[ad_1]

I posted this thread on Twitter this morning. The report back to which the thread relates is right here.

There was a lot dialogue concerning the probably failure of Thames Water within the final day or so. I have been wanting on the accounts of England’s water corporations for the final twenty years. My conclusion is that they’re all environmentally bancrupt. So, a thread…..

[Please note this is a long thread. If it appears to stop midway just hit ‘See more replies’ and the rest should appear.]

There are 9 corporations in England that take away sewage. There are extra that offer water alone. However the disaster that the English water corporations face largely pertains to sewage so my work has regarded on the ones that take our waste away.

Thames Water is a kind of sewage corporations. The others are Anglian Water, Northumbrian Water, Severn Trent, South West Water, Southern Water, United Utilities, Wessex Water and Yorkshire Water.

It is essential to say that though I used the accounts of every of those corporations in my work, the outcomes I’m speaking about right here or for the trade as a complete. To get a correct image of the water and sewage trade I mixed their accounts into one single set.

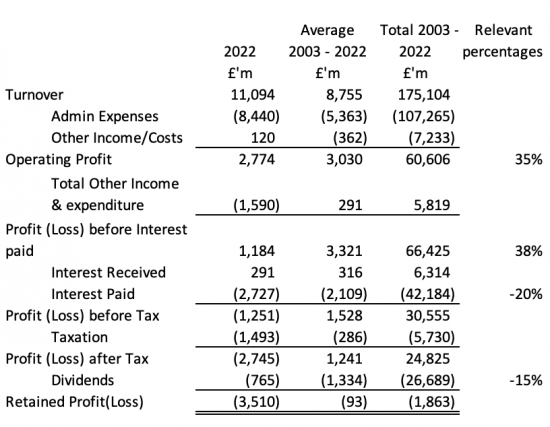

Doing so produced some fairly astonishing information. That is what the revenue and loss accounts of the mixed water and sewage corporations of the UK appears to be like like for 2022 in isolation, for 2003 to 2022 in whole, and on common over that interval:

There may be a number of information there. There are, nonetheless, some easy information to focus on.

Firstly, the working revenue margin on this trade is 35%. That’s staggeringly excessive, and it goes as much as 38% when different earnings is taken under consideration. 38p in each pound you pay for water is working revenue i.e. revenue earlier than the price of borrowing.

Second, word the price of borrowing. I’ve generously offset curiosity acquired towards curiosity paid. That also leaves curiosity prices representing a median 20% of earnings. 20p in each pound paid to those corporations, on common, goes on curiosity.

That also leaves them worthwhile although. And so they do pay tax. The typical tax fee is nineteen%, however that’s manner beneath the anticipated tax fee for this era when the tax fee was as excessive as 30% for a few of it. And far of that tax has not been paid: greater than £8bn has been deferred.

Lastly, of the virtually £25 billion they’ve made in revenue over time they’ve paid out each penny, and extra, in dividends. In different phrases, the shareholders have taken 15p in each pound paid for water. There was nothing left for reinvestment, in any respect.

No marvel the water trade is in bother. The earnings assertion reveals that the general public is being fleeced by these corporations who’re merely treating the truth that the English shopper has had no alternative as to who to purchase water from as a method to extract revenue from them.

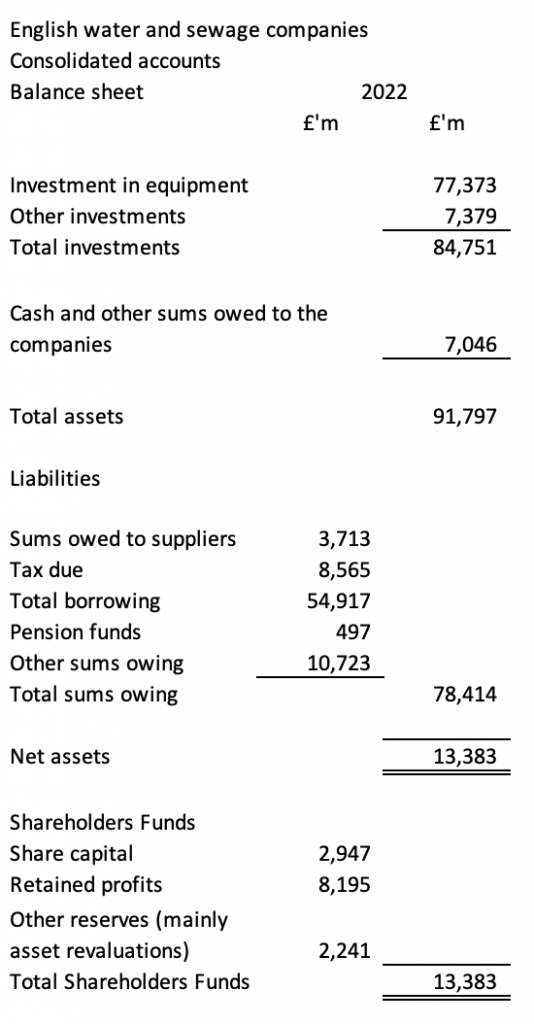

Issues are if something worse if I have a look at the stability sheets. Now I do know these scare most individuals, so I’ll discuss via the element. It is a very summarised stability sheet for the trade in 2022:

The trade has £77 billion invested in tools. The remainder of its belongings are some monetary investments, a bit of money and sums owing to it from clients. To this point, so good.

What is horrifying is what the trade owes. The £77 billion of apparatus is financed, in the primary by borrowings of virtually £55 billion, or extra. It is also funded by the tax not but due of greater than £8.5 billion, which brings down the cash-paid tax fee of the trade significantly.

Even the pension funds of these working for the trade are contributing to the funding, and there may be extra borrowing of assorted kinds within the different sums owing totalling greater than £10.7 billion.

What this implies is that of the overall close to sufficient £91 billion invested within the sector greater than £78 billion is funded by borrowing or sums owing of some type and solely simply over £13 billion is funded by the shareholders.

What that additionally means is that the shareholders present lower than 15% of the general funding for this trade. A lot for the concept non-public capital would fund water after privatisation. The fact is that borrowing is doing so.

After I started to take a look at the info in additional depth issues solely started to worsen. What I used to be actually inquisitive about figuring out was how a lot the water corporations had invested in tools over the twenty years reviewed.

The reply was, in my finest estimate, that sum was £89.8 billion. After all, a few of that has now worn out and has lengthy gone from the accounts. Property like vans and computer systems don’t final that lengthy in use.

Then I labored out how that funding was funded. There have been simply two methods. One was out of working earnings. For the technically minded that is attainable utilizing what known as the depreciation cost within the accounts. This sum amounted to £38.9 billion. Clients present this cash

The remainder of the funding got here from the rise in borrowing over the interval. That amounted to £40.5 billion. Different long-term liabilities, that are once more primarily borrowing or pension fund liabilities, elevated over the identical interval by £10.4 billion.

The online result’s that of the £89.8bn invested, clients or borrowing of assorted kinds supplied £89.8bn of the funding that means the shareholders successfully made no funding within the belongings of those companies, in any respect.

This issues for one excellent cause. As everyone knows these companies at the moment are routinely polluting England’s rivers and seashores with sewage. That sewage comes from what are referred to as storm overflows, though that is a misnomer now, as many launch sewage even after modest rainfall.

That air pollution can not persist. Until it’s stopped we’ll find yourself with out dependable clear water in England. The estimated prices of ending this air pollution do, nonetheless, fluctuate significantly.

The trade has provided to speculate £10 billion over seven years, or £1.4 billion a yr. The federal government has determined that £56 billion is required over 27 years, or simply over £2 billion a yr. The difficulty is neither sum will come near eliminating the crap in England’s water.

The Home of Lords checked out this problem primarily based on impartial evaluation and concluded that the most probably estimate of the price of eliminating all of the air pollution in our water was £260 billion. And that must be executed as quickly as attainable. I recommend ten years.

If that funding of £260 billion was made, we’d have clear water in ten years.

What the trade is providing is one thing fairly completely different. Even when they meet the federal government’s demand of them, at finest I estimate that primarily based on formally revealed information they could reduce the crap in water by two-thirds, at finest, by 2050.

So why has the federal government set such a low funding goal that also leaves us with polluted water? The one attainable reply is that they needed to guarantee that the non-public water corporations wouldn’t go bust by having to spend an excessive amount of.

Let me put that one other manner. The federal government thinks that saving the non-public water corporations is extra essential than them polluting our water, rivers and seashores with all the prices that can create.

The federal government has made the fallacious choice. But when the required £260 billion was spent (with extra required to develop into web zero compliant) then the water corporations would go bust. What meaning is that they’re environmentally bancrupt.

The idea of environmental insolvency applies to any enterprise that can’t adapt to make its enterprise environmentally pleasant – as local weather change and ending air pollution requires – and nonetheless make a revenue. What it means is that its enterprise mannequin is bankrupt.

That’s the place the English water trade is now. Thames Water could be going through environmental chapter, however this trade as a complete is in my view incapable of funding the funding required to ship clear water and be worthwhile.

The federal government could be making noises about taking Thames Water into short-term public possession, however that’s meaningless when Thames Water can by no means be worthwhile and ship clear water. There is just one reply for this trade now, and that’s nationalisation.

I’d recommend that this nationalisation needs to be with none compensation to shareholders. That’s as a result of their companies are environmentally bancrupt. Suppliers of loans may additionally must take successful too: they made a nasty choice lending to those corporations.

The federal government will then must help the trade utilizing borrowed funds. I recommend it ought to problem water bonds by way of ISAs to the general public to do that. Would not you need to save in a manner that ensures all of us get clear water sooner or later? I’d.

And the best way during which water is charged for may need to alter. The concept all of us pay the identical worth per unit regardless of the quantity of water used appears absurd now and would possibly want reconsideration.

However my important level is that the water trade has to now be nationalised as a result of it’s not solely failing us already however on the premise of present plans will most likely accomplish that ceaselessly, and that’s not solely not adequate, however is de facto harmful to our wellbeing.

Our legislators must now say it’s time to finish the shit in our water and take management of this trade to guarantee that we get clear water. In any case, if they can’t assure clear water – an absolute important for all times – what are they for?

Lastly, a number of technical notes. First, this evaluation relies on the actions of the businesses really supplying each water and sewage providers in England. It’s not primarily based on the teams of which they’re members.

Second, the conclusions are primarily based on mixture information. They can’t be utilized to anybody firm.

Third, the info used is extracted from databases however is appropriate to one of the best of my perception primarily based on that limitation.

And, if you wish to see the report on which this thread relies it’s right here.

[ad_2]