[ad_1]

Because the know-how competitors between the 2 main economies of the US and China continues to accentuate, the principle focus is more and more shifting to Synthetic Intelligence. Following restrictions on US microchip exports to China, the Ministry of Commerce introduced that it’ll management the export of some metals broadly used within the semiconductor trade. Though the reason being to guard nationwide safety and pursuits, the Chinese language Authorities requires exporters to hunt prior permission from the authorities to ship some merchandise comparable to gallium and germanium.

The USA and the Netherlands are prone to put stress on Chinese language chipmakers this summer season by additional limiting the sale of chipmakers’ gear, arguing to stop their know-how from getting used to strengthen China’s army.

China’s controls, from 1 August, will apply to eight gallium-related merchandise, particularly gallium antimonide, gallium arsenide, gallium metallic, gallium nitride, gallium oxide, gallium phosphide, gallium selenide, and indium gallium arsenide. Then for six germanium merchandise, particularly germanium dioxide, germanium epitaxial progress substrate, germanium ingot, germanium metallic, germanium tetrachloride and zinc germanium phosphide.

In the meantime, fairness markets diverged barely on Tuesday as buyers assessed the most recent escalation in US-China tensions over entry to superior semiconductor know-how. Firms comparable to Superior Micro Gadgets, Nvidia and Intel closed skinny and combined, at +0.5%; – 0.5% and +0.4% respectively, caught within the US-China financial and know-how entry tensions.

Final yr, US officers ordered Nvidia to cease exporting its prime two AI chips to China to restrict the nation’s technological capabilities. A couple of months later, Nvidia launched a brand new superior chip known as A800 in China to fulfil export management guidelines. The brand new restrictions being thought of by the Commerce Division will even embody a ban on the sale of Nvidia’s A800 chip with no US-specific chip export licence.

Nonetheless, this isn’t a no-win coverage, there are at all times loopholes out there for third-party gamers. Chinese language companies have discovered varied methods to entry AI-enabled know-how apart from utilizing Nvidia chips that have been as soon as legally restricted. Chinese language tech firms have leased entry to regulated chips by the cloud, as restrictions solely apply to the bodily export of chips. Main cloud suppliers Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) have lengthy supplied distant entry to AI chip computing capability by leasing. For the reason that restrictions have been imposed final yr, China has been utilising these choices at an growing tempo.

Nvidia introduced in March this yr that it additionally intends to lease supercomputing energy to Chinese language firms, making ready to capitalise on their want for top-tier know-how. Supply: Reuters; Barron’s; Cnbc.

Limiting gross sales of knowledge centre graphics processing models to China will have an effect on future monetary outcomes, however the firm doesn’t count on further restrictions to have a direct materials impression on its outcomes. In AI knowledge centres run by Amazon, Alphabet and Microsoft, Nvidia controls about 80% of the accelerator chip market. China accounts for about 22% of Nvidia’s whole income, with knowledge centre chip gross sales to the nation accounting for between 7% and 10% of the general whole.

Nvidia is by far the very best performing part of the S&P500 this yr. Shares of the main AI chipmaker surged greater than 180% within the first half. The opposite six largest American tech firms Apple, Microsoft, Alphabet, Amazon, Tesla and Meta have been every among the many prime 50 returns within the S&P, including a mixed market capitalisation of $4.1 trillion. Nvidia additionally led a broader rally for mega-cap tech.

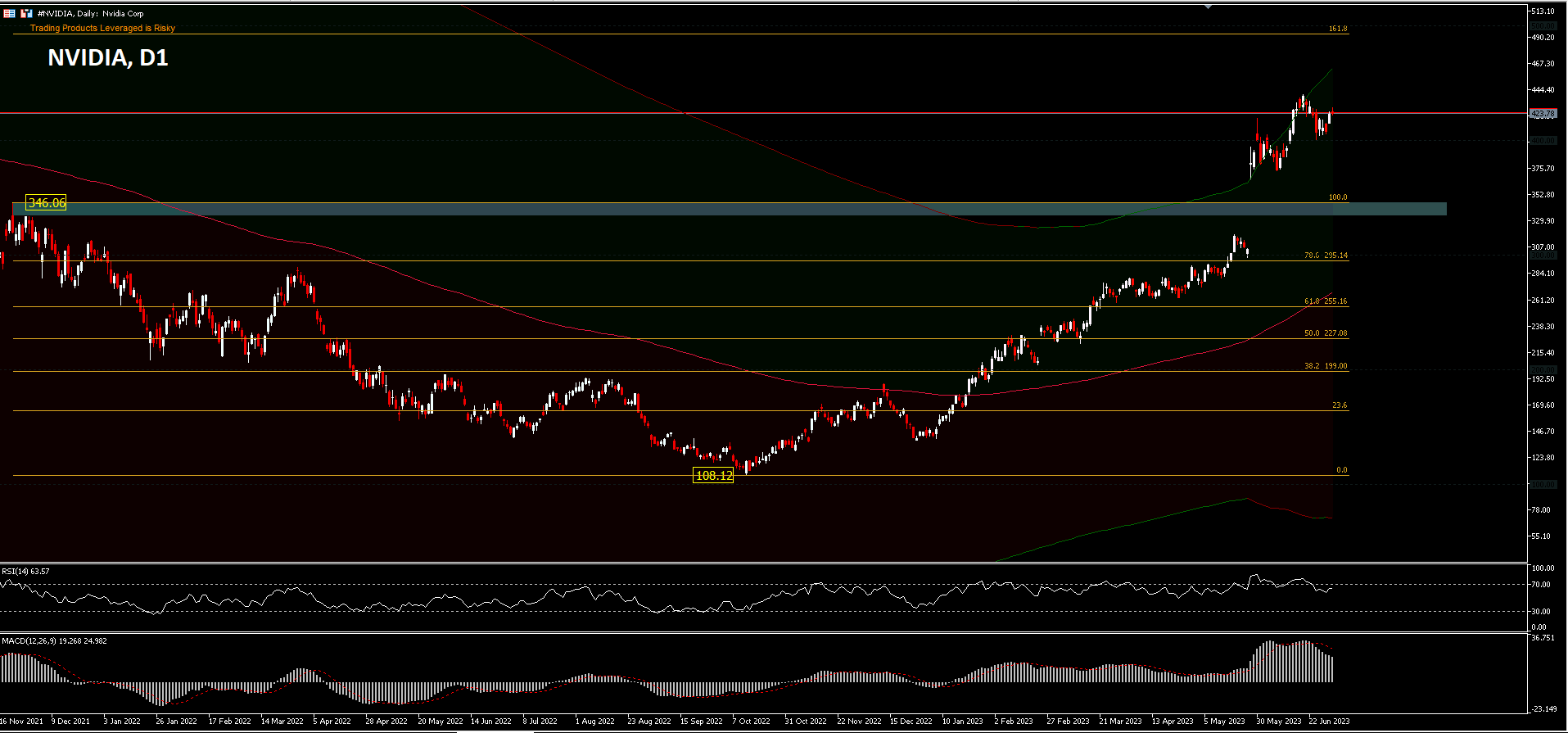

#Nvidia tried to rally again in October final yr from the $108.12 stage and the worth has even surpassed the $346.06 resistance worth stage which was recorded because the excessive worth in November 2021.

The breakout of the resistance additional strengthens #Nvidia’s place for rally enlargement as much as the 161.8percentFR enlargement stage round $493 to $500, in case of constructive progress and past the minor resistance of $439.85. On the draw back, a correction might probably take a look at again to the $346.06 resistance stage which has now change into help.

A decline within the rally’s momentum doesn’t look threatening but, with RSI staying away from overbought ranges and MACD within the purchase zone nonetheless validating the current strikes.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]