[ad_1]

The pound can most likely rely on help from the Financial institution of England’s price hike cycle till the financial system begins to indicate extra clear indicators of a slowdown.

Economists at the moment are predicting the next price peak within the UK than within the Eurozone or the US. On the identical time, bearing in mind additionally the implications of Brexit, in 2023-2024 financial development might be weaker, and inflation might be increased than within the Eurozone and the USA.

It’s potential that at some stage of tightening financial coverage, the hazard of the prospect of a slowing financial system will “take over” the dangers of rising inflation. Many economists imagine that this might occur as early because the 2nd half of 2023.

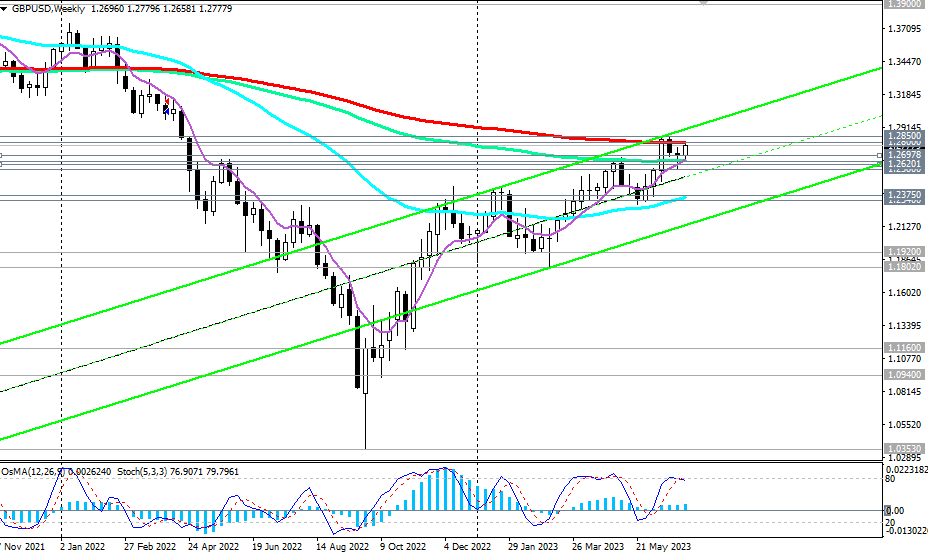

As quickly because the Financial institution of England stops the method of elevating the rate of interest, the pound will lose help from it and the reverse course of might start. As well as, it’s unattainable to not discover that on the weekly chart the expansion of the GBP/USD pair has stalled close to the zone of key long-term resistance ranges of 1.2800, 1.2850, from which a reverse motion might start. It might become far more fast than the expansion of GBP/USD since September final yr.

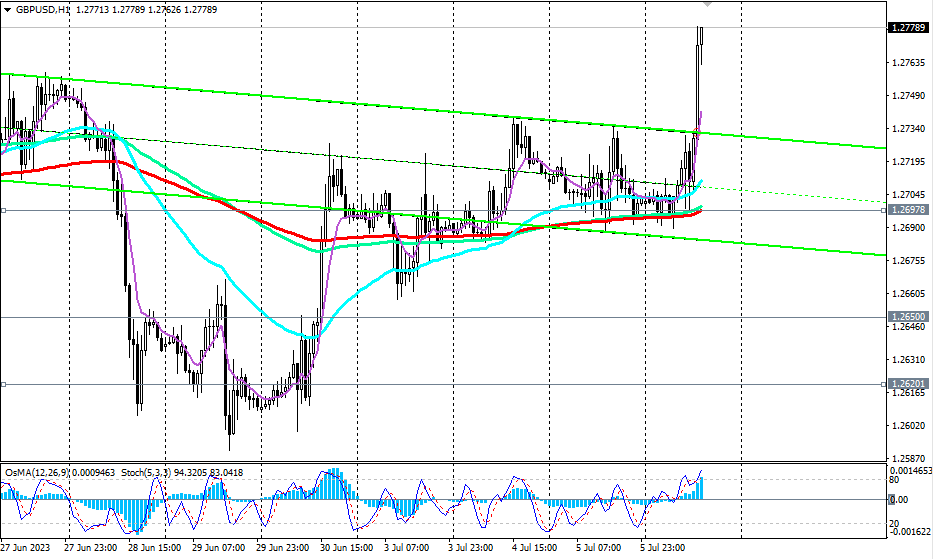

A sign for the resumption of gross sales could also be both a rebound from the resistance ranges of 1.2800, 1.2850, or a breakdown of the help ranges of 1.2620, 1.2620. The quickest promote sign right here could also be a breakdown of the necessary short-term help stage 1.2698.

A breakdown of the help stage at 1.2580 will affirm our forecast for a decline in GBP/USD, and a breakdown of the important thing medium-term help ranges at 1.2375, 1.2340 will return the pair to the zone of medium-term and long-term bear markets.

Assist ranges: 1.2698, 1.2650, 1.2620, 1.2580, 1.2400, 1.2375, 1.2340

Resistance ranges: 1.2800, 1.2850, 1.3900, 1.4335

[ad_2]