[ad_1]

Development-momentum methods that commerce stock-based ETFs ought to require two circumstances earlier than contemplating a place. First, broad market circumstances must be bullish. This implies being lengthy shares in bull markets and out of shares in bear markets. Second, the development for the ETF must be up. Using these primary stipulations can enhance efficiency. As soon as these two circumstances are met, we will start the rating course of to search out the strongest. Let’s take a look at examples with the Nasdaq 100 ETF (QQQ) and the Dow SPDR (DIA).

In the beginning, we should be in a bull market setting. TrendInvestorPro makes use of the Composite Breadth Mannequin to find out market circumstances and it has been constructive for the reason that finish of March. This implies the setting is favorable for stock-based ETFs. Second, the Development Composite should be constructive, which suggests the ETF is in an uptrend. Solely ETFs in uptrends are eligible to be ranked and regarded for positions in a trend-momentum portfolio. For ETFs, the rank indicator of alternative is Normalized ROC. The chart under reveals QQQ with a constructive Development Composite since February 2nd and Normalized ROC at 5.44.

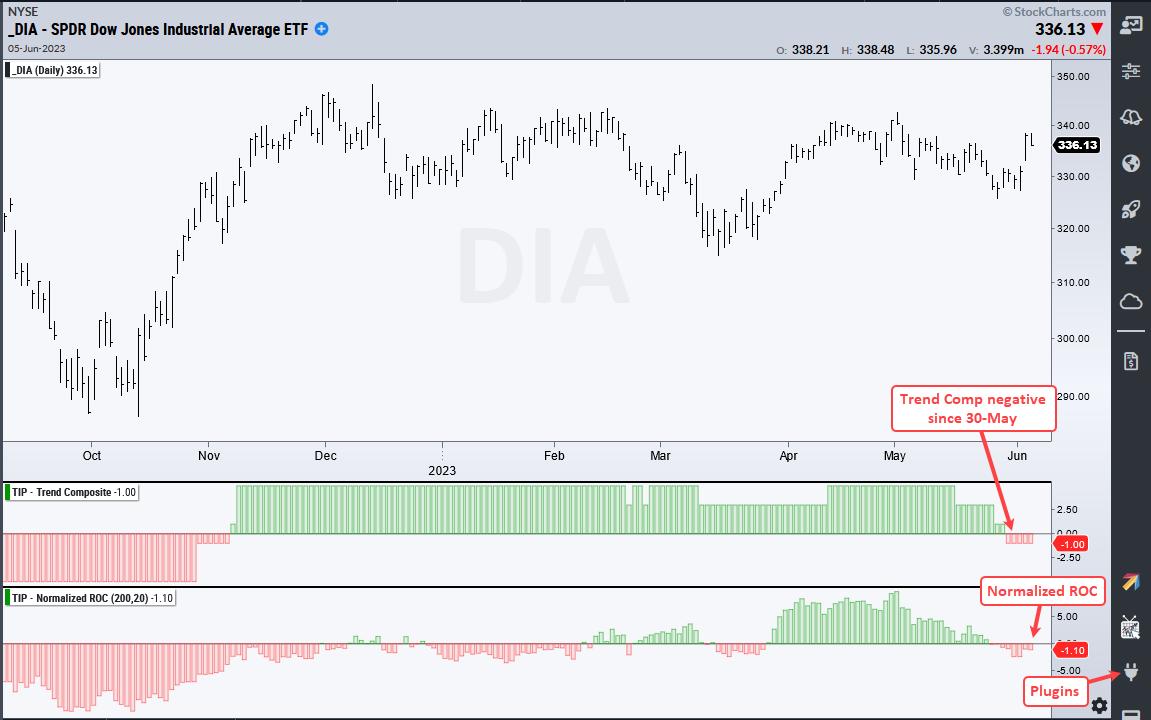

Normalized ROC (200,20) tells us the 200-day Greenback acquire or loss in ATR(20) phrases. QQQ is up $26.41 the final 200 days, ATR(20) is 4.858 and Normalized ROC is 5.44 (26.41/4.858 = 5.44). In distinction to QQQ, the subsequent chart reveals DIA with a damaging Normalized ROC (-1.1). Clearly, QQQ is main and DIA is lagging. Additionally discover that the Development Composite turned damaging for DIA in late Might. QQQ is eligible and DIA isn’t.

TrendInvestorPro not too long ago launched a technique utilizing Normalized ROC to commerce main ETFs. This technique additionally makes use of the Composite Breadth Mannequin and Development Composite, in addition to the Exponential Slope to set a momentum minimal. Subscribers get entry to a seven half article detailing the technique and displaying efficiency metrics. Click on right here for quick entry.

Normalized-ROC, the Development Composite, ATR Trailing Cease and 9 different indicators are a part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click on right here to take your evaluation course of to the subsequent stage.

———————————————————-

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out development, discovering indicators throughout the development, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.

Subscribe to Artwork’s Charts to be notified every time a brand new put up is added to this weblog!

[ad_2]