[ad_1]

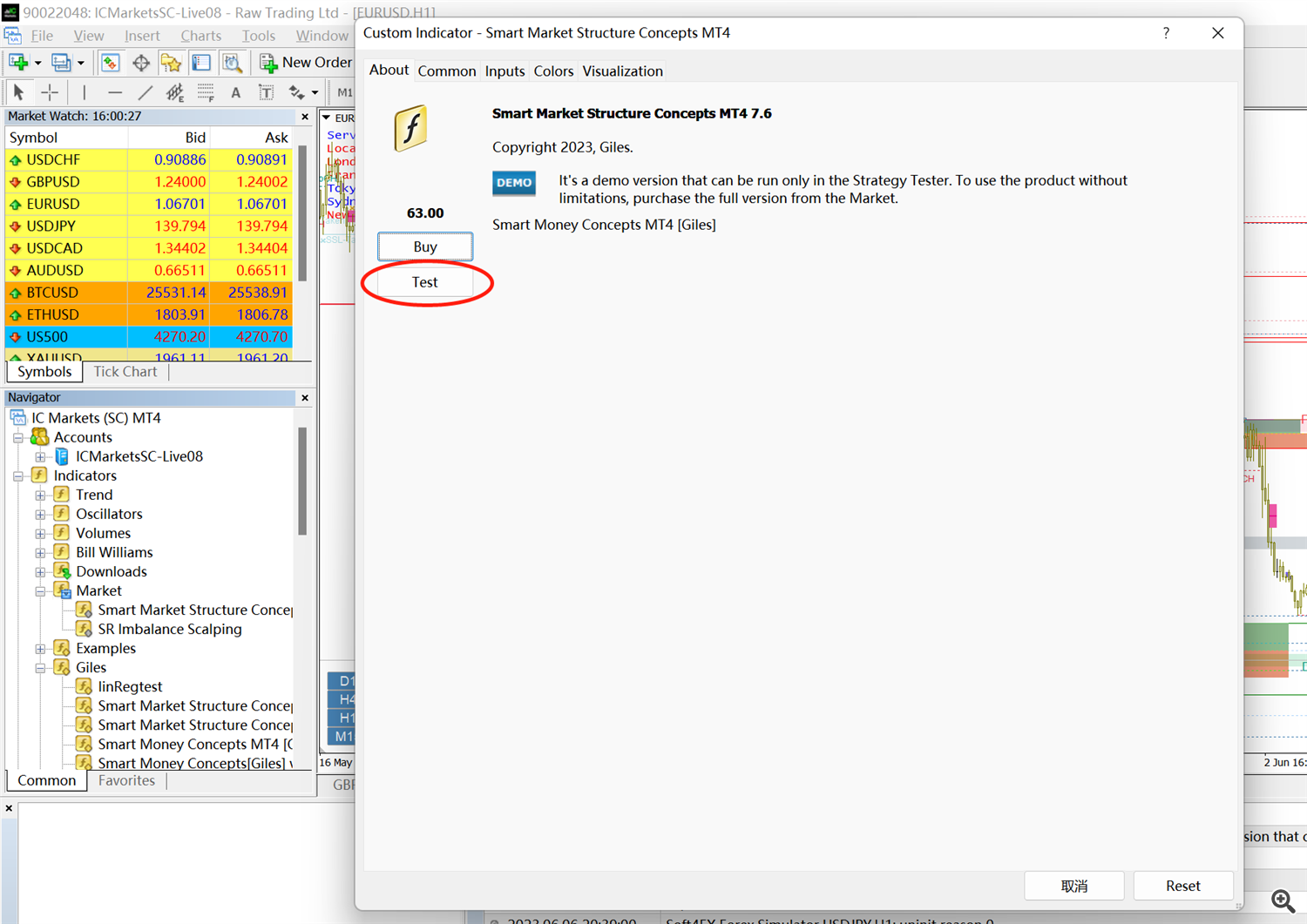

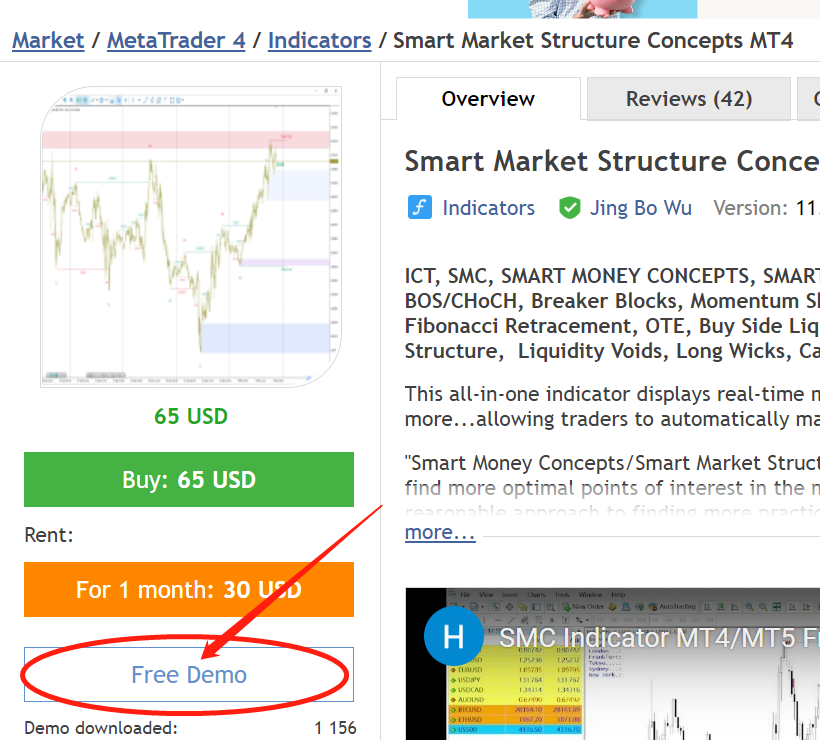

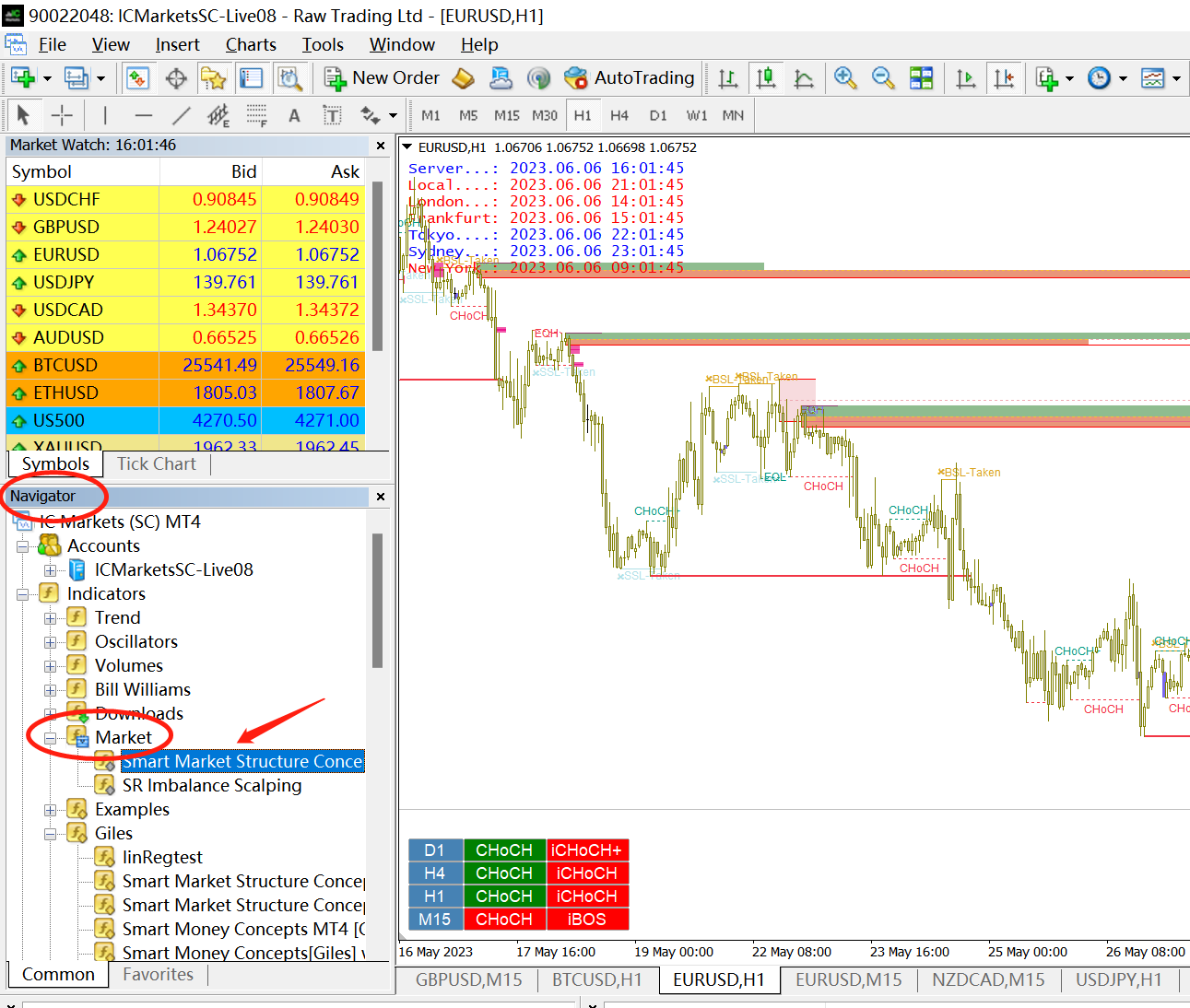

On the indicator web page, click on the “Free Demo” button to obtain a free trial model to your MT4/MT5 software program. After downloading, below the Indicators listing on the left navigation bar of your MT4/MT5 software program, you may see that the indications have been downloaded to the Market subdirectory, and all indicators downloaded by the MQL market will seem right here.

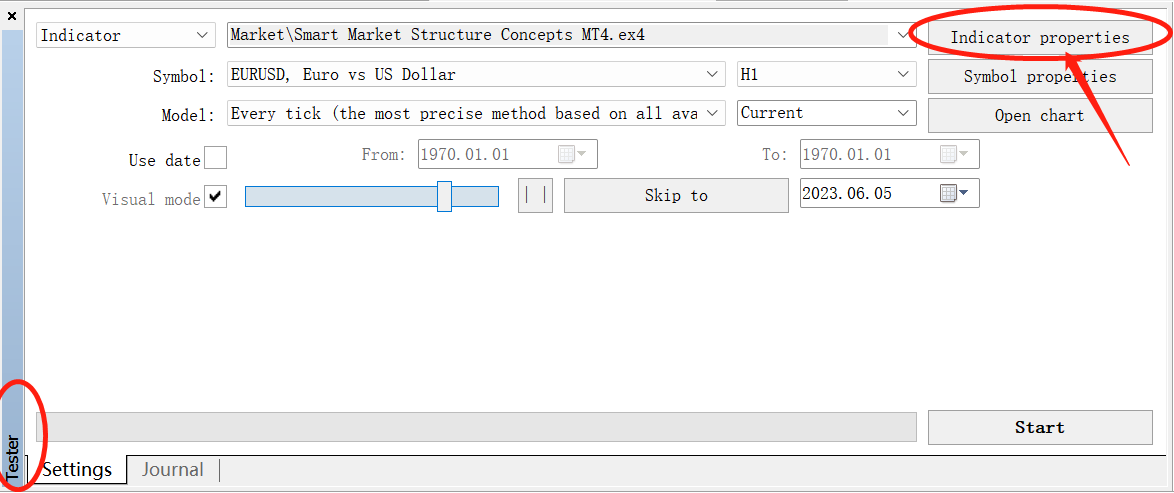

If it’s the MT4 model, double-click the indicator title immediately, within the pop-up window, click on the Check button, and you will notice the MT4 Tester window. Right here, you may select the image of the take a look at and the cycle of the take a look at. Click on Indicator properties to open the indicator setting window and set numerous parameters of the indicator. After setting the indicator parameters, click on the Begin button to begin the take a look at.

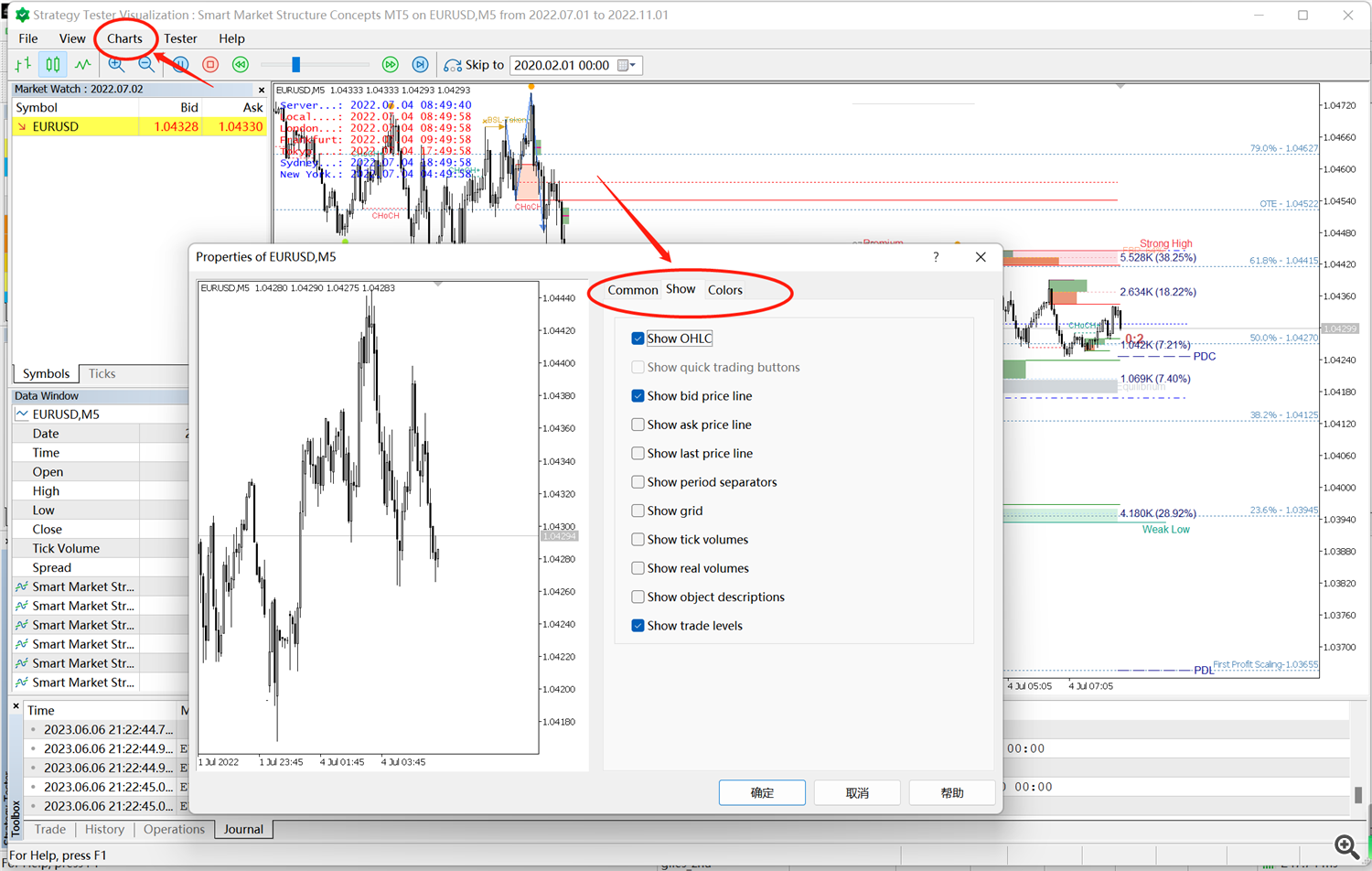

After the take a look at program begins working, we will click on Pause and modify the chart settings to learn the chart higher. Proper-click -> Properties, modify the parameters you want, OK, click on to proceed testing. Within the MT4 take a look at program, Time Zone Panel and MTF Dashboard can not work usually.

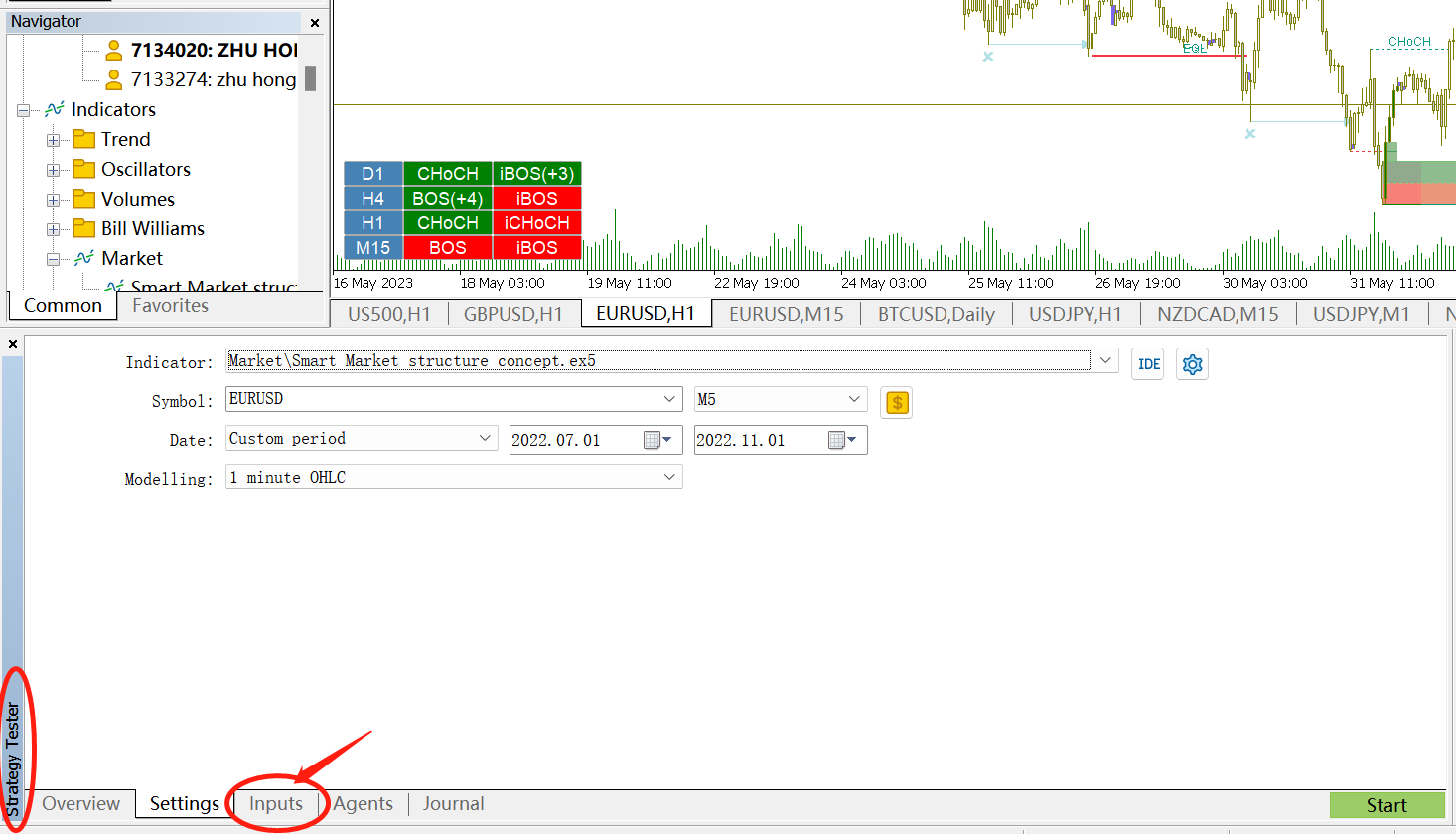

If it’s the MT5 model, click on on the title of the indicator, right-click, and choose Check within the pop-up window, and you will notice the Technique Tester window of the MT5 software program. Click on Inputs to open the setting web page of the indicator, and set numerous parameters of the indicator. After setting the indicator parameters, click on the Begin button to begin the take a look at.

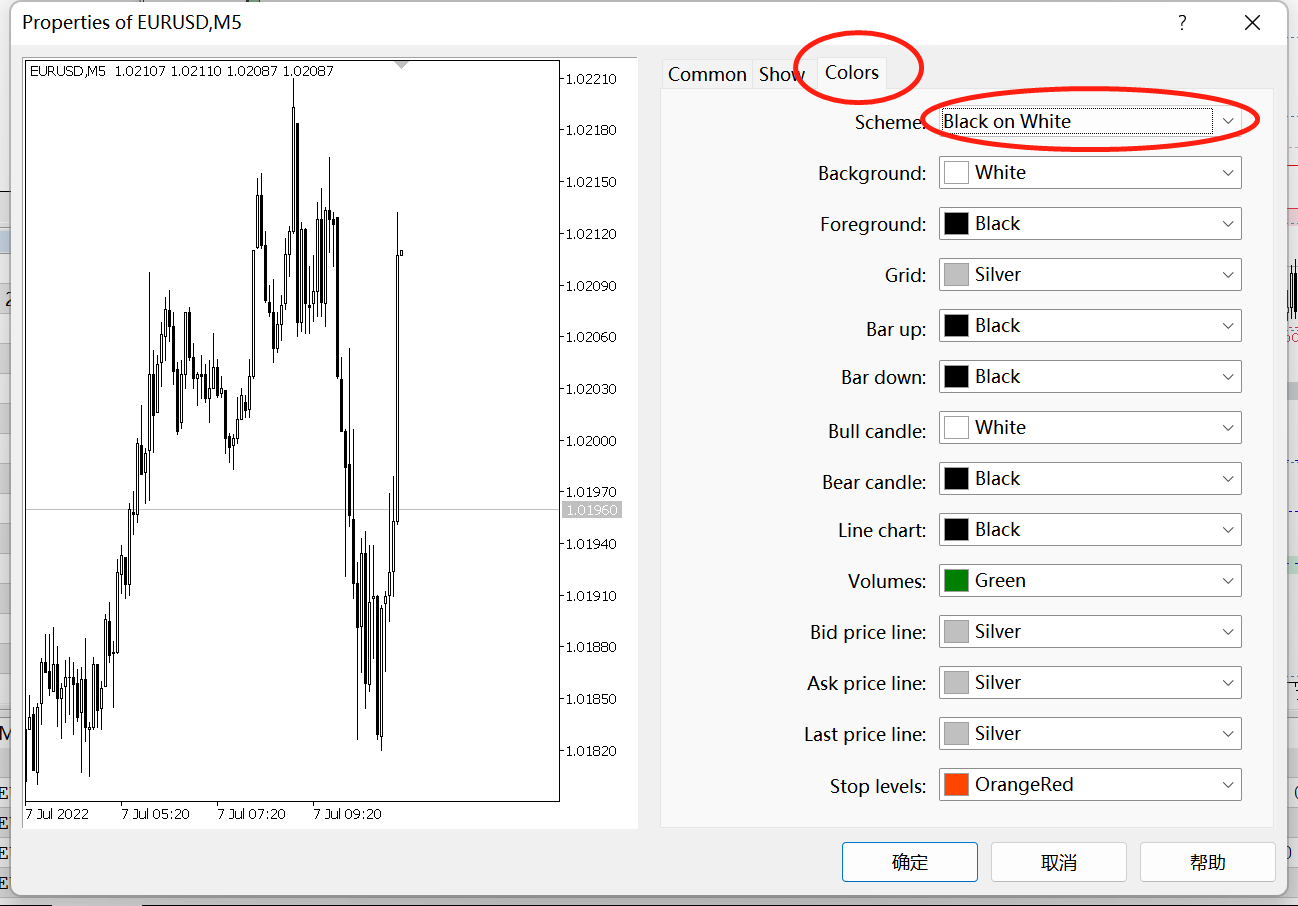

The MT5 software program will open a separate take a look at window. You’ll be able to click on the menu bar –>Charts–>Properties to open the take a look at chart property window to switch the chart property parameters for higher studying of the chart. It is suggested that customers choose the Scheme attribute as Black on White below the Colours column.

If you wish to modify the indicator parameters after which test the impact, you will need to first cease the take a look at program, then set the brand new parameters, after which begin the take a look at once more. Within the MT5 take a look at program, Time Zone Panel and MTF Dashboard can be found.

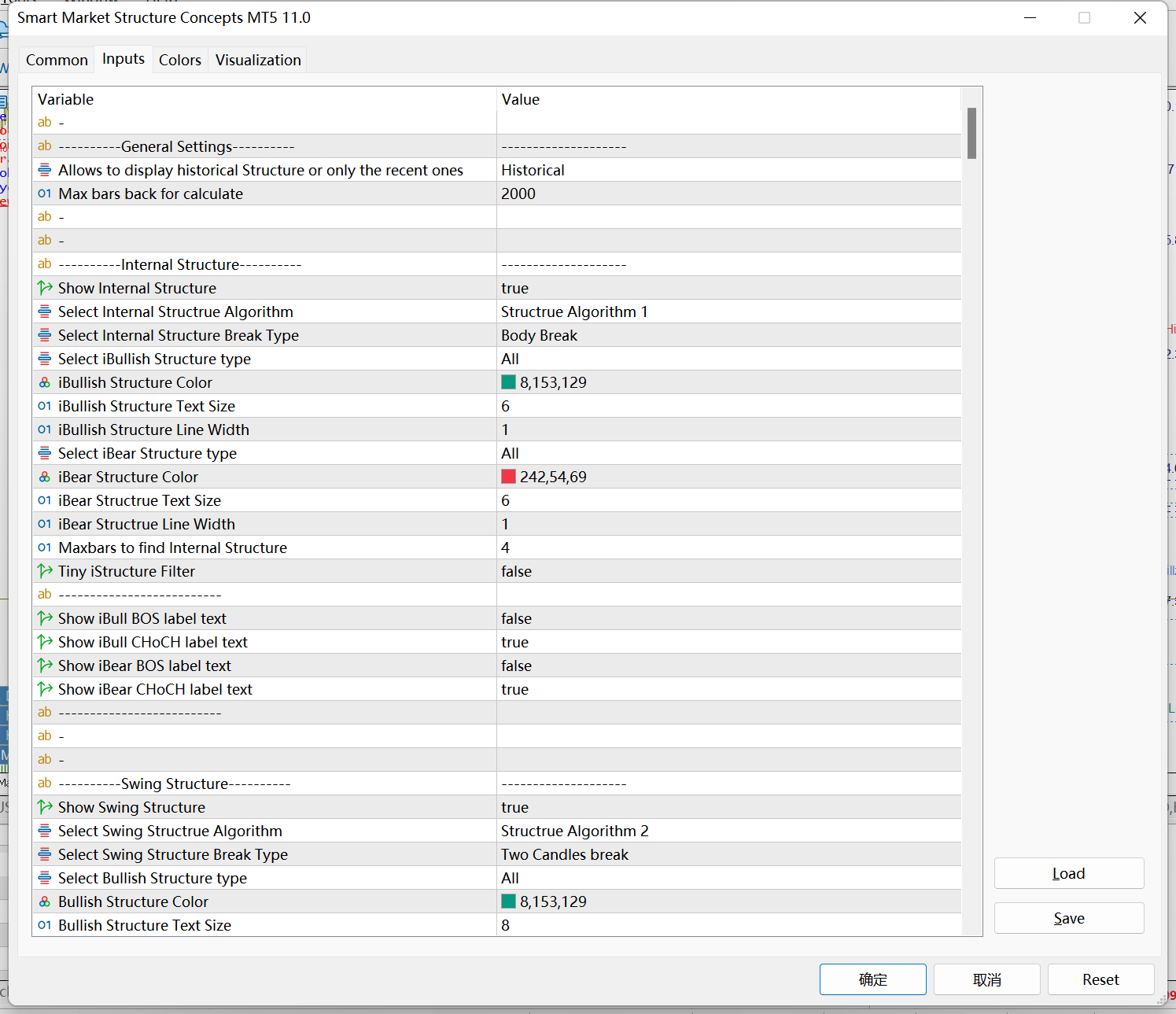

1. Normal Settings

The primary setting merchandise has three choices. Historic, Current, and Information. By default, historic is chosen, and the indicator might be calculated and displayed in historic knowledge. If Current is chosen, the indicator is barely calculated and displayed in real-time knowledge. The Information possibility is used internally by this system, and the consumer doesn’t want to concentrate to it.

The second setting specifies the variety of historic candles to be calculated for this system, and the default is 2000. If it’s good to observe extra historic knowledge, set this worth larger, however on the similar time the indicator loading pace might be slower.

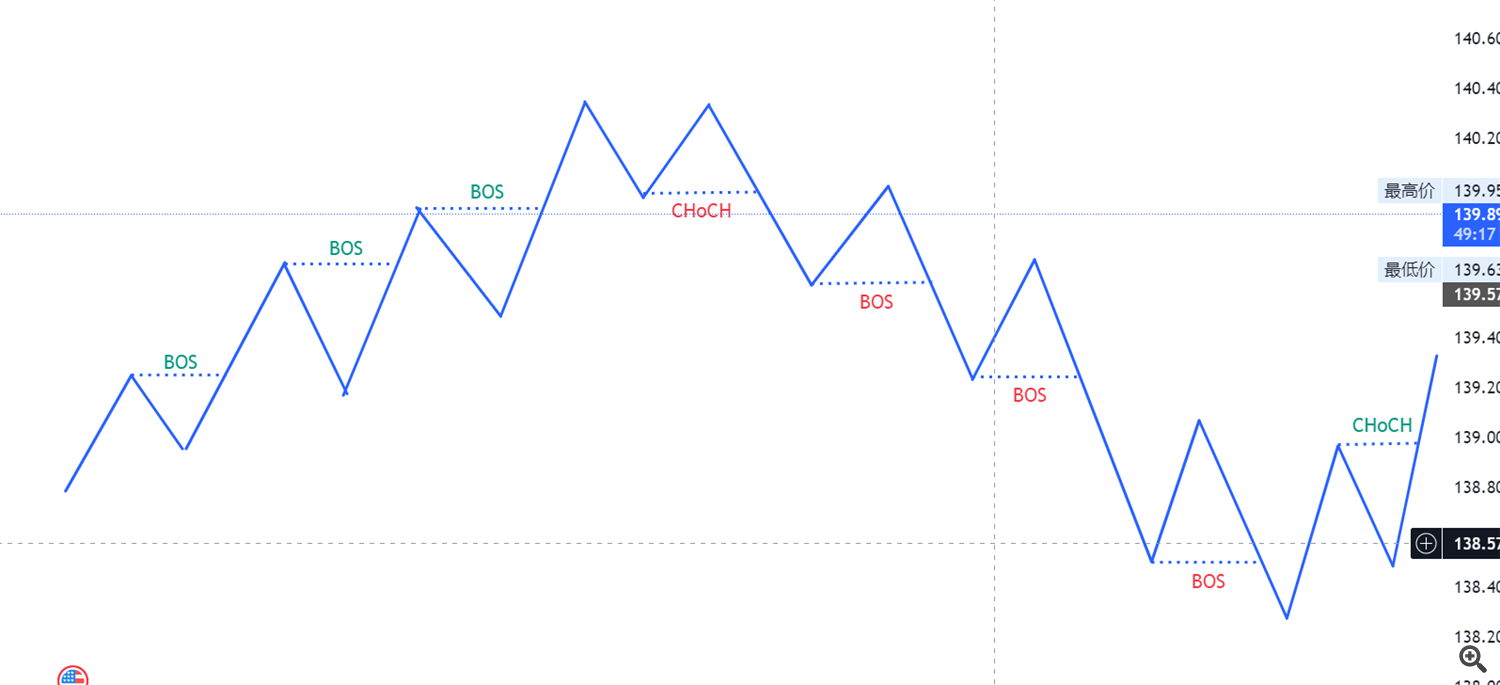

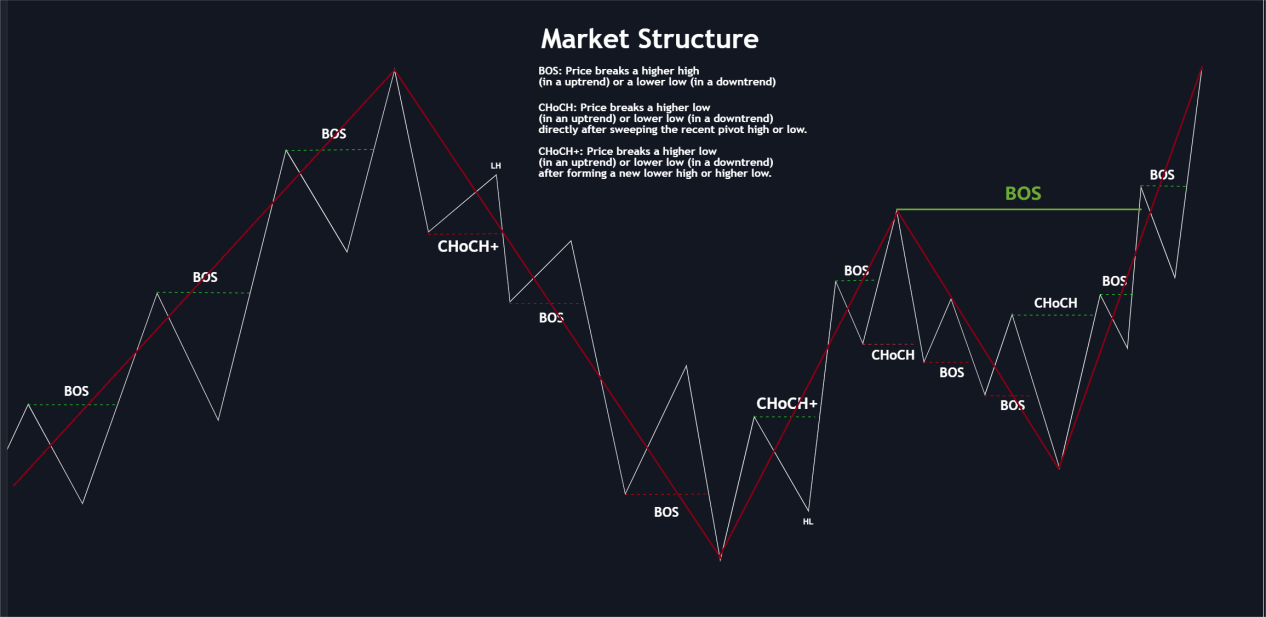

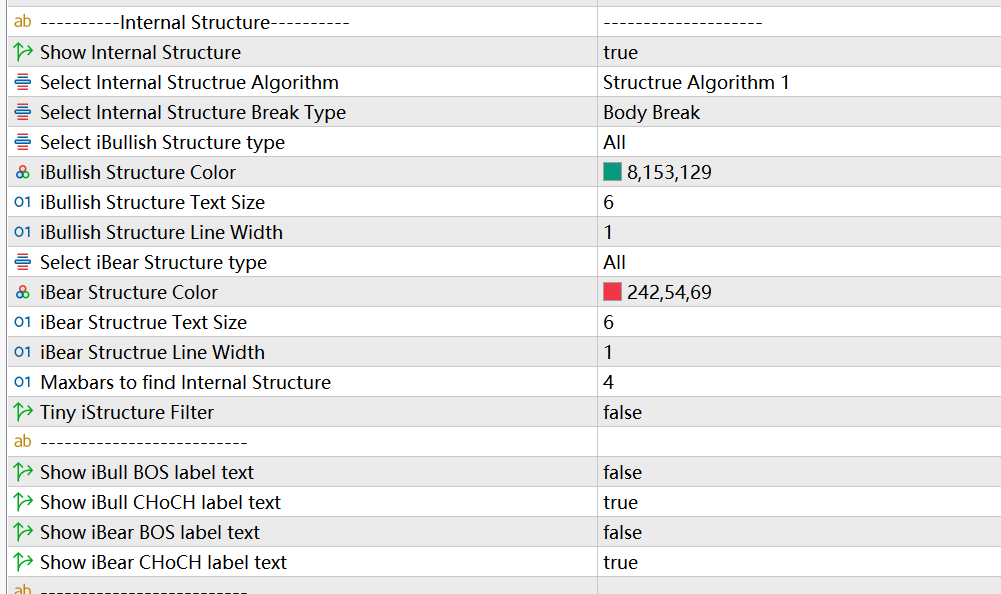

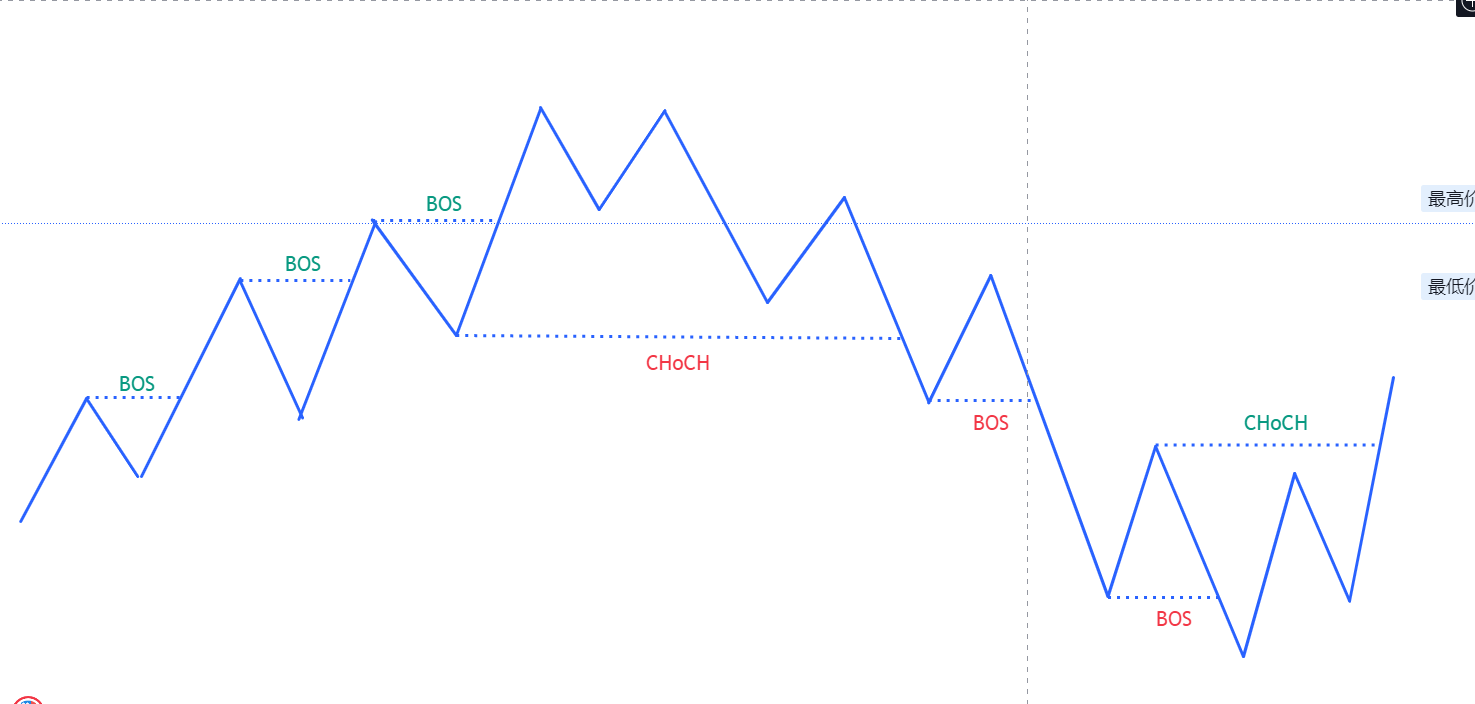

2. Inside Construction and Swing Construction

The market construction is usually divided into the primary construction and the secondary construction. The principle construction marks worth fluctuations and structural breakthroughs in a bigger interval, and the secondary construction marks worth fluctuations and structural breakthroughs in a smaller interval.

Let’s check out this market construction chart. The white line reveals the secondary construction, that’s, the breakthrough of excessive and low factors fashioned by small cycle worth fluctuations, which is outlined as inside construction within the indicator. The crimson line reveals the primary construction, that’s, the breakthrough of excessive and low factors fashioned by large-cycle worth fluctuations, which is outlined as swing construction within the indicator.

Within the setting interface, the worth of maxbars for discover inside construction determines the variety of candles wanted to verify the excessive and low factors of the small interval. The default is 4, which signifies that at the least 4 candles are required to verify the excessive or low level of a secondary construction. You’ll be able to set this worth your self based on your individual expertise or the volatility traits of the buying and selling selection.

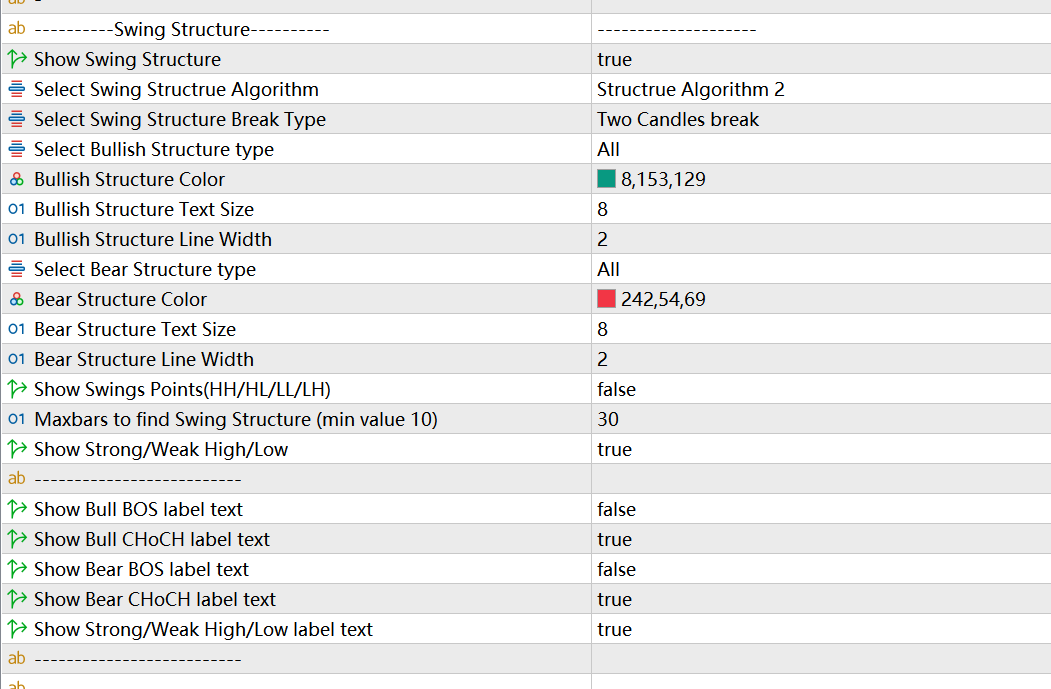

The worth of maxbars for discover swing construction determines the variety of candles wanted to find out the excessive and low factors of the primary construction. The default is 50, which signifies that 50 candles are wanted to verify the excessive or low level of a big interval. Once more, you may set this worth based on your wants. If ALGO2 is chosen for the “Choose Swing Structrue Algorithm”, it’s endorsed to set the worth of maxbars to be smaller, comparable to between 20-30.

Choose Inside/Swing Structrue Algorithm to pick out the algorithm for the market construction. This program offers two algorithms, and customers can select one in every of them based on their preferences. The distinction between the 2 algorithms is proven within the following two figures.

ALGO1

ALGO2

Within the settings of inside construction and swing construction, there are two essential settings, inside construction break kind and swing construction break kind. On the micro stage, there are primarily three conditions by which the value breaks by way of the construction, all of which will be counted as efficient breakthroughs. Launched within the SMC profile out there on the indicator’s primary web page. The article primarily introduces three conditions: the shadow line breaks by way of, the shadow line breaks by way of the shadow line, the entity breaks by way of the entity, and the entity breaks by way of.

The indicator additionally offers three kinds of breakthroughs for choice, shadow line breakthrough, entity breakthrough and double candlestick breakthrough. This system makes use of entity breakthrough by default, and customers can select the kind of breakthrough they want.

The remaining settings are mainly show settings, and customers can set them based on their preferences.

For instance, we will set to not show the interior construction in any respect, solely to show the swing construction, or set to solely show the interior construction however not the swing construction.

Or set to show solely a sure kind of market construction, bullish BOS/CHOCH , bearish BOS/CHoCH .

For knowledgeable merchants, they could not need to see too many labels, so the indicator offers a swap to show labels. You may also flip off all tags or select to solely show tags of a sure kind that you’re significantly involved about.

The present swing factors setting activates and off the show of huge cycle excessive and low factors ( HH LL HL LH ). The Present robust/weak excessive/low setting activates the show of the latest excessive/low factors of the primary construction, marked with two strains extending to the present candle, and the excessive and low factors in keeping with the large-cycle worth development are marked as robust excessive/low. In any other case, mark it as weak excessive/low.

Lastly, I wish to add that within the inside construction setting, the Tiny inside Structrue filter setting is used to filter out the market construction fashioned by small fluctuations in small intervals.

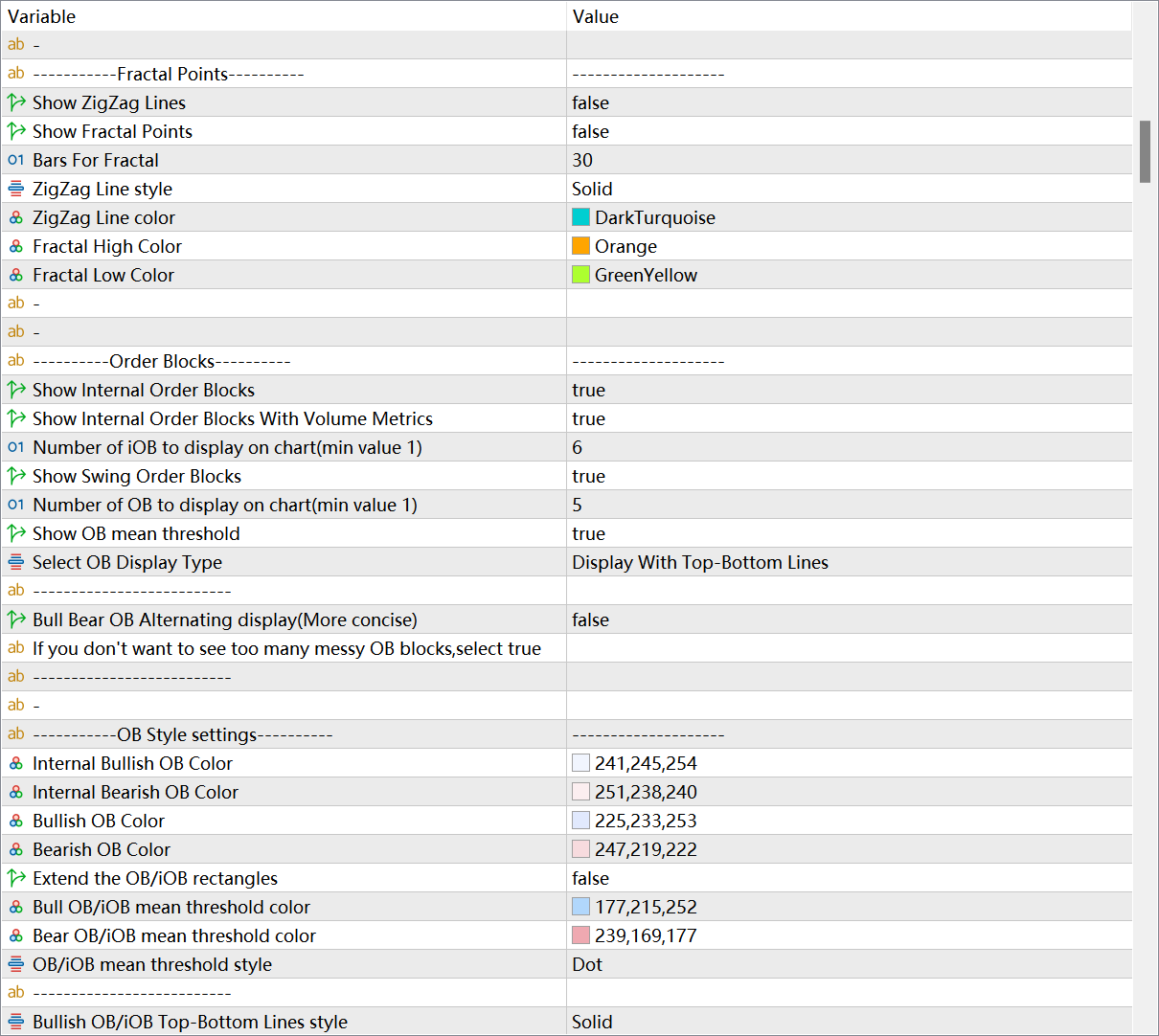

3. Fractal Factors and Order Blocks

Beneath we introduce the 2 features of Fractal and OB.

Fractal Factors:

It primarily offers customers with the perform of displaying zigzag strains and fractal factors, and might set the time interval for zigzag and fractal individually.

Right here fractal Factors is that this system finds the excessive and low factors of worth fluctuations in a given interval based on the algorithm, after which marks them with a dot. Often, there are restrict orders and cease loss orders close to the earlier excessive/low of the value, which is the so-called liquidity, which is the main target of many merchants.

Zigzag makes use of phase line to attach these excessive and low factors, in order that merchants have a clearer and extra intuitive perspective on worth fluctuations, and might keep away from the interference of some smaller periodic fluctuations.

The primary setting merchandise is to activate and off the show of zigzag, the second setting merchandise is to activate and off the show of fractal factors, and the third setting merchandise is to specify the interval for this system to calculate the excessive and low factors, which is the variety of candles required to verify the excessive and low factors. The default is 4, whether it is modified to six, and the Timeframe of the present chart is each day, it signifies that this system will mark the excessive and low factors below the one-week fluctuation interval for you.

Beneath are the formatting for the zigzag, and the formatting for the fractal factors.

Order Blocks:

Earlier than introducing the OB settings, we have to briefly introduce the order movement technique. Right here I like to recommend everybody to learn the SMC article I shared on the indicator web page, which comprises an introduction to the chapter on order movement technique.

Originally of the article, it acknowledged that the order movement buying and selling technique appears to be the alternative of the thought of development buying and selling. Pattern merchants are eager on buying and selling worth breakthroughs and promoting at larger costs. For the order movement technique, worth breakthroughs or structural breakthroughs are solely used to help in estimating the path, and the entry place is to attend for the value to return to the wholesale worth, that’s, to purchase close to the OB, after which promote on the retail worth after the value rises , that’s, await the value to rise to the earlier excessive or promote after breaking by way of the earlier excessive.

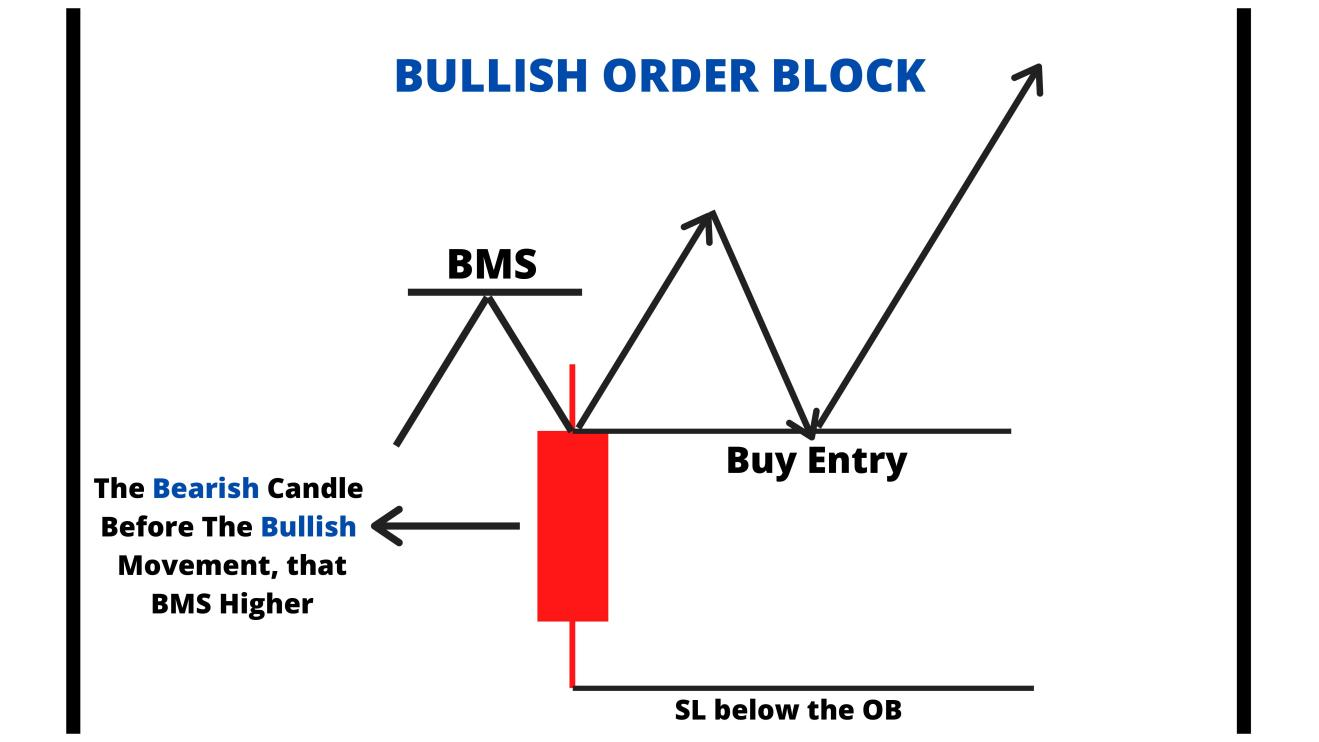

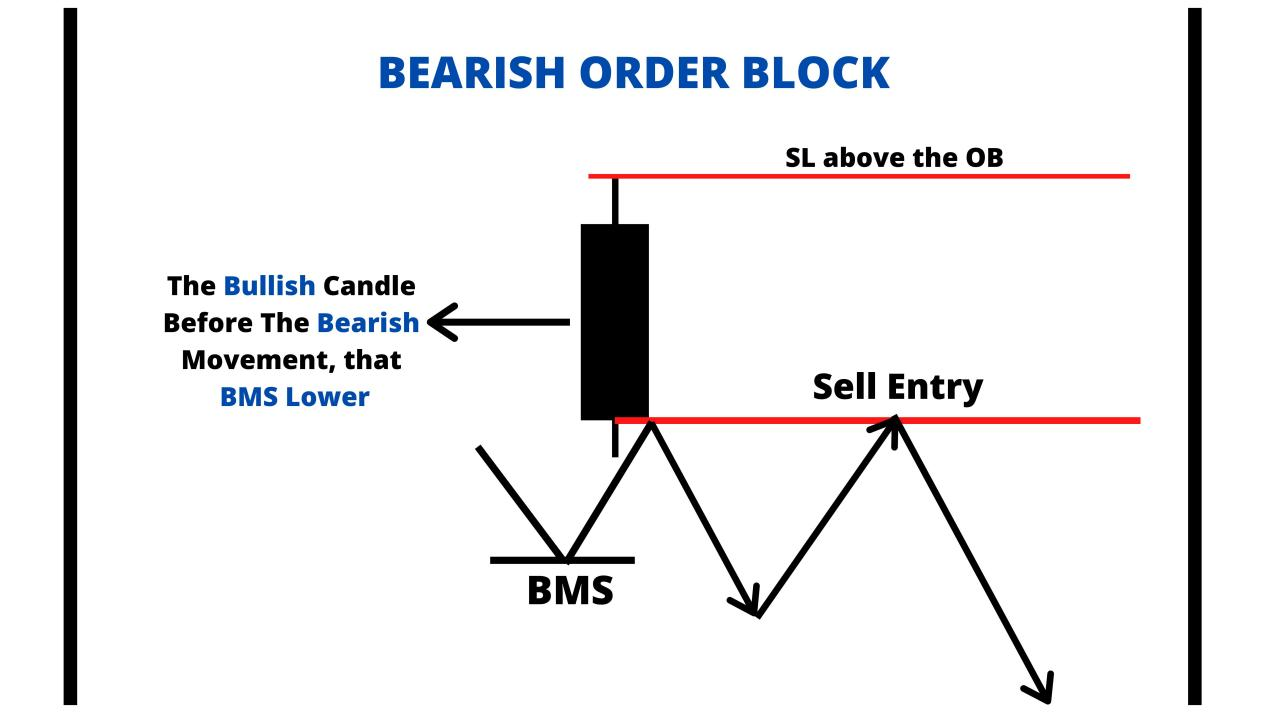

Take a look at the definition of OB once more:

An order block (OB) refers back to the final bearish candlestick earlier than a powerful upward breakout of a construction or the final bullish candlestick earlier than a big downward breakout of a construction in any time interval.

That’s, every time there’s a legitimate structural break, an OB is fashioned, a bullish construction break varieties a bullish OB, and a bearish construction break varieties a bearish OB.

Check out the next footage:

Let’s check out the trigger or precept of OB, and the position of OB. Consult with the SMC article I shared:

“Causes and Results:

As for the causes, I do not know the precise fact, however the order movement idea can clarify it, so for now, let’s assume that it’s true, as a result of nobody can perceive all of the market truths.

The bottom line is the way you view the market, what sort of market outlook you’ve gotten, and the best way to commerce primarily based in your market viewpoint.

To be able to go lengthy, somebody has to go brief, and to be able to go brief, somebody has to go lengthy. Solely when there’s a purchaser and a vendor can a transaction be accomplished. If there’s a lack of purchase orders when shorting, the market worth will fall to search out patrons. Conversely, the market worth will rise to search out sellers. (Please discuss with Daemon Goldsmith’s “Order Movement Buying and selling” for extra info.)

Massive establishments primarily commerce utilizing algorithms, and even when their massive orders are break up, they’ll nonetheless have a big affect available on the market worth. They often full worth supply each day or match orders through the intervals of the very best liquidity.

To make sure that the orders are efficiently executed, and to cut back the adversarial results of orders on market costs and slippage prices, establishments will use the “promote to purchase” or “purchase to promote” technique of buying and selling at vital positions.

That’s, first pushing down the value by promoting to interrupt by way of the help of the earlier low, after which matching the small breakout promote orders and purchase stop-loss orders (i.e., market promote orders) of retail buyers with the massive purchase orders of establishments (the primary our bodies of the finished transactions are the establishments’ personal promote orders).

After the value rises, the establishments’ promote orders are trapped as prices. If it’s a retail investor, they could need to cease loss. Nonetheless, with ample property, establishments can recuperate prices by promoting to make a revenue (conventional technical evaluation refers to this conduct as testing or pullback affirmation).

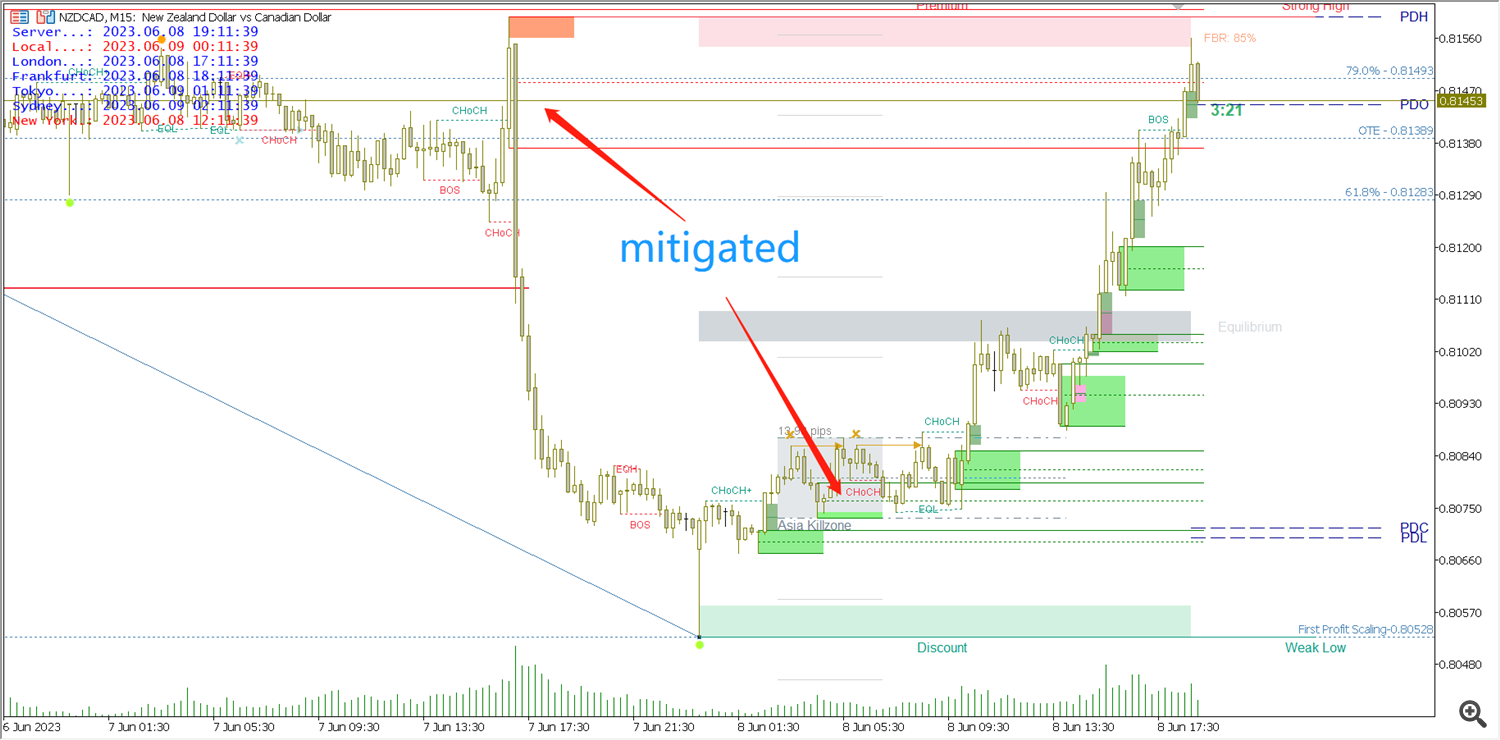

If the establishment’s orders haven’t been fully crammed, they’ll use the order movement of the recovered prices to commerce close to the preliminary value worth. These behaviors are mirrored on the chart as a affirmation of a worth reversal, which opens a brand new development.

The establishment’s value accumulation space is the order block. A lot of order prices are stacked inside, which is an space that establishments will certainly shield.

Not all order blocks might be recovered shortly, and do not be too inflexible in regards to the idea of order movement. Do not attempt to search certainty. The order movement technique is only a likelihood benefit. “

Let’s see for your self, his primary precept is to investigate the precept of institutional Positions and discover the traces of institutional Positions. OB is the price space of institutional Positions, so our Place in the price space of the establishment is in fact the place with the very best successful charge.

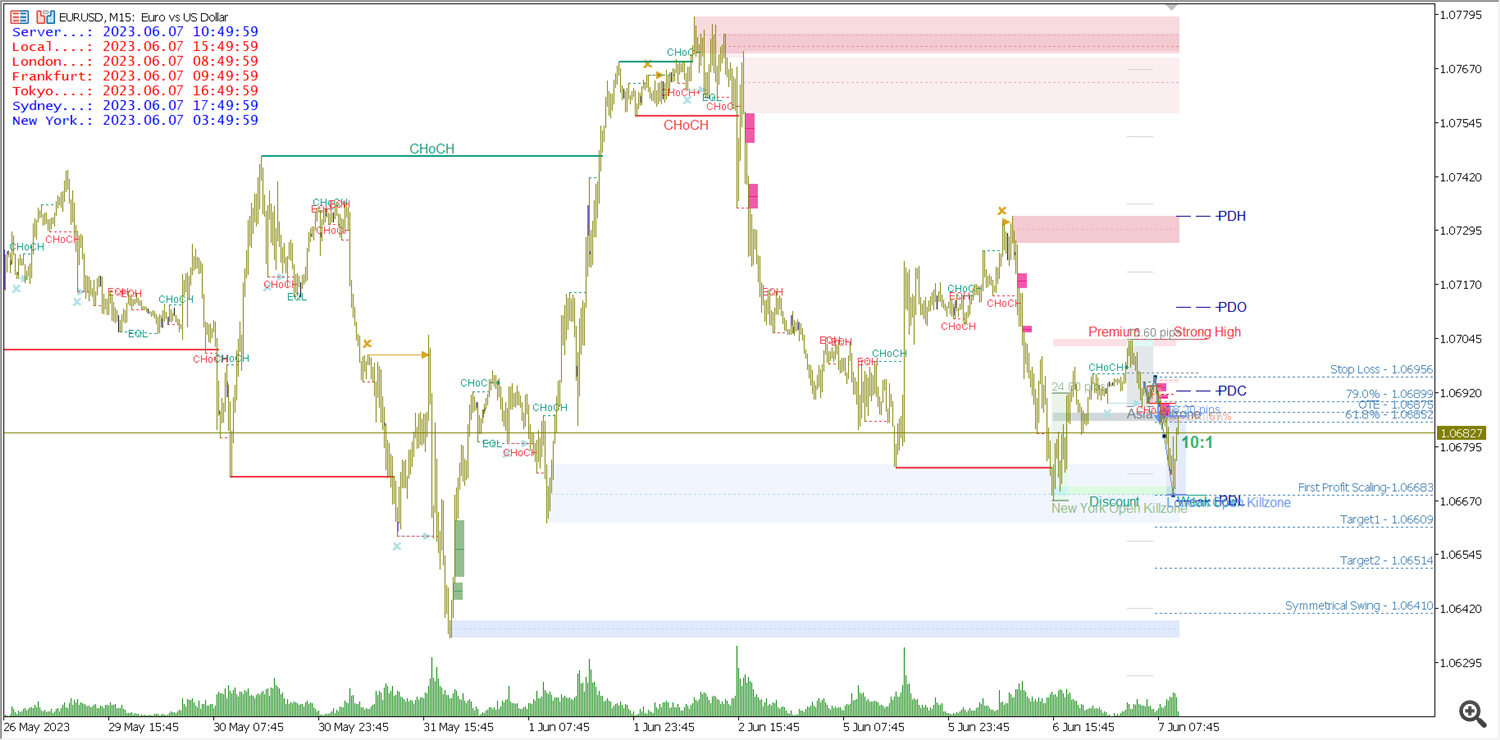

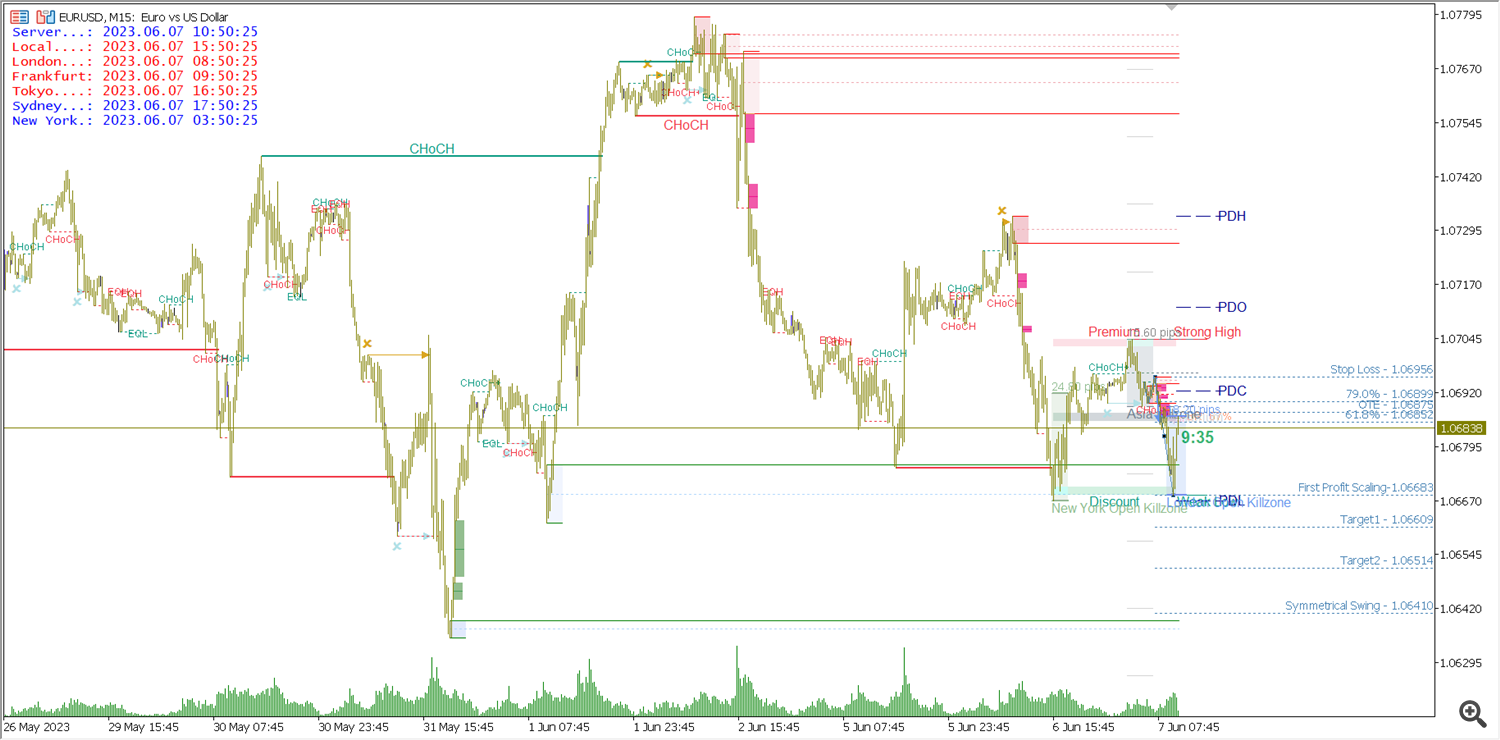

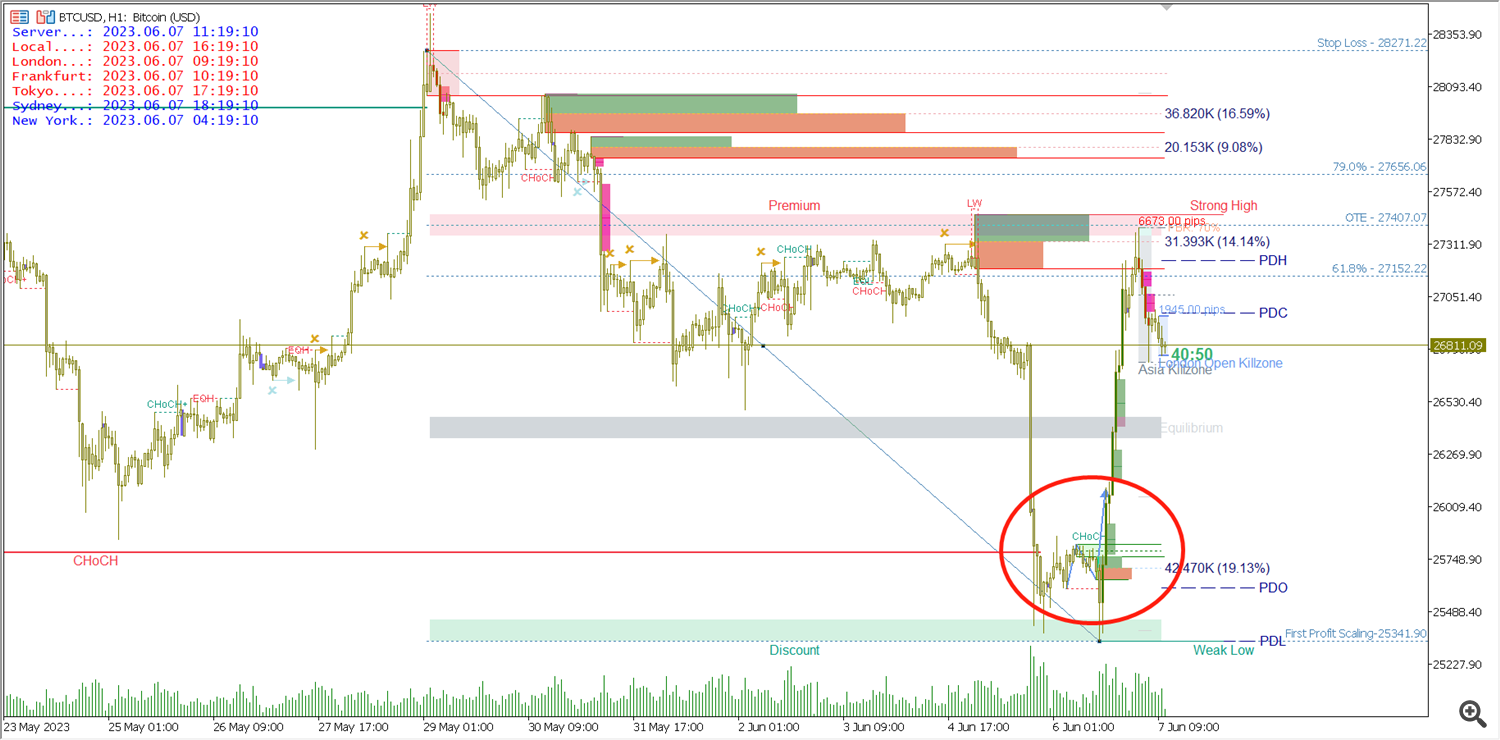

Check out this image once more:

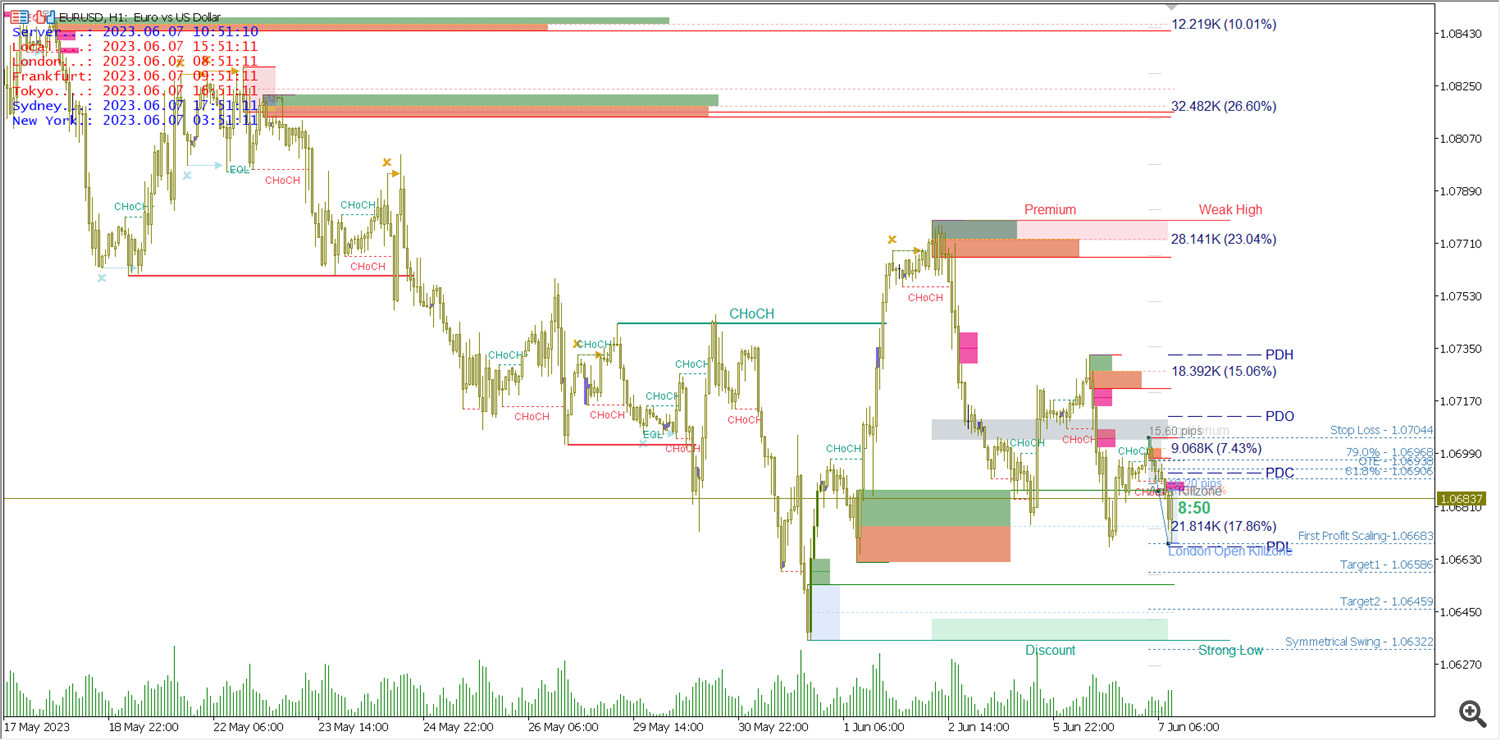

Within the order movement technique, it’s extra essential to evaluate the value development, so merchants decide the path in their very own massive cycle or path cycle, and commerce in their very own small cycle or buying and selling cycle. Multi-period evaluation is essential in SMC buying and selling, at the least you want two intervals, one path interval and one transaction interval. Many individuals ask me what’s the greatest cycle alternative, however there isn’t any unified reply. If you happen to use the 5-minute chart because the buying and selling interval, then I believe your path interval is at the least 1 hour or 4 hours; if you happen to use the 15-minute chart because the buying and selling interval, then I believe your path interval is at the least 4 hours or extra. It is a mixture that I personally suppose is smart.

When the value fully crosses an OB, the OB is deleted.

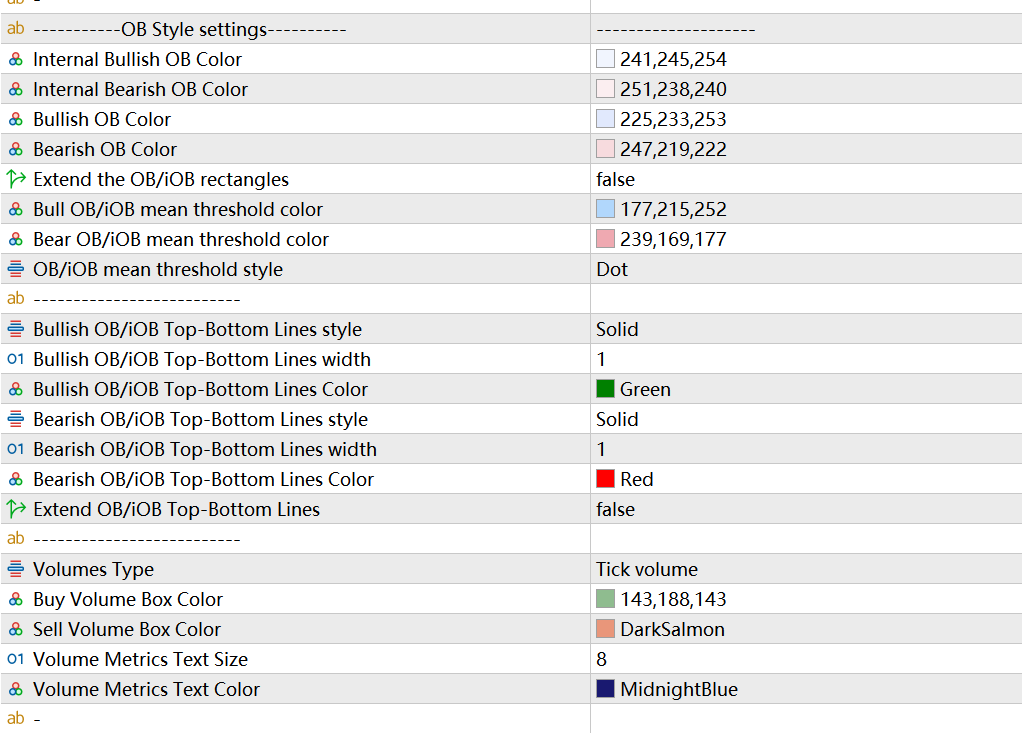

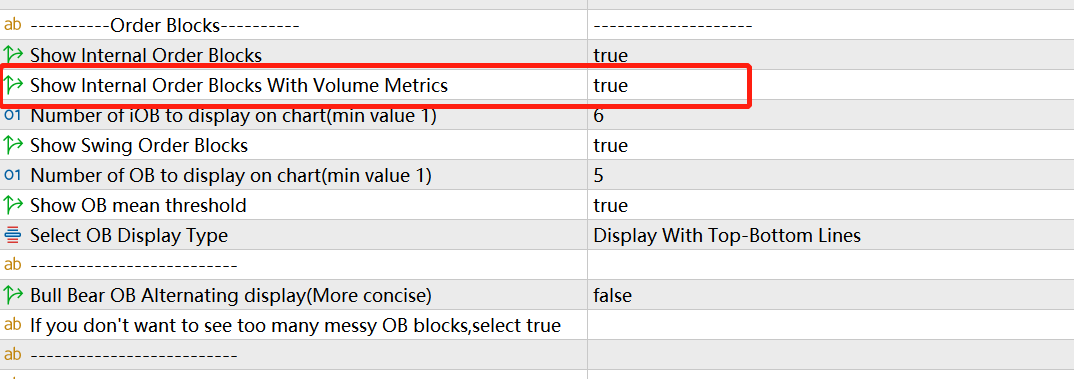

Within the settings, we will set whether or not to show inside ob and swing ob, and the variety of latest OBs that should be displayed. Customers also can set whether or not to show OB imply threshold and the best way of OB show. There are two kinds of OB show strategies to select from. One is Show As Rectangles, which signifies that this system identifies the OB with an oblong block stuffed with colour. The second kind is Show With High-Backside Strains, which signifies that this system will mark the excessive and low factors of the OB with two straight strains up and down. This selection is especially utilized by merchants who desire a extra concise OB show.

BULL bear ob various show, this setting permits the OBs on the higher and decrease sides of the present worth to be displayed alternately in the latest order and meet the show amount restrict.

OB fashion settings, the place customers can freely set the colour of OB to fit your chart fashion, making the chart look extra concise and exquisite. Prolong the ob/iob rectangles, this setting permits the OB block to robotically prolong to the far proper of the chart, if you happen to like this OB show, you may set this to TURE. Beneath is the formatting for OB imply threshold line. You’ll be able to select stable or dashed strains and the colour of the strains based on your preferences. Subsequent is the place to set the format of OB top-bottom strains, the format, colour, width and whether or not to increase to the far proper of the chart.

Beneath is the place to set the format of the interior OB with quantity metrics. You’ll be able to flip this function on or off by setting Present Inside Order Blocks With Quantity Metrics. Right here we will select two quantity sorts, Tick Quantity and Actual Quantity. If we commerce forex pairs, there may be solely Tick Quantity knowledge.

This perform will calculate and show the sum of the transaction quantity within the structural breakthrough comparable to the OB, as a reference for the OB within the transaction quantity dimension. Right here, the inexperienced rectangular block is the statistics of the buying and selling quantity of the bullish candles, and the orange rectangular block is the statistics of the buying and selling quantity of the bearish candles. The rightmost tab reveals the sum of lengthy and brief volumes. Proportion is the ratio of this OB transaction quantity in contrast with different a number of OB transaction volumes.

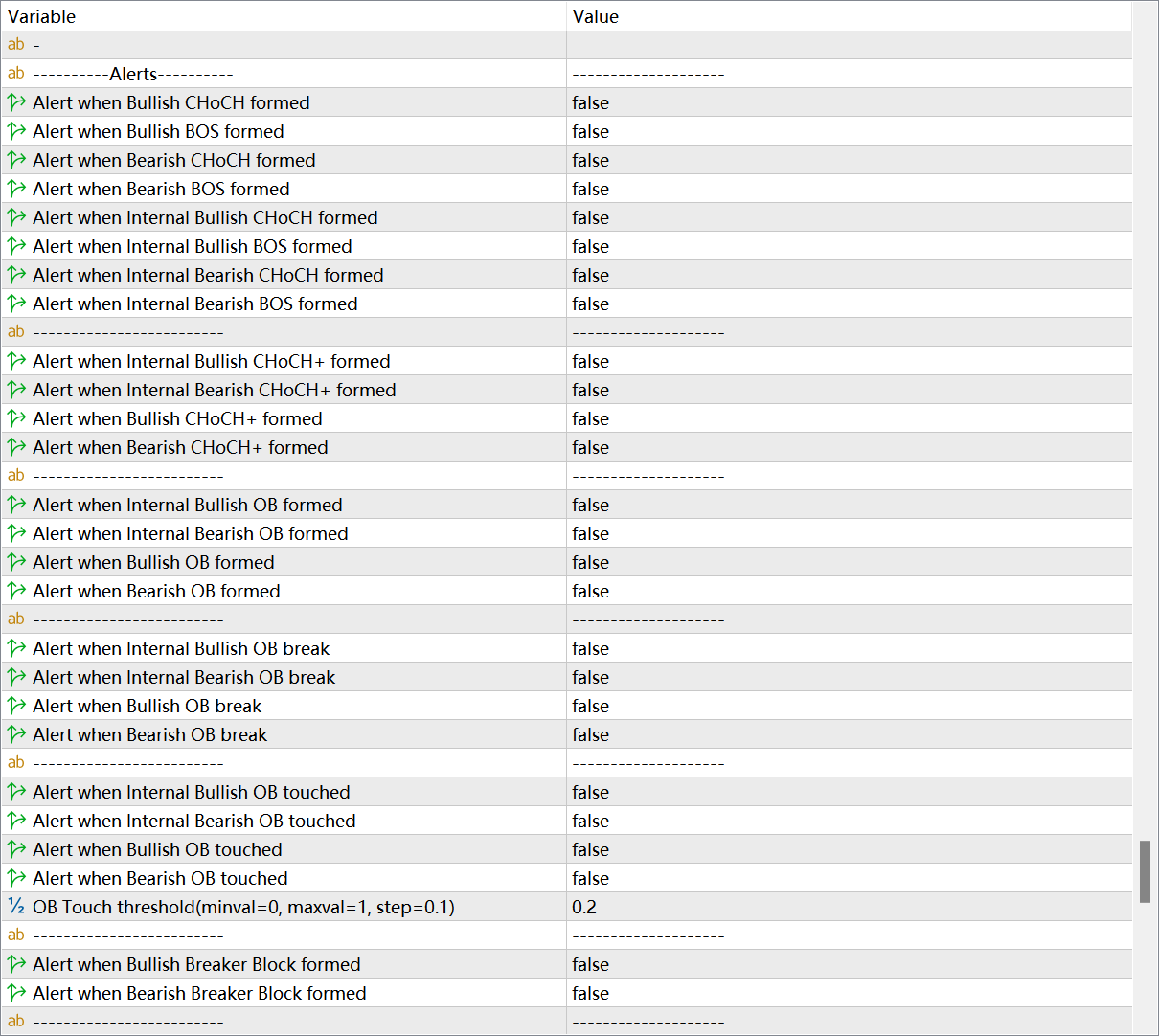

For market construction and OB, indicators have good and detailed reminder features. On the very finish of the setting interface is the realm the place ALERT is about intensively. Right here you may set alerts for the formation of every market construction. OB fashioned , OB touched , OB break also can set reminders. On the MT pc aspect, a immediate window will pop up and a immediate tone might be performed. If you wish to ship these reminders to the cellular terminal, you may set it below Alerts to cellular under. To be able to ship reminders to the MT4/5 software program on the cell phone, it’s good to carry out a easy configuration within the MT software program on the pc.

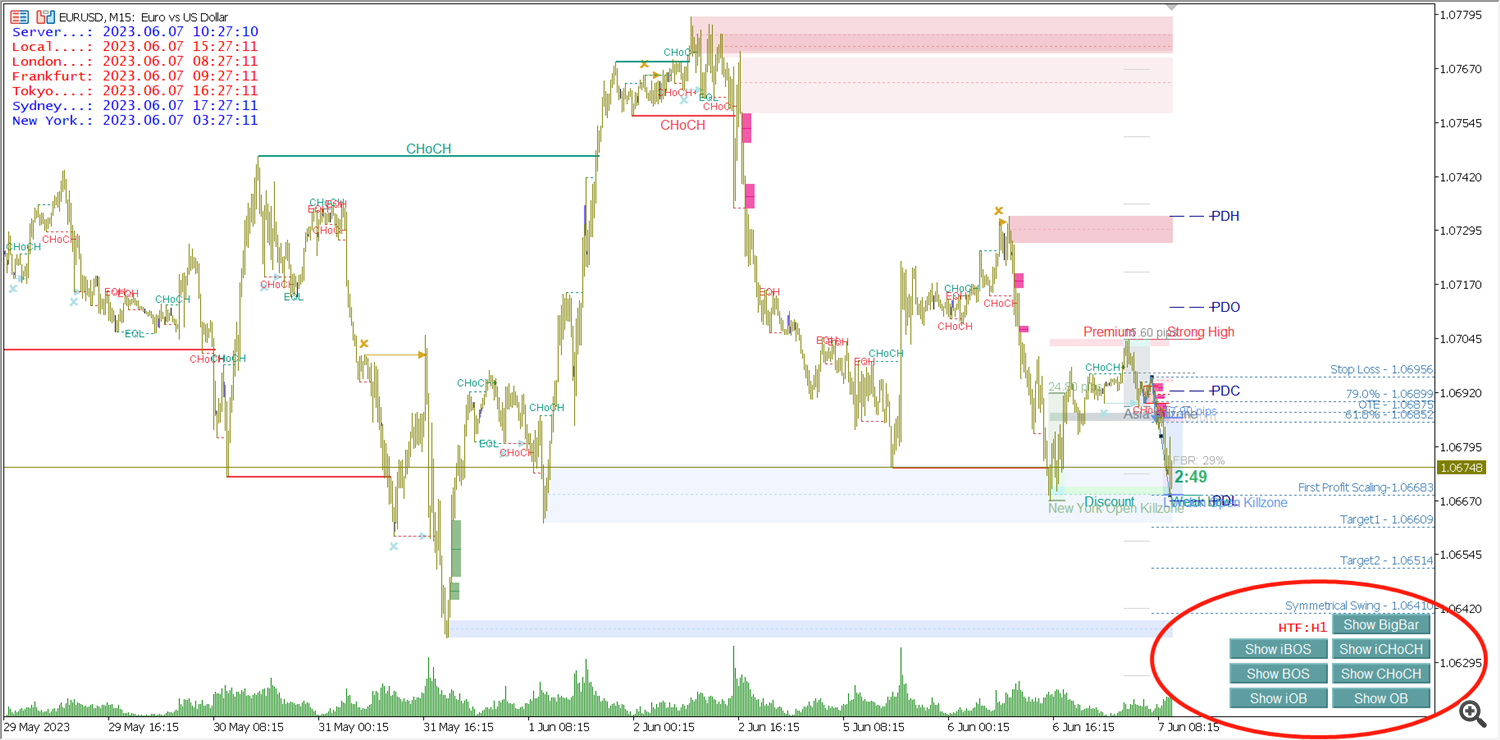

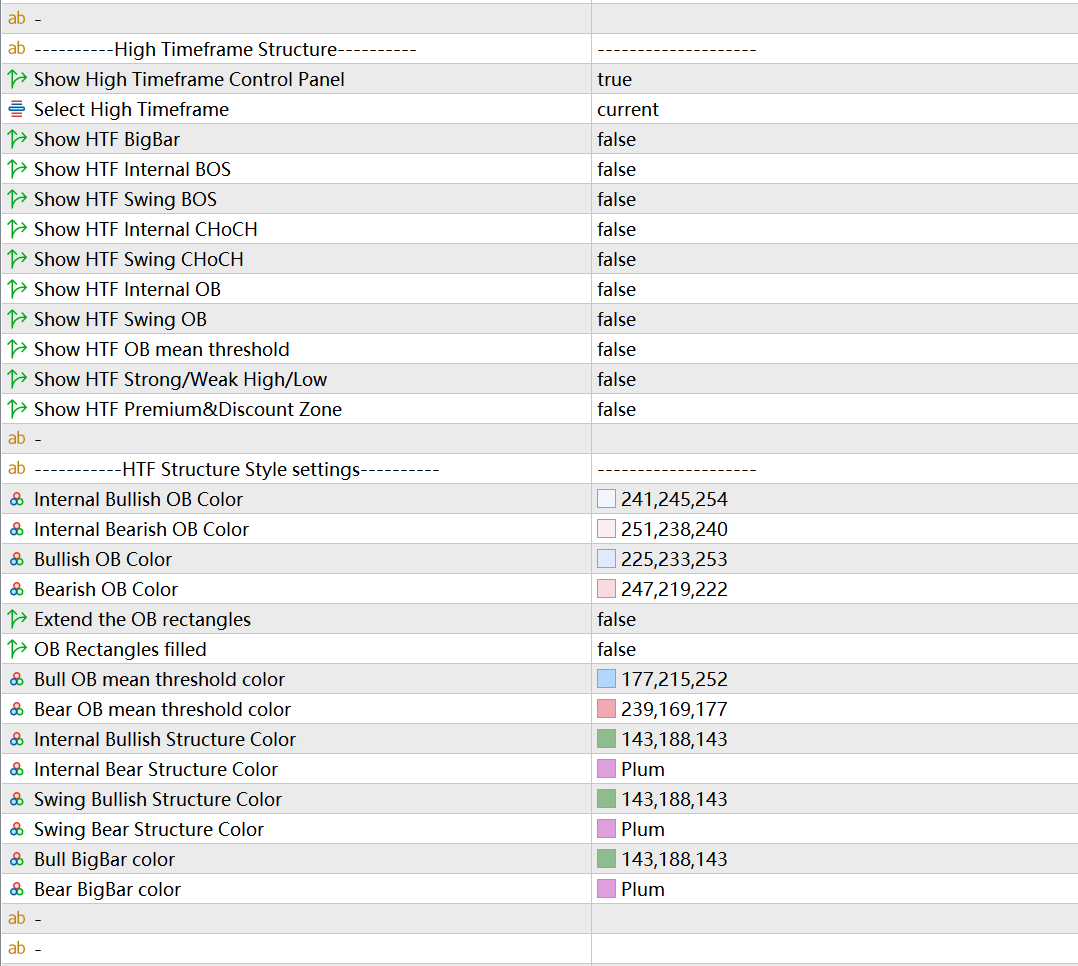

4. Excessive Timeframe Construction

The HTF Construction perform primarily offers customers the market construction info of two totally different Timeframes concurrently displayed on the identical chart. So long as the primary merchandise is about to true and the second merchandise “Choose Excessive Timeframe” selects a interval bigger than the present TF, then the HTF perform will begin. At this level, the management buttons for HTF will seem within the decrease proper nook of the chart.

Clicking totally different buttons will show totally different info of HTF. The shortcut button features of HTF BigBar, HTF inside BOS, HTF inside CHoCH, HTF swing BOS, HTF swing CHoCH, HTF inside OB, HTF swing OB are supplied right here. HTF OB imply threshold, HTF Robust/Weak Excessive/Low, HTF Premium&Low cost Zone features must open the setting interface for setting.

The HTF Construction Model Settings space is the fashion property setting space for HTF performance. Customers can set it based on their wants.

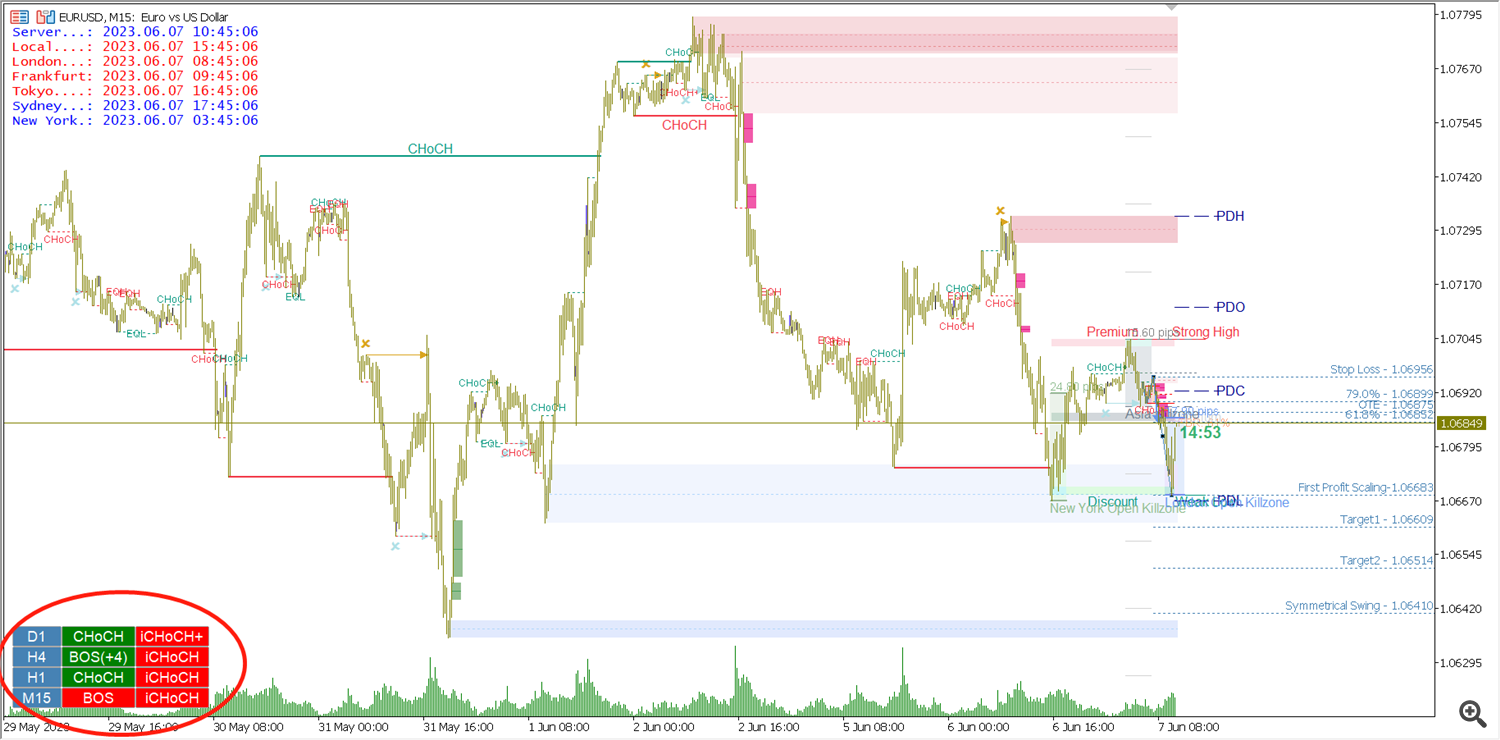

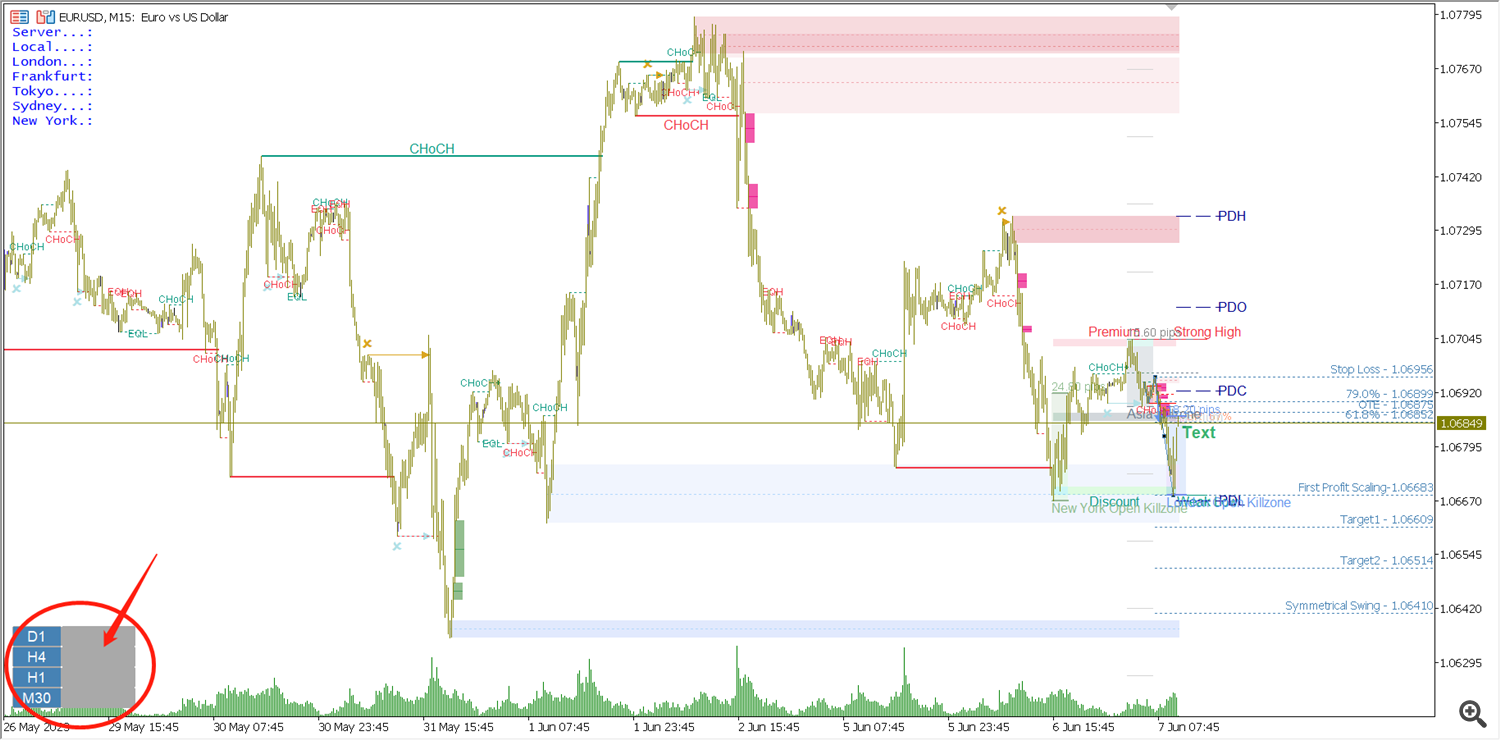

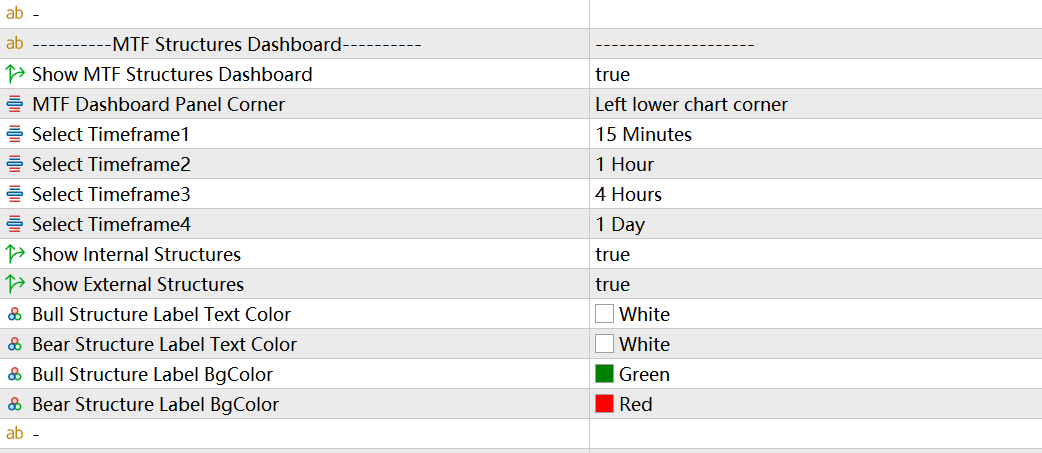

5. MTF Constructions Dashboard

This perform will show BOS/CHoCH info of 4 totally different intervals in a single panel on the chart on the similar time, in order that customers can shortly perceive the market construction info of different intervals. Customers can set the 4 intervals they want within the settings, and might select to show solely inside constructions or swing constructions. Customers can select the show place of MTF Dashboard. This system offers 4 corners of the chart for choice, and the default is the decrease left nook of the chart.

If there isn’t any knowledge as proven within the determine above, please right-click on the chart and choose Refresh on the pop-up menu.

6. Fibonacci Retracement/Fibo OTE

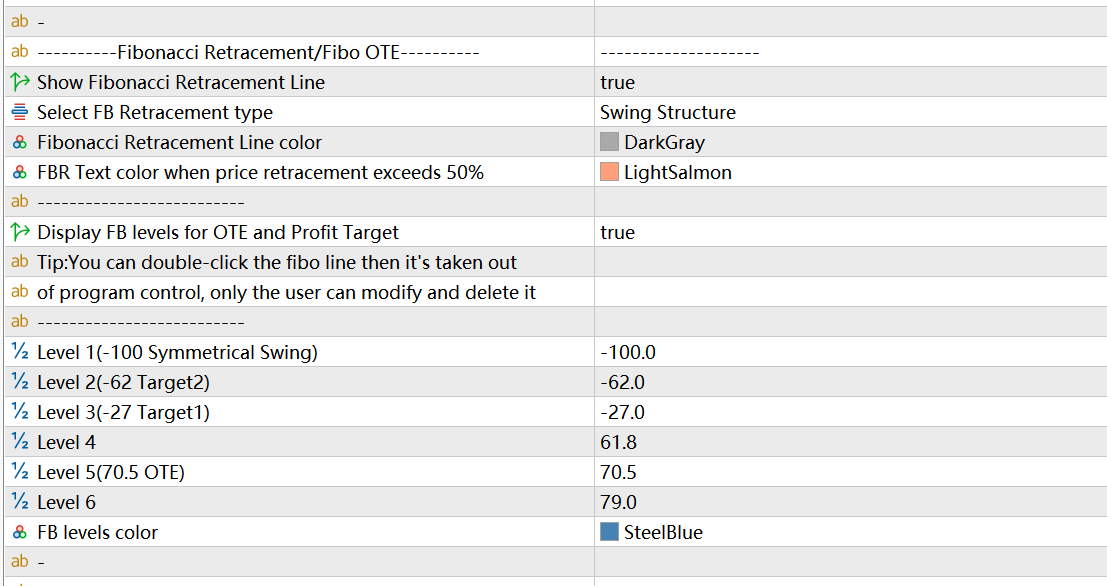

Within the order movement technique we talked about that development merchants are eager to commerce breakouts, whereas the order movement technique makes use of construction breakouts to estimate path and analyze institutional order blocks. Wait till the value pulls again to the low cost space or the order block space earlier than coming into the place. Subsequently, it’s a crucial perform for SMC merchants to make use of FIBO to mark a wave of worth breakthroughs, and to foretell and mark the potential retraction vary of costs. The Fibonacci Retracement perform can robotically draw a wave of FIBO primarily based on break inside constructions and break swing constructions, and mark essential positions that merchants care about: Cease Loss(100%), OTE(70.5), 79%, 61.8%, First Revenue scaling(0%), Goal 1(-27%), Goal 2(-62%), Symmetrical Swing(-100%). You may also set the callback vary based on your individual wants. Degree 1-6 will be set freely.

Within the setting, the primary 4 setting gadgets are for setting FBR, as proven within the determine under. In accordance with the value development, FBR shows the utmost correction vary in actual time. When the correction vary exceeds 50%, it will likely be displayed in a extra eye-catching colour. You may also set reminders for FBR within the Alerts space.

The next setting gadgets are for setting the Fibo Ranges for OTE perform. See under. If you happen to really feel that the excessive and low factors of Fibo Ranges robotically drawn by this system are incorrect, you may drag and modify by your self. If it’s good to show this Fibo Ranges on a regular basis and don’t need this system to delete or modify it, then you may double-click this Fibo Ranges to make it out of the management of this system.

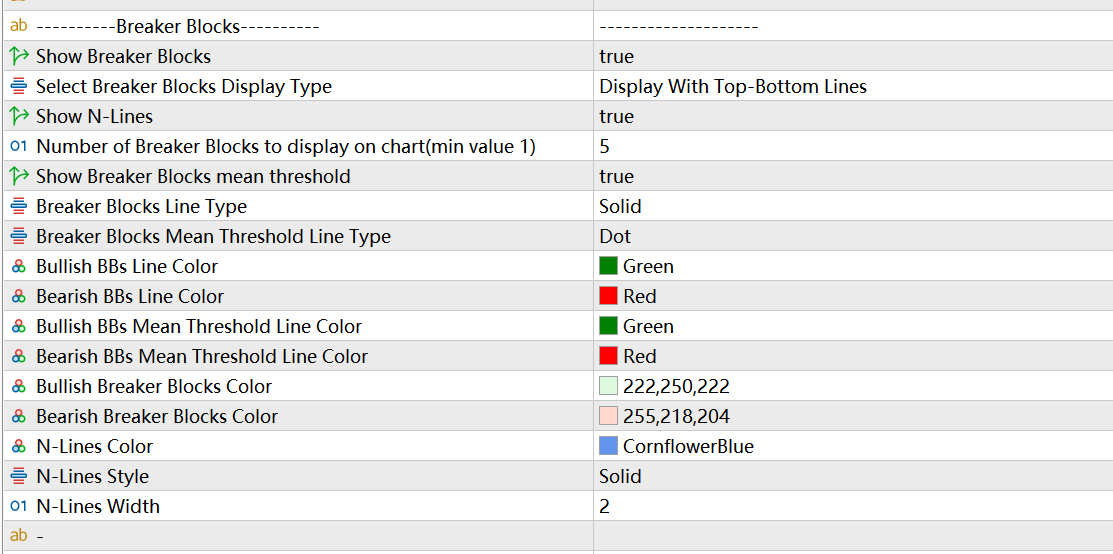

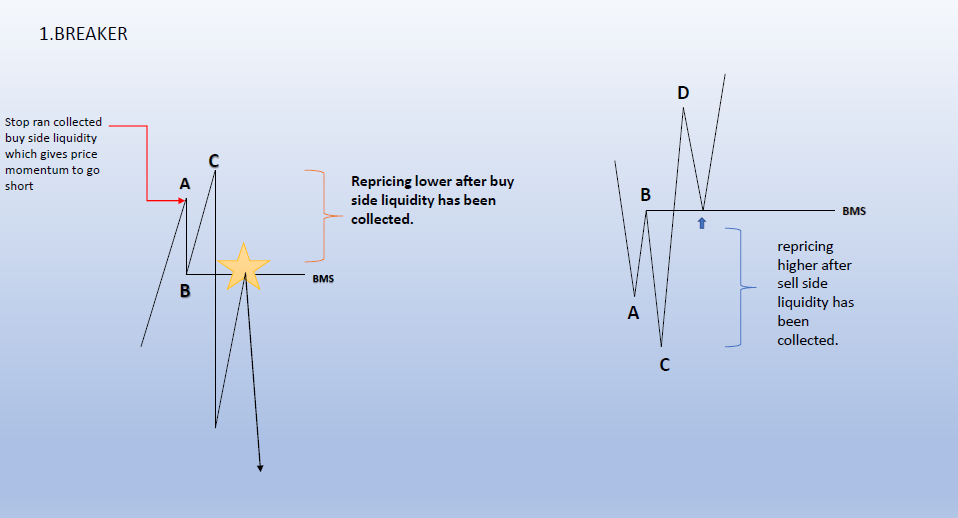

7. Breaker Blocks

The definition of Breaker is proven within the determine above. Breaker Blocks are bullish candles or bearish candles at level B. There are various worth actions that fulfill the N-shaped form of ABCD, and what we hope is to search out out the Breaker that seems when the value reverses on the finish of the development and the Breaker that happens when the value reverses on the finish of the callback. Subsequently, this system has made some judgments on development developments and callback developments, however they won’t be very correct. Customers want to make use of their very own expertise, or mix momentum indicators and overbought and oversold indicators to filter and use them.

As well as, the CD line is the value breakthrough level B (the low/excessive level of the callback). If the CD is a powerful momentum breakthrough (mixed with FVG, Robust Imbalance, Quantity Imbalance, and so forth.), then the likelihood of success of this Breaker might be larger.

The primary setting is whether or not to allow Breaker Blocks (BB) detection and show. The second merchandise units the show kind of BB, and there are additionally two kinds of filling rectangle and higher and decrease strains for choice. The third merchandise is to set whether or not to show N-Strains, N-lines is the connecting line of three line segments AB, BC, CD, forming an N form. The fourth setting must show the most recent BB amount that has not been damaged by the value. The fifth setting is whether or not to show BB imply threshold. The next settings are mainly the settings of the looks fashion, and the consumer can set it based on the wants.

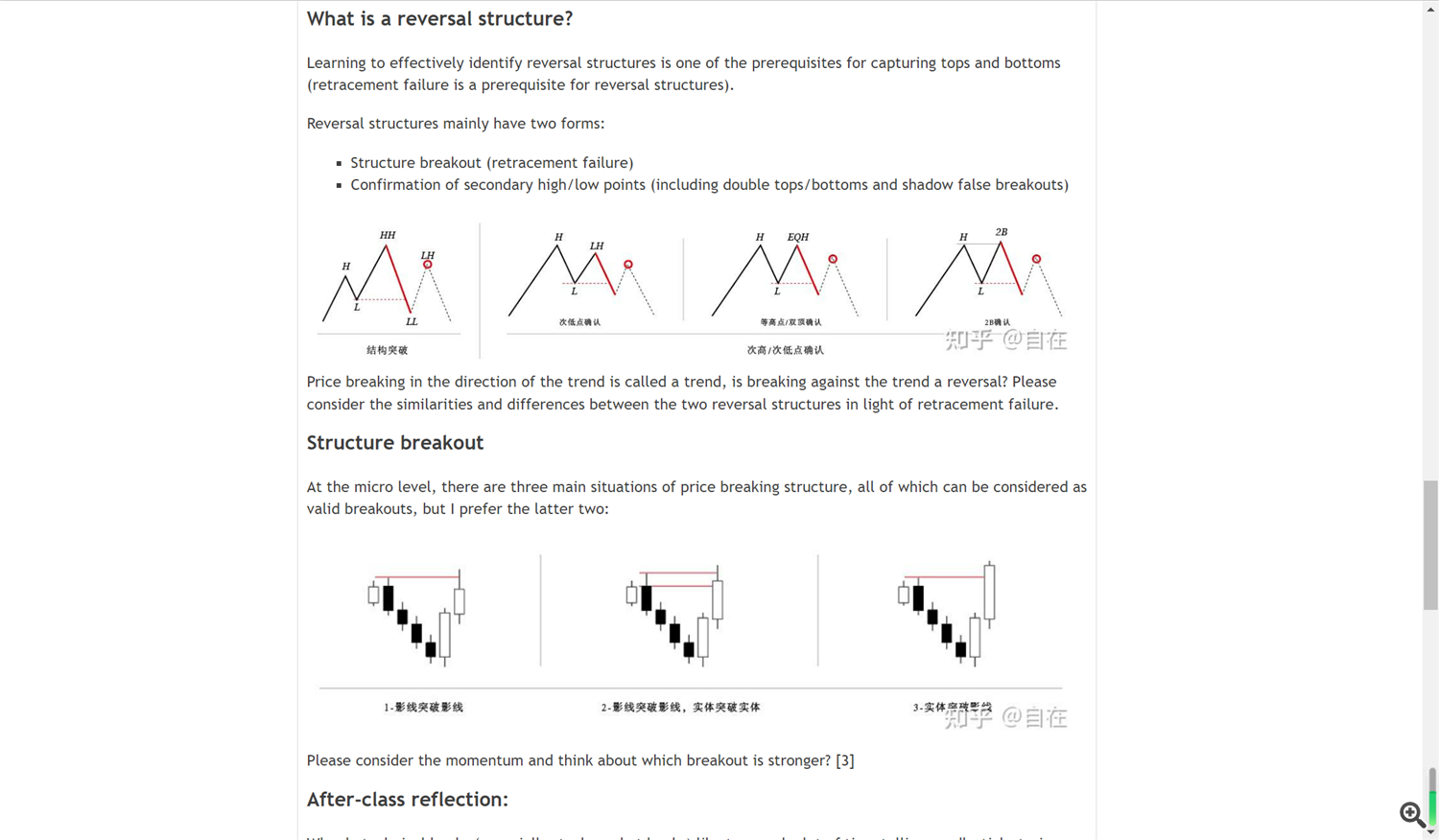

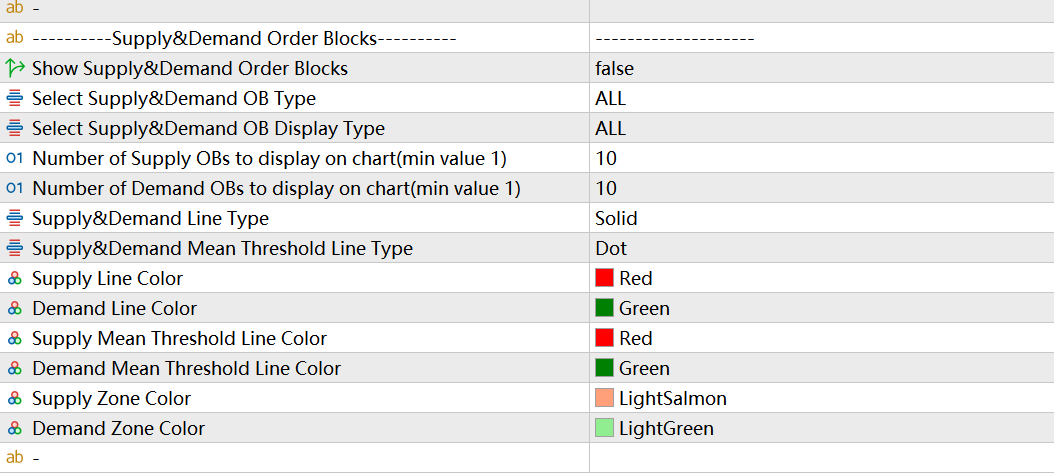

8. Provide&Demand Order Blocks

Earlier than utilizing the availability and demand order block perform, please learn the chapter “Construction-Primarily based Provide and Demand Buying and selling Technique” within the SMC article I shared. It comprises an in depth introduction of what’s a provide and demand space (Institutional positions constructing space or determination space), the best way to establish a provide and demand space, and the kind of a provide and demand space, and so forth. Merely put, provide and demand will be divided into two sorts: reversal construction and continuation construction. You’ll be able to select to show one or all of them within the indicator settings. The indicator additionally offers two show kinds of provide and demand OB, which customers can set based on their preferences.

What’s the distinction between a provide and demand zone order block and an order block so as movement technique? In my private opinion, the theoretical foundation of the 2 is totally different. In contrast with the idea of provide and demand, the order block within the order movement technique will be considered a generalized provide and demand space, or the availability and demand space will be considered a chivalrous order block. As a result of the availability and demand zone within the provide and demand technique particularly refers back to the interval candles with spindle candle/doji as the primary shadow candle(the shadow candle are better than 50%). However in observe, you can find that the availability and demand zone is considerably impractical – the value typically reverses on the massive bodily order block, moderately than the availability and demand zone (spindle/doji and so forth. interval candles). Subsequently, when the indicator calculates the availability and demand space, it doesn’t strictly comply with the definition to search out the interval candles as the availability and demand block. Customers can open OrderBlocks and Provide&Demand OBs on the similar time to view their similarities and variations, or select to make use of solely the order movement technique or solely the availability and demand technique primarily based on their very own buying and selling expertise.

9. Robust Imbalance Labeling

10. Honest Worth Gaps

11. Liquidity Voids

12. Quantity Imbalance

13. Lengthy Wicks

14. BSL/SSL Taken Detect

15. EQH/EQL

16. Premium/Low cost Zones

17. Earlier Day/Week/Month-to-month Excessive/Low and Earlier Day Open/Shut

18. Market Time Session

19. NY Midnight Open

20. Asian Vary(Asia Killzone), London Open Killzone, London Shut Killzone, New York Open Killzone, New York Shut Killzone

21. NWOG/NDOW

22. Candle Timer

23. Draw Candles By Pattern

[ad_2]