[ad_1]

My mid-week again from vacay morning reads:

• Inflation Is Overhyped, Says This Professional. “I hear lots of people say that we’re by no means going to repair it, that 7% is the brand new regular. That’s overhyped. There have been a number of issues that drove inflation up, however nearly all of them are being corrected. The large Covid-related stimulus was, in hindsight, presumably an excessive amount of. However that cash has been spent. So we’re principally previous it. The availability-chain points have been largely corrected. Freight prices have come again down. And the Fed stored charges at zero for method, method too lengthy. That has clearly been corrected. We will probably be again within the 2% to three% vary for inflation.” (Barron’s)

• The federal government numbers should not pretend. They’re simply noisy: By which David Sacks and Balaji increase a false alarm in regards to the jobs numbers. (Noahpinion) see additionally Change Your Perspective: Month-to-month NFP is probably going the one most overrated financial information level within the US, whereas the intermediate time period employment development is probably the most underrated. (When you have got 14 straight upside surprises, maybe somewthing is off in your mannequin…) (The Large Image)

• Jerome Powell’s Large Downside Simply Received Even Extra Sophisticated: The Fed goals to avert monetary instability whereas additionally preventing inflation—predicaments that incessantly name for reverse insurance policies. (Wall Avenue Journal)

• Buyers Are Placing Large Cash Into Japan Once more. Right here’s Why. The Japanese inventory market is up practically 30 % this yr, far forward of the S&P 500, as companies wager that adjustments in how corporations are run would possibly simply lastly final. (New York Occasions)

• These millionaires wish to tax the wealthy, and so they’re lobbying working-class voters: The nonprofit Patriotic Millionaires has lobbied Congress to make adjustments for greater than a decade. Its members see inequality as a hazard — they fear massive cash is corrupting politics and driving civil unrest. However they haven’t had a lot success. President Donald Trump’s 2017 tax cuts largely benefited the rich, and even when Democrats managed the Senate in 2021, they didn’t go a invoice to lift the minimal wage. (NPR)

• The tech business was deflating. Then got here ChatGPT. Final yr, Silicon Valley was drowning in layoffs and dour predictions. Synthetic intelligence made the gloom go away (Washington Publish)

• Wealthy nations say they’re spending billions to combat local weather change. Some cash goes to unusual locations. Rich nations have pledged $100 billion a yr to assist cut back the results of worldwide warming. However Reuters discovered giant sums going to initiatives together with a coal plant, a resort and chocolate outlets. (Reuters)

• Illinois Turns into First State to ‘Ban’ E-book Bans: A brand new legislation lets the state withhold funds from libraries that take away books or don’t observe American Library Affiliation pointers. (Citylab)

• Trump finds no new attorneys for court docket look in Mar-a-Lago case: Trump is anticipated to be represented by current attorneys Todd Blanche and Chris Kise. (The Guardian)

• The Denver Nuggets Have been Constructed to Final: Not each franchise might be so fortunate as to draft the perfect participant within the recreation, however any can afford to be affected person—and the Nuggets’ lengthy, regular march carried all of them the best way to the NBA title. (The Ringer)

You’ll want to try our Masters in Enterprise interview this weekend with Mathieu Chabran, Tikehau Capital A worldwide different asset supervisor with $40B in property. The agency is headquartered in Paris, and has workplaces in 13 nations, however primarily is run out of cash facilities in New York, London, and Singapore. He cofounded Tikehau in 2004 with Antoine Flamarion, a colleague at Deutsche Financial institution, and runs the US division. Chabran was named Chevalier de l’Ordre de la Légion d’Honneur by decree of the President of the French Republic in January 2022.

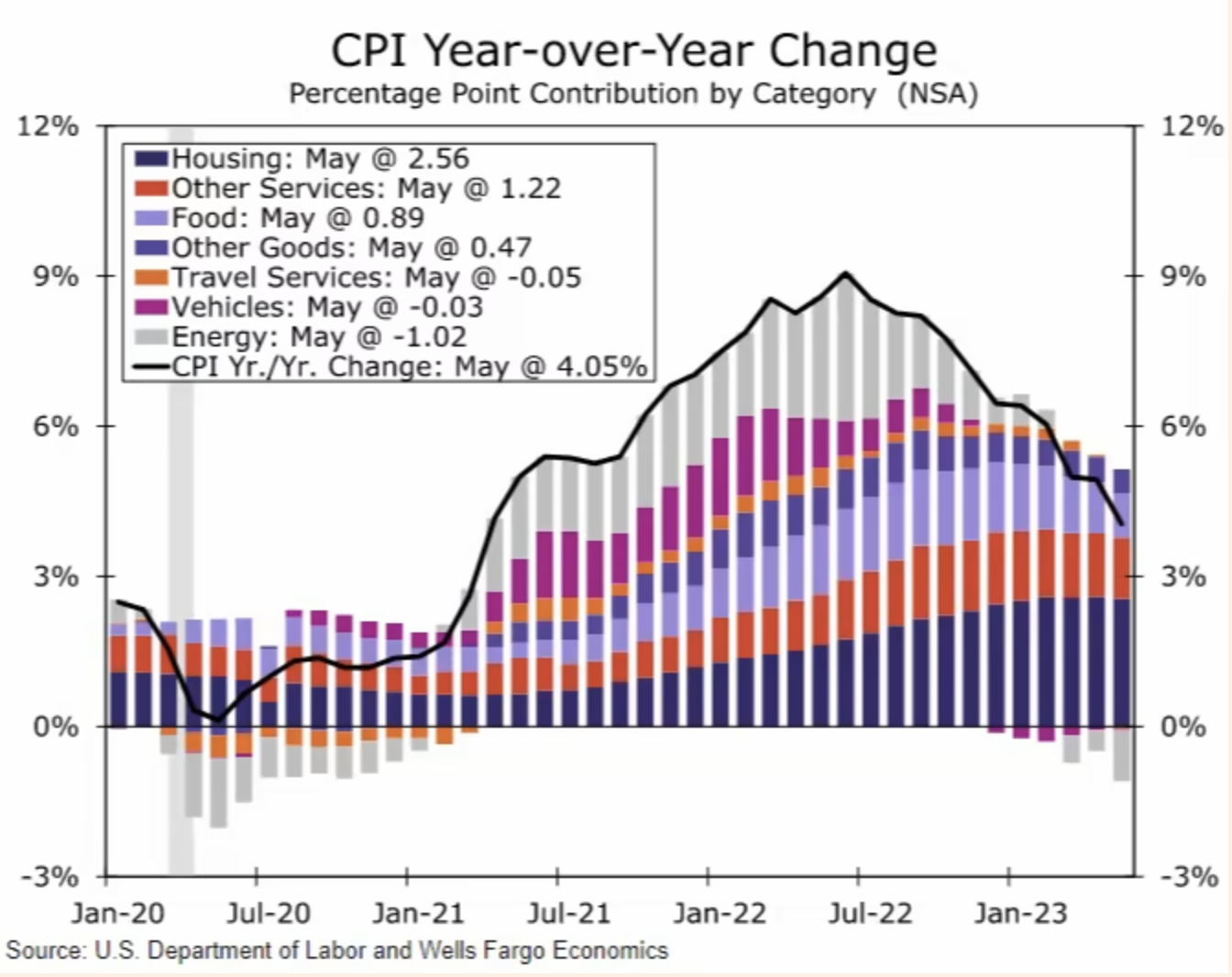

Market to Fed: Pause!

Supply: Wells Fargo by way of FT

Join our reads-only mailing record right here.

[ad_2]