[ad_1]

There’s a explicit sort of study I hold seeing that may mislead traders. It’s an necessary, single knowledge level, however one that’s missing in context. This appears to be an oversimplification that many traders have as their default setting.

It’s like a nasty syllogism:

Observe a Single Knowledge Level;

Attain a broad conclusion about it;

Specific this in a commerce or funding thought

The issue with any single knowledge level is that the true world is sophisticated, messy, and stuffed with randomness and noise. When any new financial launch comes out, you actually don’t know the way a lot is noise and the way a lot is sign.

In the event you discover ways to correctly body knowledge, you possibly can keep away from errors of this sort. It’s not simply beginner traders who fall prey to this; I see it repeated within the monetary media all too usually. And it’s extra than simply the recency impact (see this for extra on that bias); actually, all of us have to discover ways to contextualize knowledge inside each the larger image and over the fullness of a time.

Financial knowledge is very noisy, topic to revision, and based mostly on fashions which can be “flawed however helpful.” Extra importantly, most are a part of an information sequence which over time can kind a development.

And there are at all times a variety of swings round that development line: Regular volatility, pullbacks, and sudden worth surges are all the conventional meanderings of a worth sequence. My colleague Josh Brown makes use of the metaphor of a man strolling a canine by means of a park – the trail of the particular person is the development, however the wild backwards and forwards of the canine on the finish of the leash is the value sequence.

I like that analogy, as a result of it forces you to step away from a single second, zooming out to see the broader context. As a substitute of fascinated with any particular worth or knowledge level by itself, attempt envisioning that worth throughout the longer knowledge sequence. It’s extra about seeing the video of an occasion relatively than a single nonetheless picture. As I prefer to name it, its Flix versus Pix. 1

Extra Financial savings is an ideal instance of how a scarcity of context can have an effect on your pondering. All the charts displaying how far extra financial savings have fallen ignore the supply of a lot of these {dollars}: Authorities transfers in the course of the pandemic. In addition they are inclined to neglect that individuals locked up inside for two years had “Cabin Fever” and never surprisingly, all of that pent-up demand comes out as a surge in consumption, particularly leisure journey over the summer time. A little bit craziness is to be anticipated, however watch out of extrapolating an excessive amount of from what appears to be like like a one-off, post-lockdown bacchanal.

Occupied with the development avoids overreactions. Utilizing a trendline or shifting common can apply to any form of knowledge sequence. The three-month shifting common removes a lot of the noise from NFP experiences; 6-month traits will get previous the common revisions and updates in all the pieces from Client Spending to CapEx. Desire a half-decent promote sign in equities? Ignore the strategists’ experiences and take a look at a 10-month shifting common on NDX or SPX.

The benefit of a trendline is it compensates for the inherent weak point of fashions. The noise, revisions, updates, and even mannequin adjustments all kinda kind themselves out ultimately. They’re imperfect depictions of actuality, but when they’re constant, they will present a helpful framework for directional adjustments.

Individuals with funding horizons of years or a long time ought to keep away from getting pulled into very short-term information. This contains the month-to-month employment state of affairs report and quarterly GDP releases.

The long run is a sequence of brief phrases. By no means confuse the 2…

Beforehand:

What Fashions Don’t Know (Could 6, 2020)

Confessions of an Inflation Truther (July 21, 2014)

Issues I Don’t Care About (January fifteenth, 2013)

Extra Sign, Much less Noise (October 25, 2013)

The Worth of Paying Consideration (November 2012)

Is Inflation Actually Understated? (No!) (Could 08, 2008)

Lose the Information (June 2005)

Enjoyable with Hedonics or: “How I realized to cease worrying about CPI and love inflation.” (April 21, 2004)

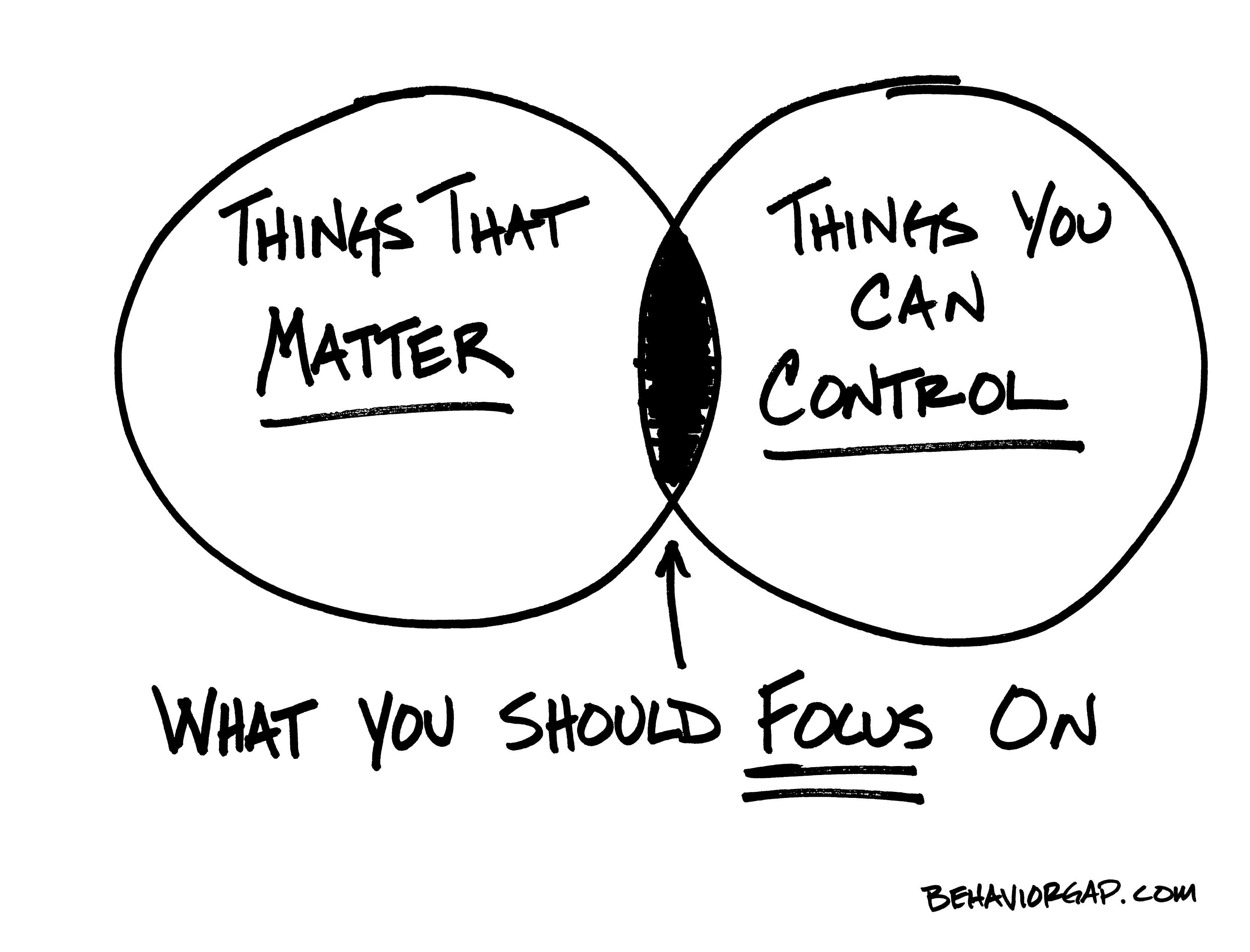

Supply: Carl Richards, BehaviorGap.com

__________

1. Since this rhymes, it must be true! That’s why I didn’t use: “Nonetheless Photos vs. Shifting Photos”

[ad_2]