[ad_1]

Plenty of folks have requested me to touch upon this text within the FT from a number of days in the past:

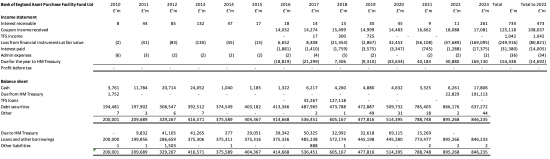

To take action I’ve ready a abstract of the accounts of the firm referred to as the Financial institution of England Asset Buy Facility Fund Restricted (or APF) that really operates the quantitative easing programme on behalf of HM Treasury, as a result of it’s a sham to say that it’s run by the Financial institution of England when the Treasury has to approve all main selections made by this firm and bears the income and losses arising from its actions. That abstract appears like this, masking all years from 2010 when it started to commerce:

My suspicion is that this will probably be just a little arduous to learn, though clicking on it a few instances ought to produce a a lot greater model. So, let me supply this abstract model as a substitute:

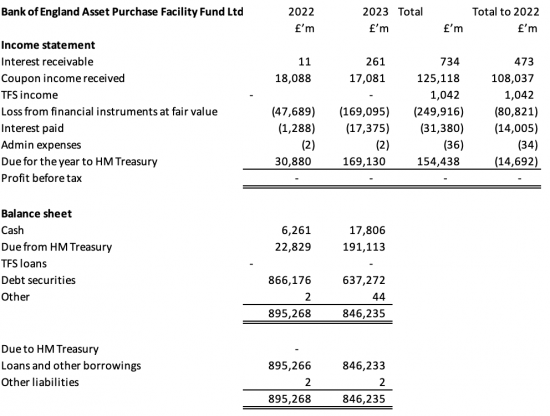

What’s now on show are the accounts for 2022 and 2023 plus a abstract of all yr’s revenue and expenditure to each 2022 and 2023.

A number of factors stand out:

- £125 billion of curiosity prices have now been saved on account of QE

- Till 2022 the operation of QE was worthwhile in yearly

- It was solely in 2023 that QE turned from having been a really worthwhile train int being a loss-making one.

- In 2023 a lack of £169 billion was made on QE operations.

- That loss was virtually totally as a result of worth of the investments held by the APF being lowered in worth on its stability sheet. There was no precise money loss within the yr.

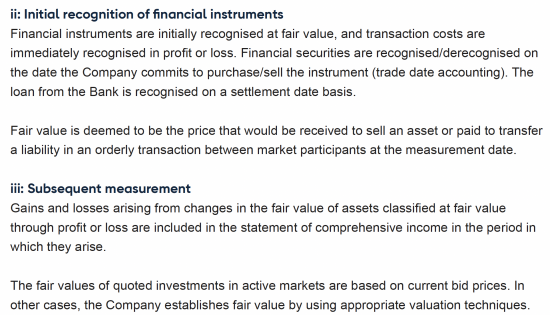

So, why did this loss occur? That’s defined by this innocuous-looking observe on accounting insurance policies included within the accounts:

What that observe, in impact says is that the monetary devices – on this case, all the federal government bonds that the APF owns – are valued at what’s, in impact, their market worth on the APF’s stability sheet date.

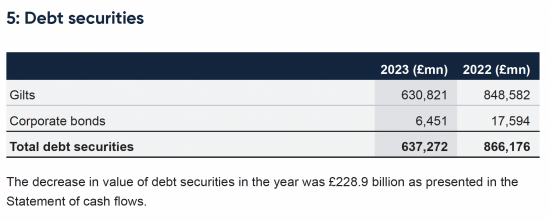

Observe 5 to the accounts provides just a little data:

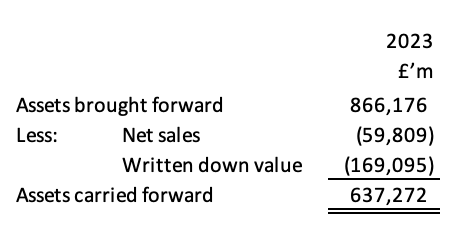

The observe is as deceptive as it’s useful. The reference to the money stream is definitely to a non-cash motion, and so isn’t very useful. What was required was a breakdown within the discount within the worth of belongings cut up between the worth written off and gross sales made. Within the absence of this knowledge within the accounts, it is vitally seemingly that the cut up was:

The diminution in worth was then due to asset gross sales beneath the quantitative tightening programme, which may have resulted in some actual losses arising, and, rather more considerably, the accounting write-down of the worth of the portfolio.

As is now clear from whole buying and selling of the portfolio to this point, together with these losses, is that general if the fund have been to be offered at present values, then to this point, the entire quantitative easing operation would have resulted in losses of round £150 billion.

So the query to ask is whether or not that could be a honest illustration of what’s going to truly occur? Will the Financial institution of England actually lose £150 billion on behalf of the Treasury, and why?

The reply is that I can not say whether or not that’s the case or not, as a result of it relies upon upon the choices that the Financial institution of England makes. There are three that matter:

- Will it hold charges as excessive as they’re now in the interim, and even improve them additional?

- Will it allow them to fall to a pure price of two% or much less, which is what the financial system clearly wants when inflationary stress is over, which it will likely be inside a few years at most?

- Will it insist on promoting massive components of its bond portfolio at a loss as it’s now doing regardless that there isn’t a want for it to take action?

These three factors want unpacking.

First, it will appear that the Financial institution of England has now received a deathwish with regard to interest-rate coverage, and even the Treasury is now changing into nervous that the will increase in rates of interest that they’re pursuing will probably be dangerous to the financial system. I can solely hope that they create stress to bear on the Financial institution to cease this coverage of accelerating charges, which is now one in all pure folly.

Equally, I hope that whoever is in workplace as Chancellor of the Exchequer on the finish of 2024 will likewise convey stress to bear on the Financial institution to scale back rates of interest quickly at the moment to ease the stress on the financial system when there’ll by then be no proof of any profit to arising to it as a consequence of sustaining the high-interest charges that the Financial institution of England does at current point out that they want to stay in place.

Third, if I used to be to get my want on rates of interest, then the present coverage of the Financial institution of England, which is to promote as most of the gilts in its portfolio as it might at current values is an additional instance of its pure monetary folly. That’s as a result of when rates of interest are increased within the market than when the gilt was issued, then the worth of that gilt does, in present phrases, fall. The eventual redemption worth of the gilt doesn’t, nevertheless, change. In different phrases, if the investor holds the gilt to the tip of its life then they are going to get again precisely what they have been promised. So if they do not promote, they won’t make these losses.

Let me use a fast instance of a ten-year bond issued final yr with an rate of interest of three.25%. The info is right here:

This bond was issued at a reduction to its £100 par worth, which is frequent.

The worth at which it has traded has different from £101 to £89 over the time it has been in problem. Proper now, it’s nearer the underside finish of the size.

If the Treasury had purchased this on problem, it will now be sitting on a loss. If it offered now, that loss can be actual: whoever purchased it will in impact purchase it at an undervalue in comparison with the problem worth. There can be a switch of worth from the Treasury to the non-public sector.

However there isn’t a motive for the Financial institution of England to promote now, apart from its wholly pointless quantitative tightening coverage. If it held it till 2033 it will get £100 again. It could lose nothing.

So, in that case, why is the Financial institution claiming a lack of £150 billion? 4 causes:

- It’s wholly unwisely placing up rates of interest.

- It needs to maintain rates of interest excessive.

- It needs to promote bonds at a giant loss to maintain rates of interest excessive.

- It’s doing this as a result of it seemingly needs to trash the financial system while offering asserts at an undervalue to monetary markets.

It’s, in different phrases, incompetence that’s driving this loss. It isn’t wanted. It doesn’t must occur. It might not occur. It simply requires sanity to be restored to our central financial institution to cease it occurring. However will that occur? Who is aware of?

What I do know is that the Financial institution is recklessly looking for to make losses to stop the federal government from spending cash to satisfy social want. And that’s the actual banking scandal of this second.

[ad_2]