[ad_1]

One of many extra silly arguments 1 that appear to be emanating from the Fed about their intention to lift charges one other quarter level right this moment: The two% inflation goal that has been in place just about the whole post-financial disaster period.

There isn’t a empirical proof displaying 2% is the optimum long-run inflation goal, given the Fed’s twin mandate of worth stability and most employment. It’s a type of spherical numbers that folks simply kinda made up and began with for no obvious cause.

If there was one thing magical about 2% as the perfect stability between costs and jobs, that will be one factor. However the 2% inflation goal is LITERALLY a random quantity 2 that originated in New Zealand within the Eighties. “Surprisingly, it got here not from any educational research,” CFR observes, “however reasonably from an offhand remark throughout a tv interview.” For causes nobody has intelligently articulated, different nations subsequently adopted it as their goal.

Laurence Ball, Professor of Economics at Johns Hopkins and Analysis Affiliate on the Nationwide Bureau Of Financial Analysis, made the case in 2013 that 4% was a extra rational goal. “Elevating inflation targets to 4% would have little value, and it might make it simpler for central banks to finish future recessions,” he famous.3

The Federal Open Market Committee has justified the two% inflation primarily based on inflation expectations. The Board of Governors acknowledged, “When households and companies can fairly anticipate inflation to stay low and secure, they can make sound selections relating to saving, borrowing, and funding, which contributes to a well-functioning financial system.”

The issue with this method is as we’ve got repeatedly proven, it’s totally ineffective. Inflation expectations are sometimes at their lowest proper earlier than a surge in inflation happens; they’re at their highest ranges simply as inflation rolls over and heads downwards. Folks’s inflation expectations mimic the everyday overenthusiastic investor, piling in on the prime of the market and panic promoting close to the underside.

Expectations are not any approach to run financial coverage and are more healthy for a Monty Python movie.4

Contemplate: We had 2% inflation expectations the whole post-GFC period. The financial system was sluggish, job creation as weak, shopper spending was delicate. ZIRP and QE had pushed charges to zero (or detrimental in some components of the world), and a couple of% appeared an affordable albeit arbitrary upside goal. However after $6 trillion in fiscal stimulus, mortgage charges at 7.5%, maybe 3% makes way more sense as a draw back inflation goal.

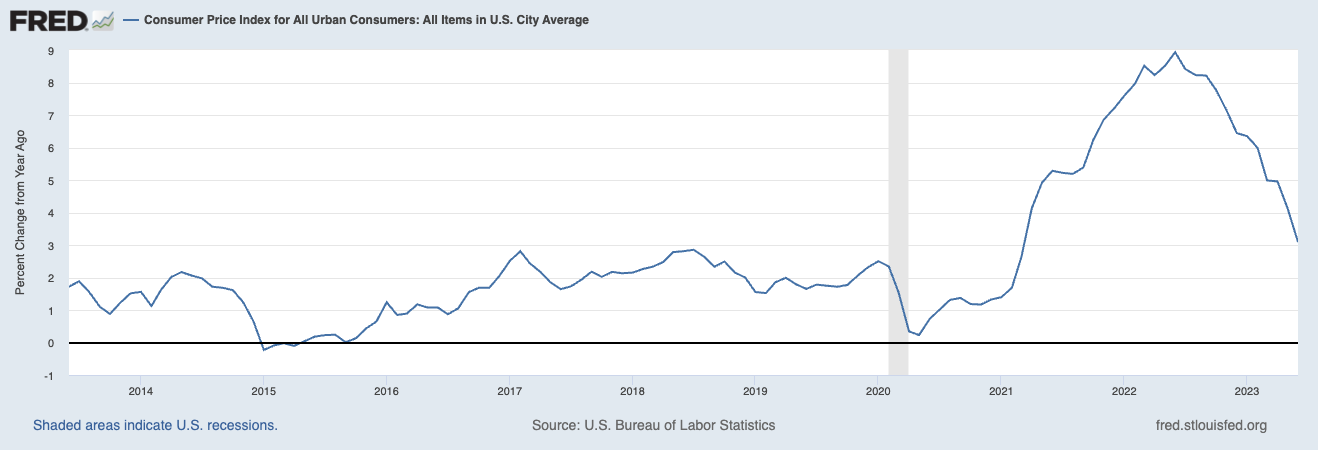

I’ve famous previously that the Fed was late to get off its emergency footing, late to acknowledge inflation pierced its 2% goal to the upside (March 2021), late to start elevating charges (March 2022), late to acknowledge inflation had peaked (June 2022), late to acknowledge that they’ve already overwhelmed inflation in (July 2023).

I’ve a pet concept as to why they’ve been constantly so late: Many economists have misunderstood this complete financial cycle, together with inflation. These older college economists – who demanded vigilance towards rising costs, declared inflation to be persistent, sticky, and non-transitory and even stagflationary – all made their bones within the Seventies/80s. They’re haunted by a really completely different kind of financial system that had very completely different inflation drivers. Their PTSD is palpable.

They’re taking the flawed lesson from that period. As Professor Ball wryly noticed to the NYT’s Jeff Sommers, “If 4% was ok for Volcker, it needs to be ok for us.”

Beforehand:

A Dozen Contrarian Ideas About Inflation (July 13, 2023)

Extra Inflation Expectations Silliness (July 5, 2023)

Inflation Expectations Are Ineffective (Could 17, 2023)

For Decrease Inflation, Cease Elevating Charges (January 18, 2023)

Why Is the Fed At all times Late to the Get together? (October 7, 2022)

Inflation Expectations: A Doubtful Survey (September 21, 2022)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

__________

1. Let’s maintain apart the declare that the Fed must “keep credibility,” as that squishy argument is just too ridiculous to deal with.

2. The case for 4% inflation, Laurence Ball, VoxEU/CEPR 24 Could 2013

3. Like 20% for a bull or bear market, its made up, with none information supporting it as both an indicator or a predictor.

4. Peasants: We now have discovered a witch! (A witch! a witch!)

Burn her burn her!

Peasant 1: We now have discovered a witch, might we burn her?

(cheers)

Vladimir: How do you identified she is a witch?

P2: She appears to be like like one!

V: Deliver her ahead

(advance)

Girl: I’m not a witch! I’m not a witch!

V: ehh… however you’re dressed like one.

W: They dressed me up like this!

All: naah no we didn’t… no.

W: And this isn’t my nostril, it’s a false one.

(V lifts up carrot)

V: Properly?

P1: Properly we did do the nostril

V: The nostril?

P1: …And the hat, however she is a witch!

(all: yeah, burn her burn her!)

V: Did you costume her up like this?

P1: No! (no no… no) Sure. (sure yeah) a bit (a bit bit a bit) However she has obtained a wart!

(P3 factors at wart)

V: What makes you suppose she is a witch?

P2: Properly, she turned me right into a newt!

V: A newt?!

(P2 pause & go searching)

P2: I obtained higher.

[ad_2]