[ad_1]

Though seemingly tough to decipher, the market usually provides us hints relating to its course. Nevertheless, that is usually a tough activity for brand new merchants to decipher. Some technical indicators might assist us establish the subsequent possible course of the market extra objectively. This technique is an instance of how we are able to use indicators to establish potential development continuation entries because the market presents these alternatives.

Smoother Adaptive Indicator

The Smoother Adaptive Indicator is a momentum indicator which is a sort of modified transferring common. This modified transferring common is intently associated to the Jurik Analysis Transferring Common (JMA). Nevertheless, it isn’t precisely the identical because the JMA indicator. As a substitute, it’s a smoothened transferring common derived from the JMA.

The basic Jurik Transferring Common is in itself a modified transferring common which makes an attempt to create a transferring common line that would get rid of market noise. In reality, it’s someway often known as a superior noise elimination filter. This creates a transferring common line which gives a smoothened illustration of worth motion with a really excessive diploma of responsiveness to cost actions attributable to its minimal noise. Nevertheless, some merchants might discover the JMA to be too jagged and erratic attributable to its responsiveness to cost fluctuations. Thus the Smoother Adaptive Indicator was developed.

The Smoother Adaptive Indicator is just a smoothened model of the JMA indicator. It plots a transferring common line which is comparatively smoother than the common JMA line. In reality, it in the direction of the aspect of smoothness slightly than responsiveness. The assumption is that since it’s a smoothened model, it may be extra dependable in stating momentum course or bias.

The Smoother Adaptive Indicator plots a line which modifications shade relying on the course of the momentum. It plots a line with a lime hue each time it detects a bullish momentum, which can progressively change to an orange hue because the indicator begins to detect a bearish momentum.

Kumo Indicator

The Ichimoku Kinko Hyo indicator is in itself an entire momentum and development course indicator system which gives development indications on a wide selection of time horizons, from the short-term to the long-term. That is made doable due to the 5 completely different parts of the Ichimoku Kinko Hyo indicator, particularly the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span, every representing and indicating a development course by itself time window.

The Kumo, which accurately interprets to “cloud”, consists of two of the principle parts of the Ichimoku Kinko Hyo indicator, particularly the Senkou Span A and Senkou Span B line. Each these strains signify the long-term development horizon of the Ichimoku Kinko Hyo system.

The Senkou Span A (Main Span A) is the median of the Tenkan-sen and Kijun-sen strains shifted ahead. It’s calculated by including the present Tenkan-sen and Kijun-sen values, dividing the sum by two, then shifting the plotting of its line worth 26 durations ahead.

The Senkou Span B (Main Span B) line is just the median of worth over a 52-bar window shifted ahead. Its algorithm detects the best excessive and lowest low inside a 52-bar window, provides the 2 values, divides the sum by two, then shifts the ensuing worth ahead by 26 durations.

Collectively, these two strains kind the Kumo. The algorithm shades the world between the 2 strains relying on the situation of the Senkou Span A line in relation to the Senkou Span B line. It shades the world sandy brown each time the Senkou Span A line is above the Senkou Span B line. Inversely, it shades the world thistle each time the Senkou Span A line is beneath the Senkou Span B line.

This function permits merchants to simply establish the course of the long-term development. The Kumo signifies a bullish long-term development each time it’s sandy brown and a bearish long-term development each time it’s thistle.

Buying and selling Technique Idea

Smoother Adaptive Development Continuation Foreign exchange Buying and selling Technique makes use of the Smoother Adaptive indicator in addition to the Kumo to establish doable development continuation market situations that the market might current.

The Kumo is principally used because the long-term development course filter. The long-term development course may be objectively recognized primarily based on the colour of the shade throughout the Kumo. Commerce course is then remoted primarily based on the course of the long-term development as indicated by the Kumo.

The Smoother Adaptive indicator is then used to substantiate momentum course and as a commerce entry sign. Momentum course is predicated on the colour of the Smoother Adaptive line, whether or not it has a lime or orange hue. Trades can solely push by way of if the short-term momentum course agrees with the long-term development.

Value motion is then allowed to tug again between the Smoother Adaptive line and the Kumo. Commerce entry indicators are viable as quickly as worth pops again out the Smoother Adaptive line whereas the momentum course remains to be in confluence with the long-term development.

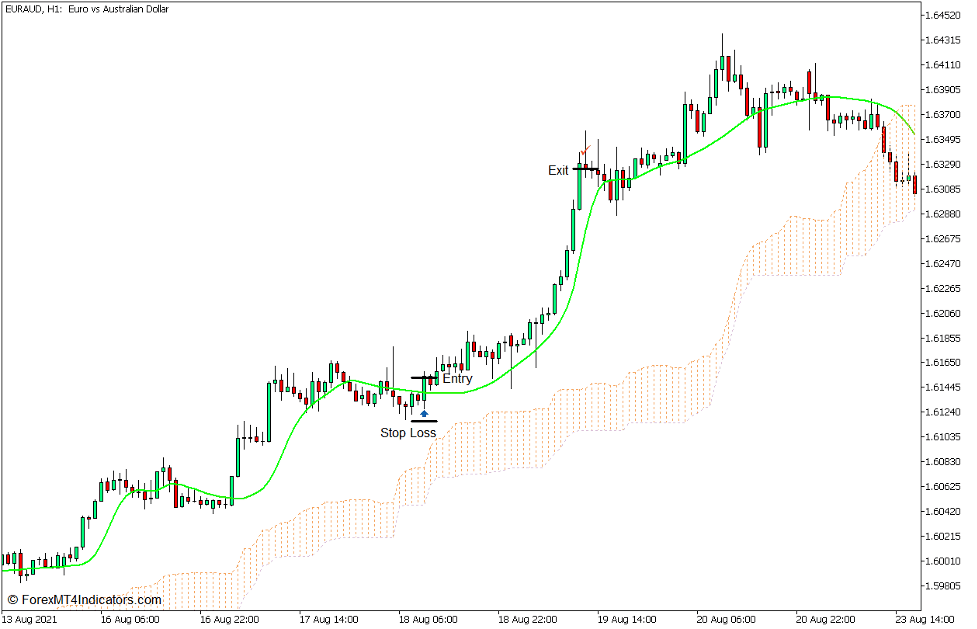

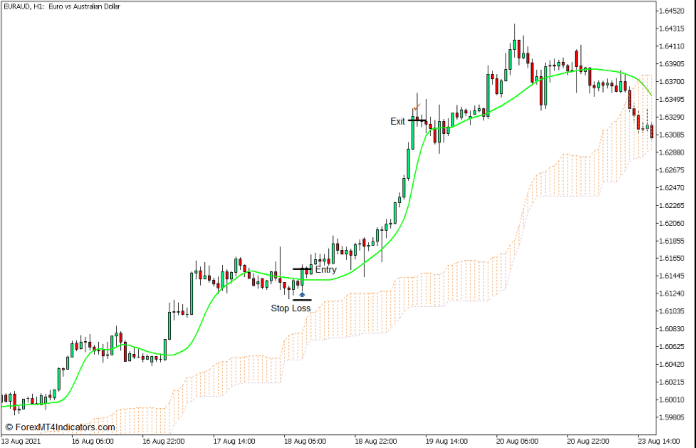

Purchase Commerce Setup

Entry

- The Kumo needs to be sandy brown.

- The Smoother Adaptive line ought to have a lime hue.

- Value ought to pull again beneath the Smoother Adaptive line.

- Open a purchase order as quickly as worth closes again above the Smoother Adaptive line.

Cease Loss

- Set the cease loss on the fractal beneath the entry candle.

Exit

- Shut the commerce as quickly as worth motion exhibits indicators of a bearish reversal.

Promote Commerce Setup

Entry

- The Kumo needs to be thistle.

- The Smoother Adaptive line ought to have an orange hue.

- Value ought to pull again above the Smoother Adaptive line.

- Open a promote order as quickly as worth closes again beneath the Smoother Adaptive line.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly as worth motion exhibits indicators of a bullish reversal.

Conclusion

This buying and selling technique is a simplified development following technique which is predicated on the idea of aligning the long-term development with the short-term development, which considerably will increase the chance of a worthwhile commerce.

This technique is predicated on technical indicators. Nevertheless, indicators don’t trigger worth to maneuver. As a substitute, it’s the different method round. As such, it’s best for merchants to grasp worth motion and market stream, utilizing these technical indicators solely as a supplementary affirmation of what the market is indicating.

Foreign exchange Buying and selling Methods Set up Directions

Smoother Adaptive Development Continuation Foreign exchange Buying and selling Technique for MT5 is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the accrued historical past information and buying and selling indicators.

Smoother Adaptive Development Continuation Foreign exchange Buying and selling Technique for MT5 gives a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional worth motion and regulate this technique accordingly.

Really useful Foreign exchange MetaTrader 5 Buying and selling Platforms

#1 – XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

#2 – Pocket Choice

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 General Score!

- Routinely Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

The way to set up Smoother Adaptive Development Continuation Foreign exchange Buying and selling Technique for MT5?

- Obtain Smoother Adaptive Development Continuation Foreign exchange Buying and selling Technique for MT5.zip

- *Copy mq5 and ex5 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Smoother Adaptive Development Continuation Foreign exchange Buying and selling Technique for MT5

- You will note Smoother Adaptive Development Continuation Foreign exchange Buying and selling Technique for MT5 is offered in your Chart

*Word: Not all foreign exchange methods include mq5/ex5 recordsdata. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]