[ad_1]

Traits are a significant consideration that merchants should look out for when buying and selling the foreign exchange market. It is because developments have a robust affect almost about the route that the market is most probably to movement to. Think about the foreign exchange market as a river which has an underlying present. Rivers sometimes movement downstream because the foreign exchange markets would often movement within the route of the pattern. Merchants who make the error of buying and selling in opposition to the pattern is sort of a swimmer going upstream. The counter-trend commerce would in the end unfastened its vitality and revert again to the route of the pattern inflicting counter-trend merchants to incur some losses.

Pattern following merchants alternatively have the benefit of buying and selling with the movement of the market. This makes value extra more likely to transfer within the route of the pattern quite than in opposition to it.

Among the best practices that merchants can do to make sure a excessive likelihood commerce setup that’s in keeping with the route of the pattern is to look at the pattern in several horizons. Merchants ought to contemplate the short-term pattern, mid-term pattern and the long-term pattern. Trades which might be in keeping with the route of the pattern on totally different horizons are inclined to have the next win likelihood.

On this technique we will likely be how a few indicators could also be used to commerce every time each the long-term and the short-term developments are in confluence.

Ichimoku Kinko Hyo – Kumo

The Ichimoku Kinko Hyo indicator is likely one of the few technical indicators that may declare to be an entire buying and selling system by itself. It is because the Ichimoku Kinko Hyo indicator consists of a number of strains which act like a transferring common line. These strains are principally a median of value motion inside differing intervals and are moved behind or forward of the present interval.

The Ichimoku Kinko Hyo indicator consists of the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B and the Chikou Span strains. These strains signify various pattern horizons, from the short-term pattern to the long-term pattern.

The Senkou Span A and B strains kind the Kumo or Cloud, which represents the long-term pattern. Senkou Span A, or main Span A, is the median of the Tenkan-sen and Kijun-sen strains forwarded 26 intervals forward. The Senkou Span B line alternatively is the median of value motion throughout the previous 52 intervals forwarded 26 intervals forward.

The long-term pattern might be recognized based mostly on how the Senkou Span A and B strains are stacked. The pattern is bullish if the Senkou Span A line is above the Senkou Span B line, and bearish if the Senkou Span A line is under the Senkou Span B line. As such, crossovers between the 2 strains might be thought-about as a sign of a long-term pattern reversal.

Lukas 1 Arrows and Curves

Lukas 1 Arrows and Curves is a momentum following technical indicator which is each a channel kind of indicator and a sign indicator.

This indicator plots two strains which envelope value motion. One line is plotted above value motion and one other under value motion. These strains are based mostly on current excessive value actions. This creates a channel-like construction which envelopes value motion.

The indicator then identifies momentum based mostly on a candle stick closing strongly exterior of the strains. The indicator identifies these momentum reversals every time the route of the breakout is in opposition to the final momentum it recognized. It then plots an arrow on the candle the place it recognized a momentum reversal.

This indicator can be utilized as a momentum reversal sign indicator based mostly on the arrows plotted. Merchants can use these arrows as an entry set off for his or her momentum-based commerce setups.

Buying and selling Technique

This buying and selling technique is a momentum-based buying and selling technique which is aligned with the long-term pattern utilizing the confluence of pattern and momentum alerts coming from the Kumo of the Ichimoku Kinko Hyo indicator and the Lukas 1 Arrows and Curves indicator.

The Kumo is used to establish the route of the long-term pattern. That is indicated by how the Senkou Span A (dotted brown line) and the Senkou Span B (dotted thistle line) are stacked.

The pattern is then confirmed based mostly on the situation of value motion and the Lukas 1 Arrows and Curves channel is in relation to the Kumo. Additionally it is additional confirmed by value motion based mostly on the sample of the worth swings it creates.

As soon as the pattern route is confirmed, we may then anticipate the Lukas 1 Arrows and Curves indicator to provide us a momentum entry sign. The entry sign is an arrow plotted pointing the route of the long-term pattern.

Indicators:

- Ichimoku

- Lukas1_Arrows_Curves

Most popular Time Frames: 1-hour, 4-hour and every day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

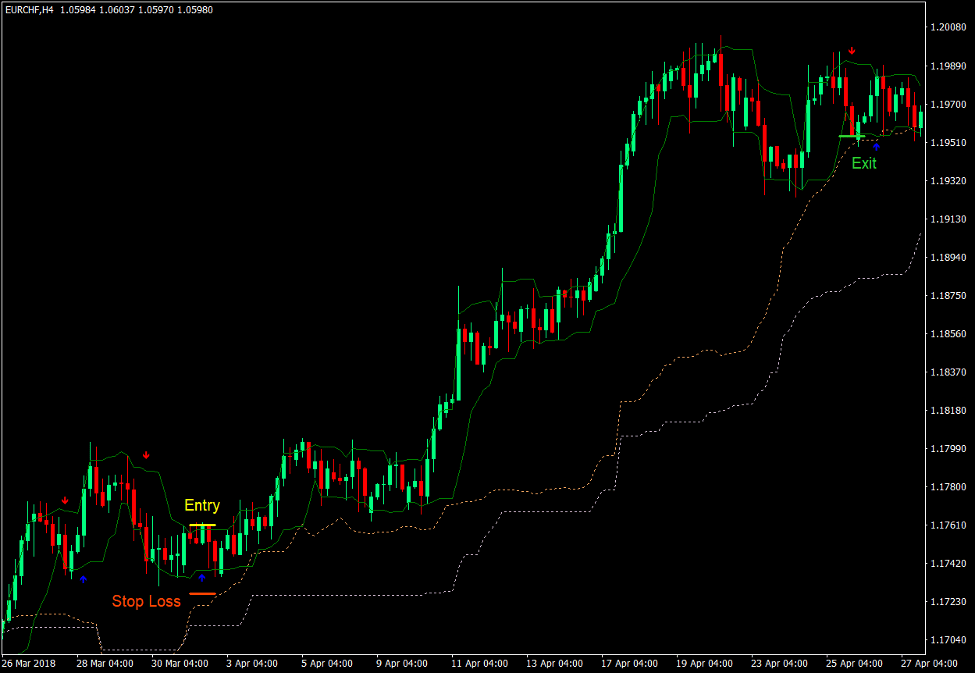

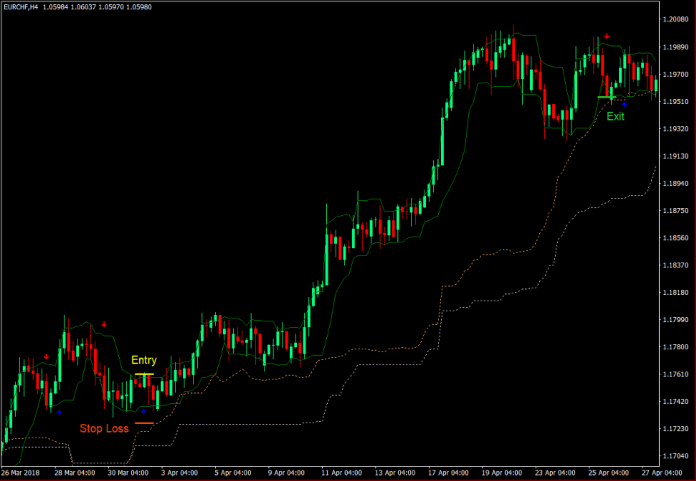

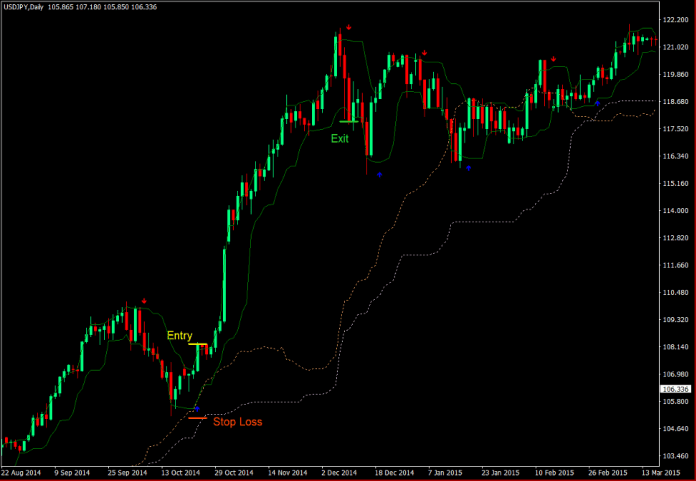

Purchase Commerce Setup

Entry

- The Senkou Span A line must be above the Senkou Span B line.

- Value motion and the Lukas 1 Arrows and Curves channel must be above the Kumo.

- Value motion ought to plot a rising swing level sample.

- Enter a purchase order as quickly because the Lukas 1 Arrows and Curves indicator plots an arrow pointing up.

Cease Loss

- Set the cease loss at a help under the entry candle.

Exit

- Shut the commerce as quickly because the Lukas 1 Arrows and Curves indicator plots an arrow pointing down.

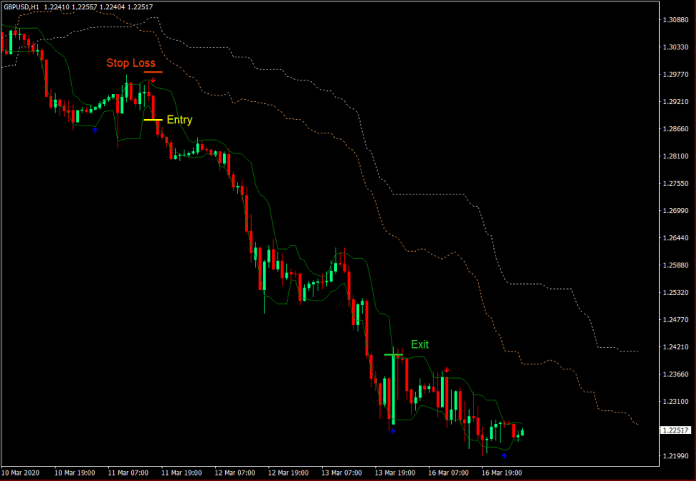

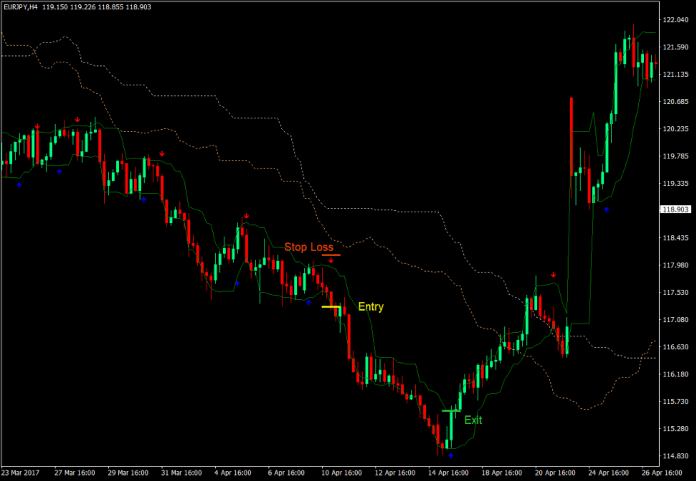

Promote Commerce Setup

Entry

- The Senkou Span A line must be under the Senkou Span B line.

- Value motion and the Lukas 1 Arrows and Curves channel must be under the Kumo.

- Value motion ought to plot a dropping swing level sample.

- Enter a promote order as quickly because the Lukas 1 Arrows and Curves indicator plots an arrow pointing down.

Cease Loss

- Set the cease loss at a resistance above the entry candle.

Exit

- Shut the commerce as quickly because the Lukas 1 Arrows and Curves indicator plots an arrow pointing up.

Conclusion

This buying and selling technique exhibits us how aligning the short-term momentum or pattern with the long-term pattern can present us with a excessive likelihood commerce setup. On prime of the excessive win likelihood, this technique additionally has the capability to supply trades with excessive yields.

This technique can be utilized as a pattern reversal technique on the long-term pattern close to the beginning of the Kumo reversal or as a pattern continuation technique because the Lukas 1 Arrows and Curves indicator plots arrows confirming the route of the pattern proper after some minor retracements.

Both approach, merchants could make use of this sort of technique to earn some income from the foreign exchange market.

Foreign exchange Buying and selling Methods Set up Directions

Arrows Curves and Clouds Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the collected historical past information and buying and selling alerts.

Arrows Curves and Clouds Foreign exchange Buying and selling Technique supplies a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional value motion and alter this technique accordingly.

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Methods to set up Arrows Curves and Clouds Foreign exchange Buying and selling Technique?

- Obtain Arrows Curves and Clouds Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Arrows Curves and Clouds Foreign exchange Buying and selling Technique

- You will notice Arrows Curves and Clouds Foreign exchange Buying and selling Technique is offered in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]