[ad_1]

“Inflationary pressures proceed to be excessive and there’s a lengthy solution to go to carry inflation again to 2%,” Fed Chairman Jerome Powell informed the Home Monetary Companies Committee on Wednesday, and “my colleagues and I perceive the difficulties {that a} excessive inflation, and we stay decided to carry inflation again to our 2% goal”, whereas “it might make sense to boost charges extra reasonably”.

“We’ll proceed to make selections from assembly to assembly primarily based on incoming information, their implications for the outlook and the stability of danger,” Powell added.

After his speech, the primary US inventory indices accelerated their decline, and their unfavorable intra-week dynamics continued into the primary half of the buying and selling day on Thursday.

Nonetheless, the greenback did not capitalize on this as its DXY index broke by way of 102.00 yesterday and has already fallen to 101.60, the bottom degree since Might twelfth. One other dissonance is noticed available on the market: the primary US and world inventory indices are falling, together with them the greenback and gold quotes are falling!!!, however the primary commodity and European currencies are rising.

The greenback is prone to stay underneath stress till optimistic and necessary macro statistics start to come back in from the US, and it’s scheduled for Friday: at 13:45 (GMT) will likely be printed preliminary indices (from S&P International) of enterprise exercise (PMI) in manufacturing sector, element and repair sector of the American economic system. They’re an necessary indicator of the state of those sectors and the American economic system as an entire. The info above the worth of fifty point out an acceleration of exercise, which has a optimistic impact on the quotes of the nationwide foreign money.

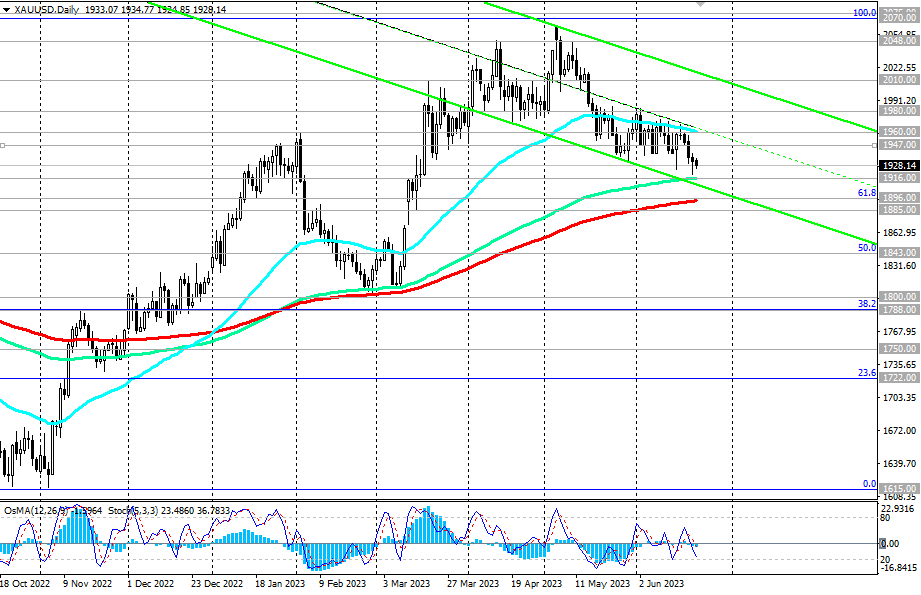

As for the gold talked about above, its quotes are very delicate to adjustments within the financial coverage of the world’s largest central banks, primarily the Fed, and proceed to say no immediately, whereas the XAU/USD pair is declining in direction of the decrease border of the descending channel on the each day value chart, passing within the zone of key help ranges 1916.00, 1896.00. A break of those ranges and the help degree 1885.00 will open the best way for a deeper decline in direction of the important thing long-term help ranges 1800.00, 1750.00, separating the long-term bullish pattern of gold from the bearish one.

In another state of affairs, the breakdown of the closest and short-term resistance degree 1936.00 would be the first quickest sign for the resumption of lengthy purchases, and the breakdown of the resistance ranges 1960.001980.00 will likely be a confirming one. Progress targets on this case are close to the resistance ranges 2000.00, 2048.00, 2070.00.

Assist ranges: 1916.00, 1900.00, 1896.00, 1885.00, 1843.00, 1800.00, 1788.00, 1750.00

Resistance ranges: 1936.00, 1947.00, 1960.00, 1980.00, 2000.00, 2010.00, 2048.00, 2070.00

[ad_2]