[ad_1]

Earnings are far more vital, however 401(okay) withdrawals have but to make their mark.

For a lot of causes, we’ve got been trying on the sources of revenue for households ages 62-75 – a gaggle eligible for Social Safety, a lot of whom may very well be presumed to be retired. Three patterns emerged when evaluating knowledge from the Federal Reserve’s 2019 Survey of Client Funds (SCF) with the 1995 SCF. Earnings have grow to be more and more vital, revenue from outlined profit plans stays a lot bigger than withdrawals from 401(okay)s, and the distribution of revenue has grow to be extra unequal.

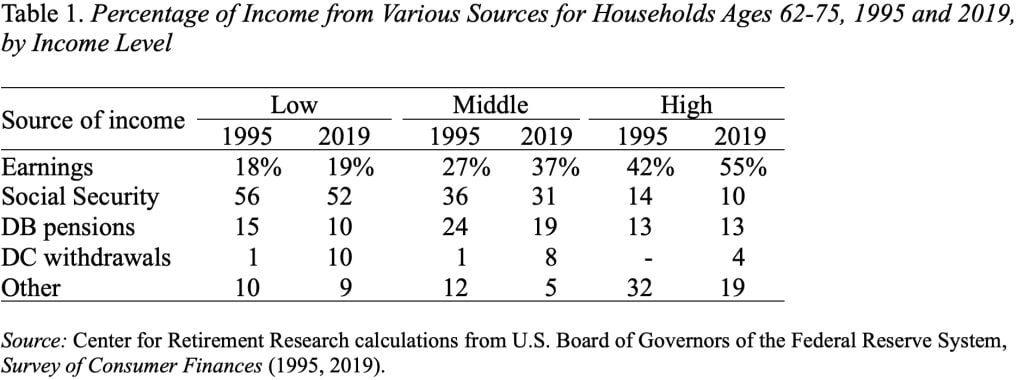

Listed below are the numbers for all households wherein the pinnacle is 62-75, grouped by revenue degree. Whereas earnings as a share of whole revenue stayed just about fixed for low-income households, earnings elevated by 10 share factors for these within the center group and by 13 share factors for high-income households (see Desk 1). Within the case of the high-income group, earnings now account for greater than half of all revenue.

The opposite fascinating factor in Desk 1 is the composition of revenue from employer-sponsored retirement plans. We’ve got all grow to be accustomed to saying that it’s a 401(okay) world. Certainly, that’s true for right this moment’s personal sector staff. However it isn’t true but for retirees. Aside from the low-income households, these of retirement age proceed to get considerably extra from outlined profit pensions than from 401(okay) withdrawals. Maybe, this sample shouldn’t be so shocking, on condition that: 1) 401(okay)s solely began within the Nineteen Eighties; 2) solely latest retirees could have been capable of spend their entire profession coated by a 401(okay) plan; and three) members are usually not required to start out drawing down their amassed balances till their early 70s. Furthermore, outlined profit plans stay the main supply of retirement revenue for state and native authorities staff, who comprise about 13 % of the workforce.

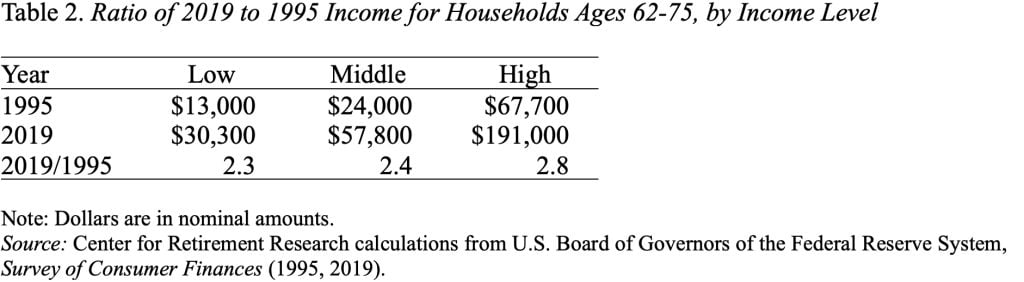

The third level that emerges from these knowledge is that the revenue distribution for these older households has gotten extra unequal (see Desk 2). Excessive-income households’ common revenue in 2019 was 2.8 instances the 1995 degree, whereas the ratios for low- and middle-income households had been 2.3 and a pair of.4, respectively. The massive distinction is earnings. The phrase has gotten out that working longer is the important thing to a safe retirement, and people with probably the most training and sources have modified their habits.

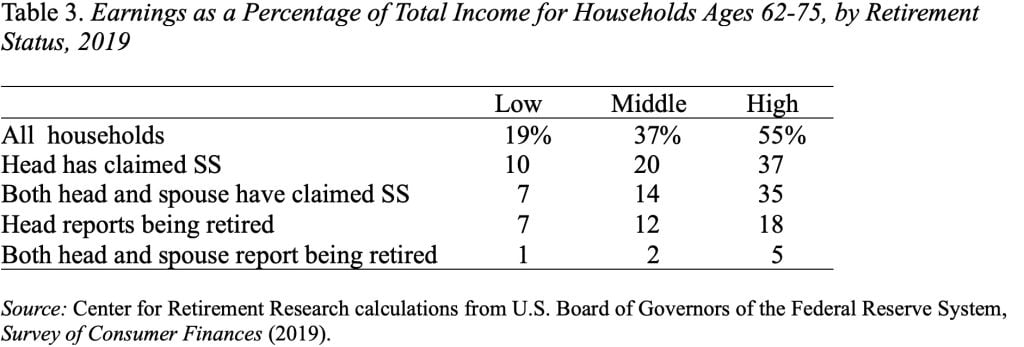

One ultimate situation is that, with the upsurge in earnings, it has gotten more and more arduous to outline “retirement” – significantly for high-income households. Receipt of Social Safety (SS) advantages used to appear like a surefire technique to classify a family as retired, however high-income households – even when each spouses have claimed Social Safety – obtain greater than a 3rd of their revenue from earnings (see Desk 3). The one criterion that appears to work – within the sense that earnings are not vital – is when each the pinnacle and the partner report being retired.

The principle conclusion that emerges from all that is that I’m actually desirous to see the outcomes from the 2022 Survey of Client Funds, which ought to come out someday this month.

[ad_2]