[ad_1]

EUR/USD: Officers’ Phrases Drive the Markets

● Only a reminder, the Federal Open Market Committee (FOMC) of the US Federal Reserve selected Wednesday, June 14 to pause the method of financial tightening and left the rate of interest unchanged at 5.25%. The next day, on Thursday, June 15, the European Central Financial institution (ECB) raised the euro rate of interest by 25 foundation factors from 3.75% to 4.00%. ECB President Christine Lagarde famous that the tightening of credit score and financial coverage would proceed in July.

The agency rhetoric was supported by different ECB representatives. In line with feedback from ECB Governing Council member Olli Rehn, the underlying inflation within the Eurozone is declining too slowly, necessitating further efforts from the regulator to stabilize costs. The intentions of the regulator to proceed elevating charges have been additionally confirmed by ECB Chief Economist Philip Lane and ECB Governing Council member Isabel Schnabel. Of their view, the regulator has vital work to do earlier than inflation stabilizes round 2%. (In line with the most recent information, annual inflation within the Eurozone remained at 6.1%, and the Core Client Value Index stood at 5.3%).

Towards the backdrop of those hawkish statements from European officers, the markets concluded that not less than two extra fee hikes needs to be anticipated for the euro, in July and September, every by 25 foundation factors. This continued to push the euro forex increased, and EUR/USD reached a peak at 1.1011 on Thursday, June 22.

● Nevertheless, the monetary world does not revolve solely across the ECB. On June 21 and 22, market individuals’ consideration was centered on Federal Reserve Chairman Jerome Powell’s semi-annual testimony earlier than the U.S. Congress. Whereas the general rhetoric was almost equivalent to the press convention on June 14, this time Powell positioned extra emphasis on the prospects of additional fee hikes within the close to future. This sentiment grew to become notably evident on the second day of his testimony. The hawkish stance of the Fed Chair and the market’s risk-averse environment helped the American forex outperform its rivals. On Thursday, the U.S. Greenback Index (DXY) reversed its course and began transferring upwards once more, whereas EUR/USD declined.

● Nevertheless, the state of affairs for the European forex isn’t as dire, not less than within the medium time period. As an illustration, economists at ANZ (The Australia and New Zealand Banking Group) imagine that whereas the Federal Reserve might scale back its key rate of interest by 20 foundation factors by the top of the 12 months, market expectations counsel that the ECB won’t decrease its charges till early 2024. Consequently, the ECB’s easing cycle shall be later and fewer vital in comparison with the Fed’s, which is favorable for the euro. Consequently, in Q3, EUR/USD might rise to 1.1200. Total, in accordance with ANZ, the alternate charges are anticipated to fluctuate within the vary of 1.0500 to 1.1400 all through 2023.

● After the discharge of PMI information for the manufacturing and providers sectors in america, EUR/USD concluded the five-day interval at 1.0893. As for the rapid prospects, on the time of scripting this evaluation on the night of June 24, the forecast seems extremely unsure: 45% of analysts favored a decline within the pair, whereas an equal share anticipated its progress, and the remaining 10% adopted a impartial place. Among the many oscillators on the every day timeframe, 90% lean in the direction of bullish indicators, whereas 10% stay neutral-grey. Concerning the development indicators, 80% are colored inexperienced, whereas 20% are in purple. The closest help ranges for the pair are positioned round 1.0865, adopted by 1.0790-1.0800, 1.0745, 1.0670, and eventually the Could 31 low at 1.0635. Bulls will encounter resistance round 1.0900-1.0925, adopted by 1.0960-1.0985, 1.1010, and 1.1045, with additional resistance at 1.1090-1.1110.

● The upcoming week brings a cascade of macroeconomic information from america. We are able to anticipate housing market information on Tuesday, June 27, in addition to the discharge of sturdy items orders and capital items orders. Moreover, the Client Confidence Index (CCI) from the Convention Board, a number one indicator, shall be introduced. The outcomes of the nation’s financial institution stress exams shall be revealed on the next day, Wednesday, June 28, which is especially attention-grabbing given the banking disaster that adopted the Fed’s rate of interest hikes. Moreover, on the identical day, Federal Reserve Chair Jerome Powell will ship a speech. Thursday will convey labour market statistics and GDP information for the nation. Lastly, on Friday, June 30, the Core Private Consumption Expenditures (PCE) Index, a key measure of inflation, shall be launched for US residents. As for the Eurozone financial system, preliminary inflation figures (CPI) for Germany and the Eurozone as an entire, which shall be printed on June 29 and 30, respectively, are of curiosity.

GBP/USD: Financial institution of England’s Delayed Shock

● The financial information launched through the previous week in regards to the UK appeared fairly combined. A major inflation indicator, the Client Value Index (CPI), remained unchanged for the month, standing at 8.7% YoY, surpassing market expectations of 8.4%. Retail gross sales confirmed a constructive outlook as they unexpectedly grew by 0.3% for the month, opposite to the anticipated decline of -0.2% and the earlier worth of 0.5%. The core retail gross sales, excluding automotive gas, elevated by 0.1% towards the detrimental forecast of -0.3% and the earlier month’s 0.7%. Nevertheless, the enterprise exercise indicators within the nation have been disappointing. The preliminary Providers Buying Managers’ Index (PMI) decreased to 53.7 in June, in comparison with the anticipated 54.8. The Manufacturing PMI additionally fell in need of expectations, dropping from 47.1 to 46.2 (forecast: 46.8).

● The inflation information launched on June 21 not solely exceeded market expectations but in addition surpassed the Financial institution of England’s (BoE) personal forecasts. Towards this backdrop, the central financial institution shocked the markets throughout its assembly on Thursday, June 22, by elevating the bottom fee not by 25 foundation factors however by 50 foundation factors, bringing it to five.00%.

Following standard logic, such a transfer ought to have considerably supported the British forex. Nevertheless, that was not the case. GBP/USD initially jumped 60 pips to 1.2841 inside 10 minutes of the BoE resolution, however then declined by over 100 pips to 1.2737. Analysts imagine that the preliminary upward motion was pushed by information headline-reactive algorithmic buying and selling, however the bullish momentum was later dampened as sellers encountered resistance close to 14-month highs recorded on June 16.

● Strategists from the biggest banking group within the Netherlands, ING, imagine {that a} 150 foundation level fee hike was already priced in earlier than the Central financial institution assembly. The 50-basis level enhance has occurred, and now markets are anticipating an extra 100 foundation level rise to six.00%. Together with the aggressive fee hike, market hypothesis is rising that the Financial institution of England, with the intention to keep away from an financial collapse, could also be compelled to start easing its financial coverage ranging from the summer season of 2024 (and even earlier).

Economists at Commerzbank argue that the BoE began elevating the important thing fee too late and too slowly, placing itself ready of enjoying catch-up. In line with their view, the regulator is chasing inflation reasonably than actively combating it by financial coverage, which might have a detrimental impression on the British forex.

Nevertheless, completely different opinions exist. Scotiabank economists, for instance, anticipate that GBP/USD might rise to 1.3000 within the close to future. Colleagues at ING share this view, stating, “Trying on the charts, it appears that evidently there aren’t any vital ranges between present ranges and 1.3000, which means that the latter isn’t far-off.”

● GBP/USD ended the previous week on the degree of 1.2714. Given the present volatility, theoretically, it might cowl the remaining distance to 1.3000 in just some weeks and even days. Presently, 45% of surveyed specialists help this situation, whereas 25% maintain the other view, and 30% desire to chorus from commenting. By way of technical evaluation, each oscillators and development indicators on the every day timeframe mirror the readings of their counterparts for EUR/USD. Within the occasion of a southward motion within the pair, it would encounter help ranges and zones at 1.2685-1.2700, 1.2625, 1.2570, 1.2480-1.2510, 1.2330-1.2350, 1.2275, and 1.2200-1.2210. Within the case of an upward motion, the pair will face resistance ranges at 1.2760, 1.2800-1.2815, 1.2850, 1.2940, 1.3000, 1.3050, and 1.3185-1.3210.

● One notable occasion within the upcoming week’s calendar is Friday, June 30, when the GDP information for the UK shall be launched.

USD/JPY: The Journey to the Moon Continues

● We issued a “Ticket to the Moon” for USD/JPY a couple of weeks in the past, and it continues to be in impact. The pair reached a peak of 143.86 final week. In line with Commerzbank, “the yen’s weak spot is progressively taking over a dramatic character.” Economists at Singapore’s United Abroad Financial institution (UOB) forecast that the greenback is prone to proceed rising within the subsequent 1-3 weeks. They state, “The subsequent vital degree is 144.00. It’s nonetheless too early to find out whether or not the greenback’s power […] will break above this barrier. Alternatively, our sturdy help degree has been adjusted to 141.60 from 141.00.”

● Economists at MUFG Financial institution imagine that the rising divergence in financial coverage between the Financial institution of Japan and different main central banks is a recipe for additional weakening of the yen. “The widening yield differentials between Japan and international international locations, together with the discount in forex and fee volatility, contribute to the yen changing into more and more undervalued,” write analysts at MUFG. In line with their counterparts on the French monetary conglomerate Societe Generale, if there may be one other rate of interest hike in america in July, the USD/JPY pair might rise to 145.00.

● It’s clear that the yen is struggling not solely from the persistently “dovish” stance of the Financial institution of Japan (BoJ) but in addition from the general rise in world yields. The strain on the Japanese forex can solely be alleviated by the hope that the BoJ will finally take step one in the direction of ending its ultra-loose financial coverage. As an illustration, economists at Danske Financial institution hope that USD/JPY alternate fee will fall under 130.00 inside a 6–12-month horizon. Comparable forecasts are made by strategists at BNP Paribas, with targets of 130.00 by the top of the present 12 months and 123.00 by the top of 2024.

● As for the Japanese authorities and the Financial institution of Japan, it appears that evidently they don’t seem to be but prepared for any vital adjustments. Final week, Finance Minister Shunichi Suzuki acknowledged that whereas they carefully monitor forex actions, they don’t have any intention of commenting on them. He added that “sharp forex actions are undesirable” and that “forex charges needs to be decided by the market, reflecting elementary indicators.” Nevertheless, it seems to us that the pinnacle of the finance ministry is being misleading. We solely must recall the sudden forex interventions carried out by the Financial institution of Japan final 12 months, prompted by the Ministry of Finance. By means of these interventions, the yen was capable of strengthen towards the greenback by over 1,500 pips. Is it not attainable for the same shock to happen now?

● After reaching one other excessive at 143.86, the pair concluded the previous five-day interval at 143.71. On the time of scripting this evaluation, 60% of analysts anticipate that the yen will get well not less than a few of its losses and push the pair decrease, whereas 30% of specialists level to the west. Though the variety of supporters for pair progress this time stands at simply 10%, it is value noting that even the minority could be proper. Furthermore, it’s supported by technical evaluation, as all 100% of development indicators and oscillators on the every day timeframe level upwards. Nevertheless, 1 / 4 of the oscillators actively sign overbought situations for the pair. The closest help degree is positioned within the 143.00-143.20 zone, adopted by 142.20, 1.4140, 140.90-141.00, 1.4060, 139.85, 1.3875-1.3905, 138.30, and 137.50. The closest resistance is at 143.85, after which bulls might want to overcome obstacles at 144.90-145.30, 146.85-147.15, 148.85, and doubtlessly attain the October 2022 excessive at 151.95.

● There is no such thing as a vital financial data associated to the Japanese financial system anticipated to be launched through the upcoming week.

CRYPTOCURRENCIES: Influencers Betting on Bitcoin

● Bears dominated the crypto marketplace for 9 consecutive weeks. Nevertheless, the state of affairs abruptly modified on June 15 as bitcoin unexpectedly demonstrated a speedy progress. It broke by resistance ranges at $25,000, $26,500, and surpassed $30,000, reaching a peak of $31,388 on June 23. The rise throughout nowadays amounted to over 26%. Altcoins additionally adopted bitcoin’s upward development, with ethereum gaining roughly 19% in weight.

Bitcoin’s surge was fuelled by a collection of constructive information. The primary spotlight was the announcement that funding big BlackRock filed an utility to launch a spot bitcoin belief, aiming to simplify institutional entry to the crypto market. Nevertheless, this information wasn’t the one one. Certainly one of Germany’s largest monetary conglomerates, Deutsche Financial institution, declared its entry into the digital asset market and its involvement in cryptocurrency custody providers. Wall Avenue monetary giants Citadel and Constancy joined forces to launch a decentralized crypto alternate known as EDX Markets on June 20. One other funding big, Invesco, which manages property value $1.4 trillion, filed an utility for a spot Bitcoin ETF. (MicroStrategy believes that such an ETF might appeal to trillions of {dollars}). Lastly, the issuance of a brand new batch of Tether (USDT) stablecoins might have additionally contributed to the expansion of BTC/USD.

● It’s value noting that the surge of the flagship cryptocurrency occurred regardless of the U.S. Securities and Change Fee’s (SEC) crackdown on the digital market. Beforehand, the SEC filed lawsuits towards Binance and Coinbase, accusing the platforms of promoting unregistered securities. Within the court docket paperwork, the Fee labeled over a dozen tokens as securities. In line with specialists, a victory for the regulator might result in the delisting of those cash and limit the potential growth of their blockchains. The regulator has already included over 60 cash on its blacklist.

Preston Pysh, the creator of widespread funding books, believes that the regulatory strain was a deliberate marketing campaign. Its intention is to supply main gamers with the chance to enter the digital asset market below beneficial situations. He helps his viewpoint with the daring strikes made by Wall Avenue giants, as talked about earlier.

● The TV host and billionaire, Mark Cuban, and former SEC government, John Reed Stark, mentioned the continued crackdown on the crypto business. Stark believes that the actions taken by the SEC are essential. In line with him, the regulator is attempting to guard buyers from potential fraud and scams on this sector. He’s additionally satisfied that the SEC’s actions will in the end profit the business by filtering out dishonest individuals and rising transparency. As for Mark Cuban, he drew parallels with the early days of the web. Within the billionaire’s opinion, “90% of blockchain corporations will fail. 99% of tokens will fail. Identical to 99% of early web corporations.”

● It’s value noting that many influencers are skeptical about cryptocurrencies and are placing bitcoin apart. We’ve already quoted Benjamin Cowen, the founding father of Into The Cryptoverse, who believes that altcoins “will face reckoning whereas bitcoin dominance continues to develop.” The same sentiment was expressed by famend dealer Gareth Soloway, who acknowledged that he has all the time in contrast the crypto market to the dot-com bubble. In line with him, a collapse much like the early 2000s will happen on this business. Soloway reassured that “the system must be cleared of junk” with the intention to thrive. He believes that 95% of all tokens “will try in the direction of zero.”.

● Robert Kiyosaki, the creator of the guide “Wealthy Dad Poor Dad,” has lately warned about an impending actual property market crash. In line with the skilled, California mortgage lender LoanDepot is already on the verge of chapter, and the upcoming actual property market collapse is prone to be a lot worse than the 2008 disaster. On this state of affairs, Kiyosaki as soon as once more suggested his followers to organize for the catastrophe and accumulate treasured metals and bitcoin.

Mike Novogratz, CEO of Galaxy Digital, additionally believes that within the struggle towards inflation, the demand for different devices will enhance, and considered one of them is Bitcoin, which he predicts will attain $500,000 in the long run. Max Keiser, a former dealer and tv host who’s now an advisor to Salvadoran President Nayib Bukele, talked about an excellent increased determine of $1 million per coin. Cathy Wooden, CEO of ARK Make investments, additionally believes that the $1 million goal is achievable.

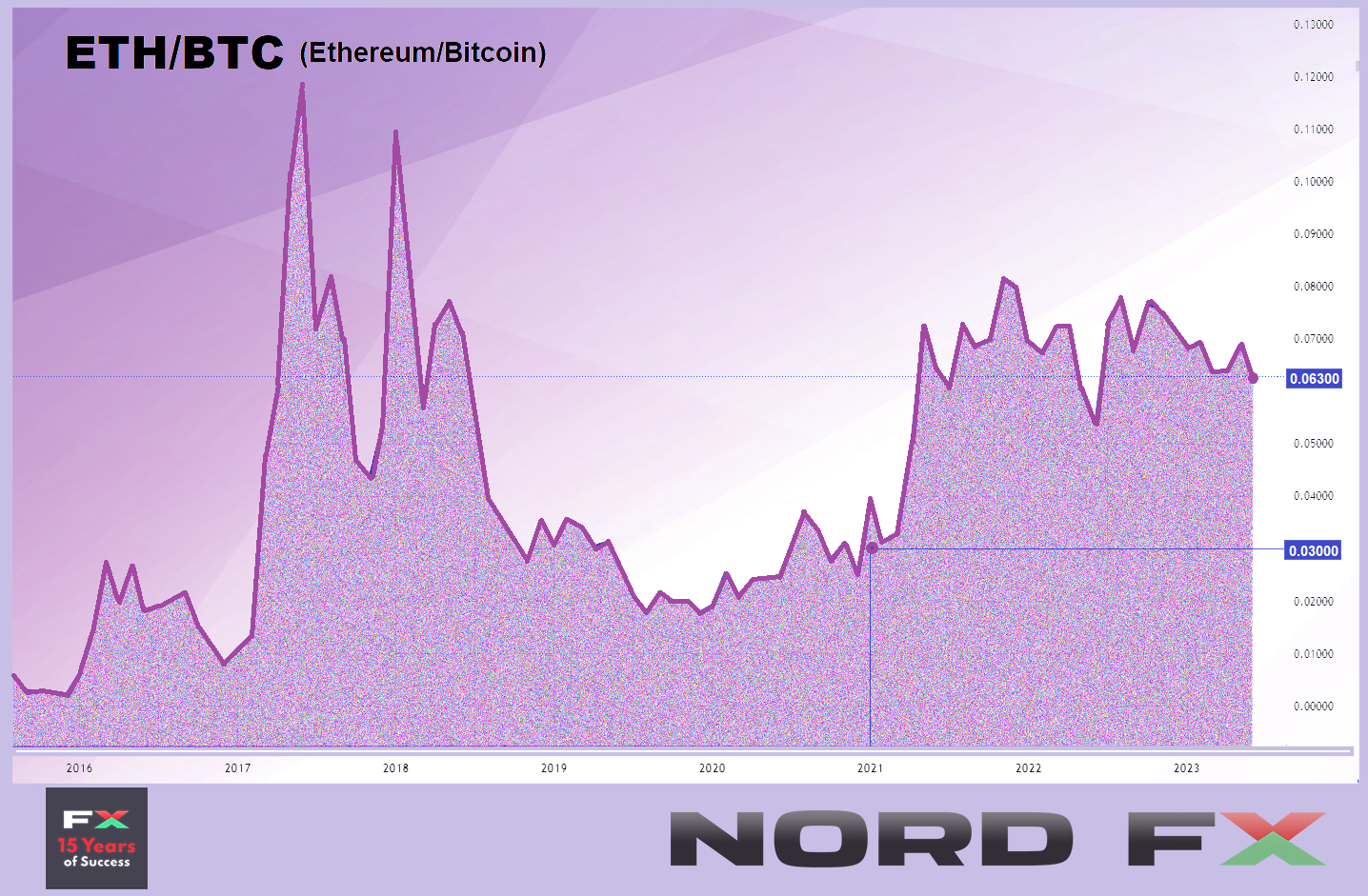

● Peter Brandt, often called the “Mysterious Market Wizard,” has joined the ranks of bitcoin reward, expressing doubts about all cash besides Bitcoin. This legendary dealer and analyst acknowledged that bitcoin is the one cryptocurrency that can efficiently end this marathon. He later added that ethereum (ETH) is prone to survive, however the actual legacy belongs to bitcoin. Benjamin Cowen, talked about earlier, additionally predicts difficulties for ethereum, suggesting that ETH/BTC might plummet to Q1 2021 ranges within the close to future, doubtlessly shedding as much as 45% of its present worth.

● Chris Burniske, a associate at enterprise capital agency Placeholder, has famous that cryptocurrencies typically expertise progress when the Nasdaq 100 (NDX) index takes a breather. Cooling off in shares prompts capital to circulation into riskier property, and bitcoin begins a bullish rally. Burniske refers to observations made by Glassnode’s founders, Jan Happel and Yann Allemann. In line with their findings, since 2019, bitcoin has proven sturdy progress after indicators of bullish exhaustion within the NDX. Presently, bitcoin is just some steps away from surpassing the NDX as soon as once more because the index nears an area peak.

● Widespread investor and founding father of enterprise firm Eight, Michael Van De Poppe, believes that the present market situations make it not possible for the detrimental forecasts for BTC to return true, as some authors predict a drop within the cryptocurrency to $12,000. In line with his opinion, buyers ought to now “fill their pockets” in anticipation of additional progress.

● BTC dominance reached 50% on Thursday, June 21. Which means that half of your complete cryptocurrency market capitalization is accounted for by this asset. The final time the index was this excessive was two years in the past in Could 2021. The present rise is attributed to the strain from the SEC on altcoins and the applying for a spot bitcoin belief by BlackRock. Michael Saylor, the CEO of MicroStrategy, believes that bitcoin dominance will proceed to develop and attain 80% within the coming years. “Presently, there are 25,000 tokens of various high quality out there, which confuses giant buyers,” he says. “After eradicating pointless property by the SEC, main capital shall be extra keen to put money into the main cryptocurrency.”.

● On the time of writing the evaluation, on the night of Friday, June 23, BTC/USD is buying and selling at round $30,840. The whole market capitalization of the cryptocurrency market stands at $1.196 trillion ($1.064 trillion every week in the past). The Crypto Worry & Greed Index has returned to mid-April ranges, leaping from the Impartial zone to the Greed zone over the week, and rising from 47 to 65 factors.

NordFX Analytical Group

Discover: These supplies aren’t funding suggestions or pointers for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]