[ad_1]

Private Capital gives a set of funding instruments and entry to a monetary advisor, fully free. Better of all, they allow you to mixture your whole monetary accounts, after which they supply an investment-related evaluation of your complete portfolio. Discover out extra about this nice service in my full evaluation of Private Capital.

One factor that I’ve craved for traders is a instrument that lets you sync all of your monetary accounts – your funding portfolio, checking and financial savings accounts, bank cards and different mortgage accounts – in a single place, after which supplies an investment-related evaluation of your complete portfolio.

Mint does a incredible job of providing you with numbers, however falls quick on offering any monetary perception.

Then there’s Blueleaf, which I subscribe to for my purchasers and discover to be glorious on each accounts, but it surely’s not obtainable to the DIY investor.

So after I found Empower (previously Private Capital), I used to be so excited to be taught extra that I instantly signed up and synced all of my funding accounts to it.

What’s Empower (previously Private Capital)?

Private Capital is an internet instrument, obtainable out of your desktop or telephone, that may allow you to:

- Monitor your whole monetary accounts in real-time – whether or not checking account, certificates of deposit, or retirement account

- Get goal funding recommendation designed to make you – not the advisor – cash

- Present funding choices which are tailor-made to your objectives

That is incredible. You see, monetary advisors that focus totally on wealth administration will be pricey to maintain round. They cost both a share of belongings managed or a flat hourly charge that may run as excessive as a number of hundred {dollars} per hour, plus buying and selling commissions and administrative charges.

So, whereas these advisors can actually be glorious, they’re principally unreachable except you’ve gotten hundreds of thousands of {dollars} to take a position.

What’s extra, these wealth advisors aren’t actually there to show you how one can put collectively a finances, they strictly handle your cash.

Private Capital to the rescue.

I do know what you’re considering. “Okay, nice, however why ought to I belief these new guys?” I’ve received to be sincere with you. There have been two phrases I noticed on Private Capital’s web site that made my coronary heart skip a beat.

These two phrases? Are you prepared?

Fiduciary Obligation

Right here’s copy straight from their web site:

Goal Recommendation: The sorry fact is that bankers and brokers are motivated to assist themselves, not you. They’re salespeople paid to push merchandise, incomes commissions and kickbacks after they do. In stark distinction, Private Capital is an funding advisor. We settle for a fiduciary obligation to behave in your finest curiosity, and our recommendation have to be geared toward being profitable for you, not for us.

That is completely key with any monetary advisor you speak to, whether or not in particular person or on-line. Fiduciary responsibility means the social gathering has a authorized obligation to place your pursuits above their very own.

Whereas regular brokers receives a commission commissions by getting you to churn your investments again and again (which prices you hundreds of {dollars} in misplaced percentages right here and there), Private Capital is placing a requirement on themselves to place your pursuits above theirs.

That is large!

Significantly, main factors for Private Capital from me on this one.

How Empower Works

Private Capital gives a free model and a premium model that options direct funding administration. Whichever model you utilize, your account is definitely held by Pershing Advisor Options, who acts as trustee in your account.

The Free Model

With the free model, you get full use of the Private Capital platform in addition to a free session from a monetary advisor. That advisor gives you a personalised evaluation of your investments and suggestions as to what you are able to do together with your portfolio. Your monetary advisor will be contacted by telephone, e mail, or by on-line chat.

In reality, the one function that differentiates the free model from Private Capital’s premium product is their personalised portfolio administration. Aside from that, the free model contains all the many options and advantages which are obtainable on the platform, together with the power to mixture your whole monetary accounts, the 401(okay) analyzer, goal funding recommendation and funding check-ups, a real-time monetary dashboard, and entry through the cell app.

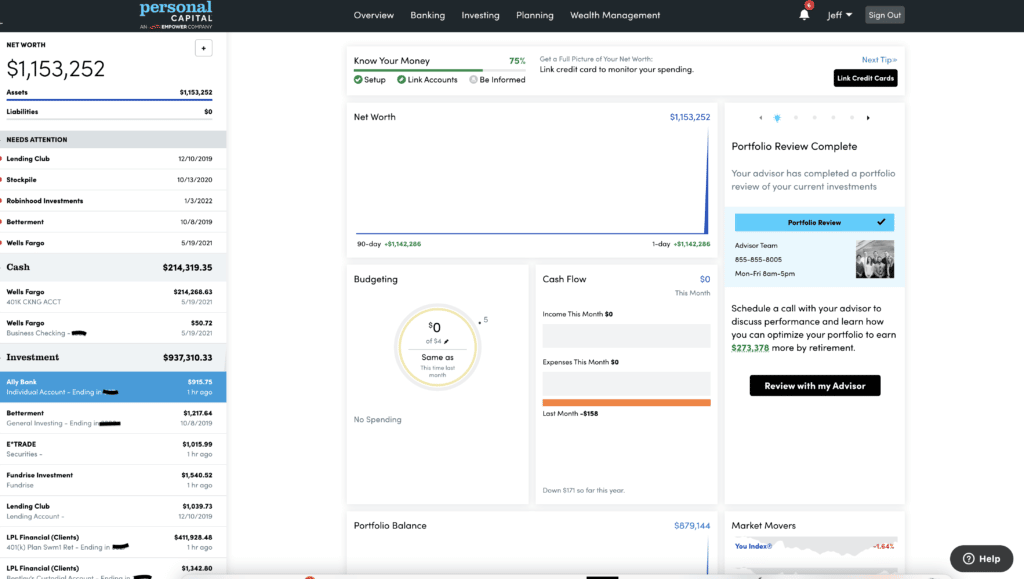

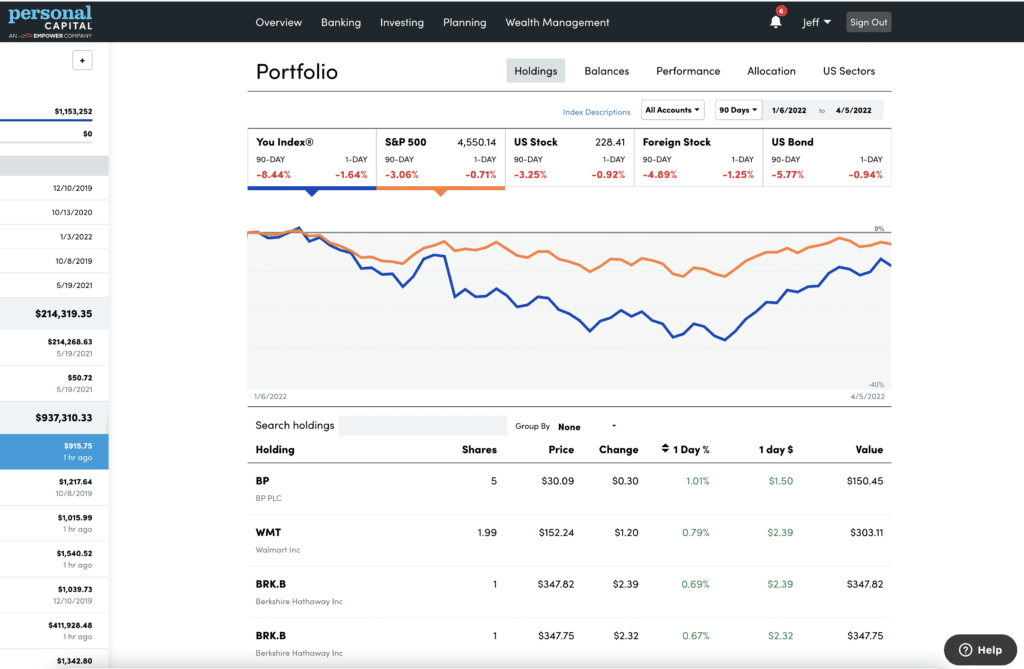

To point out you ways complete their free platform is, check out this screenshot of their Portfolio Overview from my free account:

That is simply the “Holdings” tab on this function. You can too get info in your efficiency and asset allocation. I can’t stress sufficient how useful this info is for all sorts of traders – newbie or seasoned.

The Premium Model

Also referred to as their Wealth Administration program, Private Capital’s premium program contains lively administration of your funding portfolio. Like different related merchandise, they first decide your danger tolerance, private preferences, and funding objectives. Utilizing that analysis, they then create a portfolio tailor-made to suit inside these parameters.

The charge construction for this service is as follows:

- 0.89% of the primary $1 million

- 0.79% of the primary $3 million

- 0.69% of the subsequent $2 million

- 0.59% of the subsequent $5 million

- 0.49% on balances over $10 million

These charges are fairly cheap in comparison with charges of 1% to 2% which are usually charged by lively funding administration providers. The charges apply solely to the belongings you’ve gotten underneath administration at Private Capital, and to not different investments that could be aggregated on the location, corresponding to your 401(okay) plan.

And, that’s it. There are not any further charges. Private Capital doesn’t cost buying and selling, fee, administrative, or another sorts of funding charges. Your solely price is the annual, all-inclusive share that applies to your portfolio degree.

Funding Technique

Private Capital makes use of Fashionable Portfolio Principle (MPT), to handle your portfolio. MPT focuses much less on particular person safety choice, and extra on diversification throughout broad asset courses. These asset courses embrace:

- US shares (which may embrace particular person shares)

- US bonds

- Worldwide shares

- Worldwide bonds

- Different investments (together with ETFs and commodities)

- Money

Although Private Capital makes use of funds in developing your portfolio, they could additionally embrace as much as 100 particular person securities in an effort to keep away from being too closely concentrated in a small variety of corporations.

I additionally found by means of my evaluation that Private Capital makes use of an built-in funding strategy to managing your investments, which is a fairly distinctive function. Which means they consider your whole funding holdings – together with these not managed by Private Capital – in managing your portfolio.

For instance, although they don’t handle your 401(okay) account, your 401(okay) allocations will be thought-about when making choices about your investments that are really managed by Private Capital.

There’s a lengthy checklist of instruments and advantages in utilizing Private Capital. A few of the extra fascinating ones embrace:

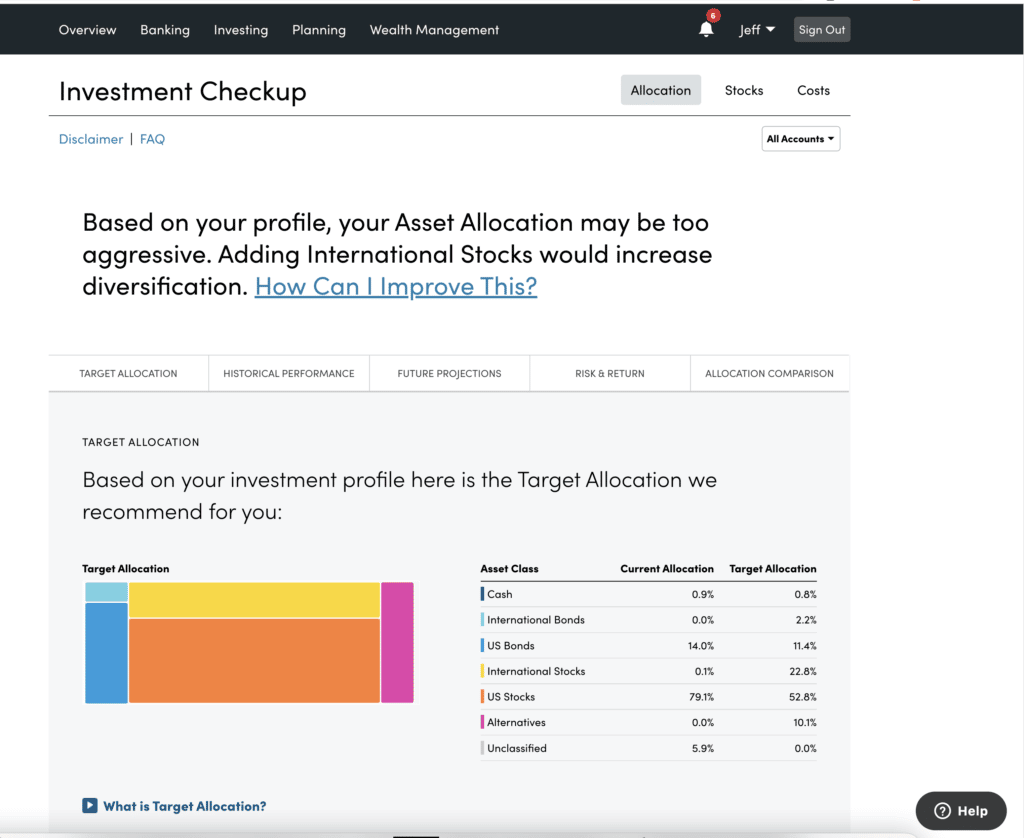

The Funding Checkup

This instrument analyzes your funding portfolio and provides a danger evaluation of it, to be sure that your degree of danger is constant together with your objectives. This may allow you to to create an asset allocation that may get you the place it is advisable go together with your investments. Right here’s a screenshot of their Funding Checkup from my Private Capital dashboard:

401(okay) Fund Allocation

This instrument can be utilized to investigate your employer-sponsored 401(okay) plan, despite the fact that it isn’t underneath the direct administration of Private Capital. It may be used that can assist you together with your asset allocation, a minimum of based mostly on the funding choices that your plan contains. This is a wonderful instrument since most 401(okay) plans don’t, any type of funding administration recommendation.

Retirement Planner

You’ll be able to typically discover retirement planners or retirement calculators on varied websites all through the Web. However what higher place than to have it obtainable the place you even have your whole funding accounts listed? Private Capital’s Retirement Planner lets you run numbers in your retirement to just remember to might be ready when the time comes. It lets you incorporate main adjustments in your life into your retirement planning, such because the beginning of a kid or saving for school.

Web Value Calculator

Since Private Capital aggregates your whole monetary accounts on the identical platform, they will additionally give you ongoing monitoring of your web value. This may allow you to get essentially the most complete view of your monetary scenario because it not solely takes into consideration your belongings but in addition your money owed. Web value is the perfect single indicator of your total monetary energy, and this gives you a chance to trace it.

Money Move Analyzer

Although our focus on this article has been totally on the funding facet of Private Capital, it’s essential to acknowledge that it additionally features a budgeting functionality. The Money Move Analyzer tracks your revenue and bills from all sources, letting the place you’re spending cash (or spending an excessive amount of of it), which is able to allow you to to make changes that may enhance your total finances.

Cellular App

Private Capital’s cell app is a free function that may be downloaded on Apple iPhone, iPad, Apple Watch and Android. The cell model has every thing that’s obtainable on the desktop platform. It is going to allow you to trace your funding portfolio, in addition to your banking and bank card exercise when you’re on the go.

Tax Optimization

Private Capital makes use of tax optimization within the administration of your portfolio. This function is out there to premium Wealth Administration purchasers, and never in case you are utilizing the free model.

They use a number of ways as a part of tax optimization. For instance, they embrace income-producing investments in tax-deferred accounts, whereas growth-oriented investments – that benefit from decrease capital good points taxes – are held in taxable accounts.

As well as, they don’t use mutual funds, however as an alternative use exchange-traded funds with a mixture of particular person shares, since shares will be simply purchased and bought for tax-loss harvesting. And talking of tax-loss harvesting, they use this technique to promote shedding shares, which offsets the good points on the sale of successful shares. This technique minimizes the unfavorable impression in your funding portfolio from revenue taxes.

Web site Safety

Private Capital makes use of bank-level, military-grade encryption on the platform. Additionally they carry out ongoing third-party safety audits to check their programs. Additionally they use gadget authentication so that every gadget you hyperlink your account to should first be authenticated in an effort to be used

Crash Check Your Portfolio

Investing bills and taxes are the 2 issues you possibly can completely rely on inside the investing world. You’ll be able to’t depend on good points yearly, however you possibly can assure you’ll be taxed and you’ll pay bills. That makes lowering these bills as certainly one of two methods you possibly can management your investing future.

Fortunately, Private Capital realizes this and gives you a extremely useful gizmo to investigate the price of your investments. The place this will get fascinating is you are able to do an evaluation in your employer’s 401 (okay) plan (as mentioned above) to find whether or not your plan is superb, simply okay, or horrible because it involves prices. You may be the particular person to go to HR to disclose simply how costly your plan is, lay out a brand new plan that might minimize prices for everybody, and find yourself getting a promotion only for operating a value evaluation.

Even for those who don’t get promoted to go funding advisor in your employer, on the very least you’ll save your individual retirement from exorbitant charges. And that’s an enormous win we are able to all accept.

Is Private Capital for Me?

The thought of wealth administration means it is advisable have wealth to handle. When you’re struggling to get out of debt, that’s okay, however Private Capital in all probability isn’t the perfect match for you. In that case, Mint may be a greater possibility and you’ll see a full comparability in my full private capital vs mint evaluation.

Nonetheless, in case you are increase your retirement belongings and wish to have the ability to maximize your nest egg with out playing on penny shares, then it is best to positively join the service. The entire options apart from the personalised portfolio administration are completely free, so there’s actually no purpose not give them a attempt.

FAQs on Private Capital App

Private Capital is a monetary administration firm that gives a spread of economic providers, together with monetary planning, funding administration, and retirement planning. The corporate is registered with the Securities and Alternate Fee (SEC) as an funding adviser and is topic to regulatory oversight.

They had been based in 2009 and bought to Empowe for as much as $1 billion in enterprise worth. You’ll be able to learn their formal ADV filed with the SEC right here.

Normally, Private Capital is a good and reliable firm. The corporate has acquired optimistic opinions from clients and business specialists, and it has a powerful monitor report of serving to its purchasers obtain their monetary objectives.

Listed here are a number of potential cons to contemplate earlier than utilizing Private Capital’s providers:

Charges: Private Capital prices charges for its monetary planning and funding administration providers. These charges could also be larger than these charged by different monetary establishments or monetary advisors. It’s essential to rigorously evaluation the charges and perceive how they’re calculated earlier than deciding to make use of Private Capital’s providers.

Restricted entry to advisors: Private Capital’s monetary planning and funding administration providers are primarily performed on-line, and chances are you’ll not have in-person entry to an advisor. This generally is a disadvantage for those who favor to have in-person conferences or you probably have advanced monetary questions that require in-depth dialogue.

Restricted funding choices: Private Capital gives a restricted variety of funding choices, together with mutual funds and exchange-traded funds (ETFs). In case you are excited by investing in particular person shares or different securities, chances are you’ll have to look elsewhere.

It’s essential to rigorously take into account these potential cons and to do your individual analysis earlier than deciding to make use of Private Capital’s providers.

Private Capital Overview

Product Identify: Private Capital

Product Description: Private Capital is a monetary advisor and funding administration firm. They supply providers corresponding to wealth administration, retirement planning, and portfolio administration.

Abstract

Private capital is an organization that gives monetary planning and funding administration providers.

- Value and Charges

- Buyer Service

- Consumer Expertise

- Funding Administration

- Portfolio Evaluation

Execs

- The app is free to make use of

- Consumer-friendly interface

- Supplies a complete overview of your monetary scenario

- Affords quite a lot of instruments that can assist you handle your funds

Cons

- Restricted options

- Funding administration charges

- Restricted entry to advisors

- Restricted funding choices

- Potential conflicts of curiosity

[ad_2]