[ad_1]

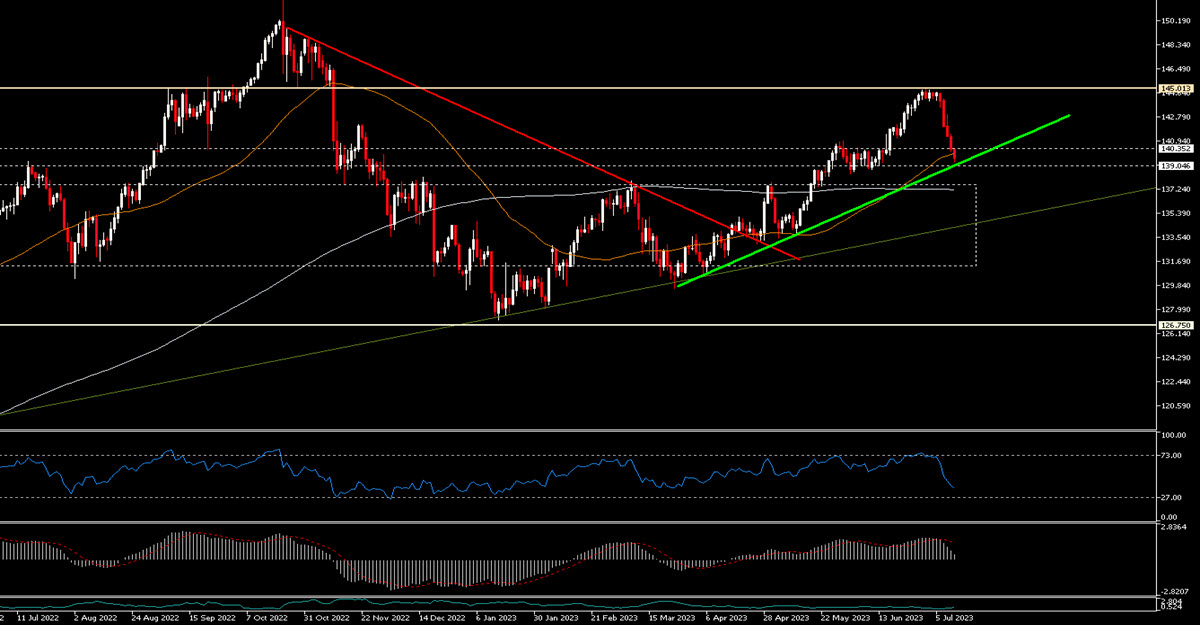

And so all of a sudden the JPY turned the star foreign money among the many majors. The motion from 145 to in the present day’s 139.64 reminds us numerous the autumn of 2022 when a powerful BOJ intervention helped kick-start the short-term appreciation of the Japanese foreign money. In that case, the transfer was a hanging one: the central financial institution had obtained its fingers by itself overseas alternate reserves by promoting them in the marketplace in a relatively clumsy method – a huge at-the-market order extraordinarily uncommon amongst establishments that was definitely additionally a message. Solely later did we be taught that the motion had continued as the big native pension and insurance coverage funds had introduced again funds from abroad within the perception that the YCC on the Japanese 10y would quickly come to an finish, lastly guaranteeing funding and revenue potentialities. As an alternative, this was not the case and we noticed the USDJPY at 145 as soon as once more.

This time it’s completely different: there was no gigantic intervention by the BOJ, however a gradual and decisive motion. It’s possible – amongst different choices – that some knowledge have given hope for a change in financial coverage within the close to future: many regional areas of Japan are seeing small and mid-sized companies aggressively increase wages and a spike in uncooked materials prices has pushed inflation above the BOJ’s 2% goal and saved it there for greater than a 12 months.

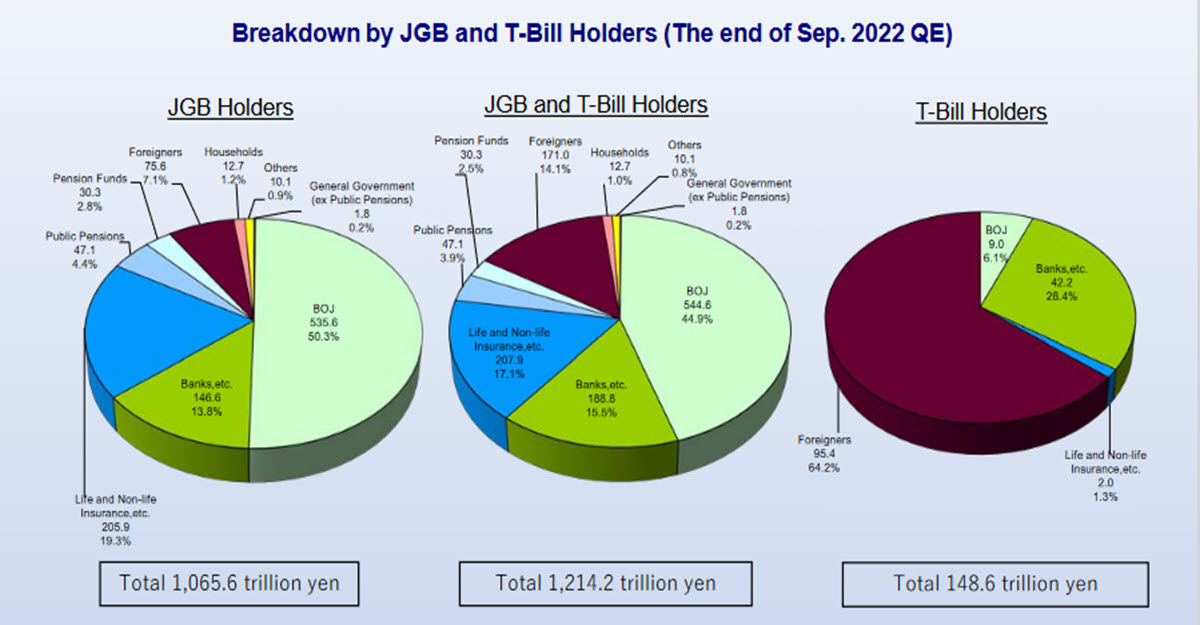

Supply: Japanese MOF

There are 2 ”restrictive” choices for the BOJ: increase the official price (presently at -0.1%) or tweak its YCC coverage from 10Y to 5Y. The latter is certainly seen as the simplest. However we don’t assume it’s going to occur. Japan’s debt construction is extremely long-term oriented, with a huge chunk of debt over 10 years of maturity (32%): many different nations have a median period shut to six/7 years. To cease artificially holding the 10y at 0.5% would expose the market to very large capital losses and – though 50% of the issuances is within the fingers of the central financial institution – the opposite main holders are pension funds, insurance coverage firms and Japanese banks. This is able to be a catastrophe, though it’s exactly the insurance coverage funds which were very lively in promoting these positions in latest months. In addition to, what can be the benefit of controlling the 5y, which already yields 0.139%?

Supply: Japanese MOF

Elevating the official price from a adverse degree may be an choice, however of little or no long-term impact: the differential with all different nations charges would nonetheless stay huge. Since it’s overseas traders who maintain 64.2% of the quick finish, that may do them a great favour from a global perspective.

Supply: Japanese MOF

Structurally, the JPY would stay weak and headed in just one route in the long run, regardless of the brand new appreciation in latest days.

There may be one other issue, nonetheless, that would show an additional weakening of the USDJPY: a worldwide risk-off episode – but to happen – which might result in the unwinding of many dangerous carry commerce positions and an total repricing.

Technically, the state of affairs might be seen on the chart: after the collapse of the final 5 classes from 145, the pair is virtually in touch with the shorter-term bullish trendline (from Mar 2023) and near the help within the 139 space. Ought to this trendline be damaged, it will not be an issue for the long run uptrend that began in August 2021 and whose bullish trendline presently passes round 134.30. Furthermore, the 200 transferring common can be flat at approx. 137.20.

That mentioned, the present macroeconomic state of affairs clearly continues to disfavour the JPY and we doubt that the BOJ can do something about it within the coming months.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a normal advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]