[ad_1]

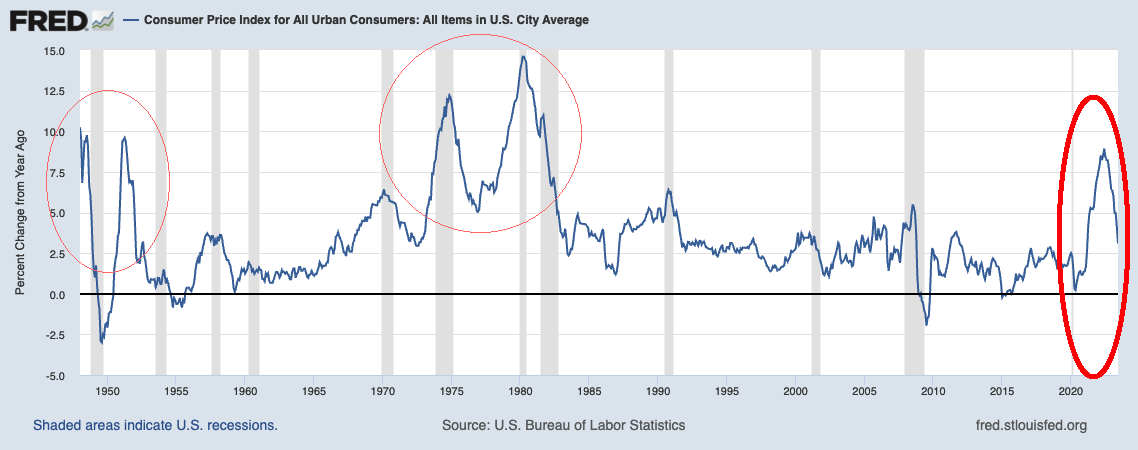

The Client Value Index was up 3% 12 months over 12 months in June, as reported by BLS yesterday. The FRED chart above reveals the close to spherical journey from the prior decade’s vary of 0-2% as much as the 9% peak, and now again down to three%.

Over the previous 12 months, I’ve been writing quite a bit about inflation — what folks get incorrect about it, why the FOMC is all the time late to the social gathering, and what the assorted causes of inflation — actual, modeled, and imagined — really are.

Listed here are 12 concepts which can be (or have been) contrarian ideas on inflation.

1. Inflation peaked June 2022; After making new highs a 12 months in the past, it has been falling quickly ever since.

This was a contrarian place for a lot of the previous 12 months; after the Might and June CPI reviews, this concept has moved into the mainstream.

2. “Lengthy and Variable Lags?:” The FOMC price will increase and different Fed coverage actions are felt within the broader economic system ultimately. Precisely how lengthy it takes is the topic of debate.

Within the Nineteen Seventies, when inflation was persistent and residential mortgages have been double digits, it was truthful to imagine it might have taken so long as 18 months for FOMC coverage to be felt. However that appears longish in a contemporary economic system that runs on credit score.

A clear Fed that tells the market precisely what going it’s going to do ought to have a a lot shorter lag — particularly coming off of a zero-rate setting the place mortgage and automotive mortgage price will increase impression the economic system far more rapidly.

3. Labor Reset: Lagging bottom-half wages over the previous 3 a long time have been deflationary; now, the lowest-paid employees are catching up and it’s inflationary. However the largest issue on this has been a scarcity of employees throughout quite a few industries; what is required is extra employees. (I’m at a loss to see how greater charges make that occur).

However economists like Lawrence Summers are caught in a Nineteen Seventies mindset. His declare that the one strategy to finish inflation was to throw 5 million folks out of labor was not simply incorrect, it relied on an embarrassingly outdated mannequin (and it was unnecessarily merciless). It’s a great factor so few listened to him and a greater factor he wasn’t the Fed chairman — the ensuing recession would have been disastrous.

4. Transitory wasn’t incorrect, it simply took longer than anticipated.

A once-in-a-century pandemic with an unprecedented world lockdown merely took for much longer to unwind than anticipated. There was actually no fashionable comparability, and everybody was making their finest guesses.

That stated, 27 months as an alternative of 12-18 is much less of a miss than many have made it out to be.

5. Inflation Fashions are Inaccurate however exact. PCE, CPI, and nearly each inflation mannequin I observe is flawed however helpful. These which can be constant can be utilized as a baseline for historic evaluation. Nonetheless, counting on them to make real-time coverage choices is deeply problematic.

They’re lagging, they make assumptions that may result in skewed outcomes, and depend on a complicated world that fashions can solely approximate however not depict exactly. For the present state of affairs, they appear to have faltered as novel conditions arose.

They could not mirror the actual world as it’s, however at the least they are often constant. This implies modeling errors result in outcomes which can be “incorrect however helpful.” Any group that fails to grasp that is susceptible to making substantial decision-making and coverage errors.

6. Inflation Expectation Surveys are Silly: They’re incorrect. And dumb. And just about ineffective. Cease counting on them…

7. Increased House Costs: Three components have decreased single-family dwelling provide, thereby driving actual property inflation:

A) Huge post-GFC lower in new dwelling development;

B) Pandemic dwelling purchases with no corresponding promote,

3) 2017-21-era mortgages of two.75% – 4.0%. These low charges lock in householders who can’t afford to pay 7.5%+ for a brand new mortgage on one other dwelling.

All of this provides as much as an enormous shortfall within the provide of houses out there on the market.

8. The Fed is driving OER greater: Given the scarcity of housing, the fast improve in charges has perversely brought on extra, not much less inflation. Not less than, within the Proprietor’s Equal Hire (OER) portion of CPI.

I’ve been railing in opposition to OER for practically twenty years; hopefully, this a part of BLS mannequin will get up to date quickly.

9. For decrease inflation, decrease charges: The principle drivers of present inflation NOW are condominium rental prices, scarcity of houses, and too few employees. Elevating charges received’t repair these points and arguably, make them worse.

FOMC elevating charges from these ranges not solely makes OER look worse, it reduces single-family dwelling provide, makes homes costlier, but in addition sends extra folks into the rental market — making condominium leases greater.

10. Shoppers drive inflation: Sure, shoppers undergo from inflation, however once they willingly pay up for items and providers no matter value will increase they trigger inflation. That is true for requirements (meals, power, garments), in discretionary gadgets (journey, 2nd houses), and most particularly luxurious items (Watches, sports activities automobiles, luggage, jewellery). Extra demand for items in the course of the pandemic led to items inflation; extra demand for providers submit re-opened led to providers inflation. Following every of these surges have been considerably various kinds of Inflation.

11. Lose the two% Inflation Goal: Severely. After the GFC, the economic system was sluggish and ZIRP/QE had pushed charges close to zero, 2% was an affordable upside goal. However after $5 or 6 trillion in fiscal stimulus, and mortgage charges at 7.5%, maybe 3% and even 2.5% makes extra sense as an inflation goal.

12. The Fed has already received: Mission achieved! Jerome Powell can take the summer time off, take pleasure in fishing at Jackson Gap, and actually, simply relax for the remainder of the 12 months. There isn’t any want for additional will increase in price because the battle is already received.

~~~

To be truthful, the Fed was late to get off zero, late to acknowledge inflation, late to behave, and they’re now late to acknowledge inflation has fallen radically. Nonetheless, even a blind squirrel finds a nut at times, and they need to take the win and cease right here.

They’re susceptible to snatching defeat from the jaws of victory…

Beforehand:

Inflation Expectations Are Ineffective (Might 17, 2023)

What the Fed Will get Incorrect (December 16, 2022)

How the Fed Causes (Mannequin) Inflation (October 25, 2022)

Why Is the Fed At all times Late to the Get together? (October 7, 2022)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Deflation, Punctuated by Spasms of Inflation (June 11, 2021)

What Fashions Don’t Know (Might 6, 2020)

Confessions of an Inflation Truther (July 21, 2014)

No person Is aware of Something

[ad_2]