[ad_1]

Vanguard is out with its annual deep dive into what its 5 million 401k members are as much as. The agency’s launch of How America Saves is chock full of knowledge and charts exhibiting how 401k financial savings have reached all-time highs at Vanguard; I count on different giant plan managers like Constancy and Schwab to be at or close to comparable ranges.

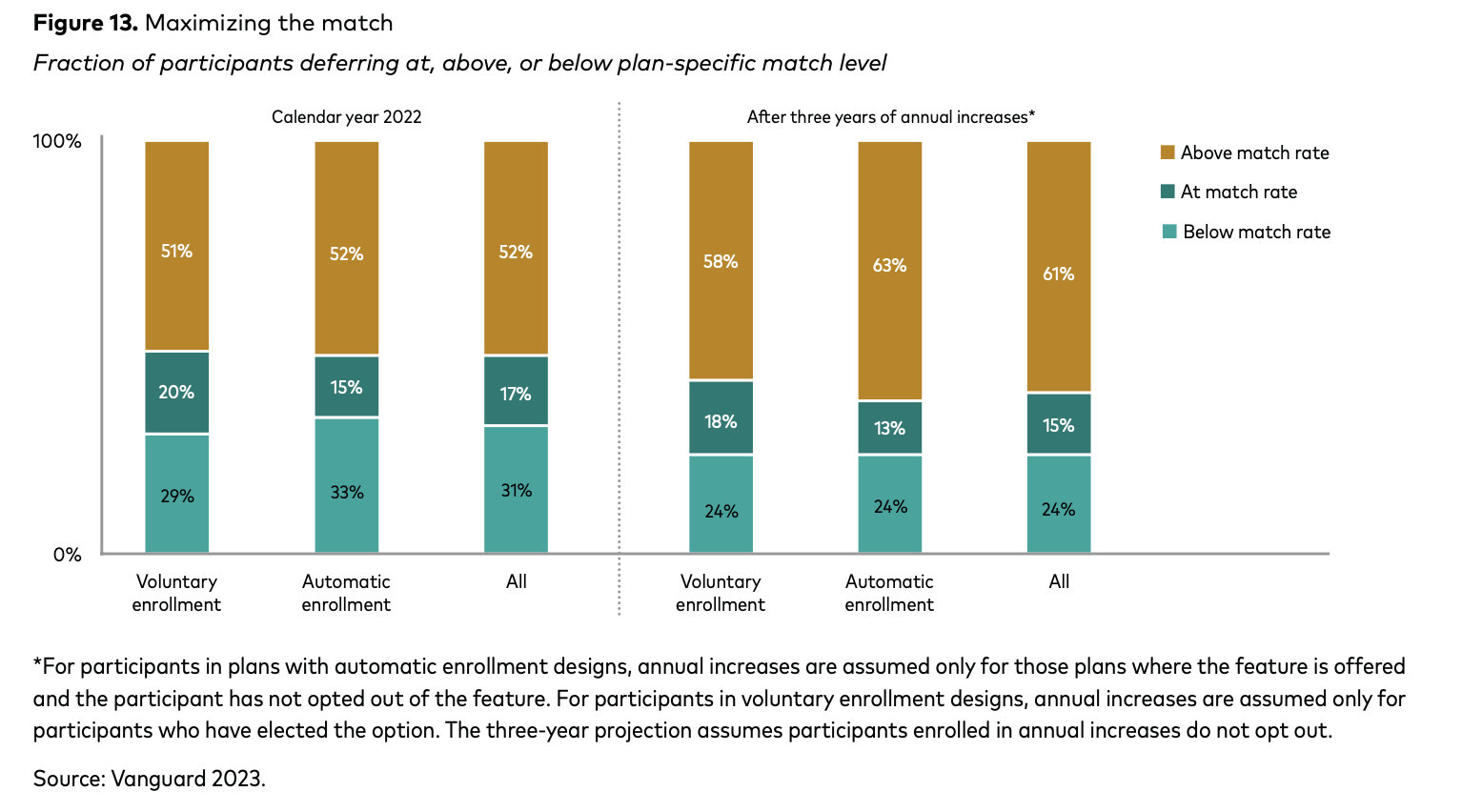

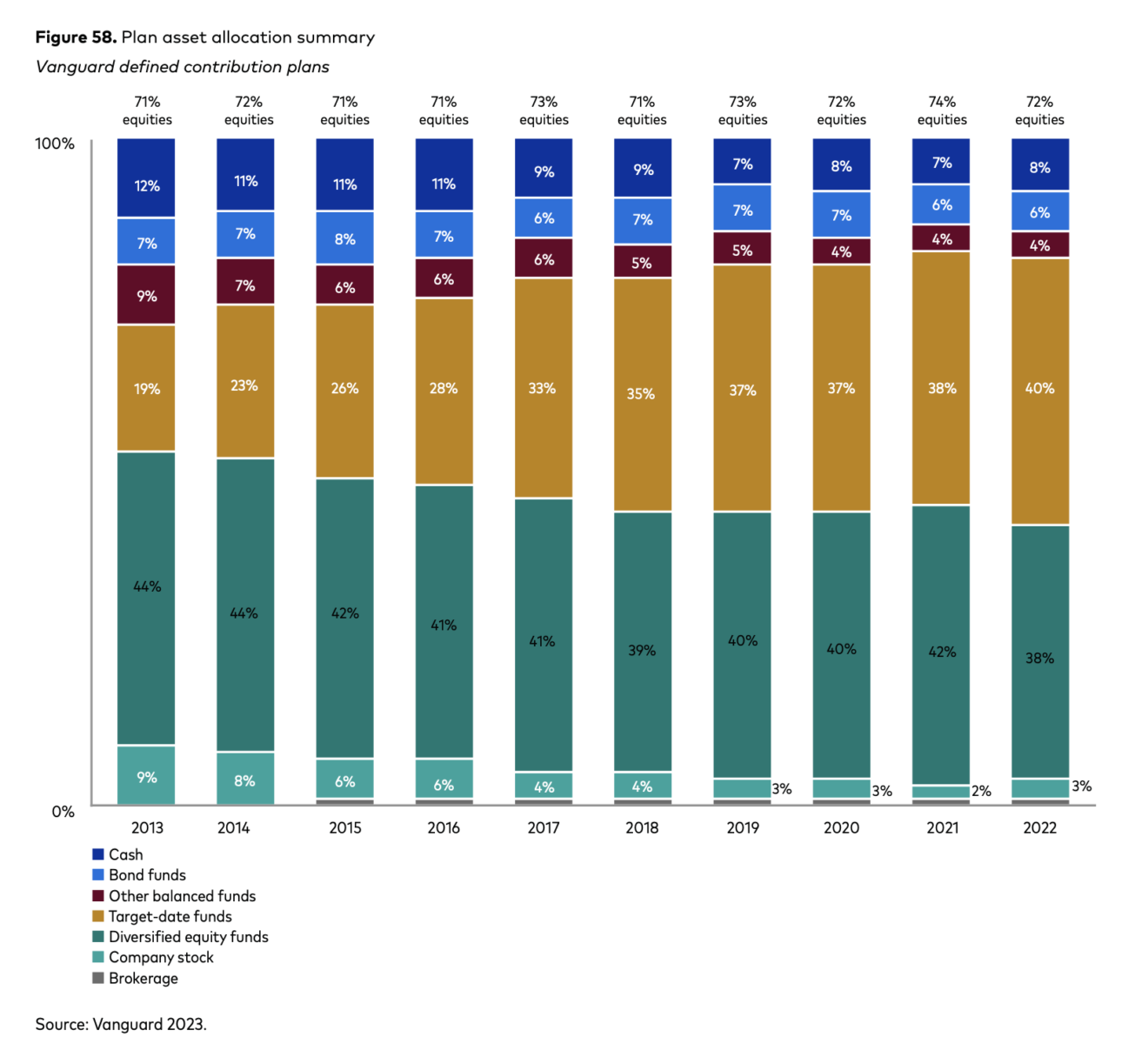

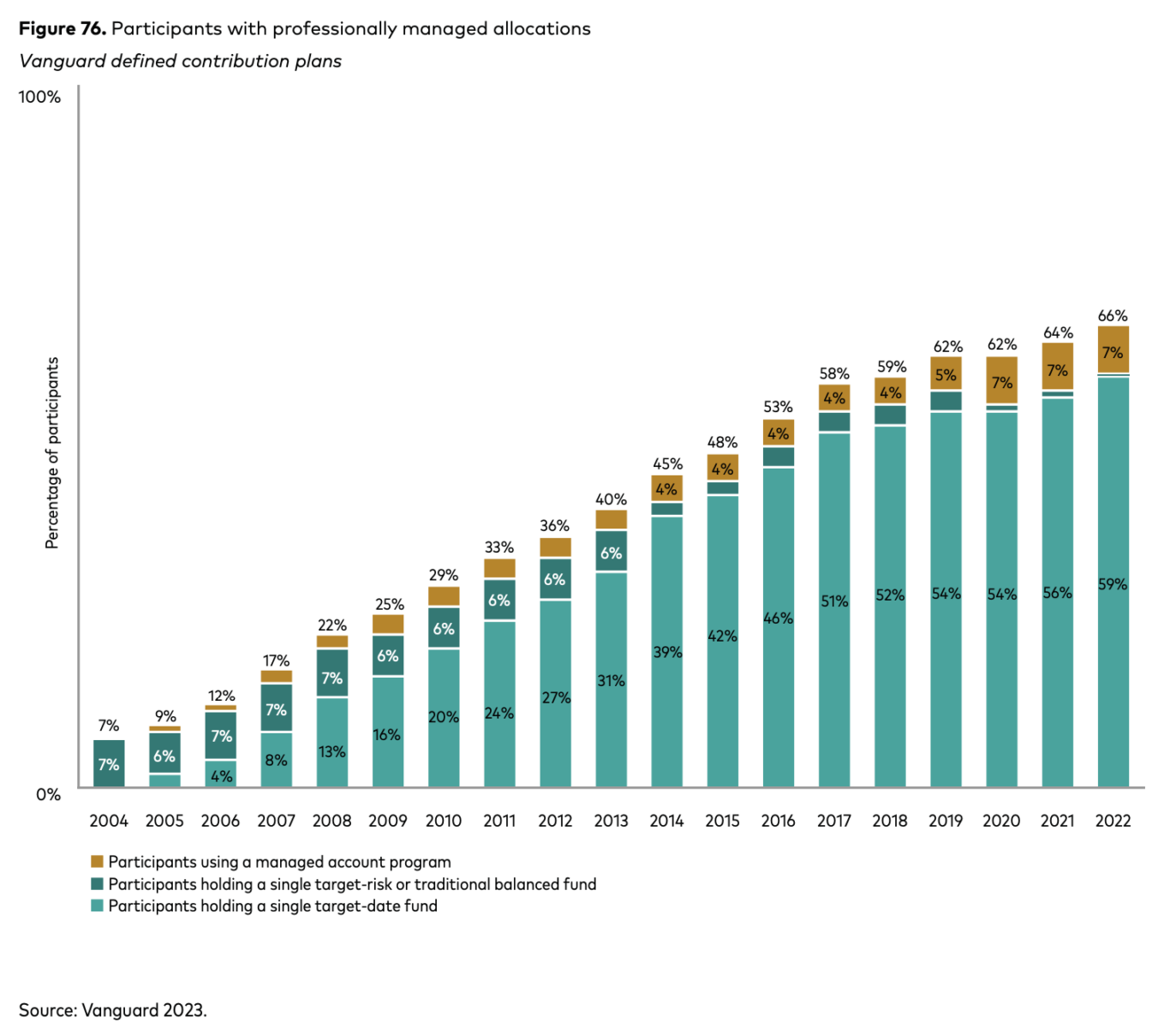

VG credit the affect of computerized enrollment/contribution escalation as main savers to this milestone. “File highs in participation, deferral charges, and using professionally managed allocations in 2022” added to the totals. The rally off of the June 2022 lows didn’t harm both.

A few of the extra fascinating knowledge factors from the report:

– 2022 featured record-high plan participation fee of 83%, pushed largely by wider adoption of computerized enrollment;

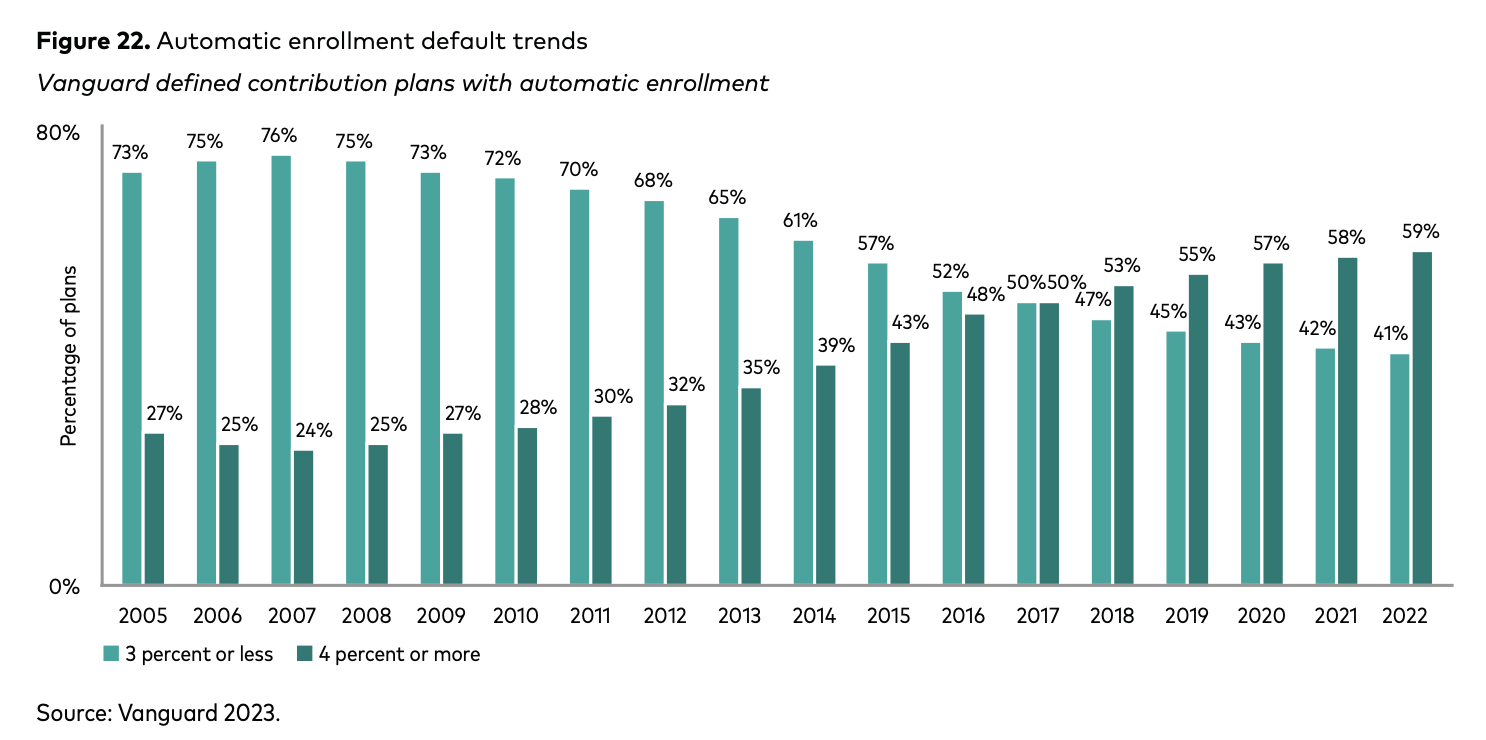

– From 2006 to 2022, computerized enrollment has tripled;

– 41% of all plans provided planning & recommendation; Bigger plans with greater than 5,000 workers, 81% provided recommendation;

– 76% of plans with a minimum of 1,000 members have adopted this design, bypassing the inertia and procrastination usually accountable for inhibiting voluntary enrollment;

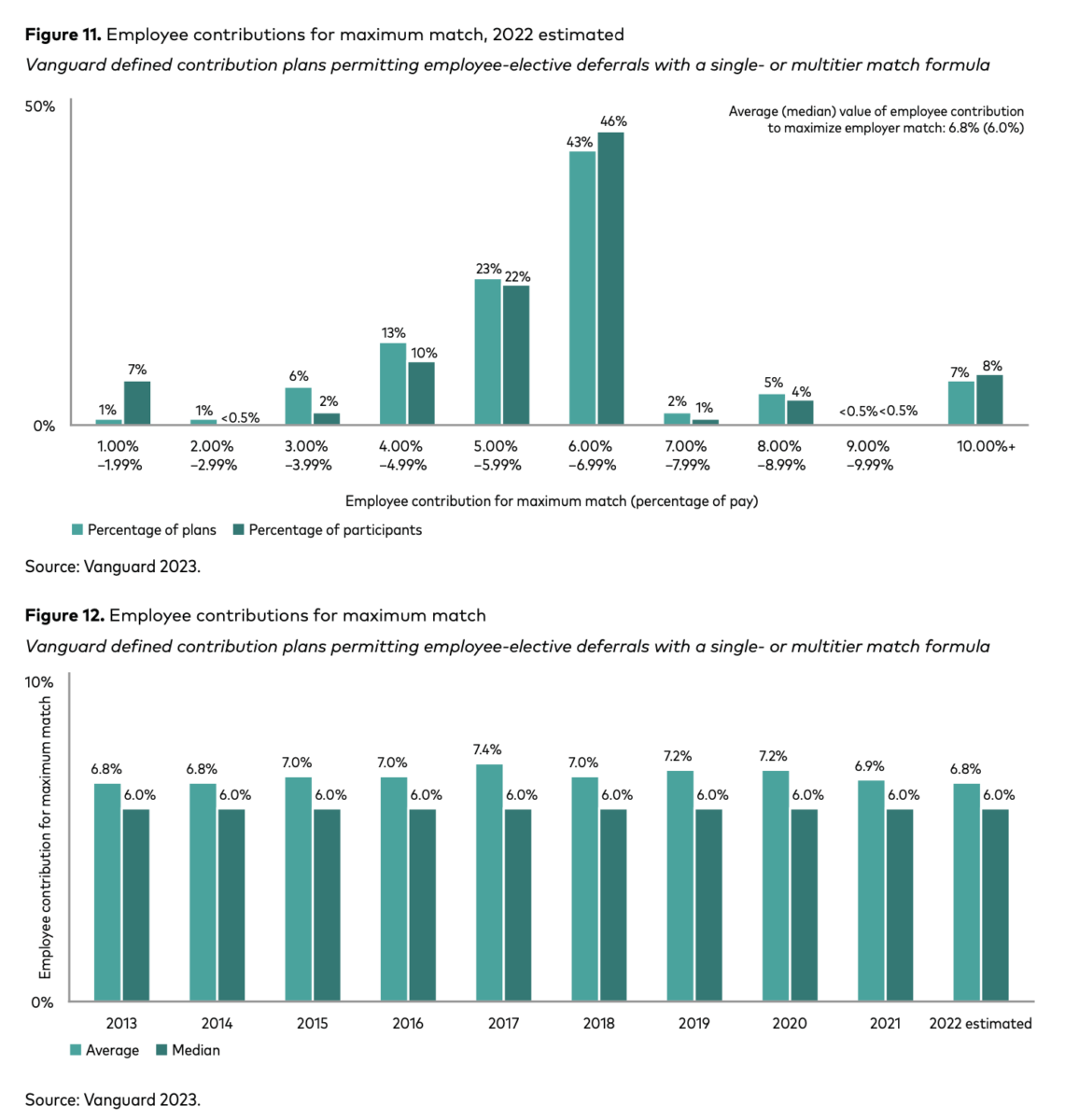

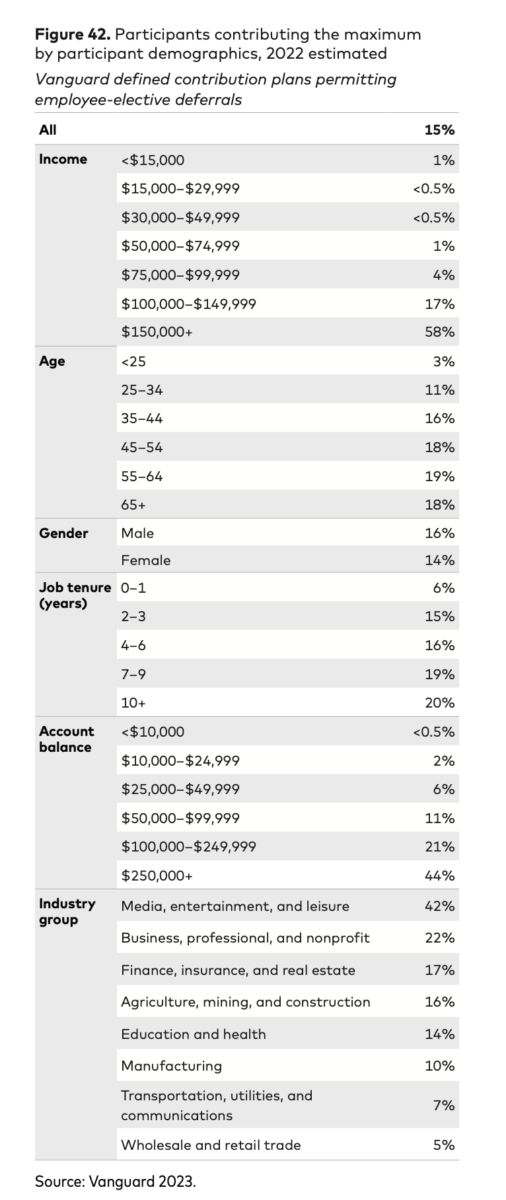

– 98% of members had been provided some sort of employer contribution; the common employer contribution fee was 11.3%;

– 20% of members want a lift of simply 1% to three% to hit their goal saving fee;

The complete analysis report is properly price your time to dive into…

Extra charts after the leap…

Supply:

How America Saves 2023 (PDF)

John James

Vanguard Group, June 2023

Chosen Charts

Computerized Enrollment Developments

[ad_2]