[ad_1]

The outcomes are in–for the third yr in a row, insightsoftware has partnered with Hanover Analysis to ship our yearly Finance Staff Traits Report. Evaluating outcomes throughout the years reveals an unbelievable journey for finance groups throughout the globe. The survey included 519 senior accounting and finance professionals throughout North America and Europe, the Center East, and Africa (EMEA). 52% are situated in North America whereas 48% are in EMEA.

What are the highest strengths, challenges, and areas of enchancment for finance decision-makers in 2023? Right here, we focus on the highest traits for finance groups this yr.

Exterior Market Challenges are Hampering Finance Groups

In 2023, the affect of exterior elements is obvious because the optimism from the earlier yr has been changed by pragmatism and realism. Though organizations have largely recovered from the COVID-19 pandemic, they’re bracing themselves for a possible recession.

Exterior market challenges together with financial disruption, abilities shortages, and rising rates of interest, are squeezing effectivity from one facet. And on the opposite, inner pressures like the necessity for extra frequent, correct forecasting drive CFOs to re-evaluate their present instruments and processes.

The Impression of Market Uncertainty

This yr, Finance decision-makers are feeling strain from each inner and exterior sources. Practically three-quarters (70%) of this yr’s survey respondents really feel strain from inflation, financial disruption, and recession. These elements create a requirement for finance professionals to be extra environment friendly.

Gartner describes current international financial pressures as a “triple squeeze,” which incorporates:

Inflation and excessive rates of interest

- Firms trying to refinance a mortgage or popping out of a five-year mounted price are all of a sudden rates of interest which can be considerably increased than they have been beforehand paying.

A good labor market

- There’s a notable abilities hole resulting from lack of present expertise, driving the necessity to do extra with much less. Many organizations have set digitization targets however lack the tech expertise to push by means of their transformation.

Provide chain constraints

- Unpredictable provide chains lately have necessitated preserving a more in-depth eye on enterprise fundamentals whereas highlighting the significance of staying forward of stock administration.

This yr’s survey outcomes echo this. The highest exterior elements impacting finance workforce effectivity have been:

- Financial disruption (48%)

- Rates of interest (42%)

- Abilities shortages (41%)

As a direct results of the COVID-19 pandemic, organizations have tailored to anticipate the sudden from the worldwide market. It’s been an important talent to maintain companies afloat. Based on the Worldwide Financial Fund’s World Financial Outlook, international inflation soared to eight.8% final yr with no indicators of slowing down–a return to a gentle rate of interest isn’t anticipated till 2025.

Along with this financial squeeze, abilities shortages are nonetheless a key problem. This yr’s survey highlighted a major drop in groups anticipating to develop in 2023 right down to 64%, in comparison with 73% in 2022.

Spreadsheet Server Suggestions & Tips: Visualise Your Report Information in Energy BI

Altering International Laws

Compliance-related finance duties, like tax administration, current a notable problem, particularly throughout a panorama the place rules are consistently shifting. Respondents highlighted a tremendously lowered notion of effectivity associated to tax administration, with solely 68% of groups ranking their processes as environment friendly, in comparison with 84% final yr.

With the primary submitting deadlines for Base Erosion and Revenue Shifting (BEPS) Pillar Two looming on the horizon, the training curve grows even steeper. The regulation requires any group that operates in multiple nation to pay a minimal efficient tax price of 15% in any nation the place they do enterprise. For finance groups fighting tax administration, it’s important to guage their present methods to find out whether or not they’re ready to adjust to new and upcoming necessities.

Inside Strain Continues to Rise

Hampered by native or legacy instruments which can be too complicated to help the elevated calls for for customized evaluation, finance groups wrestle to maintain tempo with rising calls for on their time.

The highest challenges for finance groups in 2023 are:

- Budgetary restraints (32%)

- Raised costs (29%)

- Lack of abilities in workforce (27%)

- Guide and time-consuming processes (24%)

- Information limitations and inaccuracies (24%)

Lack of Autonomy and IT Over-Reliance

One quarter (24%) of finance groups nonetheless discover “handbook and time-consuming processes” to be a key problem. Disconnected methods and handbook, spreadsheet-based processes are extremely cumbersome for Finance groups. And handbook processes enhance the chance of reporting errors. With heightened scrutiny on organizations and leaders, organizations can’t afford such a excessive danger of error.

What complicates issues are what the outcomes reveal concerning the relationship between Finance and IT. In 2023, Finance decision-makers are much less doubtless than 2022 to be utterly happy with the connection between Finance and IT, reducing from 54% to twenty-eight%. And 66% of finance professionals discover they’re too reliant on IT.

The End result? Effectivity Drops Throughout the Board

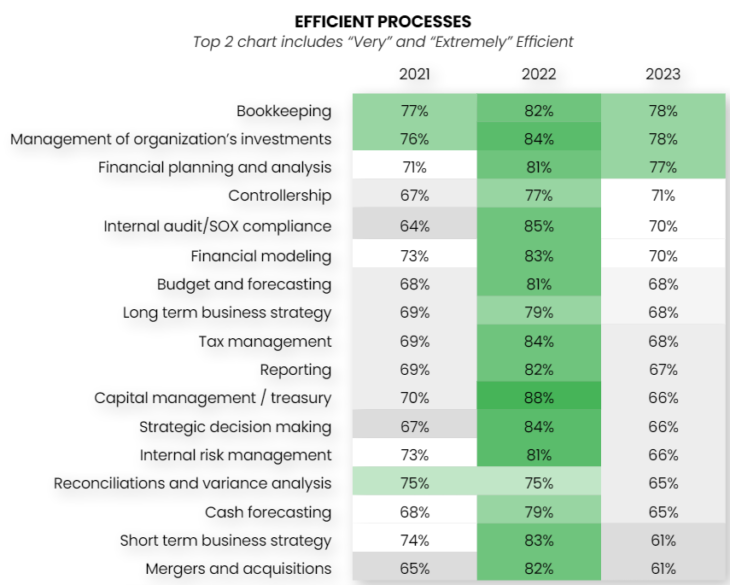

The affect of inner and exterior pressures on finance workforce effectivity is obvious. In 2023, groups are much less environment friendly at 100% of duties tracked, in comparison with 2022 outcomes. It’s inconceivable to correlate this end result with anybody issue. Nevertheless, it’s clear that the mixture of inner and exterior pressures has resulted in groups having much less sources to finish the identical quantity of labor as they’ve had lately.

While you evaluate 2023 and 2022 outcomes, the largest effectivity drops are seen throughout:

- Capital administration / treasury: -22%

- Quick time period enterprise technique: -22%

- Mergers and acquisitions: -21%

- Strategic resolution making: -18%

- Tax administration: -16%

Surprisingly, Finance Nonetheless Prioritizing Hiring

Resulting from market elements, priorities for finance groups have modified dramatically over the previous yr. High priorities for 2023 are:

- Prioritizing balancing development with revenue successfully (31%)

- Growing productiveness of present groups (30%)

- Hiring and staffing (29%)

Groups are specializing in balancing employees ranges and rising their productiveness, however effectivity challenges point out a lacking step between the place organizations are actually and the place they need to be when it comes to streamlining repetitive workflows and dedicating time to deal with future planning. Adopting new know-how can assist bridge these gaps, nevertheless it doesn’t rank excessive on finance groups’ priorities. In actual fact, there was a lower within the precedence of job automation from 40% in 2022 to 25% in 2023.

Struggling With Abilities Shortages? Why Self-Service Reporting Eases the Ache of Staffing Constraints

How Are Finance Groups Bridging the Effectivity Hole?

Impacted by exterior elements like market disruption and abilities shortages, organizations are prioritizing squeezing extra worth from present, tight sources. On the similar time, corporations are impressed to work smarter by rising effectivity to fill in staffing and abilities gaps.

Resulting from exterior elements, organizations are:

- Lowering budgets (47%)

- Slicing prices (45%)

- Executing duties with fewer individuals (38%)

To alleviate effectivity gaps, organizations are working to “right-size”– after the lack of skilled workers in 2021, organizations employed new employees in 2022, then adjusted in 2023. Regardless of efforts to coach present employees and encourage collaboration, finance groups in 2023 are about 4-5% much less environment friendly than they have been final yr. The very best efficiencies are bookkeeping (78%), administration of group’s investments (78%), and monetary planning and evaluation (77%).

Clean Crusing By way of Unsure Occasions

Investing in automation instruments can assist ease the ache of abilities shortages and repetitive duties. For instance, interactive, real-time, refreshable reporting know-how can save time on repetitive duties and enhance effectivity inside your group.

With the assistance of intuitive know-how, new employees will also be skilled quicker whereas relieving understaffed departments. insightsoftware’s related options assist finance groups scale back planning, reporting, and shut cycles by 50%, enhance knowledge high quality and accuracy, improve visibility and collaboration, and drive higher enterprise outcomes with:

Elements from market uncertainty to abilities shortages and over-reliance on IT are taking a heavy toll on finance groups in 2023. Though organizations are profiting from what they’ve, effectivity nonetheless suffers. As finance groups deal with serving to drive enterprise technique, an funding in know-how ensures organizations can take management of budgeting, planning, and reporting whereas nonetheless having time for value-added evaluation. To study extra a few suite of options that may enhance effectivity at your group, go to insightsoftware.com.

[ad_2]