[ad_1]

The cryptocurrency market appears to be recovering constructive dynamics after a noticeable drop because the starting of final month. The chief right here once more is BTC, which is presently holding close to the 26500.00 mark.

Market individuals and consumers of cryptocurrencies cheered up a little bit after the latest Fed financial coverage assembly, at which the rate of interest was stored within the vary of 5.00%-5.25% after ten consecutive will increase.

In Might, the annual client inflation price slowed to 4.0% from 4.9% a month earlier, and the bottom worth excluding gasoline and meals costs from calculations was 5.3% as a substitute of 5.5%. Fed officers have declared their readiness to return to the “hawkish” course in case of dangers of client worth will increase. However to this point, inflation is declining, enterprise exercise is recovering, and the state of affairs on the labor market stays steady.

Instantly after this determination of the Fed, cryptocurrencies virtually didn’t react to it in any method, given the lawsuits in opposition to the most important crypto forex corporations initiated by the US Securities and Trade Fee (SEC). Specifically, 13 expenses had been introduced in opposition to the Binance trade, together with distribution of unregistered BNB and BUSD tokens and unlawful staking.

Some crypto market specialists recommend that because of this, the American authorities will oblige American crypto platforms to register with the SEC as brokers, and tokens will probably be categorised as securities, which, in flip, will put unprecedented strain on the trade.

This case and the ensuing dangers of losses within the crypto trade have turn into a catalyst for the withdrawal of investor funds from crypto funds. Right here, a form of file belongs to BTC (a lack of $ 52.0 million in per week).

Nonetheless, on the finish of the week, an upward correction started on the crypto market, which can once more develop right into a steady bullish pattern.

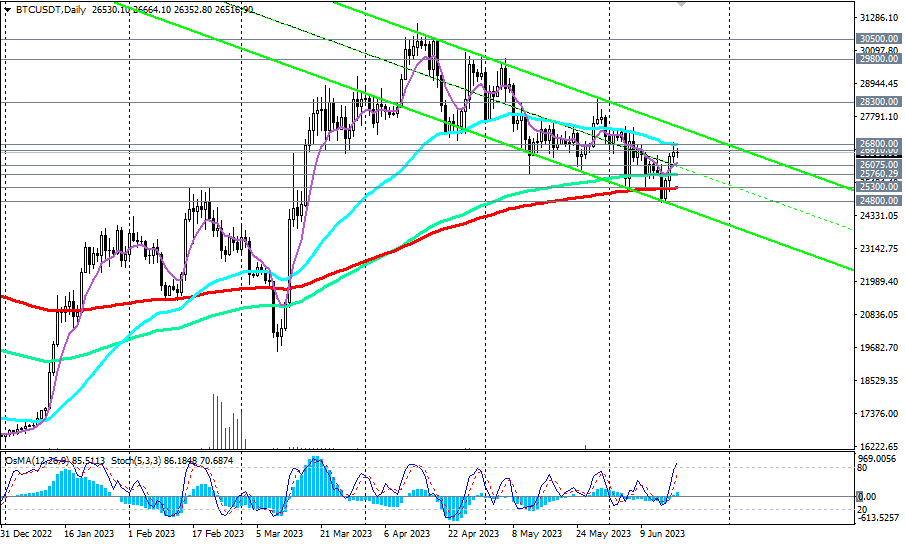

So, the BTCUSDT pair, having discovered help on the key degree of 25300.00 (EMA200 – see the each day chart), tried to interrupt by way of the resistance at 26800.00 (EMA50 on the each day chart) on the weekend, however then retreated to the present degree of 26500.00.

If the second try seems to be extra profitable, then the prospect of development opens as much as the degrees of 28300.00, 29800.00, 30500.00. As you possibly can see, now is an efficient time to renew lengthy positions and purchase.

An alternate state of affairs will probably be related to a breakdown of the native help degree of 24800.00. On this case, restrictive stops in lengthy positions will probably be acceptable already beneath the essential help ranges of 26075.00 (EMA200 on the 1-hour chart), 25760.00 (EMA144 on the each day chart).

Help ranges: 26075.00, 25760.00, 25300.00, 24800.00

Resistance ranges: 26610.00, 26800.00, 28300.00, 29800.00, 30500.00

*) ByBit charts

· see additionally “Technical evaluation and Commerce relations” -> Telegram – https://t.me/traderfxcrypto

· bonuses and rewards in Bybit -> https://www.bybit.com/en-US/task-center/rewards_hub/?affiliate_id=56638

[ad_2]