[ad_1]

ESG components will be thought-about solely to garner the very best risk-adjusted returns.

In Wisconsin and Texas district courts, plaintiffs are suing authorities officers to dam the Division of Labor’s new rule on ERISA funding duties with regard to environmental, social, and governance (ESG) components. They contend that the so-called “Biden Rule” violates the regulation and, within the case of the Texas grievance, has damage companies. In response to those fits, Mark Iwry, a former Treasury official and doubtless the nation’s main skilled on the coverage and regulation of retirement plans, has submitted Amicus briefs – to not take sides – however to make clear that, regardless of a whole lot of ping-ponging rhetoric throughout administrations, the ultimate “Biden Rule” and the ultimate “Trump Rule” are just about an identical.

The rationale for the similarity is that each guidelines are tightly constrained by ERISA, as interpreted by the Supreme Court docket in 2014 (Fifth Third Bancorp v. Dudenhoeffer). The Supreme Court docket, in a unanimous choice, mentioned very clearly that fiduciary funding choices should be made for the unique goal of maximizing risk-adjusted returns. Each the ultimate Biden Rule and the ultimate Trump Rule make it very clear {that a} fiduciary can’t make an funding choice for every other goal. The Biden Rule says ESG components will be thought-about solely to the extent that they’re related to a risk-return evaluation, not as collateral advantages. The Trump Rule successfully reaches the identical conclusion, however states it within the adverse – ESG components should not be thought-about to the extent they’re not a “pecuniary issue.”

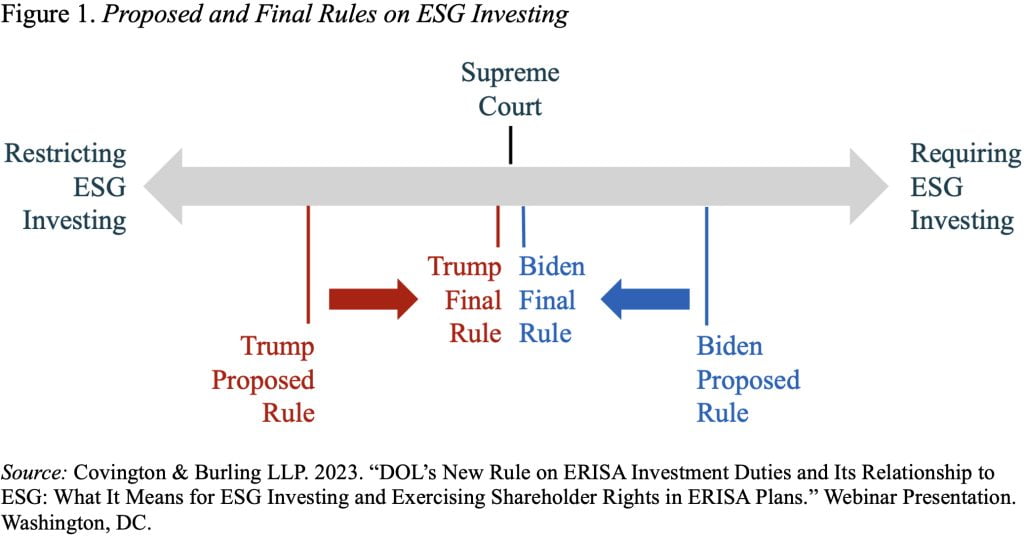

So why are the Trump and Biden Guidelines usually perceived as being inconsistent with each other? Most likely as a result of, in every administration, the proposed guidelines that preceded the ultimate guidelines staked out diametrically opposed views on the appropriateness of utilizing ESG components in funding choices (see Determine 1). The proposed Trump Rule created the impression that the ultimate rule would prohibit any consideration of ESG components, which it didn’t do. Equally, the proposed Biden Rule created the impression that the ultimate rule would require consideration of ESG components, which it didn’t do.

Each guidelines do make a slim exception to allow consideration of collateral advantages to interrupt a tie, offered risk-adjusted returns should not sacrificed. The Biden Rule makes use of barely completely different language to outline a tie and removes the formal requirement that ties should be documented, however the thrust of the slim exception stays the identical. Importantly, ties happen very hardly ever as a result of it’s so tough to ascertain that two investments would “equally serve” the monetary pursuits of the plan within the first place.

The underside line is that the provisions concerning consideration of ESG components in investments lined by ERISA are very clear. Such consideration is suitable when – and solely when – it’s related to risk-return evaluation, with the objective of that evaluation being the maximization of monetary advantages to plan contributors. And – regardless of the political rhetoric on each side – that constraint doesn’t change from one administration to the subsequent. The DOL and plan fiduciaries should observe the Supreme Court docket’s very clear interpretation of ERISA.

[ad_2]