[ad_1]

EUR/USD: When Will the Pair Return to 1.1000?

● Summarizing the second half of June, the end result within the EUR and USD confrontation may be mentioned to be impartial. On Friday, June 30, EUR/USD ended up the place it traded on each the fifteenth and twenty third of June.

● On Thursday, June 29, some fairly sturdy macroeconomic knowledge got here out of the US. The Bureau of Financial Evaluation revised its GDP figures for the primary quarter upwards to 2.0% yr on yr (YoY) (forecast was 1.3%). As for the labour market, the variety of preliminary jobless claims for the week dropped by nearly 30K, reaching the bottom stage because the finish of Might – 239K.

Recall that the Federal Open Market Committee (FOMC) of the US Federal Reserve determined at its June 14 assembly to take a pause within the technique of financial tightening and left the rate of interest unchanged at 5.25%. After this, market contributors had been left to invest on the regulator’s subsequent strikes. The launched knowledge bolstered confidence within the stability of the nation’s financial system and raised expectations for additional greenback rate of interest hikes. In accordance with the CME FedWatch Software, the chance of a price hike of 25 foundation factors (bps) on the Fed’s July assembly rose to 87%, and the chance that the full price hike by the tip of 2023 might be 50 bps is nearing 40%. Because of this, in the course of Friday, June 30, EUR/USD recorded an area low at 1.0835.

● Talking at an financial discussion board in Sintra (Portugal) on Wednesday, June 28, Federal Reserve Chairman Jerome Powell acknowledged that additional rate of interest will increase can be pushed by a powerful labour market and persistently excessive inflation. Nevertheless, the core private consumption expenditures (PCE) knowledge revealed on June 30 indicated that inflation, though slowly, is declining. Forecasts prompt that the PCE index for June would stay on the earlier stage of 4.7%, however in actuality, it fell to 4.6%. This considerably dampened the bullish sentiment on the greenback, with the DXY index heading decrease and EUR/USD returning to the central zone of the two-week sideways hall, ending the five-day interval at 1.0910.

● As for the state of the financial system on the opposite facet of the Atlantic, following excessive preliminary inflation knowledge from Spain and Germany, markets anticipated the Harmonised Index of Client Costs (HICP) within the Eurozone to rise by 0.7% in June, considerably exceeding the 0.2% a month earlier. Nevertheless, the precise worth, though increased than in Might, was solely barely so, at 0.3%. Furthermore, the preliminary Client Worth Index (CPI) revealed on Friday, June thirtieth, confirmed a lower in Eurozone inflation from 6.1% to five.5% YoY (forecast was 5.6%).

Recall that after hawkish statements from ECB leaders made in mid-June, the markets had already priced in two euro price hikes, in July and September, every by 25 foundation factors. Subsequently, the recent European inflation knowledge had little impact on investor sentiment.

● Friday, June 30, marked not solely the tip of the quarter but additionally the primary half of the yr. On this regard, representatives from a number of banks determined to make predictions for the second half of 2023 and the beginning of 2024. Economists at Credit score Agricole see dangers of a lower in EUR/USD from present ranges within the close to time period and predict its gradual restoration ranging from This fall 2023. Of their opinion, over the following 6-12 months, the pair may rise to 1.1100.

Strategists at Wells Fargo anticipate the greenback to be pretty steady and even barely stronger for the remainder of 2023. Nevertheless, they predict a noticeable weakening over the course of the next yr. “Given our expectations for a later and shallow recession within the U.S. and a later easing of Fed coverage,” Wells Fargo analysts write, “we anticipate a later and extra gradual depreciation of the U.S. greenback. […] We predict that by the tip of 2023, the trade-weighted U.S. greenback price will change little in comparison with the present stage, and by 2024 it would have declined by 4.5%.”

Economists at Goldman Sachs additionally up to date their EUR/USD forecasts. They too now point out a smaller drop within the coming months and a extra extended restoration of the euro by the tip of 2023 and the primary half of 2024. They predict the pair price to be at 1.0700 in three months, 1.1000 in six months, and 1.1200 in twelve months.

● As for the near-term prospects, on the time of scripting this evaluate on the night of June 30, 50% of analysts voted for the pair’s decline, 25% for its rise, and the remaining 25% took a impartial place. Amongst oscillators on D1, 35% are on the facet of the bulls (inexperienced), 25% are on the facet of the bears (pink), and 40% are painted in impartial gray. Among the many development indicators, 90% are colored inexperienced, and solely 10% are pink. The closest help for the pair is positioned round 1.0895-1.0900, adopted by 1.0865, 1.0790-1.0815, 1.0745, 1.0670 and, lastly, the Might 31 low of 1.0635. The bulls will encounter resistance within the space of 1.0925-1.0940, adopted by 1.0985, 1.1010, 1.1045, 1.1090-1.1110.

● Upcoming occasions to notice embody the discharge of the Manufacturing Buying Managers’ Index (PMI) for Germany and the US on Monday, July 3. The minutes from the most recent FOMC assembly might be revealed on Wednesday, July 5. The next day, on Thursday, July 6, knowledge on retail gross sales volumes within the Eurozone might be accessible. On the identical day, the ADP employment report and the PMI for the US service sector can even be revealed.

Closing out the work week, one other batch of knowledge from the US labour market might be launched on Friday, July 7, together with the unemployment price and the necessary nonfarm payroll (NFP) determine. ECB President Christine Lagarde can even ship a speech on the identical day.

Moreover, merchants ought to be conscious that Tuesday, July 4 is a public vacation within the US, because the nation observes Independence Day. Because of this, the markets will shut earlier the day earlier than as a result of vacation.

GBP/USD: How Mr. Powell “Defeated” Mr. Bailey

● Within the earlier evaluate, we famous how strongly the phrases of officers have an effect on quotes. This week was one other affirmation of this. On Wednesday, June 28, GBP/USD confirmed a powerful drop. The trigger had been the speeches of the Federal Reserve Chair Jerome Powell and Financial institution of England’s Governor Andrew Bailey in Sintra. Mr. Bailey promised that his Central Financial institution would “do no matter it takes to get inflation to focus on stage”. This suggests not less than two extra price hikes. Nevertheless, Mr. Powell didn’t rule out additional tightening of the Fed’s financial coverage, though inflation within the US is way decrease than in the UK. Because of these two speeches, Jerome Powell and the US forex gained, and GBP/USD dropped sharply.

The subsequent day, sturdy US macro statistics added power to the greenback. If it weren’t for the information on the Private Consumption Expenditures (PCE) within the US revealed on the finish of the week, the pound would have suffered fairly a bit. However because of the PCE, in just some hours it managed to get well nearly all of the losses and put the ultimate chord on the mark of 1.2696.

● Within the talked about speech in Sintra, Andrew Bailey additionally acknowledged that “the UK financial system has confirmed far more resilient” than the Central Financial institution anticipated. We wish to imagine the pinnacle of the BoE. Nevertheless, the information revealed by the Workplace for Nationwide Statistics (ONS) on June 30 increase sure considerations. Thus, the nation’s GDP grew in Q1 2023 by 0.1% in quarterly phrases and 0.2% in annual phrases. And if the primary indicator remained on the earlier stage, then the second confirmed a major decline: it turned out to be 0.5% decrease than the information for This fall 2022.

In accordance with Credit score Suisse economists, the scenario going through the Financial institution of England ought to be outlined as genuinely distinctive. However the slowdown in British GDP doesn’t appear to fret the BoE management an excessive amount of, which is concentrated on combating excessive inflation.

● Following the Might and June conferences, the BoE raised the rate of interest by 25 foundation factors and 50 foundation factors to five.00%. Many analysts imagine that the regulator might convey it as much as 5.50% already on the two upcoming conferences, after which to six.25%, regardless of the specter of financial recession. Such steps within the foreseeable future will help the pound. At Credit score Suisse, for instance, they imagine that though the pound has considerably strengthened since September 2022, GBP/USD nonetheless has the potential to develop to 1.3000.

● From a technical evaluation perspective, the indications of oscillators on D1 seem fairly unsure – a 3rd level to the north, a 3rd to the south, and a 3rd to the east. The image is clearer for development indicators – 90% advocate shopping for, 10% promoting. If the pair strikes south, it would encounter help ranges and zones at 1.2625, 1.2570, 1.2480-1.2510, 1.2330-1.2350, 1.2275, 1.2200-1.2210. In case of the pair’s rise, it would meet resistance at ranges of 1.2755, 1.2800-1.2815, 1.2850, 1.2940, 1.3000, 1.3050, and 1.3185-1.3210.

As for the occasions of the approaching week, the main target might be on the publication of the PMI within the UK manufacturing sector on Monday, July 3. On Tuesday, July 4, the Financial institution of England’s report might be revealed, which can make clear the longer term course of financial coverage. And on the finish of the week, on Friday, July 7, the information on the US labour market, together with the extent of unemployment and such an necessary indicator because the variety of new jobs outdoors the agricultural sector (NFP), might be launched.

● Within the occasions for the upcoming week, one can word Monday, July 3, when the Manufacturing Buying Managers’ Index (PMI) for the UK might be revealed.

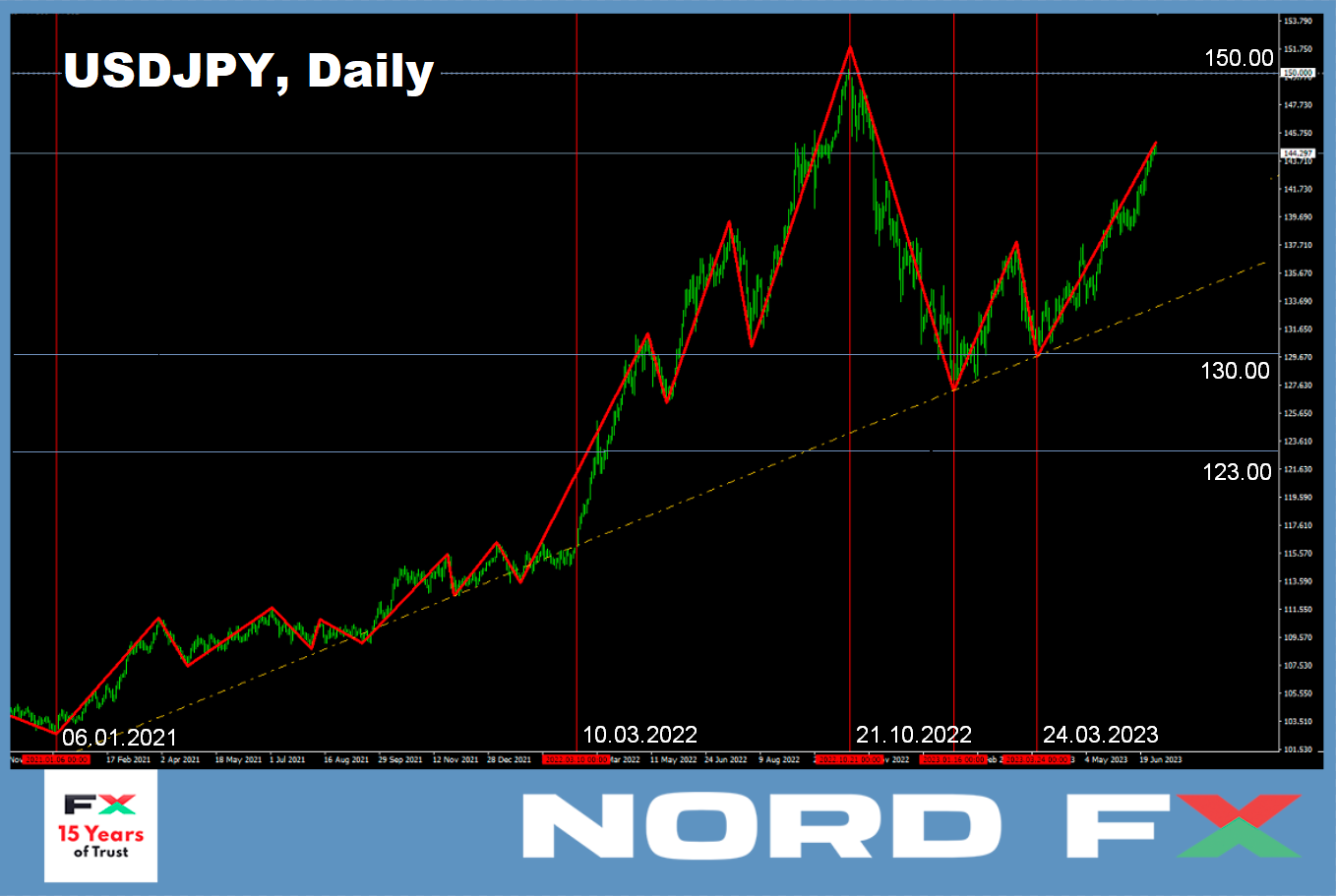

USD/JPY: The “Ticket to the Moon” Turned Out to be Multi-Use

● As quickly as we talked about the potential interventions to help the yen in our final evaluate, nearly everybody began discussing this subject, together with analysts and even officers from the Japanese Authorities. After all, our speculations weren’t the set off; it was the trade price of the Japanese forex. Final week, USD/JPY continued its “flight to the moon,” setting one other file on the peak of 145.06. Curiously, it was on the 145.00 mark that the Financial institution of Japan (BoJ) performed its first intervention in a few years.

It has been mentioned a thousand instances that rising divergence in financial coverage between the Financial institution of Japan and different main central banks is a recipe for additional yen weakening. Thus, final week, following the discharge of US GDP and unemployment claims knowledge, the yield on 10-year US treasury bonds jumped to three.84%, and two-year bonds to 4.88%, the very best stage since March. Subsequently, the unfold between US and Japanese bonds continues to widen, reflecting the rising divergence within the financial coverage of the Fed and the BoJ and pushing USD/JPY to astronomical heights. Understandably, in such a scenario, the query arose concerning the potential of the Japanese regulator to artificially help its nationwide forex.

● Hirokazu Matsuno, the Chief Cupboard Secretary of Japan, acknowledged on Friday, June 30 that the authorities are “intently monitoring forex actions with a excessive sense of urgency and immediacy.” “It is necessary that the trade price strikes steadily, reflecting basic financial indicators. Lately, sharp unilateral actions have been noticed. [We] will take applicable measures in response to extreme forex actions,” promised the high-ranking official.

Nevertheless, a number of specialists doubt that the Japanese Authorities and Central Financial institution have the power and functionality not simply to strengthen the yen as soon as, however to keep up it in such a state over an prolonged time frame. It is sufficient to recall that lower than eight months have handed because the final intervention in November 2023, and right here once more, USD/JPY is storming the peak of 145.00. Since all forex reserves are finite, say Commerzbank specialists, fixing this downside might be infinitely troublesome, and “all that continues to be is to hope that officers from the [finance] ministry understand this and don’t overestimate their capabilities.”.

● The financial coverage pursued by the Japanese Authorities and Central Financial institution in recent times clearly signifies that their focus shouldn’t be solely on the yen trade price, however on financial indicators. Nevertheless, you will need to word that one in all these indicators is inflation. On this regard, we have now seen an acceleration within the Client Worth Index (CPI) to three.1% YoY, in comparison with 3.0% the earlier month and a pair of.7% in February. Whereas these values are considerably decrease than these noticed within the US, Eurozone, or the UK, nobody can assure that inflation is not going to proceed to rise additional. If the BoJ doesn’t intend to tighten its ultra-easy coverage and lift rates of interest, the one device left to keep up the trade price is forex interventions. The one remaining query is when they’ll start – now or when the speed reaches 150.00, because it did within the autumn of 2022.

● Many specialists nonetheless maintain hope that the Financial institution of Japan will finally determine to tighten its coverage. These hopes permit economists at Danske Financial institution to forecast a USD/JPY price under 130.00 inside a 6–12-month horizon. Comparable predictions are made by strategists at BNP Paribas, who goal 130.00 by the tip of this yr and 123.00 by the tip of 2024. Nevertheless, Wells Fargo’s forecast seems extra modest, with their specialists anticipating the pair to solely lower to 133.00 by the tip of 2024. Nonetheless, reaching that stage would nonetheless be thought-about a major achievement for the Japanese forex, because it concluded the previous week at 144.29 after the publication of US PCE knowledge.

● On the time of writing the evaluate, 60% of analysts, like every week in the past, anticipate that the yen will recoup not less than a few of its losses and push the pair to the south, whereas the remaining 40% of specialists level to the east. Nevertheless, there are not any supporters of the pair’s development this time. It’s price noting that there have been solely a minimal variety of supporters the earlier week, with solely 10%. However, USD/JPY continues its journey to the celebs. Finally, whereas specialists ponder, the market decides. Relating to this matter, there are not any doubts from both development indicators or oscillators: all 100% on D1 level upwards. Nevertheless, 1 / 4 of the oscillators actively sign overbought circumstances for the pair.

The closest help stage is positioned within the 143.74 zone, adopted by 142.95-143.20, 142.20, 141.40, then 140.90-141.00, 140.60, 138.75-139.05, 138.30, and 137.50. The closest resistance is at 144.55, after which bulls might want to overcome obstacles at 145.00-145.30, 146.85-147.15, and 148.85, earlier than reaching the October 2022 excessive of 151.95.

● No vital financial data associated to the Japanese financial system is predicted to be launched within the upcoming week. Nevertheless, until the Financial institution of Japan pronounces forex interventions, which they don’t sometimes preannounce.

CRYPTOCURRENCIES: Institutional Bitcoin Frenzy Beneficial properties Momentum

● What has been talked about and dreamed of for therefore lengthy appears to be occurring: international monetary giants are lastly believing within the shiny way forward for Bitcoin. Again in 2021, Matt Hougan, Chief Funding Officer at Bitwise, talked about that futures-based cryptocurrency ETFs weren’t appropriate for long-term traders on account of excessive related prices. He acknowledged that after spot-based bitcoin exchange-traded funds (ETFs) emerged, institutional traders would begin pouring vital investments. Lately, in an interview with Bloomberg, Hougan introduced the daybreak of a brand new period, saying, “Now we have now BlackRock elevating the flag and stating that BTC has worth, that it is an asset during which institutional traders need to make investments. I imagine we’re coming into a brand new period of cryptocurrencies, which I name the ‘mainstream period,’ and I anticipate a multi-year bull development that’s simply starting.”.

● A spot BTC ETF is a fund whose shares are traded on an trade and observe the market or spot value of BTC. The primary thought behind such ETFs is to supply institutional traders with entry to bitcoin buying and selling with out bodily proudly owning it, by a regulated and financially acquainted product.

At present, eight main monetary establishments have submitted functions to the U.S. Securities and Change Fee (SEC) to enter the cryptocurrency market by spot-based ETFs. Alongside funding large BlackRock, these embody international asset managers similar to Invesco and Constancy. International banks similar to JPMorgan, Morgan Stanley, Goldman Sachs, Financial institution of New York Mellon, Financial institution of America, Deutsche Financial institution, HSBC, and Credit score Agricole have additionally joined the bitcoin fever.

● It’s price noting that the SEC has beforehand rejected all related functions. Nevertheless, the present scenario could also be totally different. SEC Chairman Gary Gensler has confirmed that the SEC considers bitcoin a commodity, opening up broad prospects for the main cryptocurrency. Cameron Winklevoss, one of many founders of the cryptocurrency trade Gemini, has confirmed that institutional traders are prepared to start out shopping for BTC, anticipating the approval of spot-based BTC funds. “Bitcoin was the plain and most worthwhile funding of the previous decade. However it would stay the identical on this decade,” mentioned Winklevoss. This sentiment is shared by Hugh Hendry, the supervisor of Eclectica Asset Administration hedge fund, who believes that BTC may triple its market capitalization within the medium time period.

● With regards to altcoins, the scenario is considerably more difficult. Max Keiser, a well-liked bitcoin maximalist and now an advisor to the President of El Salvador, believes that Gary Gensler has sufficient technical and political instruments at his disposal to categorise XRP and ETH as securities, which might finally kill these altcoins. “The Securities and Change Fee is working for the banking cartel, participating in racketeering within the curiosity of monetary constructions,” Keiser wrote in his weblog.

It’s price noting that the SEC has filed lawsuits towards Binance and Coinbase, accusing the platforms of promoting unregistered securities. Within the courtroom paperwork, the Fee recognized Solana (SOL), Cardano (ADA), Polygon (MATIC), Coti (COTI), Algorand (ALGO), Filecoin (FIL), Cosmos (ATOM), Sandbox (SAND), Axie Infinity (AXS), and Decentraland (MANA) as securities. A number of cryptocurrency platforms have already taken this SEC assertion as steering and, to keep away from potential claims, have delisted these altcoins.

● The statements above point out that bitcoin is prone to keep its market management within the foreseeable future. Mark Yusko, the founder and CEO of Morgan Creek Capital, believes that the bullish development of BTC may proceed till the following halving, which is predicted to happen in April 2024. “I feel the rally is simply starting. We have now simply entered what is called the crypto summer season season,” wrote the skilled. Nevertheless, he cautioned that after the speculative surge attributable to the halving, there’s sometimes an extreme response in the wrong way, often known as crypto winter.

In accordance with an analyst often known as InvestAnswers, along with the upcoming halving, the institutional adoption that has begun will assist drive the expansion of BTC by rising demand for the asset and decreasing its provide. The aforementioned funding giants collectively handle trillions of {dollars} in property, whereas the market capitalization of Bitcoin is simply over $0.5 trillion. Solely a tiny fraction of this $0.5 trillion is actively traded in the marketplace.

● Peter Schiff, the president of Euro Pacific Capital and a staunch critic of Bitcoin, holds the alternative view. He believes that there’s “nothing extra low-quality than cryptocurrencies.” “Till lately, the rally in extremely speculative property excluded bitcoin. Now that it has lastly joined the celebration, it’s prone to finish quickly,” he acknowledged. In accordance with Schiff, such rallies sometimes come to an finish when “the lowest-quality issues” finally be a part of them, referring to digital property.

● Trying on the BTC/USD chart, there’s a suspicion that Peter Schiff is perhaps proper. After hovering on the information of BlackRock’s and different institutional gamers’ curiosity, the pair has been buying and selling sideways inside a slim vary of $28,850 to $31,000 for the previous week. In accordance with analysts, moreover considerations about SEC actions, bitcoin and the cryptocurrency market are presently being weighed down by miners. Breaking the $30,000 barrier prompted them to ship a file quantity of cash to exchanges ($128 million in simply the previous week). Crypto miners worry a value reversal from a major stage on account of elevated regulatory scrutiny within the business. Moreover, the typical price of mining stays increased than the present costs of digital property as a result of doubling of computational issue over the previous yr and a half. Because of this, miners are pressured to promote their coin holdings to maintain manufacturing actions, cowl ongoing bills, and repay money owed.

● As of the time of writing the evaluate, on Friday night, June 30, BTC/USD is buying and selling round $30,420. The full market capitalization of the crypto market has barely decreased to $1.191 trillion ($1.196 trillion every week in the past). The Crypto Worry & Greed Index is on the border between the Greed and Impartial zones, dropping from 65 to 56 factors over the week.

● New catalysts are wanted for additional upward motion. One in all them could possibly be the expiration of futures contracts for ethereum and bitcoin on Friday, June 30. In accordance with AmberDate, over 150,000 BTC choices with a complete worth of round $4.57 billion had been settled on the Deribit Change. Moreover, $2.3 billion price of contracts had been settled for ETH. In accordance with specialists from CoinGape, this might set off vital volatility in July and supply sturdy help for these property. Nevertheless, a lot can even rely upon the macroeconomic knowledge popping out of america.

● As of the night of June 30, ETH/USD is buying and selling round $1,920. A number of analysts imagine that ethereum nonetheless has the potential for additional bullish momentum. Widespread skilled Ali Martinez factors out that ETH might encounter vital resistance close to the $2,000-2,060 vary, as over 832,000 addresses beforehand opened gross sales on this vary. Nevertheless, if ethereum surpasses this zone, it has a very good probability of experiencing a pointy impulse in direction of $2,330. Moreover, there’s potential for additional development in direction of $2,750 in the long run.

● And eventually, a little bit of historical past. Ten years in the past, Davinci Jeremie posted a YouTube video strongly recommending his viewers to spend not less than one greenback to buy bitcoin and defined why BTC would develop within the coming years. At the moment, Jeremy’s forecast angered or amused most individuals who didn’t need to hearken to his advice. Nevertheless, they now deeply remorse it as they might have acquired over 1,000 BTC for the $1 they might have invested, which is price $30 million at the moment.

In a current interview, Jeremy emphasised that it’s nonetheless worthwhile to purchase bitcoin. In accordance with him, solely 2 p.c of the world’s inhabitants owns cryptocurrency, so it nonetheless has the potential to please its traders with new data. “Nevertheless, there’s additionally one downside,” says Jeremy. “Everybody desires to personal a complete bitcoin. Nobody desires to go to a retailer and say, ‘Can I get one trillionth of an apple?’ So, though bitcoin is divisible, this property is basically its Achilles’ heel. The answer to this downside is to make the show of small fractions of BTC extra user-friendly and comprehensible. For instance, as a substitute of writing quantities like 0.00001 BTC, they could possibly be changed by the equal quantity of satoshis, which is the smallest indivisible unit of 1 Bitcoin valued at 0.00000001 BTC.”

NordFX Analytical Group

Discover: These supplies aren’t funding suggestions or pointers for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]