticipated one in September.

Although we proceed to anticipate the Fed to stay on maintain on the Sept. 20 FOMC assembly, we might not be shocked to see most officers proceed to mission yet one more charge hike by year-end of their up to date ‘dot plot,’” mentioned Brett Ryan, senior U.S. economist at Deutsche Financial institution, referring to the rate of interest projections launched by Fed policymakers on a quarterly foundation.

Of the 87 respondents who had forecasts till the center of 2024, 28 put the timing of the primary charge reduce within the first quarter and 33 had it within the quarter after that. Just one mentioned the Fed would reduce charges this 12 months.

Round 70% of these respondents, 62 of 87, had a minimum of one charge reduce by the top of subsequent June. Nonetheless, all however 5 of 28 respondents to an additional query mentioned the larger danger was that the primary Fed reduce would come later than they presently forecast.

A severe financial downturn might justify an earlier charge reduce, however that’s wanting much less doubtless. The economic system was anticipated to increase by 2.0% this 12 months and 0.9% in 2024, in keeping with the ballot.

The median view from a dwindling pattern of economists who offered responses on the chance of a recession inside one 12 months fell additional to 30%, after tumbling under 50% for the primary time in practically a 12 months final month. It peaked at 65% in October 2022.

Goldman Sachs Believes Charge Cuts Will Occur In 2Q 2024

Goldman Sachs chief US economist, David Mericle, mentioned he expects the Fed to chop charges in 2Q 2024. On the Goldman Sachs Exchanges podcast episode (Apple), he additionally believes the Fed is finished climbing charges in 2023.

“We’ve the primary charge reduce penciled in for 2Q of 2024. The brink that we take into consideration that is met at that horizon in our forecast is core PCE falls under 3% YoY and under 2.5% on a month-to-month annualized foundation.

I do not really feel terribly strongly concerning the charge cuts as a result of I do not suppose it is proper to say the Fed wants to chop. I see it type of non-obligatory. I can actually envision a state of affairs the place we get there and inflation does not come down fairly sufficient, or even when it does, Fed officers say to themselves, ‘This can be a sturdy economic system with a traditionally tight labor market, simply coming off a scary inflation surge, what precisely is the purpose of reducing, what drawback are we making an attempt to resolve?’ and resolve it is simply not price it.

Why do I feel the fitting baseline is for the Fed to chop? As a result of a 5.5% nominal funds charge, a 3%+ actual funds charge will really feel excessive relative to current historical past for many Fed officers. We’ve penciled in in our forecasts 25 foundation level (cuts) per quarter. We’ve it ending within the low 3s, not on the 2.5% quantity the FOMC has written down.”

American Bankers Affiliation’s Financial Advisory Committee Expects Charge Cuts After Could 2024

The newest forecast from the American Bankers Affiliation’s Financial Advisory Committee mentioned it expects the Fed to carry off on reducing charges till someday between Could and the top of subsequent 12 months. The committee compromis

“Given each demonstrated and anticipated progress on inflation, nearly all of the committee members imagine that the Fed’s tightening cycle has run its course,” Simona Mocuta, the chief economist of State Avenue International Advisors, mentioned.

Supply: Morningstar, U.S. inflation charge (PCE Index, %)

Vanguard Believes Fed Charge Cuts Will Start In 2H 2024

All people’s favourite cash administration firm, Vanguard, revealed an article believing the Fed might have to boost charges additional. From the article,

Josh Hirt, a Vanguard senior economist explains, “Financial coverage continues to be working its approach via the economic system, making an attempt to constrain exercise even because the impacts of supportive fiscal coverage have kicked in. This is likely one of the causes we imagine the economic system faces a interval of upper sustained rates of interest than we’ve grown accustomed to seeing.” Vanguard believes that the Federal Reserve might have to boost charges additional and preserve them at their highest ranges for an prolonged interval within the face of continued financial resilience.

Latest Vanguard analysis concludes that the “impartial charge of curiosity”—a theoretical charge that neither promotes nor restricts financial exercise—is greater than many might have thought. That discovering and our associated coverage evaluation help our view that the Fed might have to boost its federal funds goal charge by an extra 25–75 foundation factors earlier than ending a rate-hiking cycle that started in March 2022 and has totaled 525 foundation factors. (A foundation level is one-hundredth of a share level.)

The Fed’s charge goal presently stands at 5.25%–5.5%. We don’t foresee the central financial institution reducing its goal till the second half of 2024.

“We imagine the catalyst for alleviating can be both a recession or inflation falling whereas financial exercise stays sturdy (a ‘smooth touchdown’),” the crew mentioned.

2024 Fed Conferences Schedule

Let’s faux to be an economist or strategist and make our personal Fed charge reduce timing prediction. One of many methods to find out when the Fed will reduce charges is to have a look at when the following Federal Reserve conferences are. For 2024, right here is the Fed’s schedule.

There are eight scheduled Federal Reserve conferences for 2024. Allow us to assume with 99% certainty the Fed will reduce charges in 2024. Due to this fact, now we have a one-in-eight or 12.5% probability of guessing appropriately when the Fed will start reducing charges.

We should additionally assume there will probably be no shock charge cuts off schedule.

Bettering The Odds Of Our Fed Charge Lower Forecast

We are able to throw out the January 2024 assembly as a possible for a Fed charge reduce as a result of:

1) It’s too quickly after the Fed probably makes its final charge hike in 2023. Reducing charges so quickly after would make the Federal Governors look silly.

2) January can be too quickly given we’re simply beginning the 12 months. Fed staff are simply getting again to work and there could also be an excessive amount of financial distortion throughout the December vacation interval,

By eliminating January, we now have a one-in-seven, or 14.28% probability of appropriately forecasting when the Fed will reduce charges.

We are able to most likely throw out December 2024 too. The lag impact of the Fed charge hikes must be in full impact earlier than December 2024 as unemployment rises, company earnings gradual, and GDP progress slows.

With six Fed conferences left to chop charges, we now have a 16.7% probability of appropriately forecasting when the following charge reduce will probably be. All we have got to do is select a gathering date after which write about why we predict the date is the right one. Hooray for some good old school deductive reasoning!

Once I Assume The Fed Will Lower Charges

As we enter 4Q 2023, all of the financial information and shopper sentiment surveys level towards a slowdown. Delinquency charges are ticking up, housing demand is approach down, and inflation has rolled over.

Sure, there’s a danger inflation will reaccelerate given rising oil and fuel costs. Nevertheless, I imagine the larger driver for the value enhance is a man-made discount in provide, not sturdy demand.

Given how essential the U.S. housing market is to the economic system, it is laborious to check the Fed climbing as soon as extra in 2023 (30% probability). Roughly 67% of People personal properties. If transaction quantity continues to remain at multi-decade lows, associated companies reminiscent of building, furnishings, mortgage origination, structure and design, and plenty of extra will endure.

One of many positives I see relating to record-low actual property transaction quantity is rising pent-up demand. Life goes on it doesn’t matter what the Fed or the economic system does. Due to this fact, this demand will finally get unleashed on the backend, when rates of interest finally go down.

The brand new 12 months at all times brings about new demand for items and companies. As a private finance author since 2009, I at all times see a pickup in site visitors throughout the first quarter of the 12 months. I anticipate 2024 to be no completely different. Individuals are most motivated to take motion within the first quarter of every 12 months.

June 2024 Is The Goal Date

We might see sturdy financial exercise in 1Q2024. If that’s the case, sturdy shopper spending will delay inflation getting right down to the Fed’s long-term goal of two%. Robust 1Q 2024 financial figures can even scale back the Fed’s want to chop charges as a result of it can delay a recession.

Because of this, the soonest the Fed will reduce charges is Could 1, 2024 (40% probability). However I’ll go along with June 12, 2024 (60% probability) because the assembly/month when the Fed will lastly reduce. By June 12, 2024, the Fed could have had two months to digest the 1Q 2024 information. It would even have had two months of 2Q 2024 information.

If the Fed does hike once more in 2023, then it strengthens my perception additional the Fed will reduce in June 2024. The logic is that one other charge hike in 2023 will slowdown the economic system additional.

My Fed charge reduce views parallel these of Goldman Sachs’ economist, David Mericle, and committee members of North America’s largest banks.

Fed Charge Lower Chances By FOMC Assembly / Month

Listed here are some chances for a Fed charge reduce I assign by FOMC meet. As we all know from investing, there are not any absolutes. Due to this fact, we should assign chances and put together accordingly.

January 2024: 20%

March 2024: 25%

April/Could 2024: 40%

June 2024: 60%

July 2024: 50%

September 2024: 35%

November 2024: 25%

December 2024: 10%

Thrilling Occasions For Cashed-Up Buyers

Let’s get pleasure from these greater risk-free charges whereas they final. As we patiently wait to seek out nice offers in danger property like actual property, we’ll strengthen our steadiness sheets with every passing month.

The important thing to creating more cash will probably be to make the most of offers BEFORE all people can discover cheaper financing. Therefore, some persons are discovering offers and placing capital to work now. Whereas some will probably be looking for offers in 1Q 2024.

As soon as the Fed does reduce charges, there’ll doubtless be a rush of laggard consumers trying to purchase up danger property. It is not a lot the preliminary charge reduce that will probably be driving consumers because the low cost will probably be miniscule. Fairly, will probably be the reduction felt that the Fed will now not be climbing charges and that future rates of interest are doubtless.

The one individuals who lose are spenders with little money and weak money stream. Do not be one among them!

Reader Questions and Ideas

When do you suppose the Fed will lastly reduce rates of interest and why?

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and talk about among the most attention-grabbing matters on this web site. Please share, charge, and evaluate!

For extra nuanced private finance content material, be a part of 60,000+ others and join the free Monetary Samurai publication and posts by way of e-mail. Monetary Samurai is likely one of the largest independently-owned private finance websites that began in 2009.

[ad_2]