[ad_1]

EUR/USD: Subsequent week: 5 Days of Storms and Tsunamis

● It appears that evidently the entire world celebrated the Chinese language New Yr final week. There was some volatility in all main foreign money pairs after all, however we acquired an nearly excellent sideways pattern ultimately. We won’t deny the significance of the New Yr holidays, however the motive for the lull, after all, will not be on this, however in the important thing occasions which can be coming subsequent week.

On February 1, when will probably be late at evening in Europe and daybreak in Asia, the US Federal Reserve will announce its key rate of interest determination, and the regulator’s administration will inform (or a minimum of give a touch) about its future financial coverage. The European Central Financial institution will make its determination on the speed just a few hours later, on Thursday, February 02.

● However, earlier than giving forecasts, let’s flip to the occasions of the previous 5 days. Information launched on Thursday, January 26 confirmed that the US economic system is doing higher than anticipated. The nation’s GDP, in line with preliminary estimates, grew by 2.9% y/y in This fall towards the forecast of two.6%. On the similar time, preliminary claims for unemployment advantages for the week to January 21 fell to 186K (forecast 205K, the earlier worth of 192K). That is the bottom weekly determine since April 2022. Underlying sturdy items orders additionally beat estimates, dropping by -0.1% as an alternative of the anticipated -0.2%. New residence gross sales are additionally doing properly, with gross sales as much as 616K in December from 602K in November.

these figures, we will conclude that not every little thing is so unhealthy and there’s no recession in the USA. And that the Fed’s 2022 aggressive financial coverage (QT) has not had a suffocating impact on the economic system. Subsequently, it’s doable to maneuver on to its easing (QE). Nonetheless, some economists level out that client demand is dropping its momentum (2.1% in This fall towards the forecast of two.9% and a couple of.3% 1 / 4 earlier). Based mostly on this, they conclude that the possibilities of a light recession stay.

● For now, the market believes the Fed will increase charges by 25 foundation factors (bps) at its February assembly. It’s at present 4.50%, and the market consensus signifies its peak worth on the degree of 4.90-5.00% in 2023. The chance that the speed can be raised by one other 25 bp in March is estimated at 85%. Though some analysts consider that the height worth will cease at round 4.75%. Furthermore, the speed could even be lowered to 4.25-4.50% by the top of 2023. Such dynamics will clearly not profit the greenback, however it should push up the competing currencies from the DXY basket and dangerous property.

● As for the frequent European foreign money, the market is bound that the ECB will increase the speed by 50 bp on February 02. However, in line with analysts, the distinction within the rises in USD and EUR charges has already been taken into consideration by the market within the pair’s quotes, which is why it retains within the vary of 1.0845-1.0925. And its foreseeable future will depend upon the feedback and indicators that the leaders of the Fed and the ECB will give on the finish of their conferences.

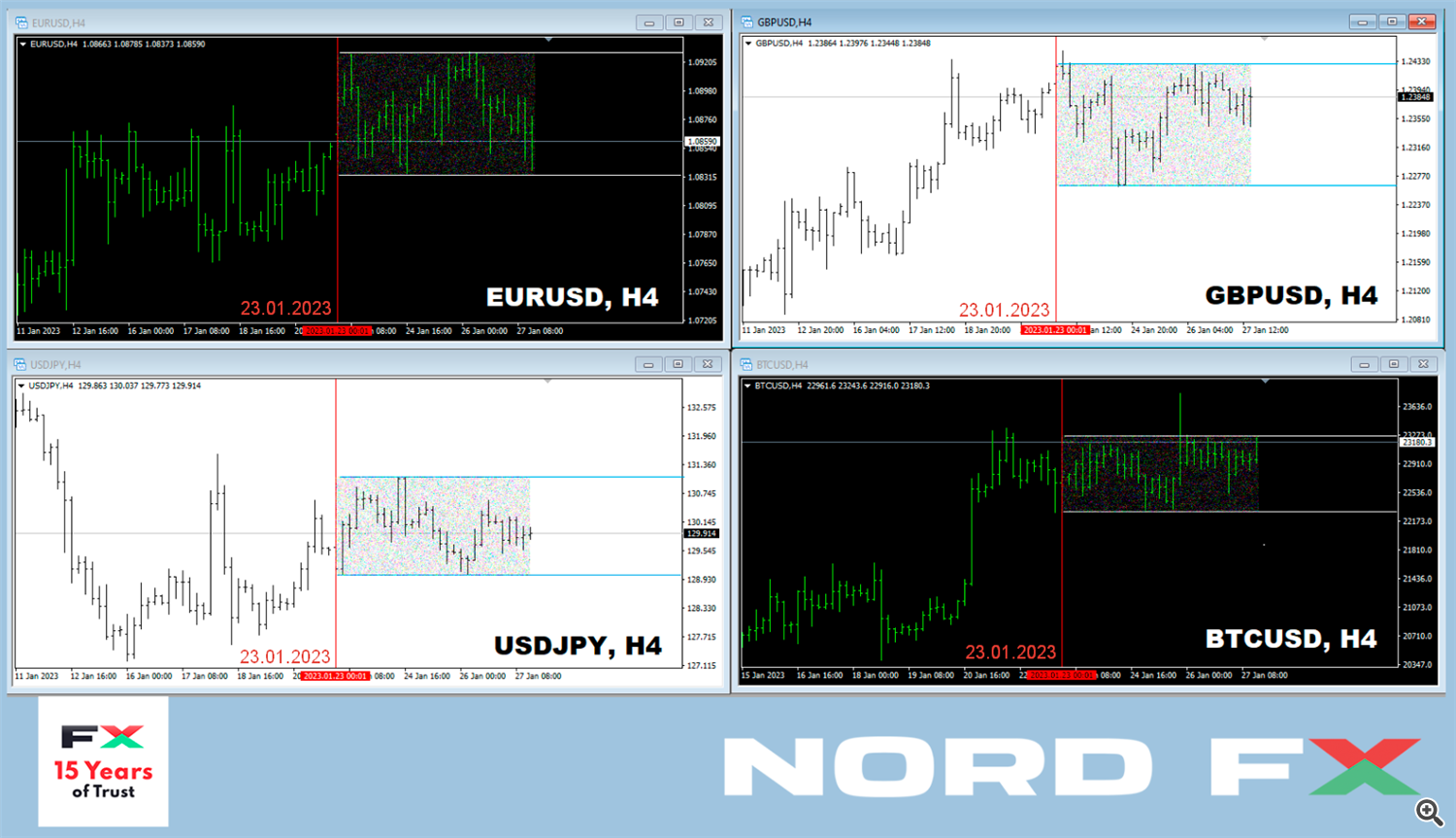

● Beginning at 1.0855 on Monday, January 23, the pair ended final week at 1.0875. On the time of writing the forecast (Friday night, January 27), the votes of supporters of bulls and bears are divided nearly equally. 50% of analysts count on additional strengthening of the euro and the expansion of the pair. 45% count on that the US foreign money will be capable of win again a part of the losses. The remaining 5% of consultants, in anticipation of the conferences of the Central Banks, desire to not make forecasts in any respect. Among the many indicators on D1, the image is totally different: 90% of the oscillators are coloured inexperienced, 5% point out that the pair is overbought, and 5% are coloured grey impartial. Amongst pattern indicators, 80% advocate shopping for, 20% advocate promoting. The closest assist for the pair is within the zone 1.0835-1.0845, then there are ranges and zones 1.0800, 1.0740-1.0775, 1.0700-1.0710, 1.0620-1.0680, 1.0560 and 1.0480-1.0500. The bulls will meet resistance on the ranges of 1.0895-1.0935, 1.0985-1.1010, 1.1130, after which they are going to attempt to achieve a foothold within the 1.1260-1.1360 echelon.

● The approaching week will undoubtedly be stormy and stuffed with occasions. Along with these Fed and ECB conferences, it must be famous that information on GDP had been printed on January 30, on the unemployment charge and inflation charge (CPI) on January 31, and on enterprise exercise (PMI) within the German manufacturing sector on February 01. We’ll discover out what’s the scenario with client costs ( CPI ) within the Eurozone and what’s taking place with enterprise exercise (PMI) within the USA additionally on Wednesday, February 01. As well as, we’re historically ready for a formidable portion of statistics from the US labor market on February 01, 02 and 03, together with the unemployment charge and the variety of new jobs created exterior the agricultural sector (NFP).

GBP/USD: The Way forward for the Pound Is in a Thick Fog

● The Financial institution of England (BoE) can even make its determination on the rate of interest on Thursday, February 02. And if the chance that the Fed and the ECB will increase their charges is near 100%, every little thing will not be so easy with the pound. In line with some analysts, the BoE could shock the markets by pausing and slowing down the tightening of its financial coverage.

Though there might not be a pause, we are going to see a brand new spherical of QT as an alternative of QE. British Chancellor of the Exchequer Jeremy Hunt mentioned on Friday, February 27 that “the weak restoration within the public sector after the pandemic reinforces the necessity for reforms” and that “the perfect tax reduce proper now’s decrease inflation.” And the perfect (if not the one) remedy for inflation, because the expertise of abroad colleagues exhibits, is to boost rates of interest.

● Pound bulls hope that the Financial institution of England will increase the pound charge by 50 bp, and it’ll rise to a minimum of 4.50% from the present 3.50% by the summer time. As for the bears, they consider that the specter of an financial downturn and recession will forestall the Central Financial institution from elevating it by greater than 25 bps now, and it’ll achieve this for the final time, after which be pressured to ease financial coverage regardless of excessive inflation.

● Usually, the long run is shrouded in fog. However the truth that the nation’s economic system has huge issues may be very clear. That is evidenced by the autumn within the Composite Enterprise Exercise Index (PMI) from 49.0 to 47.8 factors, as an alternative of the anticipated improve to 49.3.

Financial institution of England Governor Andrew Bailey has just lately mentioned that the British economic system after Brexit has confronted a scarcity of greater than 300,000 employees because of the cessation of the free motion of labor from the EU. Such a deficit has develop into an impediment to the battle towards inflation, because it entails a rise in wages. As well as, the nation’s economic system continues to be pressured by excessive vitality costs and provide disruptions, in addition to different issues associated to sanctions towards Russia resulting from its invasion of Ukraine.

● The quotes of GBP/USD haven’t modified a lot over the previous 5 days: ranging from 1.2395, it set the ultimate chord there. The median forecast for the close to future additionally appears obscure: 35% of consultants consider that it’s time for the pair to show south, simply as many level to the north, and the remaining 30% look east. Among the many oscillators on D1, 85% are coloured inexperienced, 15% sign that the pair is overbought. Development indicators are 100% on the inexperienced facet. Assist ranges and zones for the pair are1.2360, 1.2300-1.2330, 1.2250-1.2270, 1.2200-1.2210, 1.2145, 1.2085-1.2115, 1.2025, 1.1960, 1.1900, 1.1800-1.1840. When the pair strikes north, it should face resistance at ranges 1.2430-1.2450, 1.2510, 1.2575-1.2610, 1.2700, 1.2750 and 1.2940.

● Among the many occasions associated to the economic system of the UK within the coming week, other than the assembly of the Financial institution of England, one can notice February 01 and 03, when contemporary January information on enterprise exercise (PMI) within the nation can be printed.

USD/JPY: The Way forward for the Pair Relies on the Fed

● In contrast to its counterparts, the Financial institution of Japan (BoJ) left its key charge unchanged at a destructive degree of -0.1% at its assembly on January 18. The subsequent assembly will not be quickly, on March 10. The present head of BoJ chapter Haruhiko Kuroda will preside over it for the final time. His powers will finish on April 08, and the assembly of the BoJ on April 28 can be held by the brand new head of the Central Financial institution. It’s with this occasion that markets affiliate a doable change in financial coverage within the nation. Within the meantime, the views of market individuals are centered on the US Federal Reserve.

● As with the earlier pairs, USD/JPY was not a lot lively final week, beginning at 129.57 and ending at 129.85. Analysts’ forecasts don’t give any steerage till the following Fed assembly: 50% of them facet with the bulls, 40% with the bears, and 10% have determined to not make predictions in any respect. Among the many oscillators on D1, 10% level north, 35% look south, and 55% level east. For pattern indicators, 15% look north, 85% look in the wrong way. The closest assist degree is positioned at 129.50 zone, adopted by ranges and zones 128.90-129.00, 127.75-128.10, 127.00-127.25, 126.35-126.55, 125.00, 121.65-121.85. Ranges and resistance zones are 130.50, 131.25, 132.00, 132.80, 133.60, 134.40 after which 137.50.

● No essential occasions concerning the Japanese economic system are anticipated this week.

CRYPTOCURRENCIES: New Buying and selling Technique: Chinese language New Yr

● Bitcoin behaves much more calmly than the S&P500, Dow Jones and Nasdaq inventory indices on the eve of the Fed assembly on February 01. In fact, a sure correlation between them stays, however the volatility of the primary cryptocurrency has develop into noticeably much less. Though, it’s fairly doable that that is simply the calm earlier than the storm. Which, as typical, can be organized by the American regulator with its financial coverage and the important thing charge for USD.

● In line with Ark Make investments CEO Cathy Wooden, the cryptocurrency market will enter a brand new part in 2023. The rise in bitcoin and different digital currencies would be the results of the Fed’s financial easing within the second half of this yr. It’s this transfer that may develop into a set off for buyers testing inventory markets and digital currencies. (Bloomberg strategist Mike McGlone expressed an analogous perspective earlier, mentioning the opportunity of BTC rising to $30,000).

● Adam Farthing, Chief Danger Officer at crypto firm B2C2, famous that the primary cryptocurrency wants to beat the important thing degree at round $25,000 so as to proceed the rally. “It will likely be a tricky nut to crack,” the skilled shared his opinion. In line with him, after passing the designated milestone, curiosity will resume from outsiders who need to return to the market.

Nonetheless, analysts on the brokerage firm Bernstein are satisfied that such a rally is unlikely to proceed in the mean time, as there aren’t any indicators of “any new injections” into the business. Nonetheless, of their opinion, institutional capital will nonetheless start to indicate extra curiosity in cryptocurrency this yr, because it turns into an more and more regulated asset class. (Now we have additionally repeatedly raised the subject of regulation and its battle with the primary thought of cryptocurrencies in our critiques).

● And DataDash analyst and channel creator Nicholas Merten additionally believes that whereas cryptocurrencies have a vibrant future, many underestimate the present world setting. In his opinion, the harm brought on by FTX, Celsius, Three Arrows Capital and Terraform Labs has left an indelible mark on the business. As well as, it’s essential to keep in mind the macroeconomic part, since many international locations are battling fast inflation, and provide chains haven’t absolutely recovered after the coronavirus pandemic. In line with the skilled, buyers want to know that the long-term bullish pattern is over. Sadly, the digital asset business wants to arrange for brand new challenges, and the present bullish pattern available in the market is simply an area correction inside the total bearish pattern.

● Jim Cramer of CNBC agrees with Nicholas Merten. The “Mad Cash” TV presenter has additionally centered on the dangers in gentle of the FTX crash. He famous {that a} related scenario may occur at any time with every other giant crypto firm. In his opinion, nobody is aware of what the large gamers within the business are actually hiding. And there aren’t any ensures that they’re truly trustworthy with their clients. Any new scandal, in line with him, will trigger a pointy drop in bitcoin quotes, which signifies that buyers’ property are in danger. Citing Carley Garner, senior commodity strategist & dealer at DeCarley Buying and selling, he beneficial staying away from digital currencies and choosing bodily gold as an alternative as a hedge towards rising inflation and financial chaos.

● Such an authority as Jamie Dimon, the pinnacle of the American banking large JPMorgan, has additionally gone with a heavy curler on digital gold. He doubted on the air of CNBC that the provision of bitcoin is absolutely restricted to 21 million cash. “How are you aware? Possibly it should go as much as 21 million, and Satoshi’s picture will pop up and chortle in any respect of you,” he prompt. This high supervisor already publicly expressed skepticism in October 2022 concerning the code embedded within the algorithm of the primary cryptocurrency. “Have you ever all learn the algorithms? Guys, do you consider in all this? ”Dimon grinned on the time.

In your data. Given the programmed halvings, the bar of 21 million must be reached by 2141. On the similar time, consultants say that the restrict on bitcoin emissions is offered by solely 5 strains of the code. It’s open for research, and anybody can confirm this.

● And right here the query arises: what if Jamie Dimon’s raids on bitcoin are linked with the need to eradicate this profitable competitor? In any case, due to the latest bullish rally, the capitalization of the flagship cryptocurrency has exceeded $443 billion, and has surpassed all key conventional monetary establishments, together with world world banks, on this indicator. For instance, the capitalization of the American banking large JPMorgan Chase is $406.42 billion, whereas Financial institution of America has a capitalization of $277.56 billion. As well as, BTC is forward of corporations similar to Alibaba ($317.01 billion), Samsung ($335.37 billion), Mastercard ($365.09 billion) and Walmart ($385.15 billion). Nonetheless, it has barely misplaced to Tesla ($454.72 billion).

In line with CompaniesMarketCap, bitcoin is the sixteenth most precious asset on the earth. The leaders of the score are gold ($12.77 trillion), Apple ($2.25 trillion) and Saudi Aramco ($1.94 trillion).

● On the time of penning this overview (Friday night, January twenty seventh), BTC/USD is buying and selling within the $23,070 zone. The full capitalization of the crypto market is $1.060 trillion ($1.038 trillion every week in the past). The Crypto Worry & Greed Index has grown from 51 to 55 factors over the week and has moved from the Impartial zone to the Greed zone, the place, in line with the creators of the index, it’s already harmful to open quick positions.

● And on the finish of the overview, our half-forgotten half-joking column of crypto life hacks. This time we are going to speak about one attention-grabbing remark. In fact, if you happen to determine to undertake it, the entire accountability will fall on you. However if you happen to can earn cash due to it, make sure to inform us about it. And do not forget to say thanks.

So, it seems that purchasing bitcoin on the finish of the primary day of the Chinese language New Yr and promoting it after ten buying and selling days ensures a mean revenue of greater than 9%. This was discovered by Matrixport Analysis and Technique Director Markus Thielen. In line with his observations, the scheme has generated earnings in 100% of instances for the final eight years, from 2015 to 2022. Such an operation would deliver the best revenue in 2017: 15%. Even in 2018, towards the backdrop of the earlier crypto winter, the investor acquired earnings, though just one%.

To implement the scheme In 2023, it was crucial to purchase digital gold on January 22, and promote the property 10 days later, on February 1. Bitcoin was buying and selling close to the $22,900 mark on the day of the proposed buy. Thielen believes its value ought to strategy $25,000 by the start of February. We’ll quickly discover out whether or not the phenomenon can be justified this time. And if anybody decides to observe Thielen’s suggestions sooner or later, we wish to inform you that the following Chinese language New Yr begins on Saturday, February 10, 2024.

NordFX Analytical Group

Discover: These supplies usually are not funding suggestions or pointers for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]