[ad_1]

Yesterday was HMRC tax hole day – which is the day after they admit how a lot tax they didn’t accumulate, of their estimation.

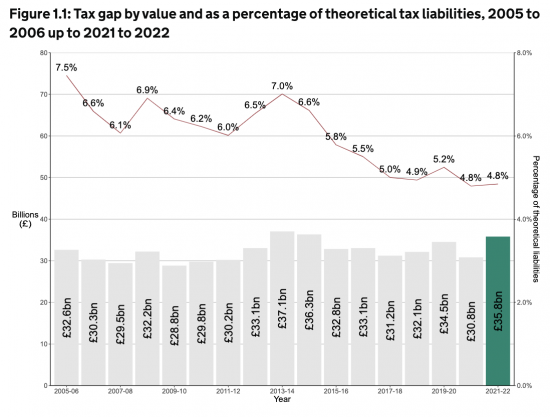

My customary joke of the final decade has been confirmed but once more. Each time I’m requested about HMRC’s tax hole (which I was typically, as a result of I did in depth work on this problem from 2008 to 2015) I joke that it is a quantity very near £32 billion, regardless of the true quantity may truly be. And so it was once more this yr:

That determine shouldn’t be even remotely right due to the restrictions inside the methodologies that HMRC use, about which I’ve written many occasions up to now.

I’d additionally observe that it’s statistically implausible to get this consequence.

I’ve argued earlier than for an Workplace of Tax Duty to correctly appraise the work of HMRC, the tax hole and now tax spillovers. It hasn’t occurred. However a authorities that was critical about this may be placing one in place. On a regular basis they do not, we’ve to imagine that they are pleased for the tax abuse to proceed, and that begs the query, why is that?

For a correct understanding of what we have to do I like to recommend a chapter I wrote on this problem some time in the past.

[ad_2]