[ad_1]

The period of tech giants overstaffing and overpaying has ended, a minimum of for now. However expertise is flooding the market, and people nonetheless employed have been left to shoulder all of the work—there’s an enormous alternative for savvy recruiters to scoop up prime performers.

At the moment’s job market is a complicated paradox. Whereas unemployment is at a report low and there’s a labor scarcity in healthcare and hospitality, tech has seen nonstop layoffs that hit 166,044 staff in Q1 2023 alone. That’s greater than all of 2022’s then-record 161,411 tech layoffs.

What’s most unprecedented is that these layoffs are hitting software program engineers, together with prime expertise at FAANG corporations that have been beforehand thought-about untouchable. That is in sharp distinction to the 2008 recession, when the U.S. high-tech trade gained about 77,000 jobs in This autumn, most in software program growth, regardless of the general U.S. labor market dropping 38,000 jobs.

327,475 folks in tech have been laid off from Q1 2022 to Q2 2023. Picture Credit: SignalFire

The reversal of fortunes for engineers is especially brutal coming off of 2021’s startup fundraising growth and relentless optimism. Corporations preempted development with hiring sprees far forward of their metrics in hopes of continued development.

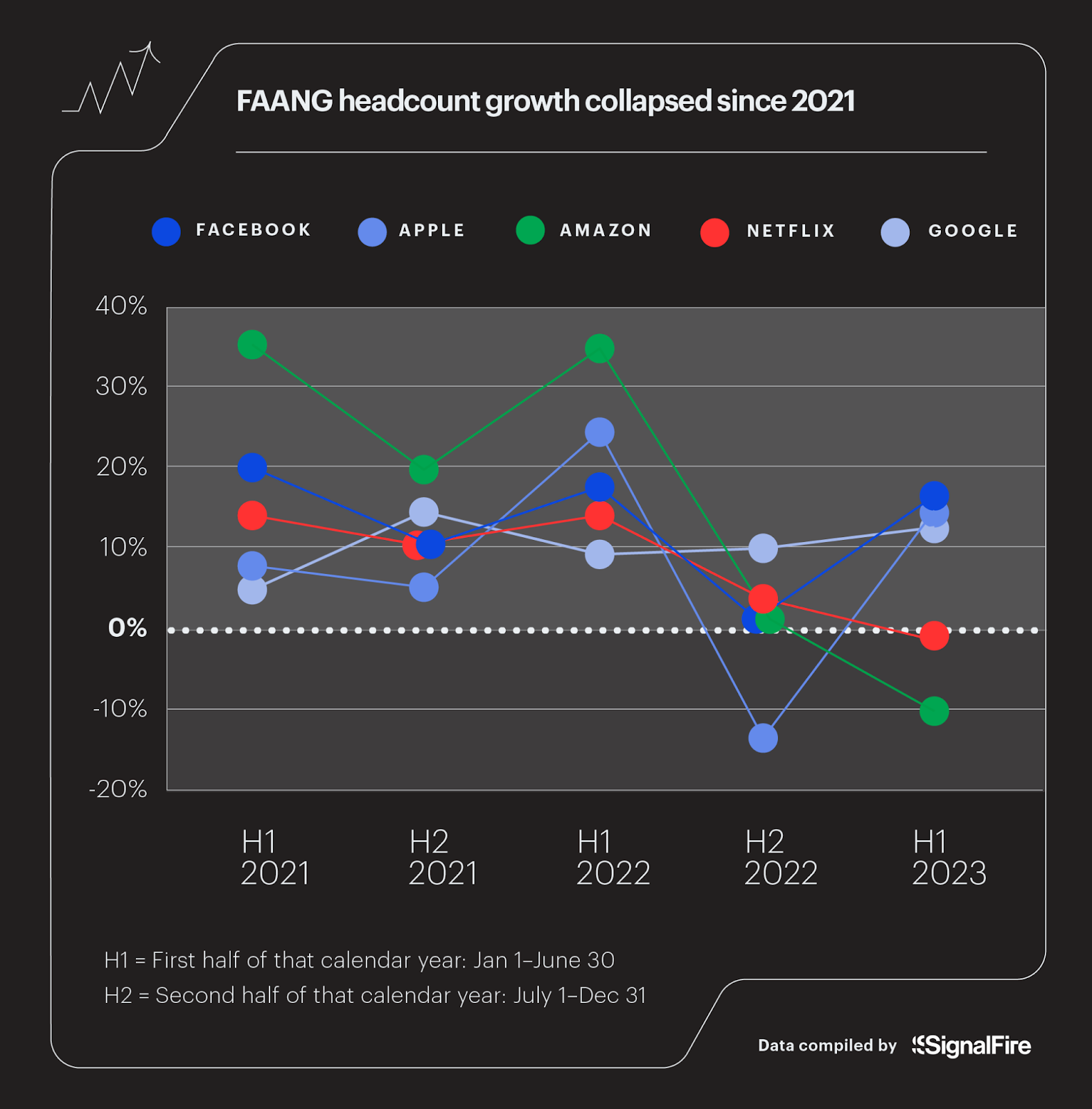

However by the summer season of 2022, the Nice Resignation and “quiet quitting” gave strategy to mass layoffs by 4 of the large 5 in tech—Meta (Fb), Apple, Amazon, Netflix, and Alphabet (Google), often called FAANG. All however Apple made sizable cuts, together with deeper cuts for software program builders.

Govt Abstract

SignalFire’s State of Expertise Report explores macro situations and top-talent motion developments in tech to determine sensible methods for profitable within the present hiring market. Prime findings embody:

-

- Hiring energy is shifting to startups as post-pandemic layoffs and finances cuts trigger a “Nice Restart” of compensation norms at huge tech corporations that may not overpay to win the perfect expertise

- An unprecedented 166,000 tech layoffs occurred in Q1 2023 – greater than in all of 2022 – and included previously untouchable software program engineers.

- Massive tech expertise has flooded the market—69% of FAANG engineers who have been laid off or left after Might 15, 2022 nonetheless listed no present job as of March 15, 2023.

- 28% of rehired FAANG engineers performed musical chairs and switched to a different tech large, whereas 6% went to early-stage startups – an 82% enhance over 2021

- Startups can capitalize on this energy shift by recruiting passive expertise who’ve survived huge tech layoffs—they’re typically loyal prime performers who’re overworked after teammates have been minimize.

- SignalFire might help startups discover and rent prime passive expertise with its Beacon AI engine and recruiting workforce.

View the State Of Expertise Takeaways deck for extra highlights.

Mass layoffs and the “Nice Restart”

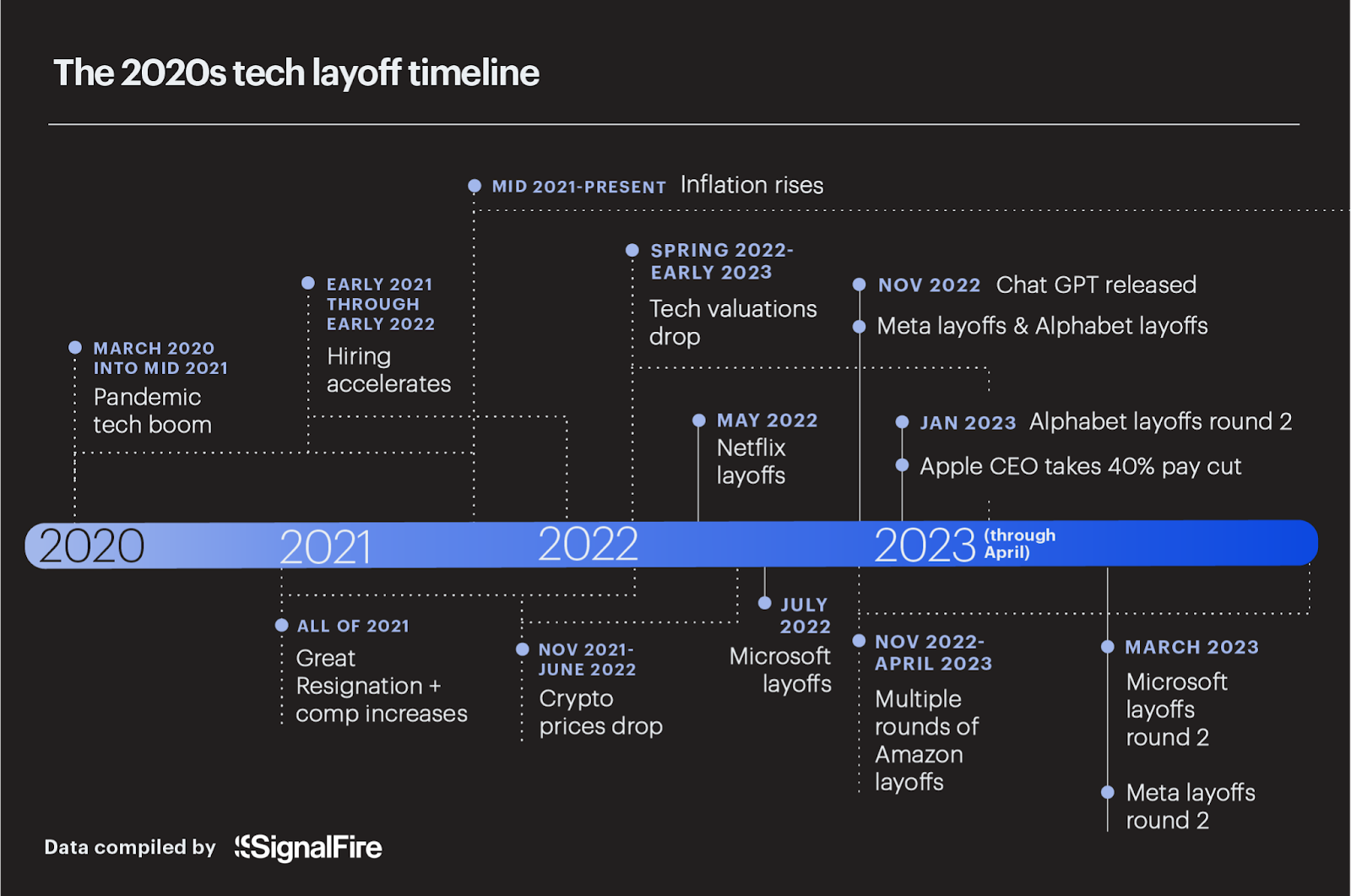

To clarify the tech expertise market’s sudden implosion, right here’s the timeline that led to an imbalance in expertise provide and demand.

Tech has seen nonstop layoffs that hit 166,044 staff in Q1 2023 alone. That’s greater than all of 2022’s then-record 161,411 tech layoffs.

- The 2020 pandemic accelerated the transfer of commerce, collaboration, and leisure on-line, inflicting a growth for a lot of tech corporations by 2021.

- Hiring accelerated in 2021, making a candidate-centric market that, coupled with the Nice Resignation, drove many corporations to make use of above-market compensation to draw and retain prime expertise.

- Coming into 2022, the fee to do enterprise normally steadily started to rise with inflation, coupled with a return to in-person actions, disrupting demand for on-line providers that had fueled pandemic tech development.

- Mid-year 2022, tech valuations and cryptocurrency costs recalibrated down.

- Bold hiring-ahead had been a strategic lever to hit formidable income targets, and as these targets have been missed, each private and non-private corporations adjusted to lower burn and lengthen their runway.

The outcome: corporations selected to equalize the decreased demand for his or her services by lowering their workforce. Notably, prime engineers weren’t spared.

2020s tech layoff timeline, March 2020-March 2023. Picture Credit: SignalFire

On this report, we share a data-based evaluation of the shifting expertise panorama beginning Might 15, 2022 — when a number of the most important modifications have been beginning to happen — by March 15, 2023, which captures the majority of related information however is just not inclusive of all exercise up to now.

We demystify the expertise market on behalf of prime engineers, in addition to the businesses the place that prime expertise may discover a new dwelling. We particularly checked out engineers who’re within the prime 25% relative to their friends — as calculated by Signalfire’s Beacon AI information platform, which leverages a proprietary machine studying algorithm we developed to gauge the standard of engineers — each individually and collectively at their corporations.

We used a cohort information method encompassing the Bureau of Labor Statistics and Layoffs.fyi to seize a time limit when tech layoffs peaked, sticking with the information lengthy sufficient to grasp outcomes for that impacted cohort. Extra on our methodology will be discovered within the appendix on the finish of the report.

How we received right here

The Bureau of Labor Statistics reported that the variety of U.S. staff who stop their jobs through the Nice Resignation between January and December 2021 made it a record-breaking yr, with practically 47.8 million whole staff quitting their jobs. That’s twice as many as left or have been laid off through the Nice Recession of 2009 and 2010.

Layoffs in tech: information compiled by SignalFire based mostly on Layoffs.fyi. Picture Credit: SignalFire

Through the years main as much as the implosion, fundraising grew in each velocity and dimension. Pitchbook NVCA Enterprise Monitor highlights that 2021 noticed a peak within the variety of offers closed (18,521) and {dollars} invested ($344.7 billion) adopted by a considerable drop in 2022, with 4 consecutive quarters of declining deal counts. The conjecture is that investor demand went down in each early- and late-stage investments.

To keep away from a down spherical — or maybe attributable to an absence of latest funding accessible altogether — corporations started to deal with extending their runway by lowering burn. Headcount and salaries are nearly at all times the largest line merchandise on an organization finances. Many corporations had used capital to rent upfront of anticipated income development after which missed income targets. They have been abruptly strapped with unsustainable burn attributable to payroll will increase.

Cue layoffs.

Because the chart beneath highlights, layoffs in tech practically doubled in 2022 in contrast with 2020; and after simply the primary quarter of 2023, that is already one other record-breaking yr for layoffs.

FAANG headcount development collapsed since 2021. Picture Credit: SignalFire

FAANGs out

For the previous decade, FAANG corporations have been seen because the protected wager for job seekers, recognized for wealthy compensation packages and excessive job safety. Beginning in the summertime of 2022, a brand new actuality set in with hiring freezes and layoffs.

[ad_2]