[ad_1]

This week, we communicate with asset administration skilled Ted Seides, founding father of Capital Allocators. His most up-to-date ebook is “Capital Allocators: How the world’s elite cash managers lead and make investments;” he’s additionally the host of the favored “Capital Allocators” podcast, which reached 16 million downloads in June. Seides is a CFA charterholder and has an MBA from Harvard Enterprise College.

He studied with David Swensen as an undergrad at Yale, and his first job was working for Swensen on the Yale endowment. What we now name the “Yale Mannequin” was invested in shares and bonds but in addition enterprise capital, hedge funds, actual property, timber, commodities, and so on. earlier than most market individuals had thought-about these sorts of belongings. As early as 1992, Yale’s Endowment had a strong portfolio of enterprise capital and hedge funds, lengthy earlier than it turned well-liked. He additionally explains why the post-financial disaster period has been so difficult for alternate options, and why the S&P 500 is just not the correct benchmark for many.

It was loads of enjoyable listening to Seides clarify how his notorious guess with Warren Buffett took place. As properly referred to as this guess was — Hedge Funds vs S&P 500 — the background was fairly superb and his backwards and forwards with Buffett led to an exquisite expertise.

At 14 months into the guess, his pool of funds was up 50%. Buffett would observe on the annual assembly, on the finish of the morning session, by saying, “I’m dropping the guess, let’s go to lunch.” Slowly however certainly over the subsequent 6 years, the market caught up.

Seides says the complete expertise was completely pleasant. He and his colleagues ended up having annual dinners with Buffett, every of which was distinctive and great. One of many dinners included Morgan Stanley CIO Steve Galbraith, who was buddies with Jack Bogle. The end result was Buffett acquired to host Bogle on the Berkshire Hathaway annual assembly.

A listing of his favourite books is right here; A transcript of our dialog is obtainable right here Tuesday.

You possibly can stream and obtain our full dialog, together with any podcast extras, on iTunes, Spotify, Stitcher, Google, YouTube, and Bloomberg. All of our earlier podcasts in your favourite pod hosts may be discovered right here.

Make sure you take a look at our Masters in Enterprise subsequent week with authorized scholar Cass Sunstein, who based and leads Harvard Legislation College’s program on behavioral economics and public coverage. He authored a number of books, together with the bestselling “Nudge: Enhancing Choices About Well being, Wealth, and Happiness.” (written with Nobel Laureate Richard Thaler) and the New York Instances best-seller “The World Based on Star Wars.” His new ebook is “Choices about Choices: Sensible Purpose in Atypical Life.”

Ted Seides Authored Books

Capital Allocators: How the world’s elite cash managers lead and make investments by Ted Seides

So You Need to Begin a Hedge Fund: Classes for Managers and Allocators by Ted Seides

Ted Seides Favourite Books

Unreasonable Hospitality: The Outstanding Energy of Giving Folks Extra Than They Count on by Will Guidara

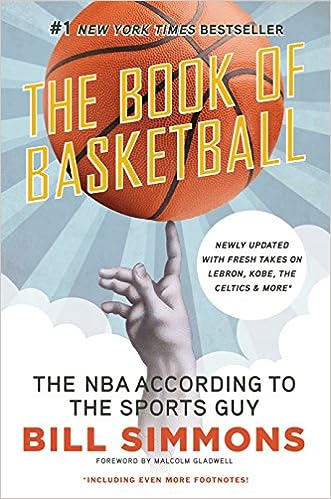

The Ebook of Basketball: The NBA Based on The Sports activities Man by Invoice Simmons

[ad_2]