[ad_1]

Extra dangerous information from Germany. Yesterday, the IFO fell in each the enterprise local weather part and future expectations; final Friday, it was the PMI information – particularly the manufacturing one – that painted a depressing image. In each circumstances, the BUND future rallied on the more and more weak financial development prospects. When an rate of interest future goes up, the yield goes down.

Though we’re all very targeted on the present financial coverage, which is more likely to embody additional steps in the direction of tightening, and though the mantra ”increased for longer” has been repeated for months, buyers can’t ignore the broader image. The excessive burden of public debt – by no means so excessive in not less than the final 70 years worldwide -, the poor demographic prospects – particularly in a area like Europe – and the modest long-term development prospects is not going to permit present rate of interest ranges to be maintained for a lot of YEARS, removed from it. The NATURAL rate of interest, R*, is a sophisticated idea virtually purely educational and calculated very in a different way by completely different establishments, however it’s not far off at 1%-1.5% for Europe.

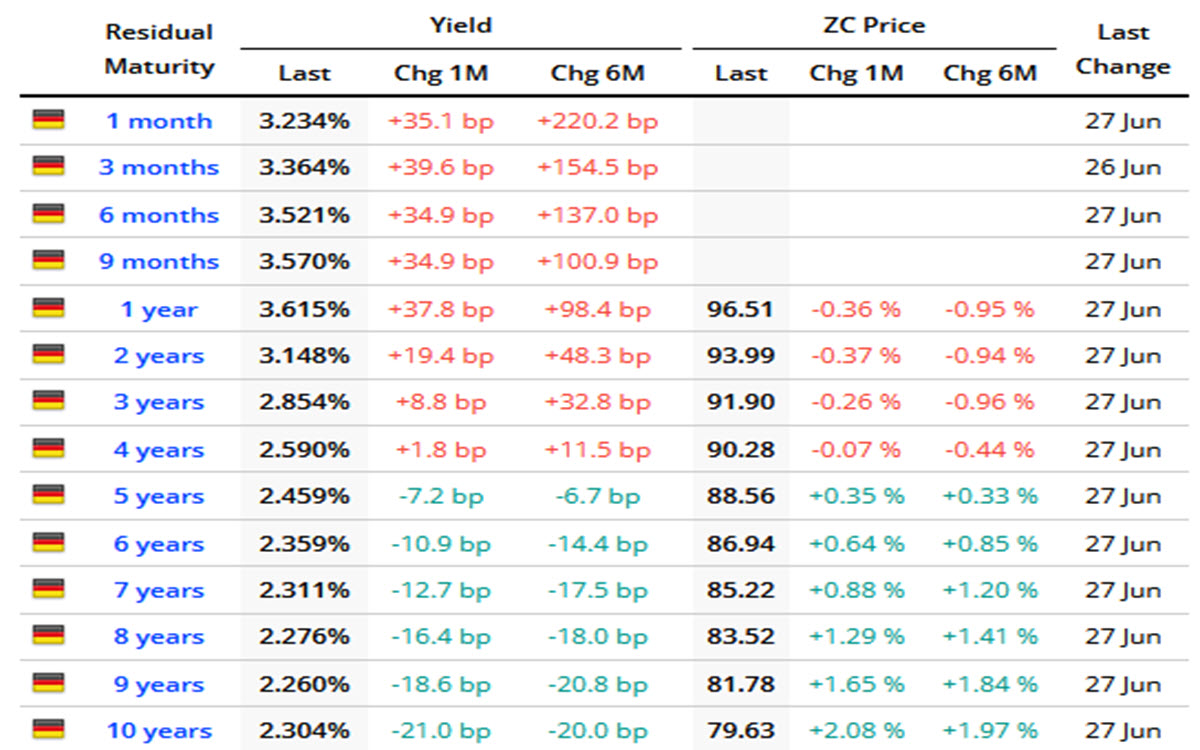

There may be nothing unusual, due to this fact, in regards to the brief finish of the curve yielding greater than the lengthy finish, as it’s extra delicate to what the central financial institution will do within the subsequent 24 months. And it’s clear that the curve is flattening (or inversely steepening) and has been doing so for months: listed below are the performances for German authorities bonds, however the identical applies for the entire Eurozone and past.

German Maturities, Yields – Costs – Change

Regardless of all of the experiences of very aggressive central banks, there have been a couple of days of fine efficiency of presidency bonds on the European continent: the UK Gilt has been rising for five periods in a row, the Italian 10 12 months BTP appears to be about to interrupt upwards the resistance represented by 117.15 and the rise within the Bund value within the final 2 days implies a drop in yields of -16 bps since final Friday.

TECHNICAL ANALYSIS

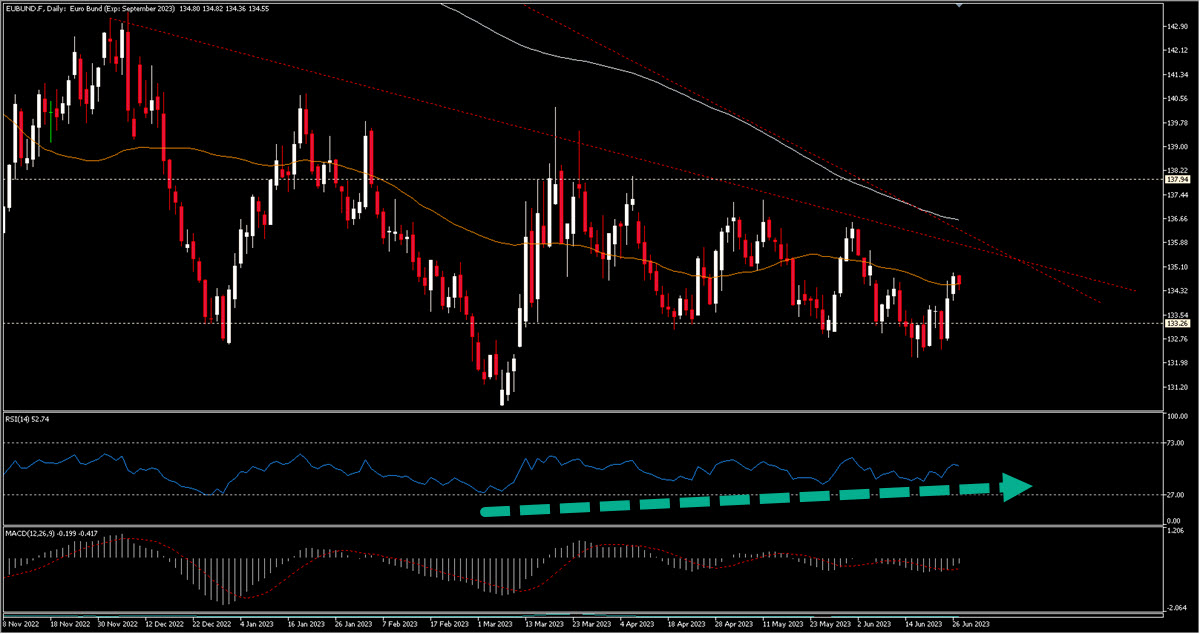

We’re solely specializing in a mid-term chart that plots the worth in 2023: to provide context, know that the BUND traded > 175 till autumn 2021 (134.56 now), so it’s clearly in a strongly bearish part (charges up).

EUBUND.F, 2023 – in the present day

The worth for the reason that finish of November is buying and selling inside a wedge and downwards we see 133.25 as an important stage (though it has been damaged a number of instances to the draw back, additionally just lately). The worth remains to be beneath the MA200 and is simply in the present day treading waters above the 50 (it has traded above it a number of instances in the previous couple of months and it might have labored as pivot for a mean-reverting technique). What can also be fascinating is RSI has been diverging – albeit slight – for months now.

A primary long-term change within the development is not going to occur and not using a break of 135.70-136.60: seeing the long run at these ranges would imply a yield decrease by about 20 bps (2.10%).

Downwards the areas to watch are the 133.25 one first after which 132.70.

In any case, after about 20 months of declining costs, it’s not to be excluded that the BUND Future might be close to the underside of its run, except there are dramatic surprises (which we contemplate unlikely for the time being) from the ECB.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]