[ad_1]

Merchants are sometimes on the look out for instruments that might give them a buying and selling edge. It could be an indicator, a charting instrument, a buying and selling technique, mainly something that might give them a bonus over most merchants available in the market. For essentially the most half, merchants would usually search for one thing novel within the hopes that their distinctive instrument would give them the benefit they’re on the lookout for. Nonetheless, most would overlook that what issues most is that they’ve a instrument that works.

The Fibonacci Retracement instrument is a primary buying and selling instrument which is discovered on all MT4 platforms, in addition to different buying and selling and charting platforms. In spite its being a primary instrument, it’s nonetheless very efficient. Skilled merchants use them. Worthwhile merchants use them. Massive financial institution institutional merchants use them. It could be a good suggestion if we’d additionally uncover what it’s and the way to use it successfully.

Fibonacci Sequence and the Fibonacci Ratio

The Fibonacci Sequence is was found by Leonardo of Pisa, also referred to as Fibonacci. Fibonacci was a mathematician who first studied with the Arabs and in a while launched algebra to Europe. Together with algebra, he additionally introduced with him his statement of the Fibonacci Sequence.

The Fibonacci Sequence is a sequence of numbers which has a core logic based mostly on the addition of two sequential sums ranging from 1. Ranging from 1, the Fibonacci Sequence is as follows:

1 + 1 = 2, 1 + 2 = 3, 2 + 3 = 5, 3 + 5 = 8, 5 + 8 = 13, 8 + 13 = 21, 13 + 21 = 34, 21 + 34 = 55, 34 + 55 = 89, 55 + 89 = 144, 89 + 144 = 233, and so forth as much as infinity.

When you would observe the sequence carefully, you’ll see that there are recurring patterns that may be discovered as you go alongside the sequence. This turns into obvious because the figures improve.

For instance, should you would divide the primary addend by the second addend, you’ll observe that the quotient is normally round 0.618. Which means the primary addend is at all times 61.8% of the second addend. Inversely, the distinction between the 2 addends would at all times be 38.2%.

When you would additionally divide the sum by the second addend, the outcome would at all times be near 1.618, that means that the sum is at all times near 161.8% of the second addend. We might additionally observe that the sum is at all times near 261.8% of the primary addend.

These share patterns, 38.2%, 61.8%, 161.8% and 261.8%, type the fundamental Fibonacci Ratios, with the ratio of 61.8% being the “Golden Ratio”. There are numerous extra mathematical patterns that may very well be noticed on this sequence. Nonetheless, these percentages are essentially the most primary Fibonacci Ratios.

These ratios is probably not attention-grabbing mathematically. What makes it extra attention-grabbing is that these patterns are additionally recurring ratios in nature, be it the helix of a shell, the veins of a leaf, the human limbs or a fractal of a snowflake. What makes it much more attention-grabbing is that these similar Fibonacci Ratio patterns have additionally been found by merchants to be recurring ratios in a technical value chart.

Fibonacci Ratios and the DiNapoli Ranges

Joe DiNapoli included the Fibonacci Ratios as one of many bases for a DiNapoli Stage in his e book “Buying and selling with DiNapoli Ranges: The Sensible Utility of Fibonacci Evaluation to Funding Markets”.

DiNapoli Ranges are mainly ranges during which value sometimes bounce from. In his e book, Joe DiNapoli outlined how value tends to bounce off sure Fibonacci Ratio ranges based mostly on swing factors. He launched there the concept value tends to bounce off the 61.8% value level of the size of a value swing throughout trending markets. This 61.8% ratio has been generally known as the “Golden Ratio”.

He famous that value sometimes bounces off 61.8% and would hardly ever attain 78.6%, which is likely one of the extra intricate Fibonacci share ratios. He additionally famous that value would sometimes transfer within the course of the pattern normally by the identical size because the prior value swing or 100%, 138.2%, or 161.8%. As such, his most important buying and selling technique was to enter the market at 61.8% of the worth swing, set a cease loss at 78.6%, and take revenue at 100%, 138.2% or 161.8%.

He additionally added ranges 50% and 38.2% as potential factors the place value might additionally bounce off making it a sound entry stage.

Fibonacci Retracement Instrument

Up to now, Joe DiNapoli used a program that might enable him to compute for the DiNapoli Ranges by inputting the swing factors. These days, this course of could be too tedious as there’s already a instrument that might plot these ranges routinely simply by dragging a line throughout the swing factors. This instrument is named the Fibonacci Retracement instrument.

The Fibonacci Retracement instrument is mainly a ruler like construction that might routinely plot the degrees 38.2%, 50%, 61.8%, 100%, 138.2% and 161.8% of a value swing. All we’ve got to do now’s simply drag the Fibonacci Retracement instrument throughout the worth swing.

Buying and selling Technique Utilizing the Fibonacci Ratios

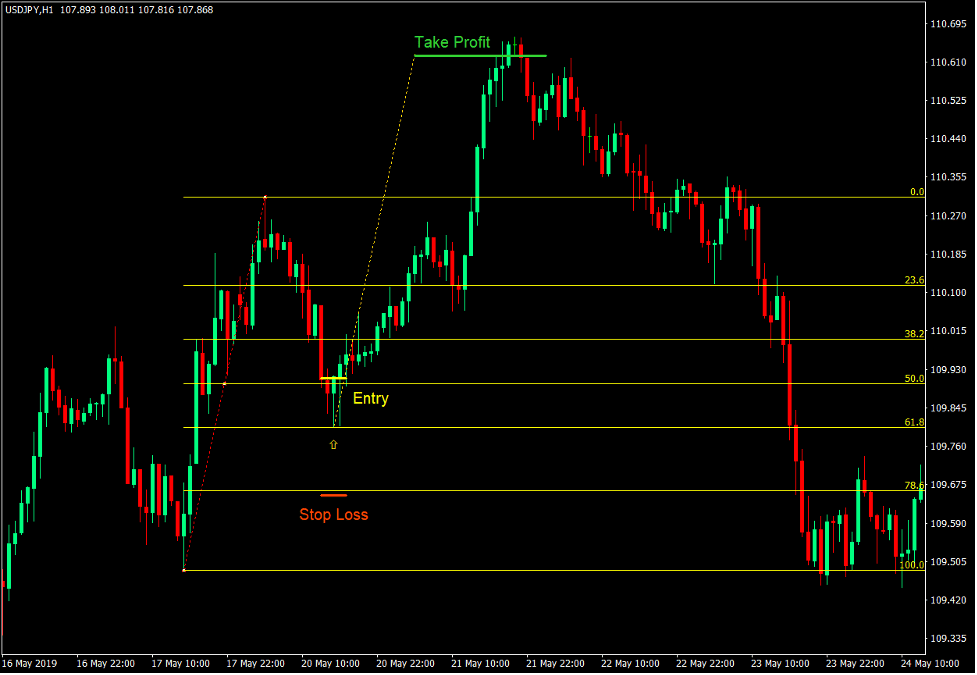

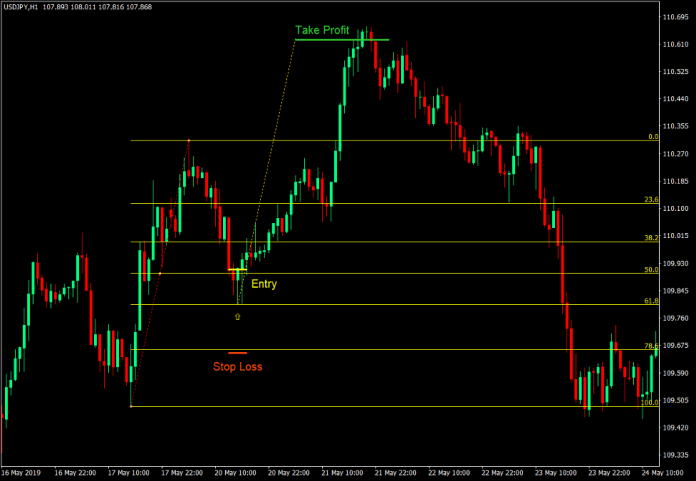

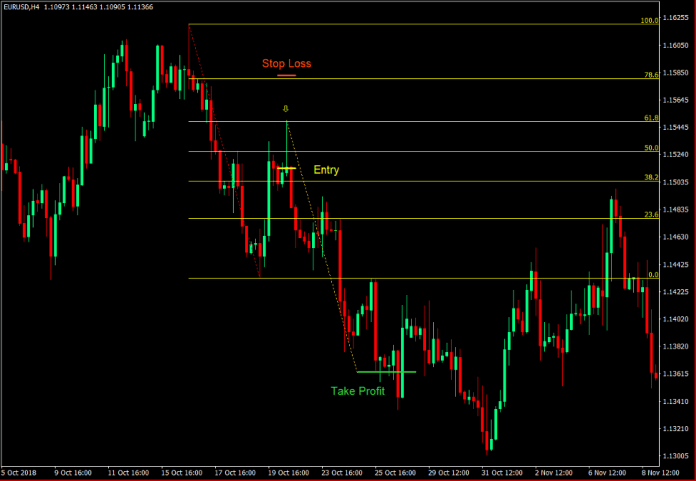

On this technique, we can be buying and selling retracement entries based mostly on reversal candlestick patterns occurring on the 61.8% stage of a value swing. We then set our take revenue targets as value travels the identical size because the prior value swing.

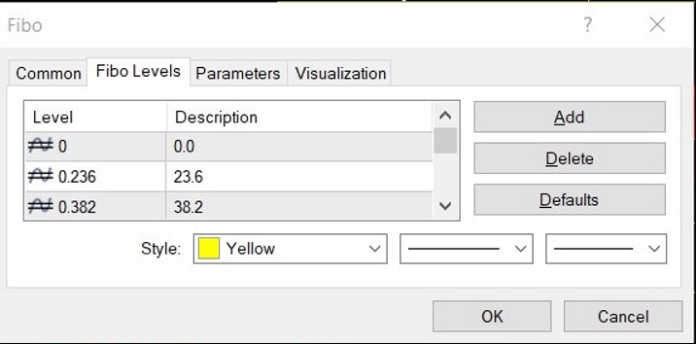

Most Fibonacci Retracement instruments don’t have 78.6% as a retracement stage. This is a crucial stage as we are going to use this as a cease loss stage. We will add this by proper clicking on the Fibonacci Retracement instrument and selecting Fibo properties. This is able to carry us to the Fibo properties window. Click on Fibo Ranges tab and add the 78.6% stage.

Purchase Commerce Setup

Entry

- Establish a bullish value swing and place a Fibonacci Retracement ruler on the swing factors from the swing low to the swing excessive.

- Wait value to retrace to 61.8% of the worth swing.

- Enter a purchase order as quickly as a bullish reversal candlestick sample happens on the 61.8% stage.

Cease Loss

- Set the cease loss beneath 78.6% stage.

Exit

- Drag a pattern line alongside the Fibonacci Retracement instrument to establish the size of the worth swing and transfer the pattern line ranging from the brand new swing low. The size of the pattern line would be the take revenue goal.

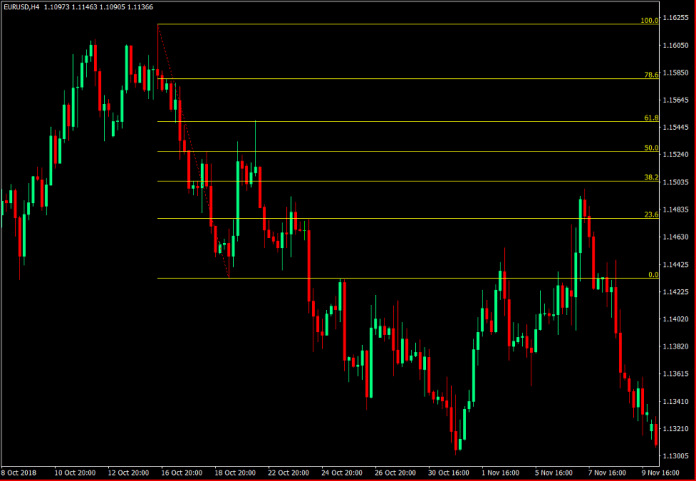

Promote Commerce Setup

Entry

- Establish a bearish value swing and place a Fibonacci Retracement ruler on the swing factors from the swing excessive to the swing low.

- Wait value to retrace to 61.8% of the worth swing.

- Enter a promote order as quickly as a bearish reversal candlestick sample happens on the 61.8% stage.

Cease Loss

- Set the cease loss above 78.6% stage.

Exit

- Drag a pattern line alongside the Fibonacci Retracement instrument to establish the size of the worth swing and transfer the pattern line ranging from the brand new swing excessive. The size of the pattern line would be the take revenue goal.

Conclusion

The Fibonacci Retracement ranges have been confirmed to be an efficient foundation for potential retracement ranges. Skilled merchants use these ranges to enter the market at an efficient retracement stage and have made cash doing so.

The Fibonacci Retracement simplifies this course of by permitting us to establish such ranges with out having to compute it for ourselves.

Merchants who can accurately establish acceptable swing factors might successfully use the Fibonacci Retracement instrument to their benefit when buying and selling the foreign exchange markets.

[ad_2]