[ad_1]

With few exceptions, the worst performing tech shares yesterday had been very well-known names which were on the lips of each dealer eager about US equities for months. We  had already began to see one thing comparable about 1 month in the past: the best-performing shares – but additionally those with probably the most stretched valuations in lots of circumstances, backed by very robust momentum – have reached some extent the place sure medium- to long-term buyers can begin trying round for different names that provide a greater danger/return ratio. It’s the traditional phenomenon of rotation, which with the Nasdaq above 15,000 factors appears to be beginning to weigh on its Crown Jewels. We’ll take a look at some attention-grabbing charts in a second.

had already began to see one thing comparable about 1 month in the past: the best-performing shares – but additionally those with probably the most stretched valuations in lots of circumstances, backed by very robust momentum – have reached some extent the place sure medium- to long-term buyers can begin trying round for different names that provide a greater danger/return ratio. It’s the traditional phenomenon of rotation, which with the Nasdaq above 15,000 factors appears to be beginning to weigh on its Crown Jewels. We’ll take a look at some attention-grabbing charts in a second.

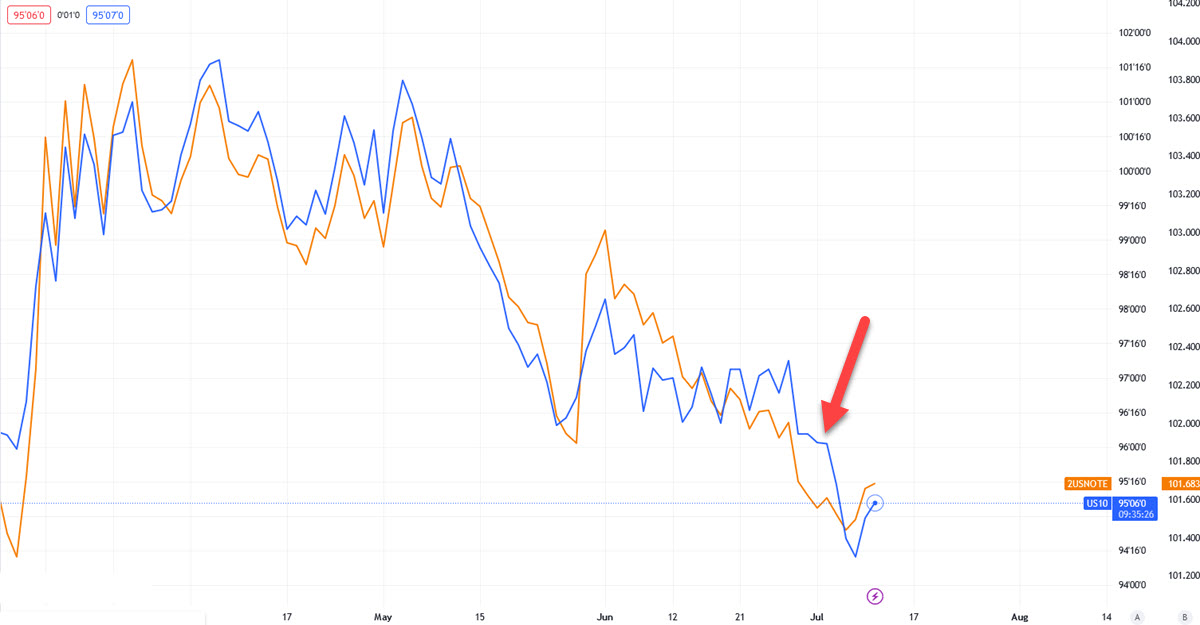

Final week after the very robust ADP information we additionally witnessed the start of a discrete steepening on the US price curve and that is additionally a change, a sort of ”rotation”: though such information ought to usually have led to a robust promoting of the brief finish (of the 2Y, in our case), on this case the promoting was on the lengthy finish (brief length commerce), almost definitely seen as extra unstable and with extra meat across the bones than a 2Y that for a number of days traded properly above 5%. For the file, the next chart begins in March as that had been the earlier peak for the 2Y (and the final time the 10y had traded above 4%): it’s attention-grabbing to know that again then the expectations for the terminal price priced by the futures market had been a lot increased than now (5.70% versus the 5.40% at present priced for Nov 2023). However let’s return to shares for a really temporary however hopefully attention-grabbing overview. We’ll classify the FAANGMs into the next 3 teams:

2Y US T-note / 10Y US Bond, day by day relative efficiency

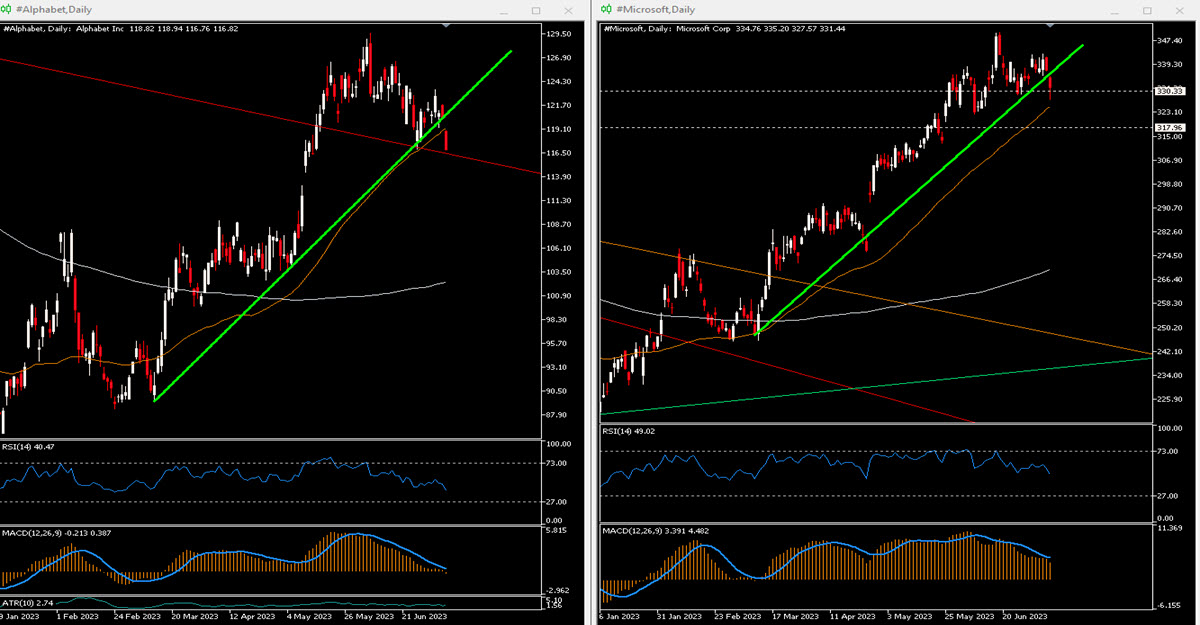

Steepest trendline damaged

On this class we put GOOGL and MSFT: the previous might be clearer and the worth has additionally clearly misplaced its MA50. Each RSI and MACD are negatively sloped after a number of weeks of divergence.

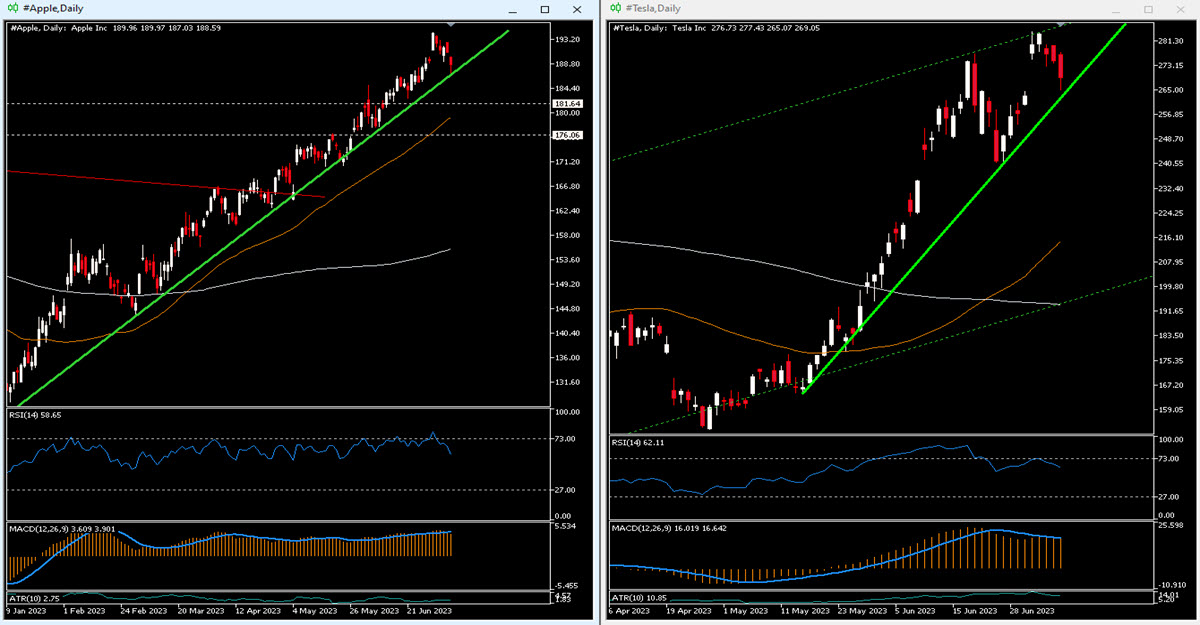

Steepest trendline examined, unfavorable indicators, long-term outperformance

Right here we will put AAPL and TSLA. Within the case of the previous one it is usually attention-grabbing to know that it’s at ATH ($194.48). The symptoms are unfavorable and the space to the MA200 is 21.54% and 39% respectively: these are values the place a minimal imply reversion might happen.

Nonetheless properly anchored above the trendline

Final we’ve AMZN and META (the latter printed +1.23% yesterday): in these circumstances even the steepest development continues to be intact, however the indicators are slowly turning south and the pink candles are starting to be accompanied by excessive volumes. For Meta it is usually very attention-grabbing that it has virtually closed the Hole left open by the terrible earnings launched again in February 2022.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]