[ad_1]

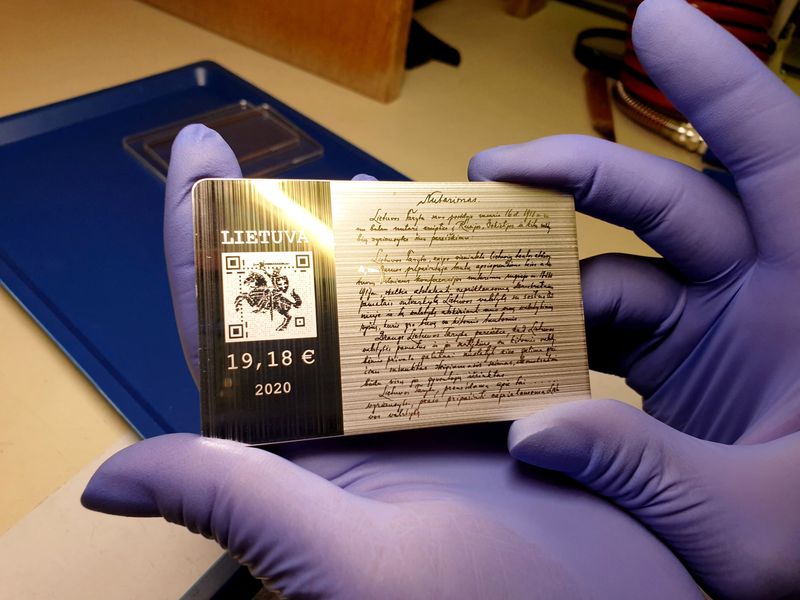

© Reuters. FILE PHOTO: A employee on the Lithuanian mint holds a silver coin, produced to be exchanged for units of digital foreign money launched by Lithuanian central financial institution in Vilnius, Lithuania June 1, 2020. REUTERS/Andrius Sytas/File Picture

By Marc Jones

LONDON (Reuters) – A complete of 130 nations representing 98% of the worldwide economic system are actually exploring digital variations of their currencies, with nearly half in superior improvement, pilot or launch levels, a closely-followed research reveals.

The analysis by the U.S.-based Atlantic Council assume tank revealed on Wednesday mentioned vital progress over the previous six months meant that every one G20 nations excluding Argentina had been now in a type of superior phases.

Eleven nations, together with a quantity within the Caribbean, and Nigeria, have already launched central financial institution digital currencies (CBDCs) as they’re identified, whereas pilot testing in China now reaches 260 million individuals and covers 200 eventualities from e-commerce to authorities stimulus funds.

Two different large rising economies, India and Brazil, additionally plan to launch digital currencies subsequent 12 months. The European Central Financial institution is on observe to start its digital euro pilot forward of a attainable launch in 2028, whereas over 20 different nations may even take vital steps in direction of pilots this 12 months.

In the US, although, progress on a digital greenback is barely “transferring ahead” for a wholesale (bank-to-bank) model, the Atlantic Council’s analysis mentioned, whereas work on a retail model to be used by the broader inhabitants has “stalled”.

U.S. President Joe Biden ordered authorities officers to evaluate the dangers and advantages of making a digital greenback in March 2022.

The heavyweight standing of the greenback within the monetary system means any U.S. transfer has doubtlessly monumental world penalties, however the Federal Reserve mentioned again in January that Congress, relatively than it, ought to resolve whether or not a digital model is launched.

The worldwide push for CBDCs comes as bodily money use falls and authorities look to fend off the risk to their money-printing powers from bitcoin and ‘Massive Tech’ companies.

Sanctions imposed on the likes of Russia and Venezuela in recent times have been one other driver, together with even for long-time U.S. allies like Europe, which desires to make sure it has a substitute for the Visa (NYSE:), Mastercard (NYSE:) and Swift cost networks.

“Since Russia’s invasion of Ukraine and the G7 sanctions response, wholesale CBDC developments have doubled,” the Atlantic Council mentioned, including that there have been now 12 multi-country “cross-border” initiatives being labored on.

It mentioned that Sweden remained one in all Europe’s most superior with its CBDC pilot, whereas the Financial institution of England is urgent on with work on a attainable digital pound that might be in use by the second half of this decade.

Australia, Thailand, South Korea, and Russia all intend to proceed pilot testing this 12 months too.

Regardless of the rising curiosity in CBDCs, nevertheless, some nations which have launched them – equivalent to Nigeria – have seen a disappointing take-up, whereas Senegal and Ecuador have each cancelled improvement work.

[ad_2]