[ad_1]

Bollinger Bands® have been created by John Bollinger within the ’80s, and so they have shortly grow to be one of the crucial generally used instruments in technical evaluation. Bollinger Bands include three bands—an higher, center and decrease band—which might be used to highlight excessive short-term costs in a safety. The higher band represents overbought territory, whereas the decrease band can present you when a safety is oversold. Most technicians will use Bollinger Bands® along side different evaluation instruments to get a greater image of the present state of a market or safety.

The Technique

Most technicians will use Bollinger Bands® along side different indicators, however we wished to try a easy technique that makes use of solely the bands to make buying and selling choices. It has been discovered that purchasing the breaks of the decrease Bollinger Band® is a solution to reap the benefits of oversold circumstances. Normally, as soon as a decrease band has been damaged as a result of heavy promoting, the worth of the inventory will revert again above the decrease band and head towards the center band. That is the precise state of affairs this technique makes an attempt to revenue from. The technique requires a shut beneath the decrease band, which is then used as a right away sign to purchase the inventory the subsequent day.

Beneath is an instance of how this technique works beneath excellent circumstances.

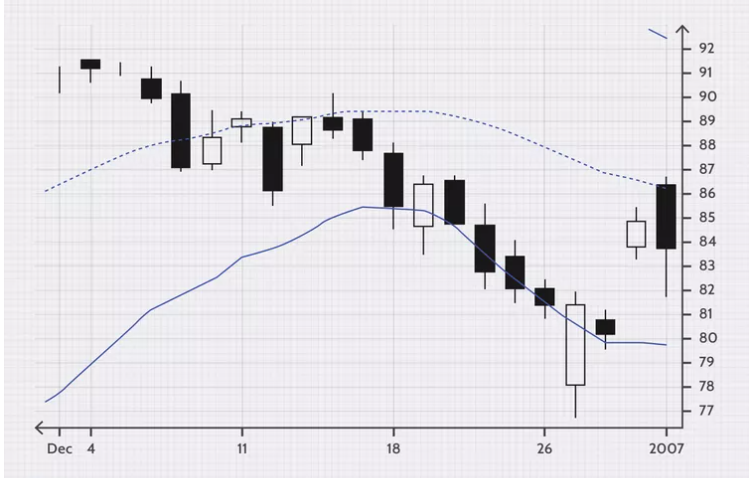

Determine 1 reveals that Intel breaks the decrease Bollinger Band and closes beneath it on December 22. This offered a transparent sign that the inventory was in oversold territory.

Our easy Bollinger Band® technique requires an in depth beneath the decrease band adopted by a right away purchase the subsequent day. The subsequent buying and selling day was not till December 26, which is the time when merchants would enter their positions. This turned out to be a superb commerce. December 26 marked the final time Intel would commerce beneath the decrease band. From that day ahead, Intel soared all the best way previous the higher Bollinger Band. It is a textbook instance of what the technique is in search of.

Whereas the worth transfer was not main, this instance serves to spotlight the circumstances that the technique is trying to revenue from.

One other instance of a profitable try utilizing this technique is discovered on the chart of the New York Inventory Alternate when it broke the decrease Bollinger Band® on June 12, 2006.

NYX was clearly in oversold territory. Following the technique, technical merchants would enter their purchase orders for NYX on June 13. NYX closed beneath the decrease Bollinger Band® for the second day, which can have induced some concern amongst market members, however this may be the final time it closed beneath the decrease band for the rest of the month.

That is the perfect state of affairs that the technique is trying to seize. In Determine 2, the promoting strain was excessive and whereas the Bollinger Bands® modify for this, June 12 marked the heaviest promoting. Opening a place on June 13 allowed merchants to enter proper earlier than the turnaround.

In a unique instance, Yahoo broke the decrease band on December 20, 2006. The technique referred to as for a right away purchase of the inventory the subsequent buying and selling day.

Identical to within the earlier instance, there was nonetheless promoting strain on the inventory. Whereas everybody else was promoting, the technique requires a purchase. The break of the decrease Bollinger Band signaled an oversold situation. That proved appropriate, as Yahoo quickly rotated. On December 26, Yahoo once more examined the decrease band, however didn’t shut beneath it. This might be the final time that Yahoo examined the decrease band because it marched upward towards the higher band.

Driving the Band Downward

As everyone knows, each technique has its drawbacks and this one is certainly no exception. Within the following examples, we’ll show the constraints of this technique and what can occur when issues don’t work out as deliberate.

When the technique is inaccurate, the bands are nonetheless damaged and you will find that the worth continues its decline because it rides the band downward. Sadly, the worth doesn’t rebound as shortly, which may end up in vital losses. In the long term, the technique is commonly appropriate, however most merchants won’t be able to face up to the declines that may happen earlier than the correction.

For instance, IBM closed beneath the decrease Bollinger Band on February 26, 2007. The promoting strain was clearly in oversold territory. The technique referred to as for a purchase on the inventory the subsequent buying and selling day. Just like the earlier examples, the subsequent buying and selling day was a down day; this one was a bit uncommon in that the promoting strain induced the inventory to go down closely. The promoting continued effectively previous the day the inventory was bought and the inventory continued to shut beneath the decrease band for the subsequent 4 buying and selling days. Lastly, on March 5, the promoting strain was over and the inventory rotated and headed again towards the center band. Sadly, by this time the injury was executed.

In a unique instance, Apple closed beneath the decrease Bollinger Bands on December 21, 2006.

The technique calls for getting Apple shares on December 22. The subsequent day, the inventory made a transfer to the draw back. The promoting strain continued to take the inventory down the place it hit an intraday low of $76.77 (greater than 6% beneath the entry) after solely two days from when the place was entered. Lastly, the oversold situation was corrected on December 27, however for many merchants who have been unable to face up to a short-term drawdown of 6% in two days, this correction was of little consolation. It is a case the place the promoting continued within the face of clear oversold territory. In the course of the selloff there was no solution to know when it might finish.

What We Discovered

The technique was appropriate in utilizing the decrease Bollinger Band® to spotlight oversold market circumstances. These circumstances have been shortly corrected because the shares headed again towards the center Bollinger Band®.

There are occasions, nevertheless, when the technique is appropriate, however the promoting strain continues. Throughout these circumstances, there isn’t any approach of figuring out when the promoting strain will finish. Subsequently, a safety must be in place as soon as the choice to purchase has been made. Within the NYX instance, the inventory climbed undaunted after it closed beneath the decrease Bollinger Band® a second time. The technique appropriately obtained us into that commerce.

Each Apple and IBM have been completely different as a result of they didn’t break the decrease band and rebound. As an alternative, they succumbed to additional promoting strain and rode the decrease band down. This could typically be very expensive. In the long run, each Apple and IBM did flip round and this proved that the technique is appropriate. The most effective technique to guard us from a commerce that can proceed to journey the band decrease is to make use of stop-loss orders. In researching these trades, it has grow to be clear {that a} five-point cease would have gotten you out of the dangerous trades however would have nonetheless not gotten you out of those that labored.

The Backside Line

Shopping for on the break of the decrease Bollinger Band® is an easy technique that usually works. In each state of affairs, the break of the decrease band was in oversold territory. The timing of the trades appears to be the most important subject. Shares that break the decrease Bollinger Band® and enter oversold territory face heavy promoting strain. This promoting strain is normally corrected shortly. When this strain is just not corrected, the shares continued to make new lows and proceed into oversold territory. To successfully use this technique, a superb exit technique is so as. Cease-loss orders are the easiest way to guard you from a inventory that can proceed to journey the decrease band down and make new lows.

What’s the distinction between a Trading technique and a Buying and selling Robotic?

In reality, nothing, this is identical buying and selling technique solely written in code. The robotic is devoid of feelings and prejudices, so it should undoubtedly observe the technique. The second benefit is which you could run the technique on historical past and see precisely whether or not it really works or not and what sort of earnings it brings and what dangers. If you wish to get your individual buying and selling technique, get certainly one of our methods already written within the type of a robotic. Our buying and selling methods embodied within the type of robots:

EA Lengthy Time period MT4 https://www.mql5.com/en/market/product/92865

EA Lengthy Time period Mt5 https://www.mql5.com/en/market/product/92877

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108

Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

Scalper Lego – https://www.mql5.com/en/market/product/90776

Scalper Golden Gate – https://www.mql5.com/en/market/product/87986

EA Impuls Professional MT4- https://www.mql5.com/en/market/product/72402

EA Impuls Professional MT5 – https://www.mql5.com/en/market/product/72335

EA Pump and Dump MT4 – https://www.mql5.com/en/market/product/73165

EA Pump and Dump MT5 – https://www.mql5.com/en/market/product/72403

[ad_2]