[ad_1]

Observe: For the sake of brevity, this text will take a bullish and long-only strategy. In case you’re interested by going brief, you possibly can apply this data, however in reverse.

How are you going to effectively use the Ichimoku Kinko Hyo (aka Ichimoku Cloud) indicator to seek out buying and selling alternatives, particularly when it has so many transferring elements with bullish and bearish combos?

As described in ChartSchool, the Ichimoku Cloud is a complete indicator designed to provide clear indicators. Complete and clear, but additionally complicated in lots of circumstances, and everybody who makes use of these indicators has their most popular means of mixing the parts.

One strategy, which will help simplify the method and make it extra environment friendly, can be to make use of the Chikou Span (aka Lagging Span) to evaluate present value motion and future value targets. In brief, you’d look 26 durations again to invest what may occur between now and 26 durations into the longer term. Sure, that sounds unusual, however when you give it an opportunity, it is truly fairly helpful.

Not aware of the Ichimoku Cloud and the completely different bullish and bearish indications derived from its 5 parts? You possibly can assessment it right here.

One bullish sign is that of value transferring above the cloud. StockCharts has a scan for this sample occasion. As a result of it tends to provide plenty of outcomes, it is best to change it by elevating the every day quantity (included within the code beneath).

The right way to Do a Worth-Transferring-Above-Cloud Scan

To scan for this sample occasion, do the next:

Go to Member Instruments > Superior Scan Workbench > New

Copy and paste the next code:

[type = stock]

AND [country is US]

AND [[exchange is NYSE] OR [exchange is NASDAQ]]

AND [market cap > 100]

AND [Daily SMA(20,Daily Volume) > 500000]

AND [Daily Above Ichimoku Cloud is true]

AND [yesterday’s Daily Above Ichimoku Cloud is false]

Click on the Run Scan button.

The scan produced many outcomes. One of many candidates was Allegheny Applied sciences (ATI).

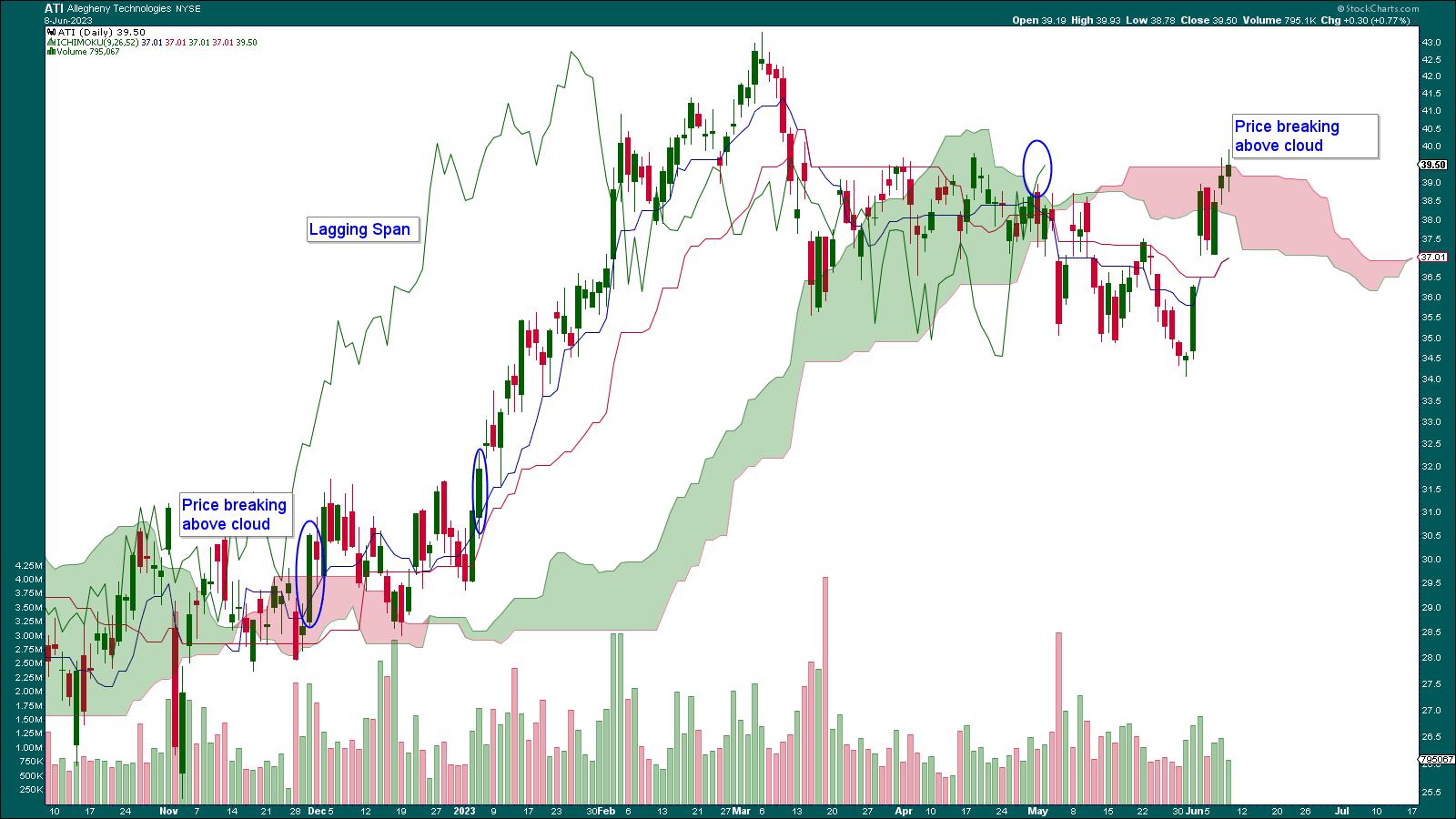

CHART 1: ALLEGHENY TECHNOLOGIES BREAKS ABOVE ICHIMOKU CLOUD. May this inventory be a candidate for a future commerce?Chart supply: StockCharts.com (click on chart for stay model). For illustrative functions solely.

Worth has moved above the cloud—what the scan picked up. When value strikes above the cloud, it is a sign to watch for future alternatives. In case you return to December 2022, the blue arrow reveals a time when value broke above the cloud.

This is what that you must look out for. The Lagging Span (the inexperienced line) performs an essential function. When it is above the conversion line, final analysis, value, and the cloud (all Ichimoku lingo), it signifies the chance of a stronger diploma of shopping for strain supporting the development. The Lagging Span can be 26 durations behind the present value.

So, within the chart above, the purchase sign got here later when value broke above the conversion line (second blue oval). In case you had entered a commerce at the moment, you’ll have made a great return, so long as you exited the commerce at across the time when the conversion line crossed beneath the bottom line and the Lagging Span turned decrease.

Wanting on the present value on the chart of ATI, the Lagging Span is transferring larger above the cloud, however the cloud has turned pink. Loads will rely upon how a lot upward momentum the value has, because it’s throughout the now-bearish cloud.

Let’s check out one other scan end result, the inventory of an organization chances are you’ll be aware of—Blackstone Group (BX).

CHART 2: BLACKSTONE GROUP’S SIX-MONTH SYMMETRICAL TRIANGLE. It is a inventory to patiently watch.Chart supply: StockCharts.com (click on chart for stay model). For illustrative functions solely.

Discover the extraordinarily prolonged symmetrical triangle formation that is been enjoying out over the past six months. The response to this Ichimoku scan can be iffy and one to patiently watch. Why?

Due to the next causes:

- The inventory is consolidating and never trending.

- The lagging span is not able that is signaling (not to mention confirming) a bullish improvement.

- The triangle is establishing for a breakout.

The Ichimoku Cloud (26 durations forward) and the lagging span (26 durations behind) could offer you early buying and selling or affirmation indicators as soon as the breakout happens.

The Backside Line

The Ichimoku Kinko Hyo indicator, or Ichimoku Cloud, is a complete instrument that may yield fruitful buying and selling alternatives, however should be used appropriately. Though the cloud’s many transferring elements could initially appear daunting, its parts might be harnessed to effectively consider present and future value motion. This text offered an evaluation of a bullish sign—value transferring above the cloud—and illustrated how scanning for such shares will help you narrow by the noise of this complicated indicator.

Nonetheless, the scan’s outcomes spotlight potential alternatives for nearer monitoring, slightly than offering rapid buying and selling indicators. The Lagging Span performs a vital function right here; when all its situations are met, it signifies sturdy shopping for strain supporting the development. Nonetheless, do not forget that vigilance and endurance stay key virtues, particularly when the indicators point out a necessity to attend, as demonstrated within the Blackstone Group instance. The perfect consequence all the time depends on instrument effectivity, insightful evaluation, and strategic timing.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Karl Montevirgen is knowledgeable freelance author who makes a speciality of finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Collection 3 and Collection 34 licenses along with a twin MFA in vital research/writing and music composition from the California Institute of the Arts.

Study Extra

Subscribe to ChartWatchers to be notified at any time when a brand new publish is added to this weblog!

[ad_2]