[ad_1]

My mid-week morning prepare WFH reads:

• Are You Wealthy? Billionaires know they’re. Low-wage staff are very effectively conscious that they aren’t. However huge swaths of America’s “common wealthy” don’t really feel that approach, and it’s conserving all people down. them. They’re attorneys in New York, medical doctors in Phoenix, dentists in Memphis. They personal building firms in your hometown, burger franchises off the freeway, houses within the resort villages your mother and father need to retire in. They’re younger, previous, Democrats and Republicans. They’ve two issues in frequent: They’re wealthy. However they don’t really feel that approach. (Bloomberg)

• Inspecting Gold’s ‘Retailer of Worth’ Status: The numerous riffs on the shop of worth theme appear to harken again to gold’s longstanding function in human historical past and tradition. However one shouldn’t conflate this notion with precise stability in buying energy on a nominal or inflation-adjusted foundation: It’s an asset extra unstable than shares with decrease returns. (Fisher)

• Shock Inventory-Market Rally Bulldozes Bearish Hedge Funds: Quick masking reaches highest cumulative greenback quantity in years. (Wall Avenue Journal)

• Why Are NYC Rents So Excessive? It’s Sophisticated: COVID spurred many tenants to vacate metropolis flats, however altering hire legal guidelines and rising rates of interest are amongst components now encouraging folks to remain put — with few new flats accessible. (The Metropolis)

• The personal lending explosion: Personal credit score has gone from primarily non-existent within the Seventies, to a huge $1.3 trillion market right now. However are the dangers rising together with the returns? (Alts.co) see additionally An enormous credit standing company simply downgraded the U.S. Do you have to fear? What struck many observers as particularly weird was not a lot Fitch’s motion, however its timing. “I might see a case for downgrading the US … after the Trump tax cuts have been handed in 2017, after January 6 and earlier than Congress suspended the debt ceiling (however not after).” The costs of long-dated U.S. bonds, which might have been likeliest to reply to a downgrade, really level to continued robust investor demand. (Los Angeles Instances)

• The State of Russia’s Wartime Economic system: Russia’s Economic system is Recovering From Western Sanctions—However the Value of the Warfare Itself is Rising (Apricitas Economics)

• What if Generative AI turned out to be a Dud? Some doable financial and geopolitical implications (The Street to AI We Can Belief)

• The Clear Vitality Future Is Roiling Each Mates and Foes: Resistance to wind and photo voltaic tasks, even from some environmentalists, is amongst an array of impediments to widespread conversion to renewables. (New York Instances)

• San Franciscans Are Having Intercourse in Robotaxis, and No person Is Speaking About It: As autonomous automobiles change into more and more in style in San Francisco, some riders are questioning simply how far they’ll push the automobiles’ limits—particularly with no front-seat driver or chaperone to discourage them from questionable conduct. (San Francisco Normal)

• Why Did Scouts Whiff on Luis Arraez, MLB’s Base-Hit King? And can the sudden success of baseball’s batting common chief pave the best way for different unconventional prospects? (The Ringer)

You should definitely take a look at our newest Masters in Enterprise interview with Ted Seides, founding father of Capital Allocators, an advisory platform to managers and allocators. Beforehand, he labored underneath David Swensen on the Yale Investments Workplace, the place he invested immediately with three of Yale’s managers. We talk about his well-known guess with Warren Buffett about whether or not a collection of hedge funds might beat the S&P 500 over a decade. (Buffett received).

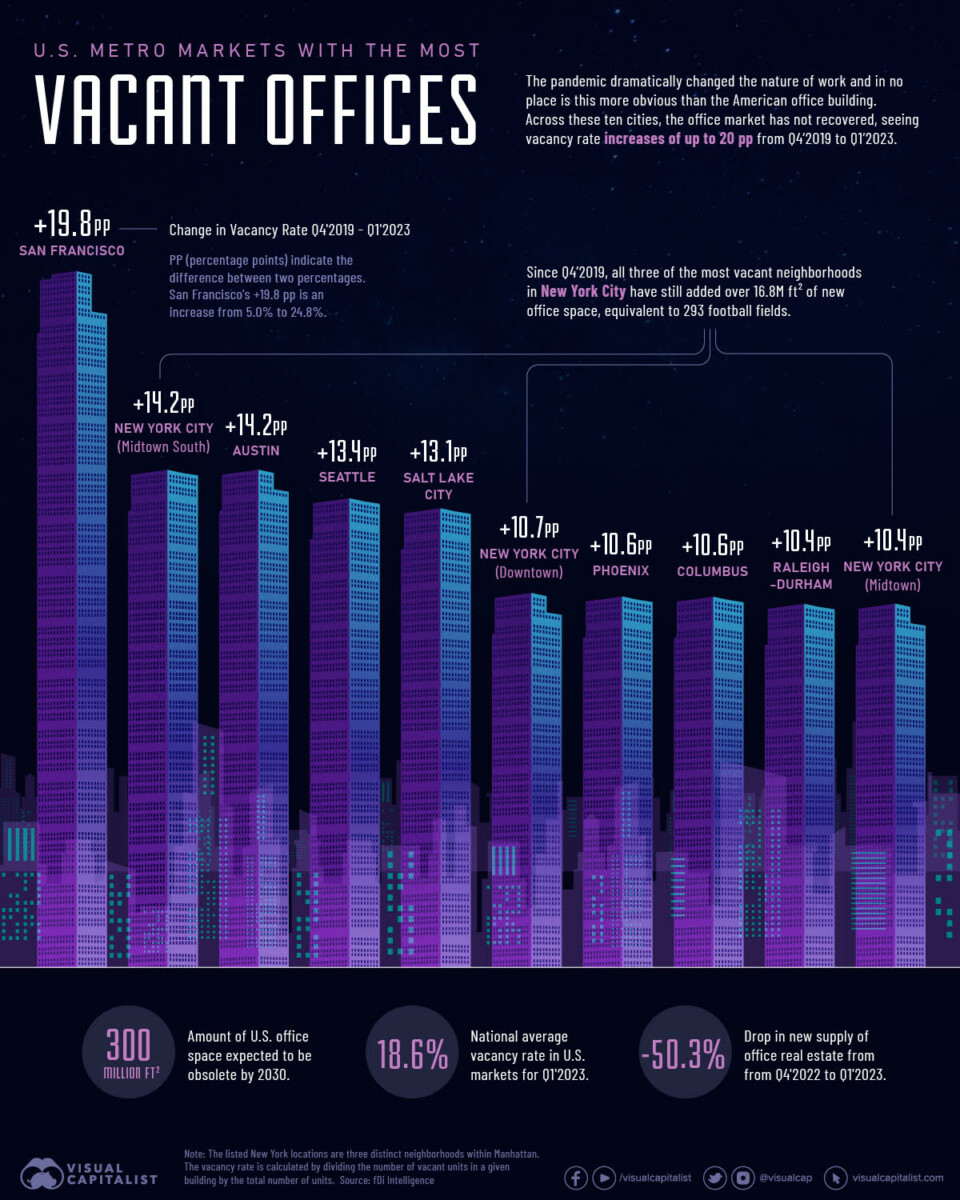

Ranked: The U.S. Cities with the Most Vacant Workplaces

Supply: Visible Capitalist

Join our reads-only mailing record right here.

[ad_2]