[ad_1]

Development reversals may be wonderful buying and selling alternatives because it permits merchants to realize big earnings each time they determine and reply to market reversals in a well timed method. Nevertheless, new merchants usually discover that pattern reversal setups may be very tough to anticipate particularly in a unadorned chart. New merchants usually want a extra goal indication of a potential reversal to substantiate what they see in worth motion. For this reason this technique makes use of a few momentum indicators to assist merchants objectively determine and make sure potential pattern reversals.

Supertrend Indicator

The Supertrend Indicator is a momentum indicator which identifies pattern path based mostly on the idea of utilizing an Common True Vary (ATR) indicator as a foundation for figuring out pattern path.

One of many methods merchants would determine pattern path is with the usage of the ATR. Merchants would use a a number of of the ATR as a gauge for figuring out pattern reversals. For instance, merchants would multiply the ATR by 2. In an uptrend, they’d then subtract the ensuing worth of the a number of of the ATR from the worth of the very best current swing excessive. The distinction could be the edge for figuring out a bearish pattern reversal. The pattern is taken into account to have reversed to the draw back if worth would drop under the above talked about threshold.

Inversely, merchants would add the product of the ATR and the nominated a number of to the newest recognized lowest swing low. This worth then turns into the edge for figuring out bullish pattern reversals. A bullish pattern reversal is recognized each time worth motion would breach and shut above the edge coming from a downtrend market.

Given the pattern reversal situations said above, pattern reversals and pattern path may additionally be objectively recognized utilizing the identical idea by automating the method of multiplying the ATR with a a number of, then including or subtracting the worth to the swing excessive or swing low.

The Supertrend Indicator merely plots the edge values above or under worth motion relying on the pattern path. It plots the road under worth motion to point a bullish pattern, and above worth motion to point a bearish pattern. The road crosses over worth motion each time worth motion would breach the stated threshold indicating a pattern reversal. The indicator additionally shades the realm between worth motion and the edge line making the identification of the pattern path a lot simpler.

Relative Energy Index as a Development Indicator

The Relative Energy Index (RSI) is a momentum indicator which measures the magnitude of current worth modifications. The indicator makes use of an algorithm which calculates for momentum based mostly on current worth modifications. The ensuing worth is then drawn as a line which oscillates inside the vary of 0 to 100. Its vary additionally has markers at ranges 30 and 70. The realm under 30 signifies the oversold space, whereas the realm above 70 signifies the overbought space.

Though the RSI indicator is usually used as an oversold and overbought indicator, it can be used as a pattern path indicator. To do that, we might add ranges 45, 50, and 55 as markers. The extent 50 could possibly be used as a normal pattern bias indication. Ranges above it signifies a bullish pattern, whereas ranges under point out a bearish pattern. The RSI line ought to usually be above 50 in an uptrend and under 50 in a downtrend. The degrees 45 and 55 can be utilized as a help and resistance marker for the RSI. The RSI line shouldn’t drop under 45 throughout an uptrend and shouldn’t breach above it throughout a downtrend. Crossovers above 55 might affirm a bullish pattern reversal, whereas crossovers under 45 might affirm a bearish pattern reversal.

Buying and selling Technique Idea

Supertrend RSI Reversal Confluence Foreign exchange Buying and selling Technique is an easy pattern reversal buying and selling technique which makes use of the confluence of the Supertrend reversal sign and the RSI as a foundation for figuring out potential pattern reversals.

On the Supertrend, the pattern reversal could be the crossing over of the Supertrend line and worth motion, which can be simply recognized by the altering of the colour of the filling between worth motion and the Supertrend line.

The RSI alternatively is used as a affirmation of the pattern reversal sign. This might be based mostly on the RSI line breaching above 55 or dropping under 45.

These indicator indicators also needs to be utilized in confluence with worth motion indications. This may be recognized by a break in a swing excessive or swing low help or resistance stage.

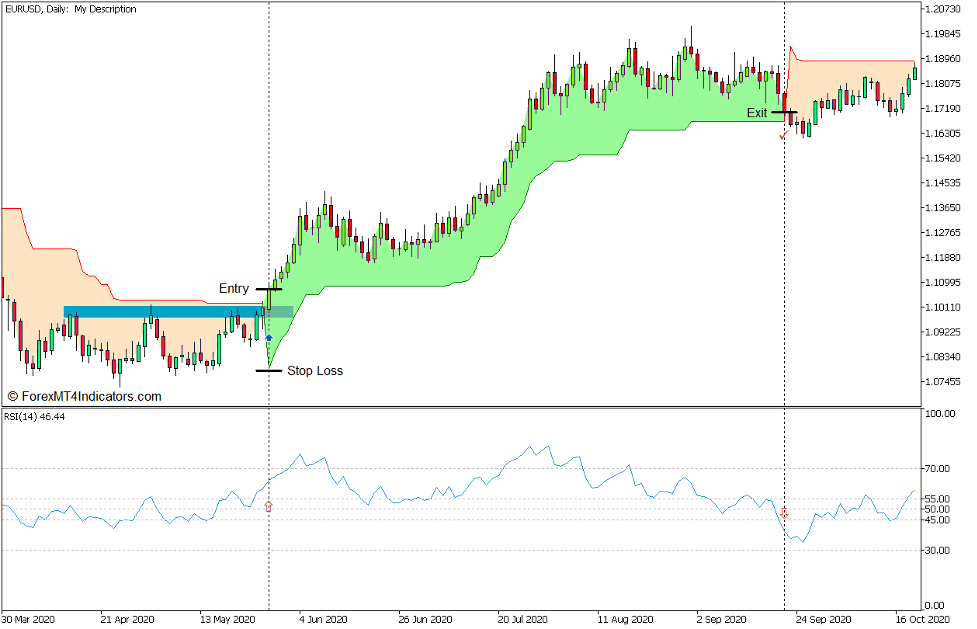

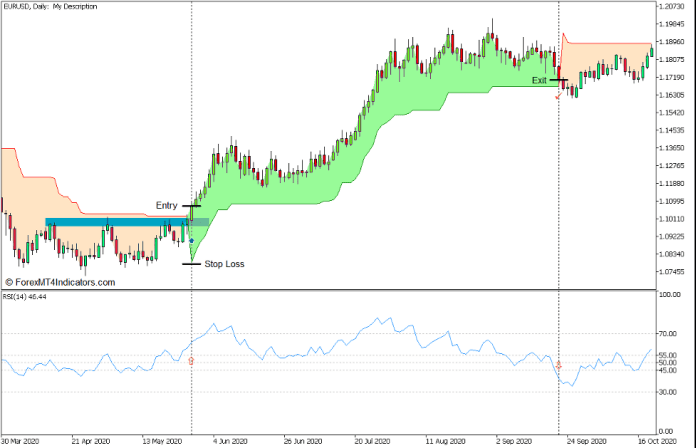

Purchase Commerce Setup

Entry

- Worth motion ought to cross and shut above the Supertrend line whereas the realm between the value motion and the Supertrend line ought to change to pale inexperienced.

- The RSI line ought to cross above 55.

- Worth motion ought to break above an recognized swing excessive resistance space.

- Open a purchase order on the confluence of those situations.

Cease Loss

- Set the cease loss under the Supertrend line.

Exit

- Shut the commerce as quickly as worth motion crosses under the Supertrend line or as quickly because the RSI line drops under 45.

Promote Commerce Setup

Entry

- Worth motion ought to cross and shut under the Supertrend line whereas the realm between the value motion and the Supertrend line ought to change to bisque.

- The RSI line ought to cross under 45.

- Worth motion ought to break under an recognized swing low help space.

- Open a promote order on the confluence of those situations.

Cease Loss

- Set the cease loss above the Supertrend line.

Exit

- Shut the commerce as quickly as worth motion crosses above the Supertrend line or as quickly because the RSI line breaches above 55.

Conclusion

This buying and selling technique is a simplified methodology for figuring out pattern reversals, permitting merchants to simply determine buying and selling alternatives which can come up each time the market begins to reverse. Using the Supertrend indicator and the RSI permits merchants to objectively affirm the pattern reversals. Nevertheless, as with all indicators, these indicators do have lag as its indicators solely observe worth. As such, this buying and selling technique is greatest utilized in confluence with worth motion pattern reversal indicators as worth motion is essentially the most direct technical indication of potential pattern reversals.

Foreign exchange Buying and selling Methods Set up Directions

Supertrend RSI Reversal Confluence Foreign exchange Buying and selling Technique for MT5 is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past information and buying and selling indicators.

Supertrend RSI Reversal Confluence Foreign exchange Buying and selling Technique for MT5 supplies a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional worth motion and alter this technique accordingly.

Beneficial Foreign exchange MetaTrader 5 Buying and selling Platforms

#1 – XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

#2 – Pocket Possibility

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 General Score!

- Mechanically Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

Learn how to set up Supertrend RSI Reversal Confluence Foreign exchange Buying and selling Technique for MT5?

- Obtain Supertrend RSI Reversal Confluence Foreign exchange Buying and selling Technique for MT5.zip

- *Copy mq5 and ex5 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Supertrend RSI Reversal Confluence Foreign exchange Buying and selling Technique for MT5

- You will notice Supertrend RSI Reversal Confluence Foreign exchange Buying and selling Technique for MT5 is obtainable in your Chart

*Notice: Not all foreign exchange methods include mq5/ex5 recordsdata. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]