[ad_1]

The transient’s key findings are:

- Since 2019, monetary markets have seen uncommon turmoil, most just lately a pointy rise in rates of interest to curb excessive inflation.

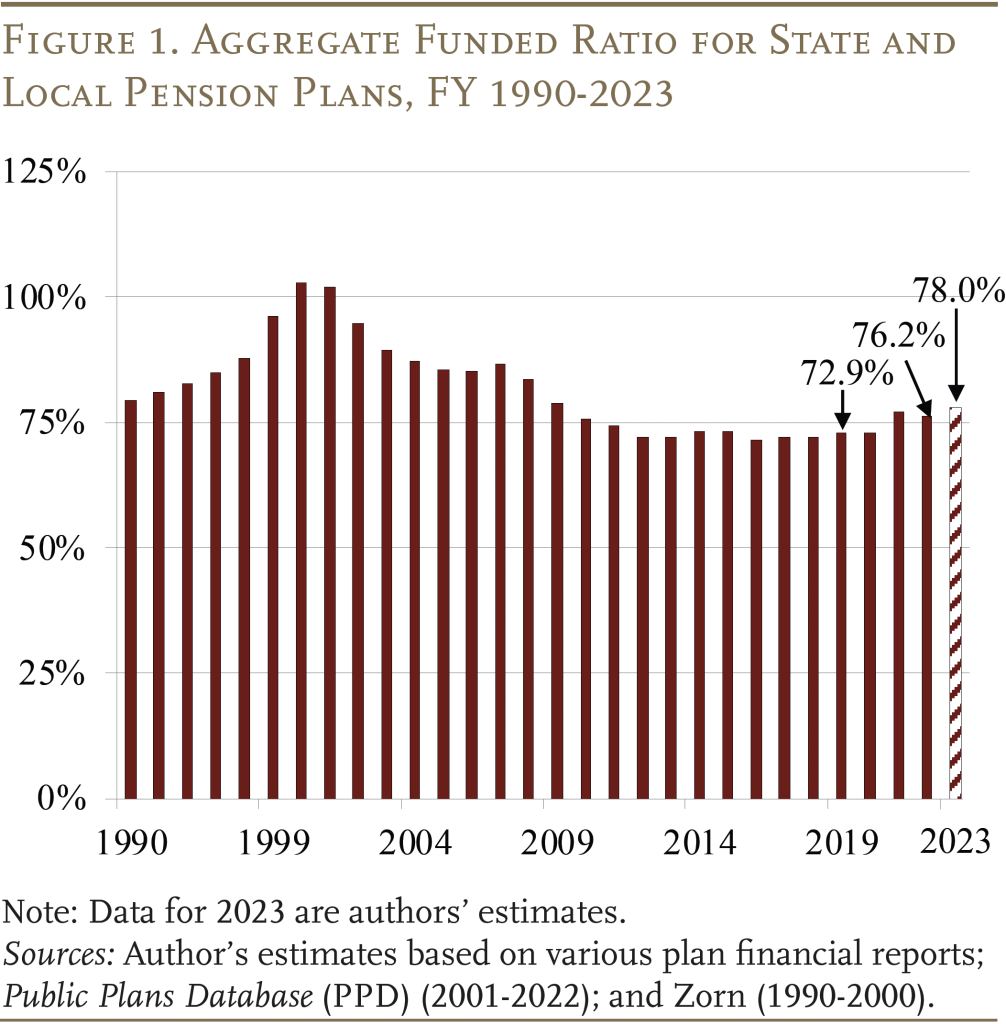

- Regardless of risky asset values, the funded standing of state and native pension plans has risen about 2 proportion factors since 2023, and 5 factors since 2019.

- That’s, the robust efficiency of different asset lessons has greater than offset the affect of rising rates of interest on fixed-income belongings.

Introduction

Since fiscal yr 2019, monetary markets have been jostled by a collection of surprising occasions: 1) the onset of COVID; 2) the following COVID stimulus; 3) declining rates of interest; 4) rising inflation; after which 5) rising rates of interest. Regardless of the volatility of asset values over this era, the 2023 funded standing of state and native pension plans is about 78 p.c, which is 5 proportion factors greater than in 2019.

This transient reviews the change within the funded standing of public plans; paperwork that, regardless of the turbulence, values for many asset lessons are forward of their 2019 ranges; after which appears extra carefully on the main exception – fixed-income belongings (“bonds”).

The dialogue is organized as follows. The primary part exhibits tendencies within the funded standing and prices of state and native pension plans. The second part paperwork the final efficiency of main asset lessons since 2019 – highlighting the general constructive portfolio beneficial properties regardless of the comparatively poor efficiency of bonds. The third part quantifies how a lot the rise in rates of interest has damage bond costs. The ultimate part concludes that the funded standing of pension plans has improved, with the latest rise in rates of interest solely marginally impacting their general funds.

Funds of Public Plans

As of June 2023, roughly two-thirds of the most important state and native pension plans within the Public Plans Database (PPD) had reported their 2022 funded ranges. None had reported 2023 ranges. To explain the present standing of public plans, this evaluation makes plan-by-plan projections utilizing information from every plan’s most just lately launched reviews. Primarily based on the 2022 information and projections for 2023, the combination actuarial funded ratio rose by 1.8 proportion factors in 2023 (see Determine 1). Regardless of the considerably rocky path of market asset values within the wake of COVID, the 2023 funded standing is 5 proportion factors greater than the 2019 degree. Whereas market returns have a considerable impact on funded ranges, their affect on the funded ratio in any given yr is muted by the actuarial smoothing strategies used when reporting asset values. (See Appendix A for a dialogue of actuarial versus market belongings.)

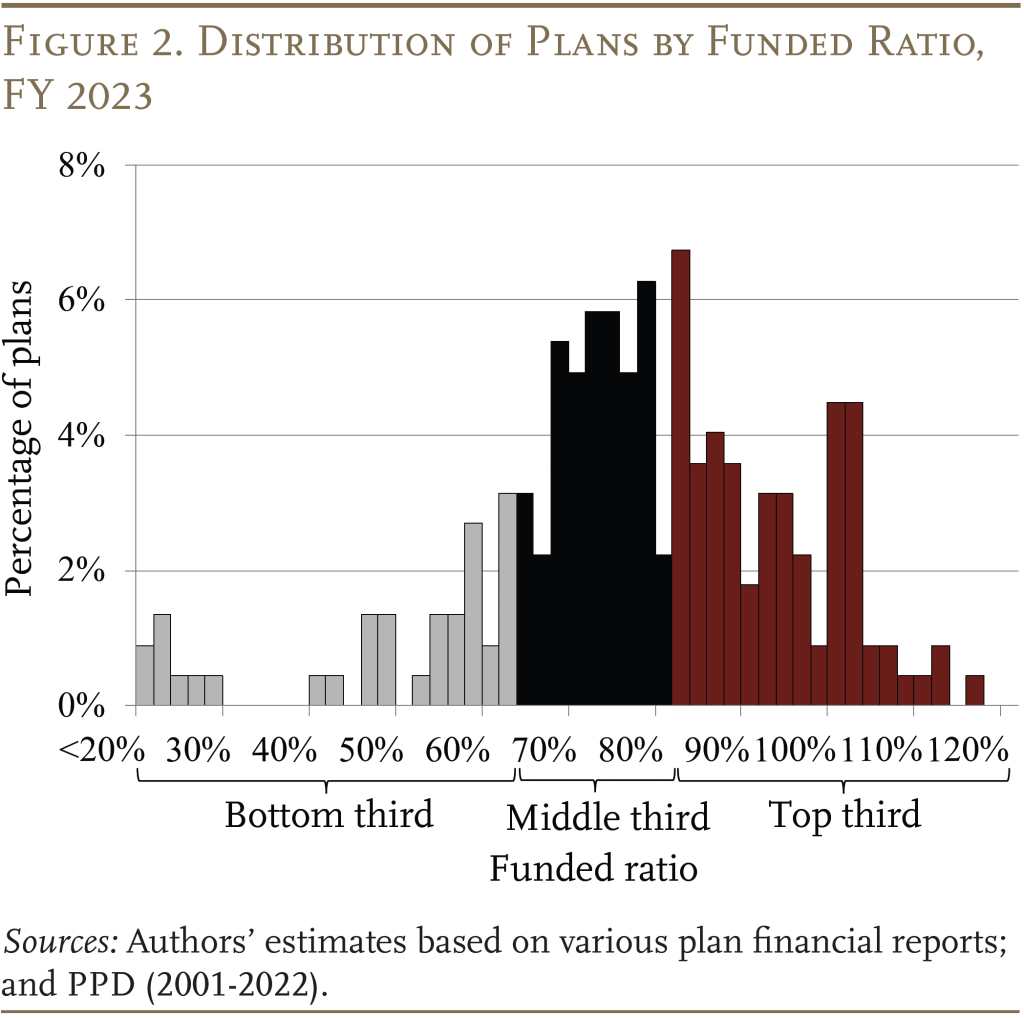

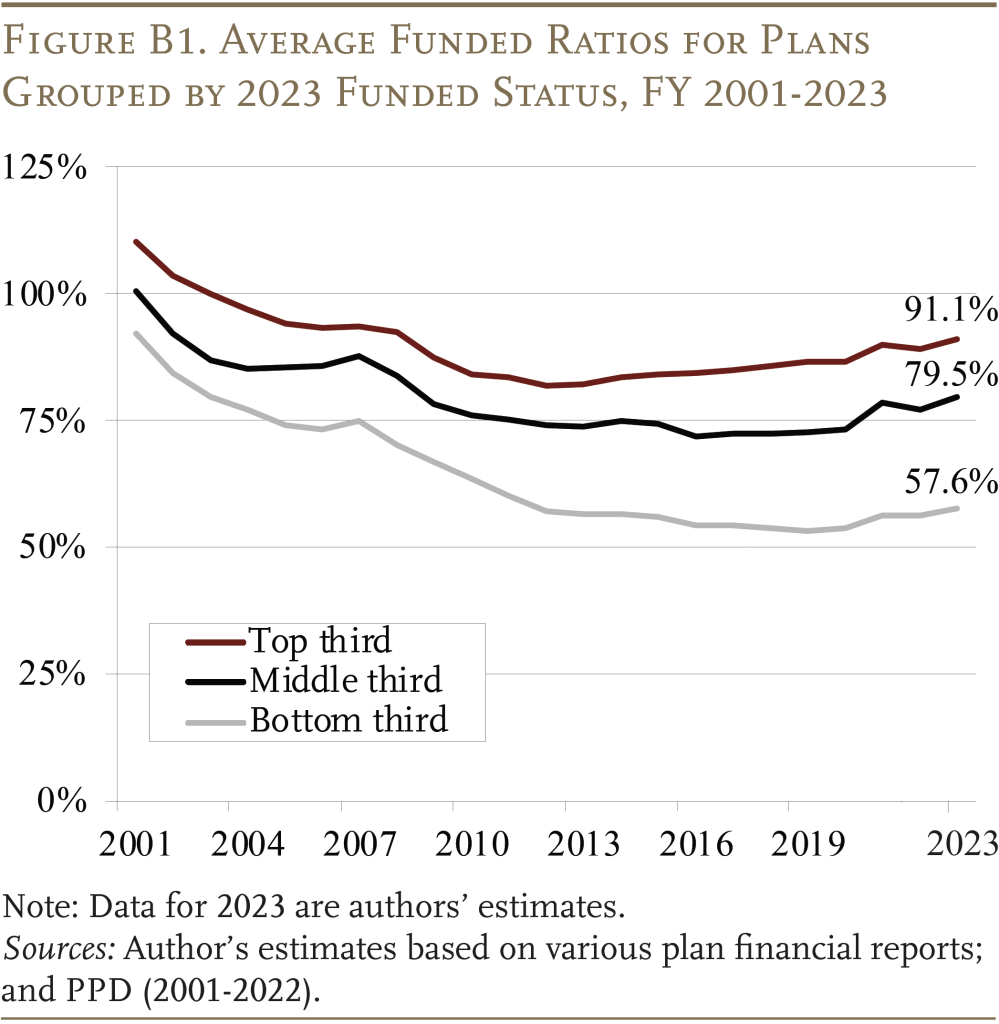

Whereas the combination funded ratio supplies a helpful measure of the general public pension panorama at massive, it can also obscure variations in funding on the plan degree. Determine 2 separates PPD plans into thirds primarily based on their present actuarial funded standing. The funded-ratio boundaries for the three teams have been 15-70 p.c for the underside third, 70-85 p.c for the center third, and 85-120 p.c for the highest third. The common 2023 funded ratio for every group was 57.6 p.c for the underside third, 79.5 p.c for the center third, and 91.1 p.c for the highest third (see Appendix B for tendencies on this distribution over time).

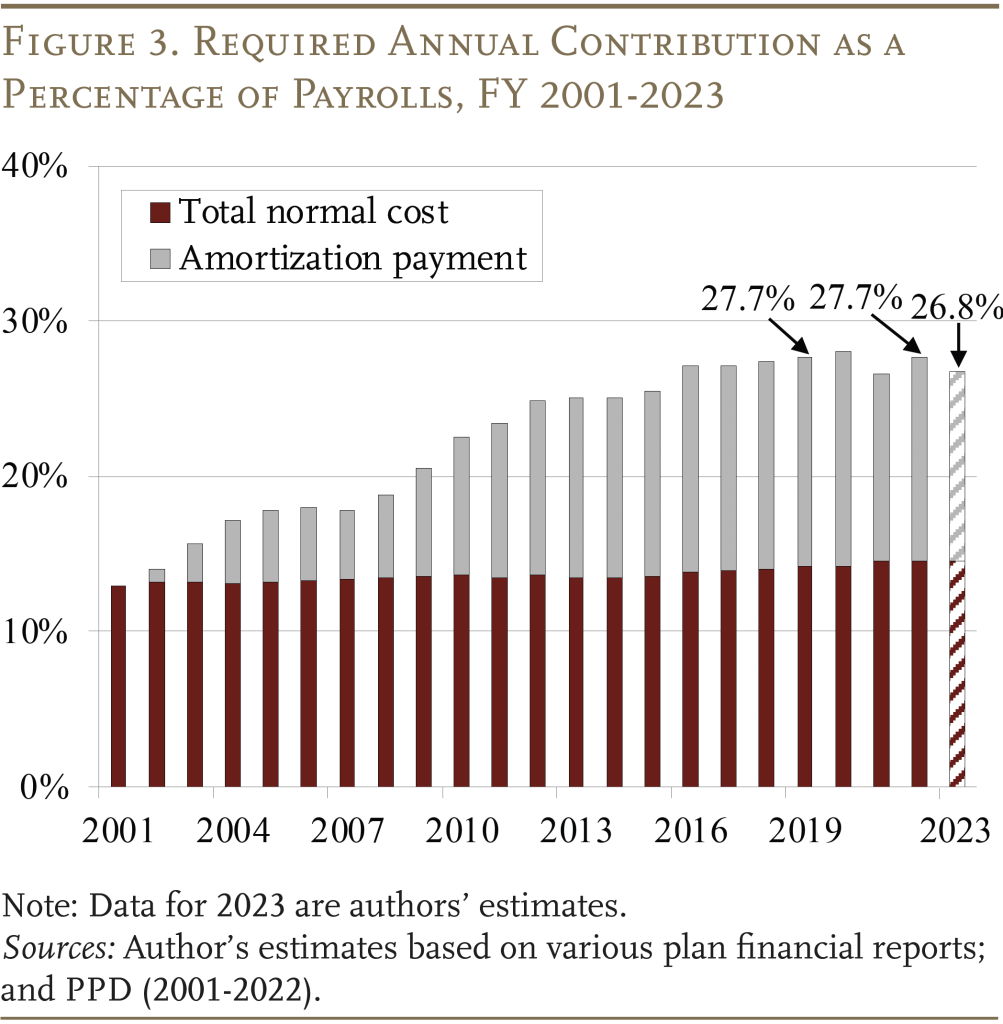

The actuarially decided contribution price – the speed required to maintain a plan on a gentle path towards full funding – is estimated to say no barely from 2022 to 2023 (see Determine 3). The contribution price can also be decrease than it was in 2019. This latest sample is opposite to that of the previous twenty years, throughout which contribution charges have elevated because of an increase within the amortization funds to cowl rising unfunded liabilities. In the present day, the portion of the required contribution devoted to paying down unfunded liabilities is roughly half.

Importantly, many pension researchers (and a few practitioners) query the adequacy of actuarially decided contributions as they’re sometimes calculated – highlighting the usage of overly optimistic funding return assumptions and comparatively lax strategies for amortizing the unfunded legal responsibility by backloading funds. If funding return assumptions extra carefully mirrored precise efficiency since 2001, and plans adopted extra stringent approaches to amortizing their unfunded liabilities (through the use of degree greenback as a substitute of degree p.c of pay), the typical actuarial contribution in 2023 would rise from 26.8 p.c to 34.6 p.c of payroll.

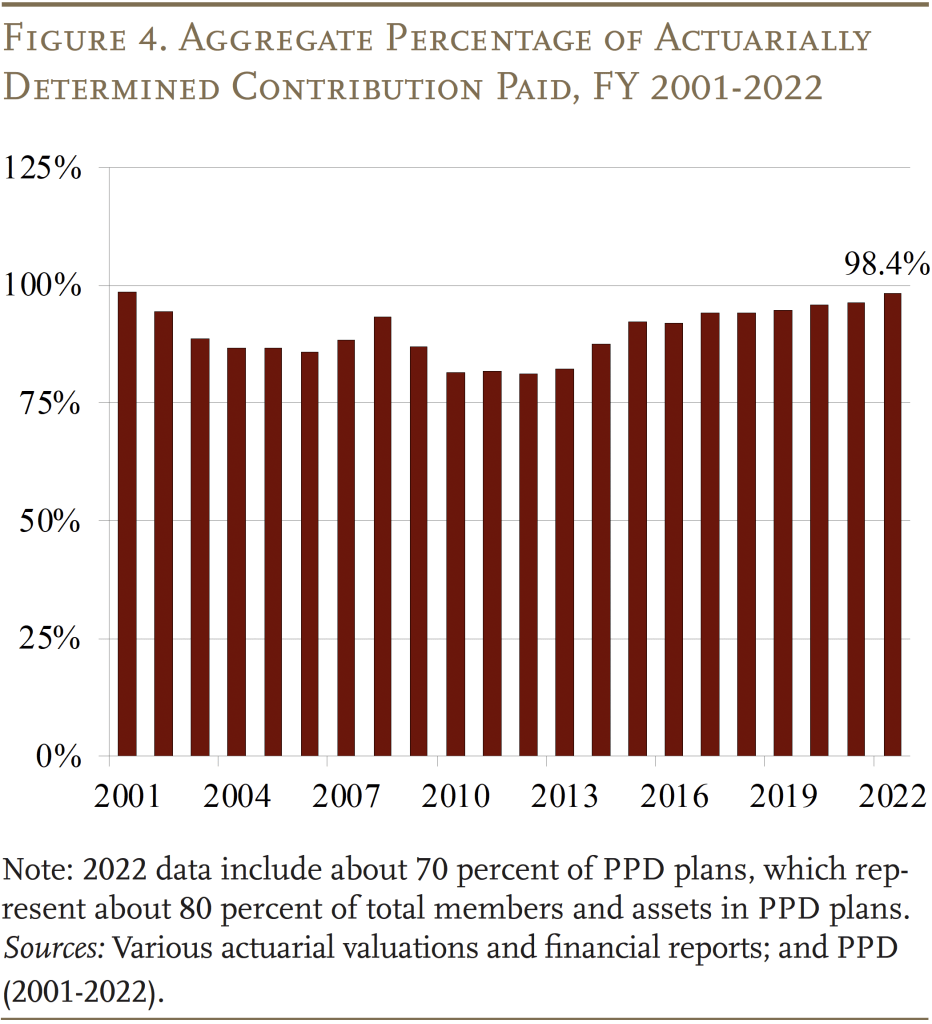

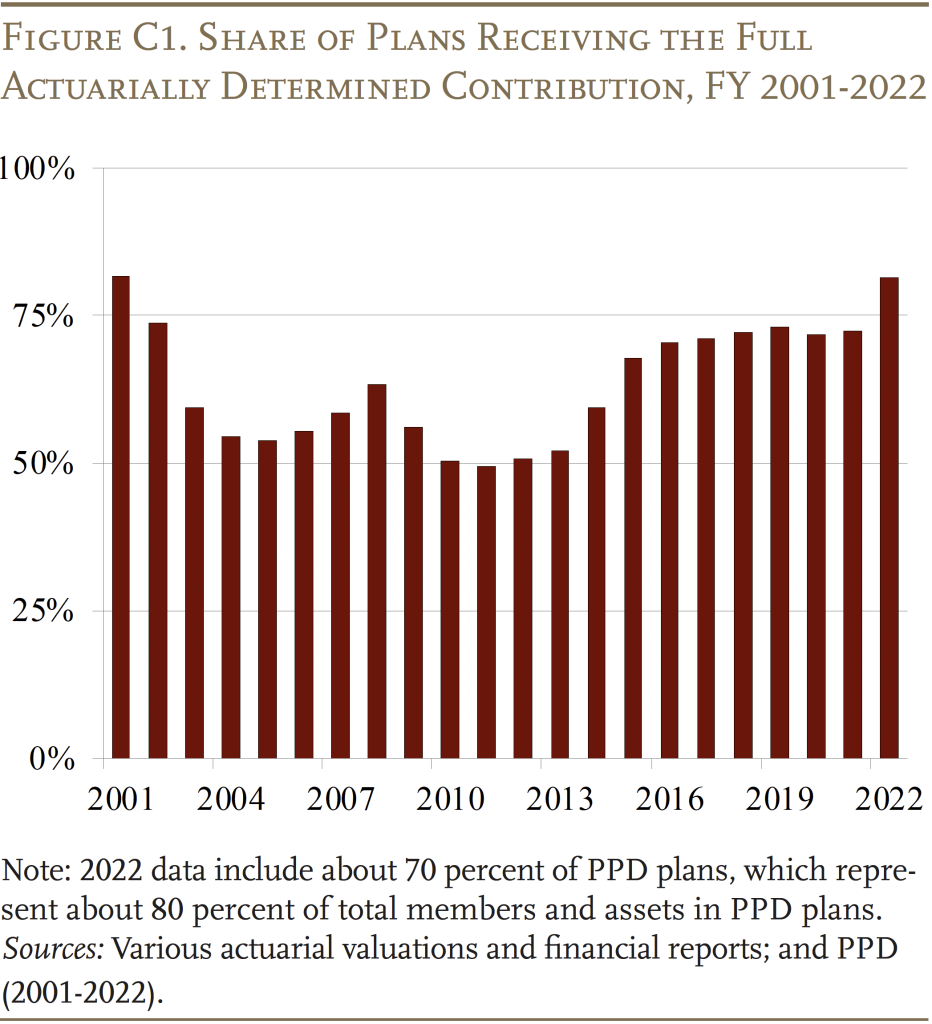

Determine 4 exhibits that, in mixture, the share of the actuarially decided contribution paid is closing in on 100%. This measure is considerably cyclical as a result of monetary and financial downturns typically coincide. For instance, it fell within the wake of the dot.com crash of the early 2000s and the monetary disaster of 2008-2009. As budgets recovered and the funded ratios stabilized because of inventory market beneficial properties, the required contributions additionally stabilized and the share of required contribution paid elevated. (See Appendix C for information on the share of plans that obtain the total required contribution from their sponsoring governments.)

Asset Class Efficiency Since 2019

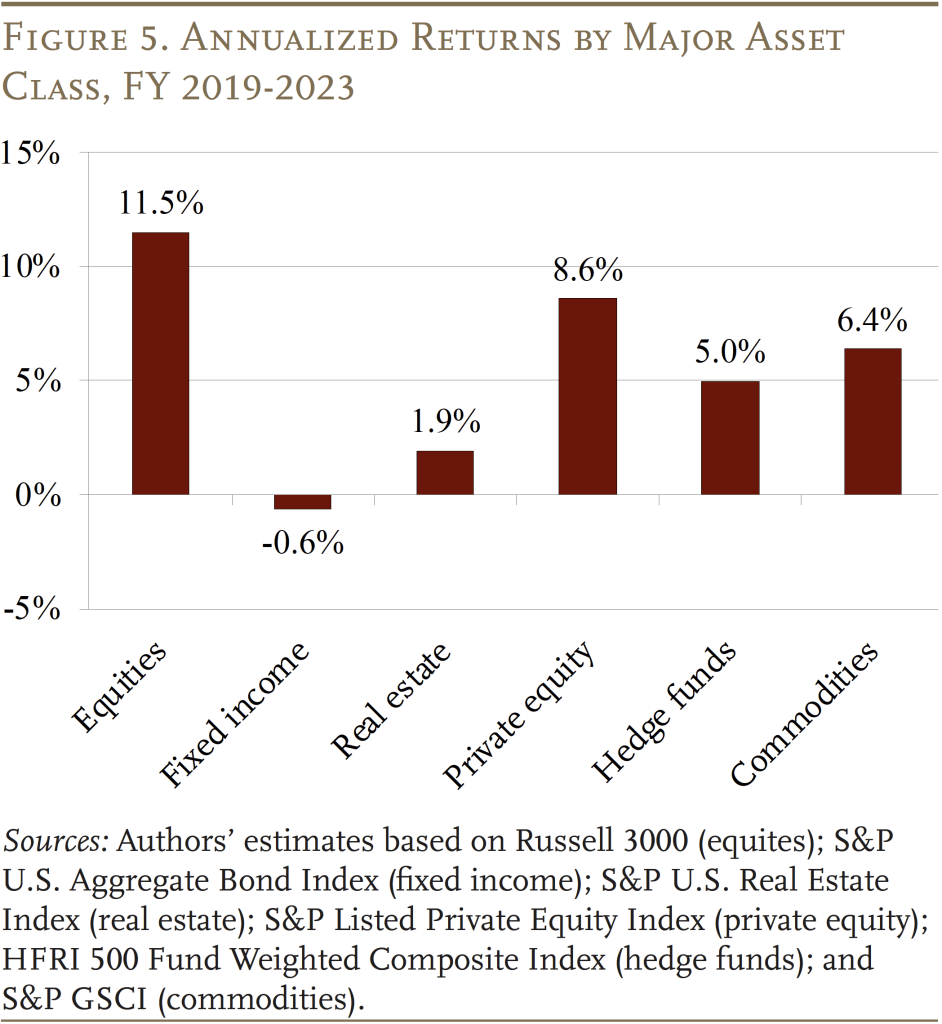

The most important cause for the advance in plans’ funded standing is that, regardless of the turbulence within the economic system, whole annualized returns, which embody curiosity and dividends, have risen noticeably for nearly all main asset class indices over the 2019-2023 interval (see Determine 5). The exception over this quick and risky interval is fastened earnings belongings, which have declined in worth.

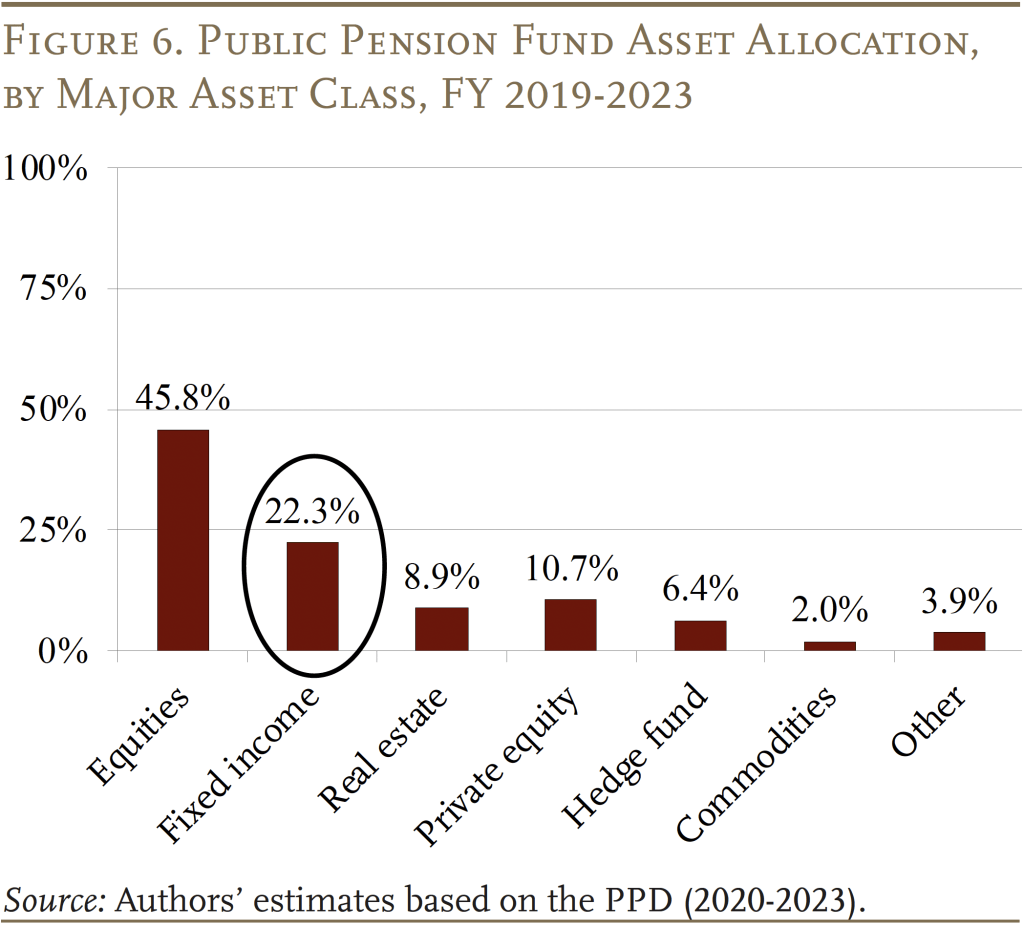

The significance of fastened earnings’s decline on general portfolio efficiency will depend on the share of the portfolio allotted to every asset class. Since 2019, as proven in Determine 6, fastened earnings has averaged solely about 20 p.c of pension fund belongings (a decline from about 30 p.c in 2001). In consequence, the constructive efficiency of the opposite main asset lessons greater than compensated for the decline within the worth of fastened earnings, suggesting a mean annualized return of about 6.7 p.c for pension funds since 2019, nonetheless considerably under their common assumed return of about 7.0 p.c.

Rising Curiosity Charges and Fastened-Revenue Property

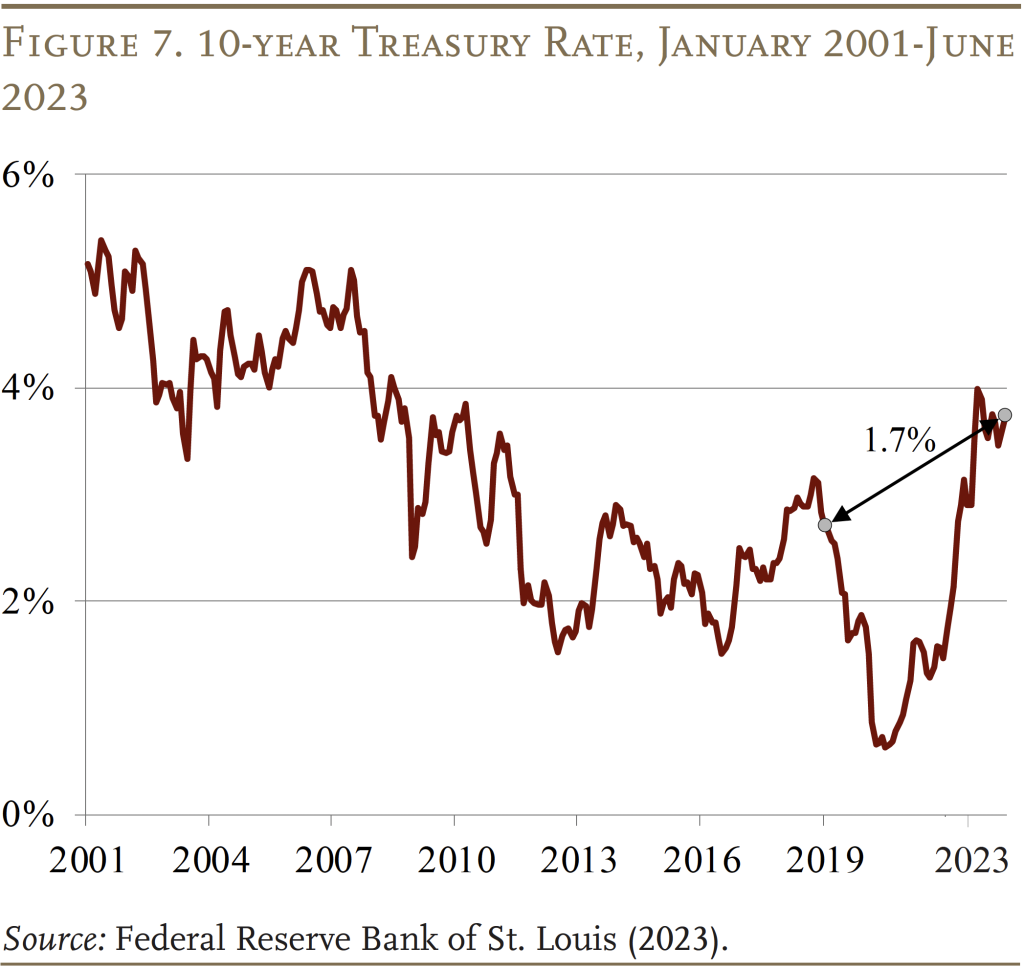

Since 2019, rates of interest first fell sharply, with the onset of COVID, after which soared much more dramatically because the economic system rapidly recovered and inflation emerged as a severe risk. Over the total interval, charges on 10-year Treasury bonds rose about 1.7 proportion factors – from simply over 2 p.c to almost 4 p.c (see Determine 7). This enhance, which marks a departure from the pattern over the past decade, was the most important contributor to the poor efficiency of fastened earnings. All else equal, when market rates of interest rise, the market worth of present bonds declines as demand drops for belongings that have been issued at decrease charges.

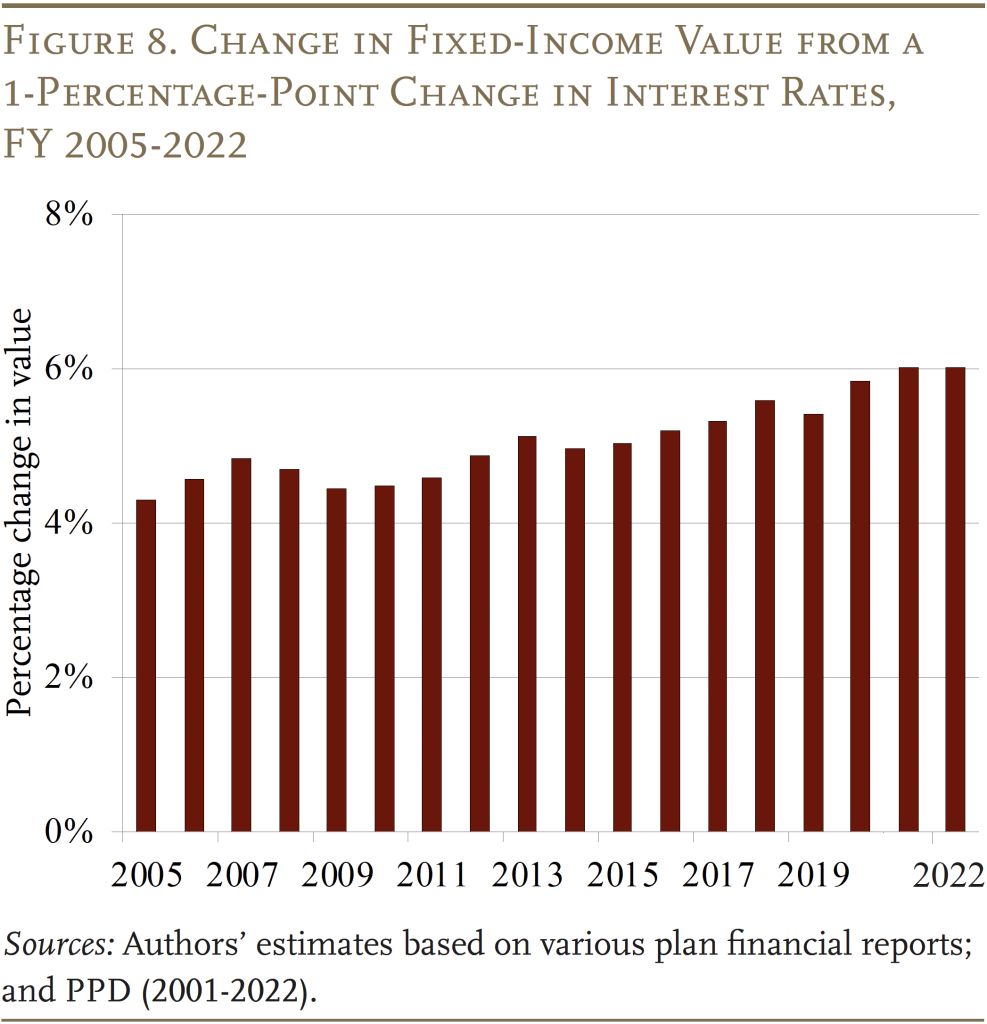

To quantify the affect of the rate of interest modifications, Determine 8 exhibits the estimated change within the worth of fixed-income belongings held by public pension funds because of a 1-percentage-point change in rates of interest. The information present that, as of 2022, a 1-percentage-point enhance in charges would decrease fixed-income values by about 6 p.c. Combining the interest-rate sensitivity reported by public pension funds with the modifications in 10-year Treasury charges means that the worth of pension funds’ fixed-income belongings would have declined roughly 2.5 p.c per yr since 2019. This quantity is according to the annualized return of broad-based fixed-income indices over the identical interval (proven in Determine 5), as soon as curiosity funds are taken into consideration.

Conclusion

Since FY 2019, monetary markets have been jostled by the onset of COVID; the following COVID stimulus; declining rates of interest; rising inflation; and rising rates of interest. Regardless of the risky path of market asset values over this era, the FY 2023 funded standing of state and native pension plans is about 78 p.c – greater than in FY 2022 and about 5 proportion factors above the FY 2019 degree.

That mentioned, pension funds have been navigating rising rates of interest. Whereas this enhance has damage their fixed-income holdings, the general affect has been offset to date by the comparatively robust efficiency of different asset lessons.

References

Aubry, Jean-Pierre and Caroline V. Crawford. 2018. “How Do Charges Have an effect on Plans’ Potential to Beat Their Benchmarks?” State and Native Plans Situation in Temporary 61. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Federal Reserve Financial institution of St. Louis. 2023. “Federal Funds Efficient Fee” and “Market Yield on U.S. Treasury Securities at 10-12 months Fixed Maturity.” St. Louis, MO. Accessible at: https://fred.stlouisfed.org/

Public Plans Database. 2001-2022. Heart for Retirement Analysis at Boston Faculty, MissionSquare Analysis Institute, Nationwide Affiliation of State Retirement Directors, and the Authorities Finance Officers Affiliation. Accessible at: https://publicplansdata.org/

Zorn, Paul. 1990-2000. Survey of State and Native Authorities Retirement Techniques: Survey Report for Members of the Public Pension Coordinating Council. Chicago, IL: Authorities Finance Officers Affiliation.

Appendix A. Modifications in Actuarial and Market Property

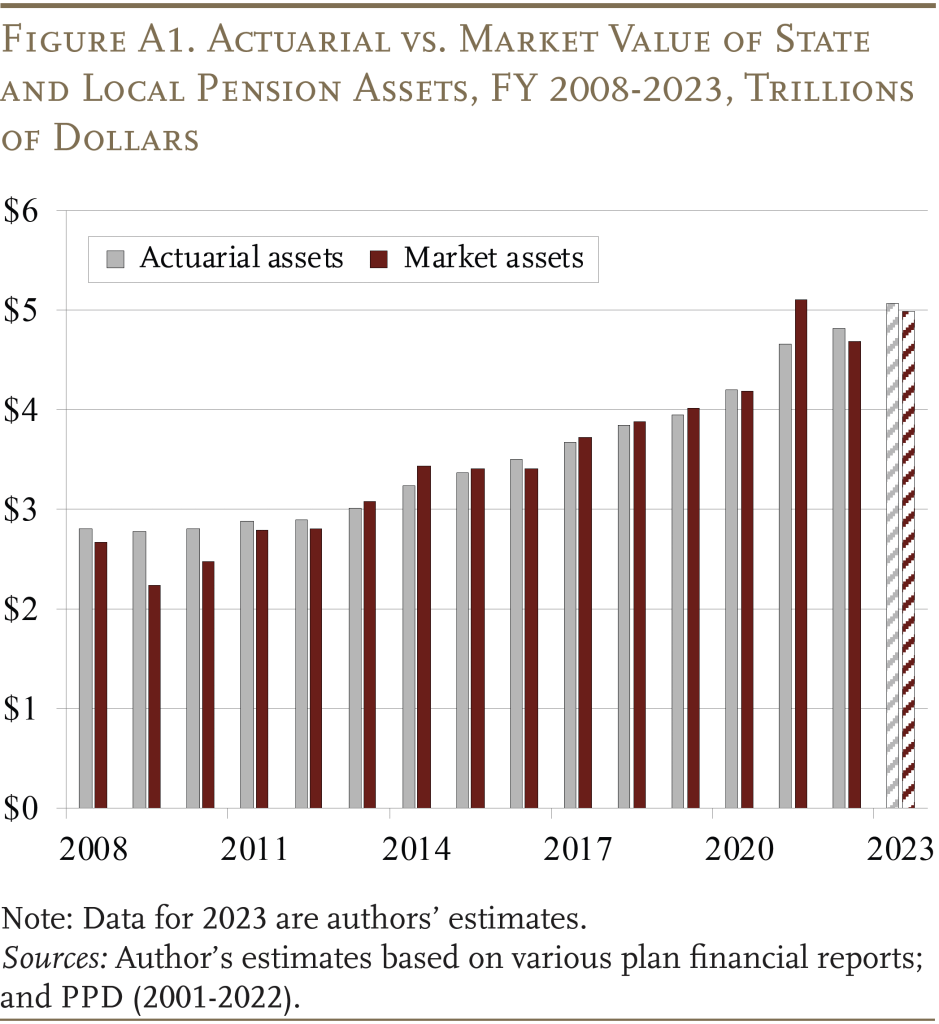

Actuarial asset smoothing limits volatility within the funded standing by incrementally recognizing – sometimes, over 5 years – market beneficial properties and losses. In consequence, actuarial asset values enhance a lot lower than market values throughout years wherein market efficiency is robust – for instance, in 2021 (see Determine A1).

This method limits the decline in funded ranges when market efficiency ranges are weak, comparable to in 2022 and throughout the 2008-2009 monetary disaster – however it is going to additionally scale back the rise in funded standing when markets soar, as a result of parts of earlier market losses skilled throughout the smoothing interval will proceed to be acknowledged incrementally in actuarial asset values.

Appendix B. Developments in Distribution of Plans’ Actuarial Funded Ratio

Determine B1 tracks the typical funded standing for every third of plans from 2001-2023. Whereas the underside third has been persistently much less funded all through the interval, the typical funded ratios for all teams have been above 85 p.c in 2001. Nonetheless, over time, the funded standing of the three teams has grown aside. A lot of this divergence has occurred because the 2008-2009 monetary disaster because the worst-funded group has continued to deteriorate whereas the opposite two teams have stabilized. In consequence, the hole between the highest and backside teams in 2023 was 33.5 proportion factors – a lot bigger than in 2001.

Appendix C. Plans Receiving the Full Contribution

The share of plans that obtain their required contributions in full additionally fluctuates over time however, apparently, by no means drops under 50 p.c (see Determine C1). This sample suggests two forms of sponsoring governments – one that’s dedicated to full contributions and one other that not often pays in full with fluctuating ranges of underpayment depending on fiscal circumstances.

[ad_2]