[ad_1]

There’s a common criticism encountered by builders from amongst open banking members, even after associate APIs are made accessible: Adoption isn’t simple.

We’ve skilled this throughout lots of of integration factors. Even with the developer help toolbox, which incorporates documentation, software program developer kits and sandboxes, and developer self-service consoles, associate integration timelines are intractable. Developer and assist groups are overloaded for every integration.

For monetary merchandise with advanced buyer journeys and for BaaS partnerships requiring advanced on-boarding, compliance and API integrations, the diploma of handholding required is even larger.

Extra assist, larger integration price

This additionally impacts open banking accessibility, placing it out of attain for the broader ecosystem. If there’s a excessive price to a partnership, the profit turns into a key criterion. As monetary establishments change into choosy about who companions with them, this de-levels the taking part in discipline creating an obstacle for smaller gamers.

So, what’s the proper degree of integration help? How can open banking be made accessible to all?

It is a dialogue on methods to create integration choices on your API shoppers. I’ll talk about what the choices are and why and when they’re significant.

A typical associate integration follows these 4 steps:

1. Channel front-end: That is the applying on which the companies powered by the APIs shall be made accessible to the tip consumer. That is the place the associate designs its buyer journey.

Nonetheless, whereas the associate has full management over the branding, look and consumer expertise (UX), that is additionally the place the shopper authenticates themself, inputs their private info, and supplies consent to the app to share this through APIs. For designing such a consumer interface (UI), a associate with out sufficient expertise could require oversight to make sure that the general buyer journey meets the regulatory necessities.

2. Information safety compliance: Along with consent, there are compliance necessities that govern how and what buyer knowledge must be captured, transmitted, shared and saved. In an open banking partnership, this compliance may be the accountability of all ecosystem companions concerned within the integration, and the integrating associate wants to make sure that its software and connectors meet the necessities.

3. API service orchestration: In a typical multi-API journey, the APIs have to be stitched collectively to create the journey. This will entail a session administration and authority; message encryption and decryption; third social gathering handoffs; and logic-built right into a middleware layer, which can doubtless be development-intensive, relying on the complexity of the journey.

4. API integration: For every API required for the journey, the associate software should devour the API; this implies it should be on-boarded and full the configuration necessities, full the event to name the required strategies and devour the responses.

Not all companions within the integration could have the aptitude for all 4 steps. For instance, there could also be incumbents from a nonfinancial business who need to associate with a financial institution for co-branded lending or a card providing for its prospects, however don’t meet the PCI-DSS compliance necessities.

This implies there’ll have to be important funding from the associate to change into compliant or {that a} sub-par buyer expertise design will end result. Additionally, there could also be smaller fintechs with out the developer capability for the orchestration effort required. Therefore, they could have to stretch past their attain to make the partnership occur.

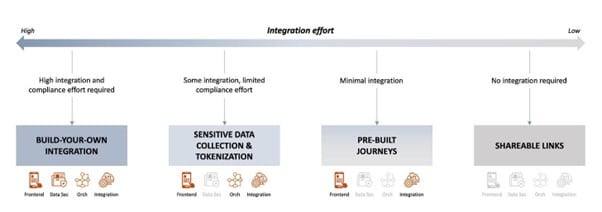

Integration effort is variable

How can we finest scale back the combination effort?

The nuance this query misses is that several types of companions have very totally different wants. There are gamers who need full management over their prospects’ expertise, and need to “look below the hood” and tinker with the elements, nuts and bolts. There are gamers who need management, however don’t need to tackle the burden of compliance. And there are gamers who solely need the BaaS partnership to finish their digital choices, however don’t need to spend money on any further growth.

Democratizing API integration: 4

The start line is, after all, understanding associate archetypes and associate necessities from the combination. The platform answer design follows these 4 wants.

1. Construct-your-own integrations: Making uncooked supplies and instruments accessible

This integration possibility is analogous to ranging from primary uncooked supplies, or substances, and is for those who know precisely what they need and methods to obtain it. The important thing platform choices are the APIs and a whole developer expertise toolbox. When you’re interested by what which means from an API banking context, we’ve got a piece about that.

The form of integrating companions who’re doubtless to make use of the build-your-own possibility are these with choices intently adjoining to banking, and which have completed this earlier than.

2. Integration with managed knowledge compliance: All uncooked supplies and instruments, with compliance crutches

With this feature, additionally, the combination associate has all of the uncooked supplies to utterly management the expertise, however with out the overhead of compliance, particularly associated to delicate knowledge.

With the assistance of cross-domain UI parts, tokenization, assortment and storage of information may be dealt with solely on the financial institution finish, whereas the associate solely has to embed these parts into its front-end.

This selection is very useful for these integrating companions that need to management the expertise, however to whom monetary companies is just not a core providing, and so compliance is an pointless overhead which they’re completely satisfied to keep away from.

3. Pre-built journeys

Providing pre-built journeys permits a associate to focus solely on the front-end expertise, whereas your entire API orchestration and compliance is dealt with in a middleware layer and abstracted away for the integrating companions.

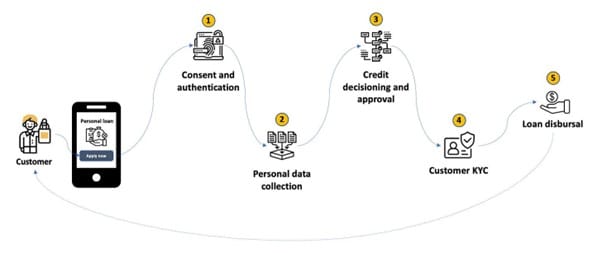

For a typical banking service, designing an API-first journey means working with numerous separate endpoints and stitching the companies collectively. For example, a easy mortgage origination journey for a buyer could appear to be this: (simplified for illustration)

This journey requires 5 companies from the financial institution: buyer authentication and consent, buyer private knowledge assortment, credit score decisioning and approval, KYC and mortgage disbursal.

Stitching these companies collectively to create a single end-to-end digital expertise for a buyer could name for a thick middleware with a database and caching, knowledge tokenization and encryption, session administration, handoffs throughout companies and different associated orchestration.

To allow companions to ship this journey with out the necessity for orchestration, this layer may be moved to a platform on the financial institution facet and supplied as an integration answer to the companions. The associate now solely must combine with the platform, and construct its UI and UX.

Such an answer, after all, helps drastically reduce down growth time for the combination and is very compelling for smaller gamers and channel gross sales companions that need to supply banking services or products to their prospects.

4. Pre-built UI or shareable hyperlinks

No integration required, however with instantly embeddable, customizable UIs, companions can supply the related banking performance or companies with minimal effort. That is equal to a contextual redirect and is extraordinarily helpful for circumstances the place the associate needs to avail itself of solely minimal open banking companies and doesn’t need to undergo your entire on-boarding, configuration and integration processes required for all different integration choices.

Bringing all of it collectively

Whereas it’s actually potential to proceed to develop partnerships by providing customizations and help to every integration, for attaining a fast scale-up in open banking ecosystem partnerships, there’s a want for a platform that standardizes these issues and cuts throughout developer expertise and integration wants.

Tvisha Dholakia is the co-founder of London-based apibanking.com, which appears to construct the tech infrastructure to take away friction on the level of integration in open banking.

[ad_2]