[ad_1]

I had a request yesterday that I write an article explaining the nationwide debt, most particularly within the context of trendy financial concept.

Let me supply two responses. First there may be this video:

That was one of many actually early ones I made. The sound is inferior to I would love.

Then there may be this text, which was first printed as a Twitter thread in 2021. I hope that they assist.

We have now simply had one other week when the media has obsessed about what they name the UK’s nationwide debt. There was wringing of palms. The handcart wherein we are going to all go to hell has been oiled. And none of that is obligatory. So this can be a thread on what you really want to know.

First, as soon as upon a time there was no such a factor because the nationwide debt. That began in 1694. And it led to 1971. Throughout that interval both straight or not directly the worth of the pound was linked to the worth of gold. And since gold is briefly provide, so may cash be.

Then in 1971 President Nixon within the USA took the greenback off the gold customary, and after that there was no hyperlink in any respect between the worth of the pound within the UK and something bodily in any respect. Notes, cash and, most significantly, financial institution balances all simply turned guarantees to pay.

A forex like ours that’s only a promise to pay is named a fiat forex. That signifies that nothing provides it worth, besides somebody’s promise. And the one promise we actually belief is the federal government’s.

When you do not imagine that it is the authorities’s promise to pay that provides cash its worth, simply recall when Northern Rock failed in 2007. There was the primary run on a financial institution within the UK for 160 years. However the second the federal government stated it could pay everybody that disaster was over.

There is a paradox right here. We belief the federal government’s promise, which means it has a number of cash, and we get paranoid in regards to the nationwide debt, which suggests the federal government has no cash. Each of these issues cannot be proper, until there’s one thing fairly odd in regards to the authorities.

And naturally there’s something actually odd in regards to the authorities in terms of cash. And that’s that the federal government each creates our forex by making it the one authorized tender in our nation and likewise really creates plenty of the cash that we use in our financial system.

The way it makes notes and coin is simple to grasp. They’re minted, or printed, and it is unlawful for anybody else to do this. However notes and coin are solely a really small a part of the cash provide – a number of % at most. The remainder of the cash that we use is made up of financial institution balances.

The federal government additionally makes a major a part of our digital cash now. The business banks make the remaining, however solely with the permission of the federal government, so actually the federal government is admittedly accountable for all our cash provide.

This digital cash is all made the identical method. An individual asks for a mortgage from a financial institution. The financial institution agrees to grant it. They put the mortgage stability in two accounts. The borrower can spend what’s been put of their present account. They comply with repay the stability on the mortgage account.

That’s actually how all cash is made. One lender, the financial institution. One borrower, the client. And two guarantees to pay. The financial institution guarantees to make fee to whomsoever the client instructs. The client guarantees to repay the mortgage. And people guarantees make new cash, out of skinny air.

In case you have ever questioned what the magic cash tree is, I’ve simply defined it. It’s fairly actually the flexibility of a financial institution and their buyer to make this new cash out of skinny air by merely making mutual guarantees to pay.

The issue with the magic cash tree is that creating cash is so easy that we discover it actually laborious to grasp. We will have as a lot cash as there are good guarantees to pay to be made. It is as fundamental as that. The magic cash tree actually exists, and thrives on guarantees.

However there’s an issue. Bankers, economists and politicians would actually slightly that you simply didn’t know that cash actually is not scarce. In any case, when you knew cash is created out of skinny air, and costlessly, why would you be keen to pay for it?

What’s extra, when you knew that it was your promise to pay that was at the very least as vital because the financial institution’s on this cash creation course of then would not you, as soon as extra, be slightly aggravated on the track and dance they make about ever letting you get your palms on the stuff?

The most important cause why cash is so laborious to grasp is that it has not paid ‘the cash folks’ to let you know simply how cash works. They’ve made good cash out of you believing that cash is scarce in order that you need to pay prime greenback for it. So that they preserve you at nighttime.

There are two extra issues to learn about cash earlier than going again to the nationwide debt. The primary is that simply as loans create cash, so does repaying loans destroy cash. As soon as the promise to pay is fulfilled then the cash has gone. Actually, it disappears. The ledger is clear.

Individuals discover this difficult as a result of they confuse cash with notes and coin. Besides that is not true. In a really actual sense they are not cash. They’re only a reusable document of cash, like recyclable IOUs. They will clear one debt, after which they can be utilized to document, or repay a brand new one.

The actual fact is that until somebody’s owed one thing then a word or coin is nugatory. They solely get worth when used to clear the debt we owe somebody. And the one who will get the word or coin solely accepts them as a result of they’ll use them to clear a debt to another person.

So even notes and coin cash are all about debt. They’re solely of worth in the event that they clear a debt. And we all know that. When a brand new word comes out we wish to do away with the previous kind as a result of they now not clear debt: they’re nugatory. When the flexibility to pay debt’s gone, so has the worth.

So debt compensation cancels cash. And all business financial institution created cash is of this type, as a result of each financial institution, slightly annoyingly, calls for compensation of the loans that it makes. Besides one, that’s. And that exception is the Financial institution of England.

So what’s particular in regards to the Financial institution of England? Let’s ignore its historical historical past from when it started in 1694, for now. As a substitute you have to remember that it has been wholly owned by the UK authorities since 1946. So, to be blunt, it is simply part of the federal government.

Please keep in mind this and ignore the sport the federal government and The Financial institution of England have performed since 1998. They’ve claimed the Financial institution of England is ‘unbiased’. I will not use unparliamentary language to explain this fable. So let’s simply persist with that phrase ‘fable’ to explain this.

To place it one other method, the federal government and the Financial institution of England are about as unbiased of one another as Tesco plc, which is the Tesco dad or mum firm, and Tesco Shops Restricted, which really runs the supermarkets that use that title. In different phrases, they are not unbiased in any respect.

And this issues, as a result of what it means is that the federal government owns its personal financial institution. And what’s extra, it is that financial institution which prints all banknotes, and declares them authorized tender. However much more vital is one thing referred to as the Exchequer and Audit Departments Act of 1866.

This Act may sound obscure, however underneath its phrases the Financial institution of England has, by regulation, to make any fee the federal government instructs it to do. In different phrases, the federal government is not like us. We ask for financial institution loans however the authorities can inform its personal financial institution to create one, at any time when it desires.

And that is actually vital. Every time the federal government desires to spend it might. Not like all the remainder of us it would not need to test whether or not there may be cash within the financial institution first. It is aware of that legally its personal Financial institution of England should pay when advised to take action. It can not refuse. The regulation says so.

As ever, politicians, economists and others like to assert that this isn’t the case. They fake that the federal government is like us, and has to boost tax (which is its earnings) or borrow earlier than it might spend. However that is not the case as a result of the federal government has its personal financial institution.

It is the truth that the federal government has its personal financial institution that creates the nationwide forex that proves that it’s nothing like a family, and that each one the tales that it’s constrained by its means to tax and borrow are merely unfaithful. The federal government is nothing like a family.

In actual fact, the federal government is the other of a family. A family has to pay money for cash from earnings or borrowing earlier than it might spend. However the gov’t would not. As a result of it creates the cash we use there can be no cash for it to tax or borrow until it made that cash first.

So, to have the ability to tax the federal government has to spend the cash that will likely be used to pay the tax into existence, or nobody would have the means to pay their tax if it was solely payable in authorities created cash, as is the case.

Which means the federal government actually cannot tax earlier than it spends. It has to spend first. Which is why that Act of 1866 exists. The federal government is aware of spending at all times comes earlier than tax, so it needed to make it unlawful for the Financial institution of England to ever refuse its demand that fee be made.

So why tax? At one time it was to get gold again. Kings did not wish to give it away ceaselessly. However since gold is now not the difficulty the reason is totally different. Now the primary cause to tax is to manage inflation which might improve if the federal government saved spending with out restrict.

There may be one more reason to tax. That’s that if folks need to pay a big a part of their incomes in tax utilizing the forex the federal government creates then they’ve little alternative however use that forex for all their dealing. That provides the federal government efficient management of the financial system.

Tax additionally does one thing else. By decreasing what we will spend it restricts the dimensions of the non-public sector financial system to ensure that the sources that we’d like for the collective good that the general public sector delivers can be found. Tax makes area for issues like schooling.

And there may be one different cause for tax. As a result of the federal government guarantees to simply accept its personal a reimbursement in fee of tax – which general is the largest single invoice most of us have – cash has worth.

It is that promise to simply accept its personal a reimbursement as tax fee that makes the federal government’s promise to pay inside an financial system rock strong. Nobody can ship a greater promise to pay than that within the UK. So we use authorities created cash.

So, what has all this bought to do with the nationwide debt? Properly, rather a lot, to be candid. I’ve not taken you on a wild goose chase to keep away from the difficulty of the nationwide debt. I’ve tried to elucidate authorities made cash so that you could perceive the nationwide debt.

What I hope I’ve proven up to now is that the federal government has to spend to create the cash that we have to preserve the financial system going, which it does each day, day in and time out by its spending on the NHS, schooling, advantages, pensions, defence and so forth.

After which it has to tax to deliver that cash that it is created again underneath its management to handle inflation and the financial system, and to provide cash its worth. However, by definition it might’t tax all the cash it creates again. If it did then there can be no cash left within the financial system.

So, as a matter of truth a authorities like that of the UK that has its personal forex and central financial institution has to run a deficit. It is the one method it might preserve the cash provide going. Which is why nearly all governments do run deficits within the trendy period.

And please do not quote Germany to me as an exception to this as a result of it, after all, has not bought its personal forex. It makes use of the euro, and the eurozone as an entire runs a deficit, which means that the rule nonetheless holds.

So deficits will not be one thing to fret about, until that’s you actually don’t need the UK to have the cash provide that retains the financial system going, and I believe you’d slightly we did have authorities cash as a substitute of some dodgy different.

However what of the debt, which is mainly the cumulative whole of the deficits that the federal government runs? That debt has been rising since 1694, nearly repeatedly, and fairly dramatically so over the past decade or so, when it has greater than doubled. Is that a problem?

The reply is that it isn’t. This debt is simply cash that the federal government has created that it has determined to not tax again as a result of it’s nonetheless of use within the financial system. That’s all that the nationwide debt is.

Consider the nationwide debt this manner: it is simply the long run taxable earnings of the federal government that it has determined to not declare, as but. Nevertheless it may, at any time when it desires.

That is one of many bizarre issues about this supposed nationwide debt. After we’re in debt we won’t out of the blue determine that we’ll cancel the debt by merely reclaiming the cash that makes it up for our personal use. However the authorities can just do that, at any time when it desires.

This offers the clue as to a different bizarre factor about this supposed nationwide debt. It actually is not debt in any respect. Sure, you learn that proper. The nationwide debt is not debt in any respect.

That is as a result of, as is obvious from the outline I’ve given, the so-called nationwide debt is simply made up of cash that the federal government has spent into the financial system of our nation that it has, for its personal good causes, determined to to not tax again as but.

So, the nationwide debt is simply authorities created cash. That’s all it’s. However the fact is that the folks of this nation didn’t, again in 1694 when rates of interest had been a lot larger than they’re now, like holding this authorities created cash on which no curiosity was paid.

You must keep in mind one thing else about those that held this authorities created cash in occasions of previous (although not a lot has modified now). They had been the wealthy. When you do not imagine me go and browse Jane Austen’s ‘Delight and Prejudice’ and word how a lot Bingley had in 4% authorities bonds.

And there was one thing in regards to the wealthy, then and now. They get the ear of presidency. And so their protests about ending up with authorities cash with out curiosity being paid had been heard. And so, cash it could be, however from the outset the nationwide debt had curiosity paid on it.

The so-called nationwide debt nonetheless has curiosity paid on it. However then so do financial institution deposit accounts. They usually look just about like cash too. Solely, they are not as safe (at the very least with no authorities assure in place) and so the federal government pays much less.

However let’s be clear what this implies. The nationwide debt is cash that represents the financial savings of these wealthy or lucky sufficient to have such issues on which curiosity is paid by the federal government as a result of it has been persuaded to make that fee.

Let me even be clear about one thing else. These financial savings will not be in a really actual sense voluntary. If the federal government decides to run a deficit – and that’s what it does do – then another person has to save lots of. This isn’t by likelihood it’s an absolute accounting truth.

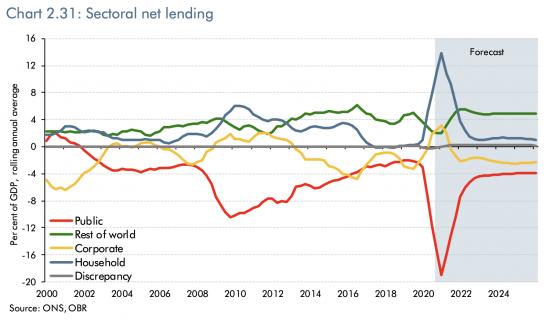

The place cash is anxious for each deficit somebody needs to be in surplus. To be geeky for a second, this is a matter decided by what are referred to as the sectoral balances. There is a authorities created chart on these right here.

The chart makes it clear that when the federal government runs an enormous deficit – because it did, for instance, in 2009 – then somebody merely has to save lots of. They don’t have any alternative. And what they save is authorities created cash. Which is strictly what can be occurring now.

A rising deficit is at all times matched by financial savings. So who’s saving? I’m intentionally utilizing approximate numbers, as a result of they’ll fairly actually change by the day. However let’s begin by noting that the commonest determine for presidency debt was £2,100 billion in December 2020.

Of this sum, in response to the federal government, £1,880 billion was authorities bonds, £207 billion was nationwide financial savings accounts and the remaining a hotch-potch of all types of offsetting numbers, like native authority borrowing. I do not assume they do their sums proper, however let’s begin there.

Besides, these official figures are improper. Why? As a result of on the finish of December the Financial institution of England had used what is named the quantitative easing course of to purchase again about £800 billion of the federal government’s debt, with that determine scheduled to rise nonetheless additional in 2021.

I do not wish to clarify QE intimately right here, as a result of I’ve already performed that in one other thread, that I posted as a weblog right here. https://www.taxresearch.org.uk/Weblog/2020/11/22/the-history-and-significance-of-qe-in-the-uk/

So let’s, taking QE under consideration, talk about what actually makes up the nationwide debt, beginning with an acknowledgment that if the federal government owns round £800bn of its personal bonds they can’t be a part of the nationwide debt as a result of they’re actually not owed to anybody.

Round £200 billion of the nationwide debt is made up of Nationwide Financial savings & Investments accounts. That is issues like Premium Bonds, and the fashion of actually protected financial savings accounts older folks have a tendency to understand.

Round £400 billion of the nationwide debt is owned by international governments, which is sweet information. They do this as a result of they wish to maintain sterling – our forex. And that is as a result of that helps them commerce with the UK, which is massively to our benefit.

However what’s additionally the case is that that due to QE UK banks and constructing societies have round £800bn on deposit account with the Financial institution of England proper now. That is vital although: that is the federal government supplied cash stops them failing within the occasion of a monetary disaster.

After which there’s very roughly £700 billion of different debt if the Workplace for Nationwide Statistics have gotten their numbers proper (which I doubt: they overstate this). No matter the best determine, this debt is owned by UK pension funds, life assurance firms and others who need actually safe financial savings.

Why do pension funds and life assurance firms need authorities debt? As a result of it is at all times assured to pay out. So it gives stability to again their promise to pay out to their clients, whether or not pensioners, or life assurance clients, or whoever.

So now I’ve defined how we get a nationwide debt and that it is a option to have one made by authorities. I’ve additionally defined that each one it represents is the financial savings of individuals. And I’ve defined the federal government may declare it again at any time when it desires. And I’ve lined QE.

So, the query is in that case, which little bit of the nationwide debt is so worrying? Can we not need folks to save lots of? Or, would we slightly that they’d riskier financial savings that our pensions in danger? Is that the explanation why we wish to repay the nationwide debt?

Or can we wish to cease international governments holding sterling to help their commerce, and ours?

Alternatively, can we wish to take the federal government created a reimbursement out of the banking system when it is saved it from collapse twice now (2009 and 2020) and which gives it with the soundness that it wants to forestall a banking crash?

Or is it the nationwide debt paranoia actually some bizarre dislike of Premium Bonds that implies that they will deliver the UK financial system down?

The purpose is, when you perceive the nationwide debt it is actually not threatening in any respect. And what you start to marvel is why so many individuals obsess about it. To which query there are three doable solutions.

The primary is that the obsessive don’t perceive the nationwide debt. The second is that they do perceive it, however wish to ensure you do not. And the third is that they realise that when you did perceive the nationwide debt there can be no cause for austerity.

Of those the final is by far the probably. There’s at all times been a conspiracy to not inform the reality about cash, and the way simply it is made. There’s additionally a conspiracy to not inform the reality in regards to the truth authorities spending has to come back earlier than taxation, and the regulation ensures it.

And I strongly counsel that the hullabaloo in regards to the nationwide debt – which is a superb factor that there’s completely no must repay and which is admittedly low-cost to run – is all a conspiracy too.

The reality is that the nationwide debt is our cash provide. It retains the financial system of our nation going. It retains our banks secure. And it additionally represents the most secure type of financial savings, which individuals wish to purchase.

There isn’t a debt disaster. Neither is the nationwide debt a burden on our grandchildren. As a substitute, the fortunate ones may inherit part of it.

However some politicians don’t need you to know that there is no such thing as a actual constraint on you having the federal government and the general public providers you need. What the federal government’s means to make cash, sensibly used, proves is we don’t want austerity. And we by no means did.

As a substitute, the chance we would like is offered. And we don’t want the non-public sector to ship it. The federal government can and will participate in that course of as effectively, which it might do utilizing the cash it might create because the capital it wants to take action.

However so as to pursue their very own non-public beneficial properties and earnings some would slightly that this isn’t recognized, so that they promote the concept that cash is briefly provide and that the nationwide debt is a hazard. Neither is true. We have to go away these myths behind. Our future depends upon doing so.

[ad_2]